The dollar’s share of global central-bank reserves slumped to the lowest level since 2013 while holdings of the Chinese yuan rose for the fifth quarter in the past six, IMF data showed Friday.

The U.S. currency accounted for 61.7% of global allocated foreign-exchange reserves in the fourth quarter, down from 61.9% and the tenth decline in the past 12 quarters according to the IMF’s Currency Composition of Official Foreign Exchange Reserves (COFER) for Q4 2018 report. The drop occurred despite a 1% jump in the value of the dollar in the fourth quarter. The euro, yen and yuan each gained as a share of allocated reserves. While modest at just 1.9%, reserve allocation to the Chinese Yuan has been increasing rapidly and is now almost double where it was two years ago.

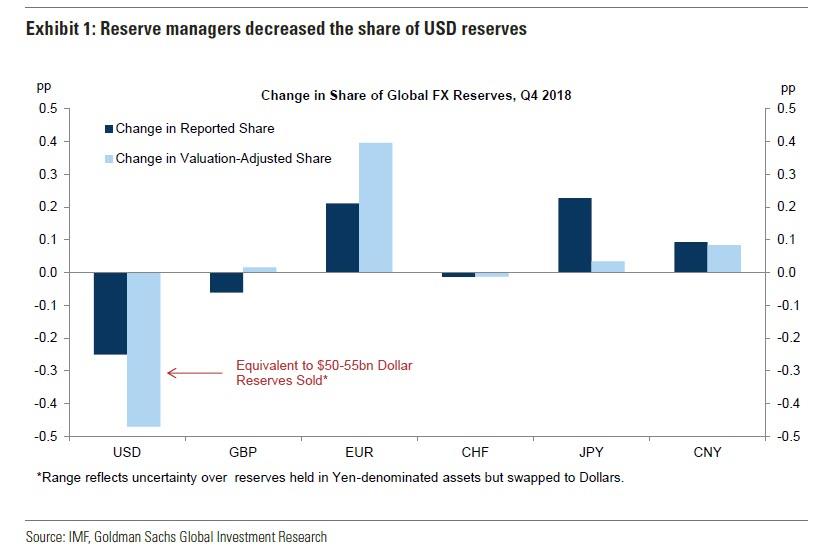

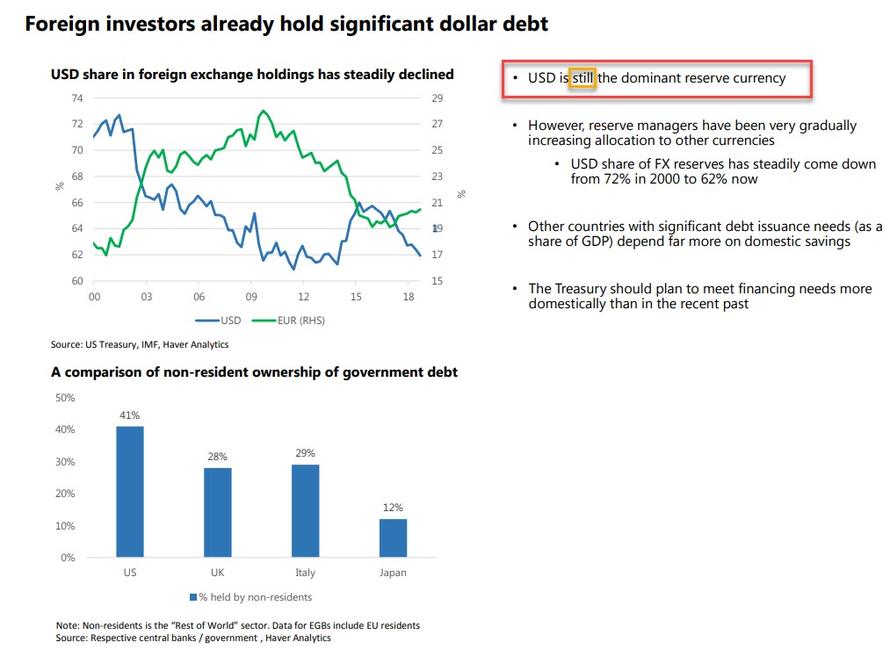

The chart below shows the main takeaways from the report: reserve managers actively decreased their allocation to USD—the share of USD reserves declined despite modest Dollar appreciation—while they actively added to EUR and CNY reserves. According to Goldman calculations, the drop in Q4 USD reserves was equivalent to just over $50 billion in dollar reserves sold.

