The cryptocurrency sector has struggled since the bubble popped in December 2017, battling through a vicious bear cycle that collapsed the initial coin offering (ICO) market.

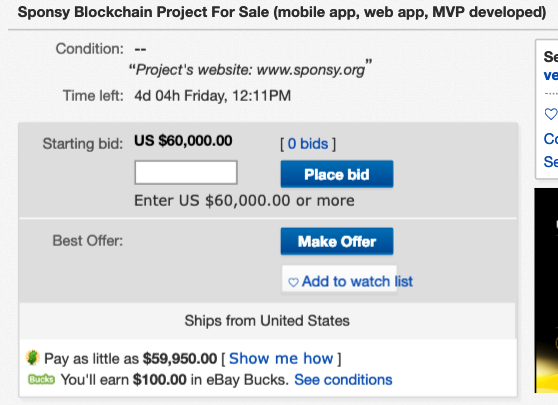

One failed ICO has recently called it quits; the company listed itself on eBay last week for $60,000.

Sponsy, a decentralized platform that allows sponsors and sponsees to conduct sponsorship deals, was expecting to raise millions of dollars in late 2017, even though it didn’t have a product. The founder told the Financial Times that it was the norm for a company to raise tens of millions of dollars without a real product during the Great Crypto Bubble of 2017-2018. However, the company’s lawyer advised Ivan Komar, the founder of the platform, not to ICO before a real product was built. Komar said that listening to his lawyer was the greatest mistake he made.

Here is the transcript of FT’s conversation with Komar who sums up what went wrong in the Great Crypto Bubble of 2017-2018:

We hired a lawyer and that was a big mistake for us. Because our lawyer basically told us that we should not launch any ICO before we built a real product that might have some users. And I asked him why, because I saw so many ICOs out there who did not have any idea for any product, yet they managed to raise tens of millions of dollars.

Komar acknowledged that the lawyer’s advice was probably the right advice from the customer’s — or token-buyers — point of view, but not from the point of view of raising money. So what would Sponsy have done differently if they had the chance again, we asked?

We would not have tried to build a product first, we would have tried to run a token sale as soon as possible, to jump into this crypto craze bandwagon, and raise as much money as possible before building any product. And that’s exactly what others were doing.

Instead, rather than launching in late 2017 when “this crypto craze bandwagon” was in full swing, Komar waited until summer 2018, by which stage, he says, the “market had vanished and nobody was interested in our offer”.

So even though there is no market for ICOs, or at least not for his ICO, Komar is hoping his eBay auction will attract an “enterprise client” with a big blockchain R&D budget — he suggested Bosch — or an individual who wants to try to launch an ICO into the non-existent market. Or just someone who wants to start a sponsorship platform that has nothing to do with blockchain or crypto. Komar told us:

The core business model would run just as well in the centralised world without any tokens or crypto or blockchain… They can easily eliminate the crypto functionality out of this. The core component is a platform — it doesn’t require any crypto or blockchain component to work. Just a typical, centralised server.

Again Komar — without necessarily realizing it — had managed to rather nicely encapsulate the spaciousness and incoherence of the ICO bubble. All Sponsy requires to function is a “typical, centralized server”, and yet its tagline is: “Decentralised Sponsorship Platform”.

The eBay listing also contained some other potentially attractive promises to prospective buyers, such as:

Full set of investment documents

Designed and approved by investment bankers.

Aside from the fact that it seemed a little odd to be selling any kind of preapproved investment documents, this seemed good! Which investment bank had approved the project, we wanted to know? At that point Komar, who is Belarusian but seemed to speak perfectly decent English, appeared to get in a bit of a twist:

“Approved” might be a huge word for it. It might be some kind of exaggeration. We did have a law firm based in the UK that ran some sort of audit of our project, and it ranked it, and the rank that we got was pretty high and the risk we got was pretty low. This was an audit by a British firm. This couldn’t be called a fully fledged investment banking audit, it’s just some firm that was considering investing in crypto.

* * *

FT said it was best that Komar listened to his lawyer’s advice about not ICO-ing without a product. That is because nine months later, U.S. courts ruled ICO frauds would fall under securities law.

Komar believes $60,000 minimum bid on eBay is a “very low” amount for the platform. He said the amount should be north of $200,000.

Glancing at the listing on Monday morning, there are four days left on the auction with zero bids and no watchers.

via ZeroHedge News https://ift.tt/2OsYVzx Tyler Durden