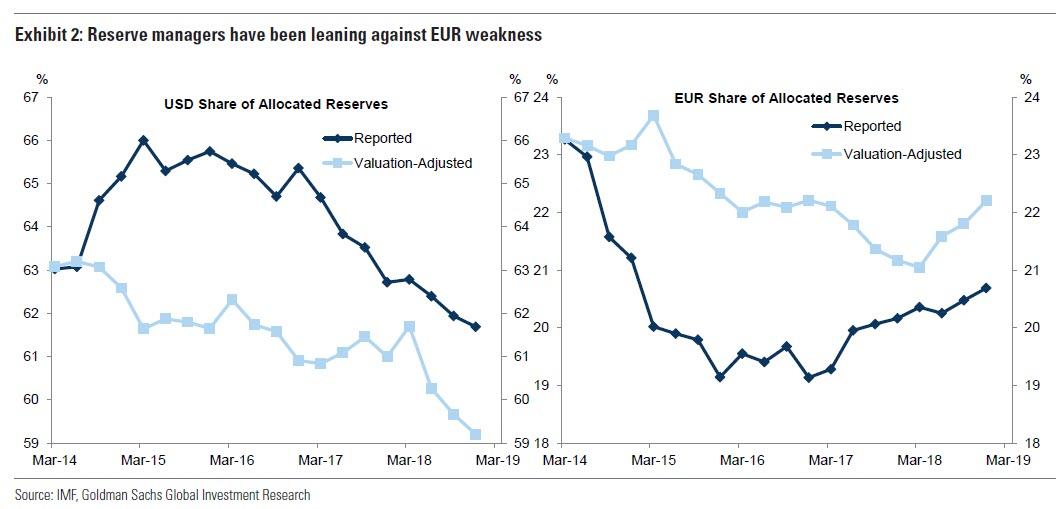

More specifically, the reported USD share of allocated reserves declined by another 0.3% in Q4. Cumulatively, the USD share has fallen by 3.7% since the end of 2016 and by 1.0% in 2018 (despite supportive Dollar price action). Against this, reserve managers continued to add to their EUR reserves with the reported EUR share increasing by 0.2% this quarter, and by 1.6% on net since the end of 2016. Both in Q4 and 2018 as a whole, reserve managers more than offset a weaker Euro to keep the share of EUR reserves on a rising trend, despite a number of political and growth tensions and concerns.

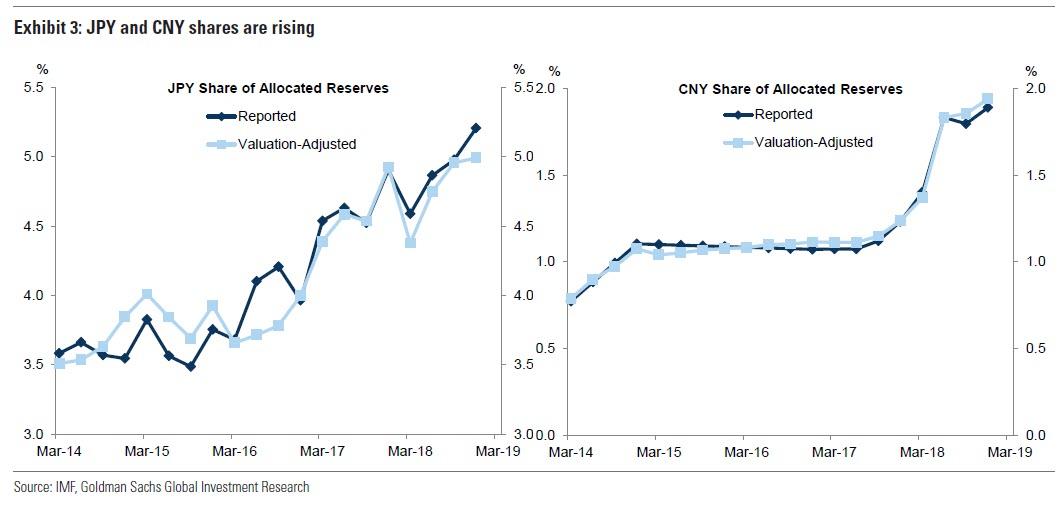

Meanwhile, as shown in the next chart, reserve managers continued to increase their allocation to JPY, although this was mostly due to yen appreciation in Q4. Still, at 5.2%, the share of JPY reserves is the highest it has been since June 2002. According to Goldman, this can be at least partially attributed to reserve managers purchasing Japanese securities on an FX-hedged basis in order to take advantage of the wide Yen cross-currency basis. However, it is worth noting that the USD share appears to be on a declining trend even after accounting for possible JGB asset swap trades.

Finally, the share of Chinese Yuan reserves continued to increase in Q4, which according to Goldman was almost entirely due to new inflows, and as the bank concludes “de-dollarization flows from Russia account for the substantial increase earlier this year.“

Commenting recently on the ongoing currency reserve trends, Standard Chartered’s head FX strategist Steven Englander said that political rifts between the U.S. and other countries could be to blame, but the numbers don’t offer firm conclusions.

Back in September, when the dedollarization trend first emerged, Alan Ruskin, global co-head of foreign-exchange research at Deutsche Bank said that the shift to allocated reserves could also be skewing the data: “I wouldn’t go too far in running with the idea that people are shifting out dollars in any aggressive sense.”

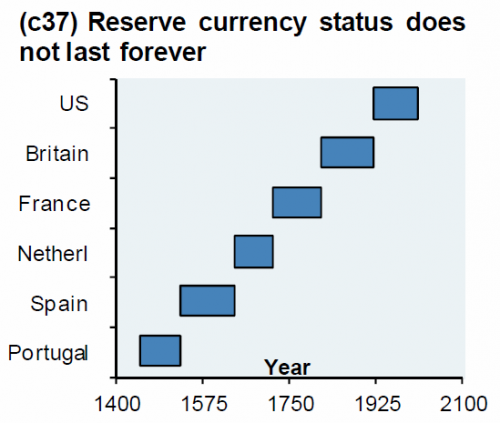

Still, the ramifications of the shift away from dollars are significant. For more than a half century, the dollar has been the reserve currency of choice for most of the world’s central banks, for its depth and stability in global markets.

That may be changing: as we reported at the end of January, the Treasury Borrowing Advisory Committee (or TBAC) is increasingly worried about the future status of the reserve currency as confirmed by the tongue-in-cheek observation that reserve managers have been very gradually increasing allocation to other currencies, and that the USD share of FX reserves has steadily come down from 72% in 2000 to 62% now even though the “USD is still the dominant reserve currency.”

The question is for how much longer.

via ZeroHedge News https://ift.tt/2HOPz0q Tyler Durden