Back in January 2018, just weeks ahead of the infamous VIXtermination event on Feb. 5 2018 that wiped out virtually all inverse VIX ETPs in seconds, we predicted that such an event was imminent as a result of a sharp spike in the total outstanding Vega across the entire levered and inverse volatility derivative space, which had reached an all time high.

And while since then, the VIX ETP market had been relatively quiet as a result of last year’s fireworks which wiped out countless retail investors and other vol sellers, another VIX “event” may be coming.

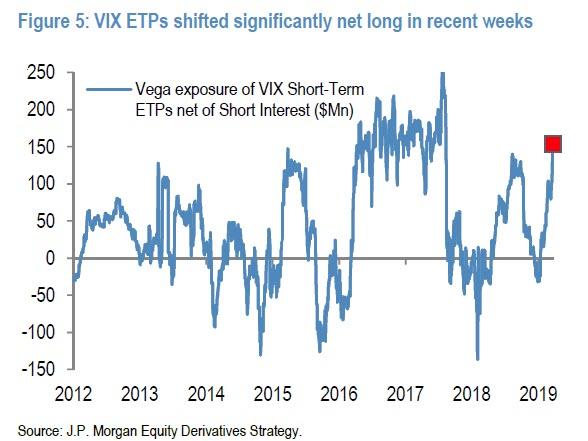

According to JPMorgan’s Bram Kaplan, after a years of relatively quiet, the net exposure among VIX ETPs has recently spiked to their largest net long position in 1.5 years, tilted long by ~$150Mn vega, which is just shy of the record vega exposure hit in early 2018 and which precipitated the VIX ETP implosion. However, unlike 2018, this time the trade is in the other direction as investors piled into long and levered VIX ETPs beginning in February, as soon as the VIX index fell below 16, to as JPM suggests. “position for/speculate on the next volatility spike.”

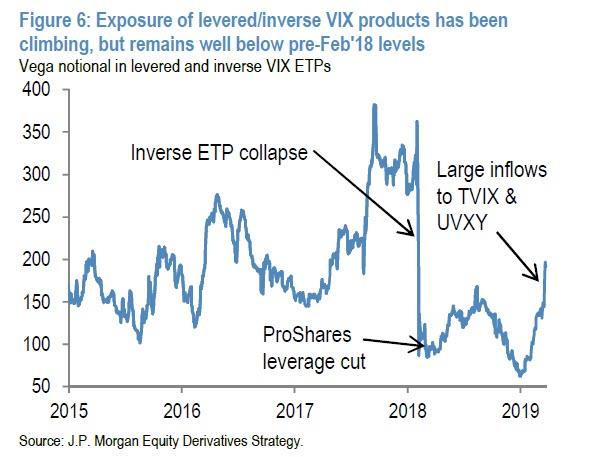

Specifically, over this period, investors have deposited $600MM net into unlevered long VIX ETPs, and $1.1Bn into levered products (the majority of which went into 2x levered TVIX). Following these flows, the vega notional in levered and inverse VIX ETPs has increased significantly, but remains well below pre-Feb’18 levels.

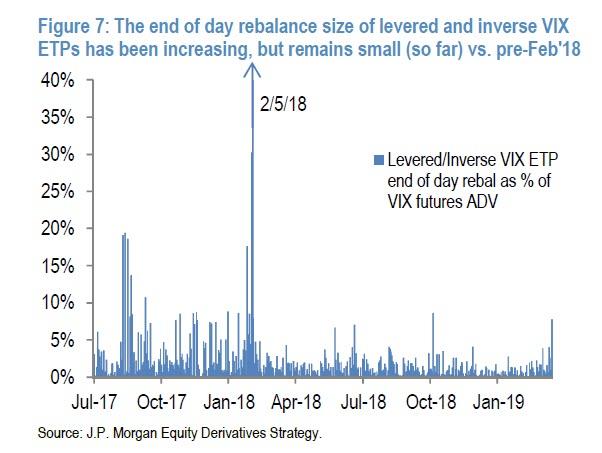

And here is the cautious conclusion from JPM, which notes that while the bank doesn’t – yet – expect these ETPs to drive end-of-day short gamma rebalancing effects anywhere close to those experienced on 2/5/18, “their end of day rebalances are becoming material.” To wit, the next chart illustrates how the end of day rebalance requirements for levered and inverse VIX ETPs has been increasing as a percentage VIX futures volumes, but remains small (so far, at least) compared to pre-Feb’18.

The key thing is that as noted above, unlike last year’s vol selling stampede, the current build-up of long vega exposure in VIX ETPs suggests they could provide a headwind to the next volatility spike…

… as investors are likely to take profits on these positions and/or invest in inverse products to monetize the spike. On the other hand, should the EOD rebalance persist, growing increasingly skewed in one direction as contrarian traders boost their bets on a VIX spike in the coming months using various ETP products, then it is only a matter of time before another major VIX spike takes place, only this time instead of wiping out the vol buyers, it results in a very generous pay day.

via ZeroHedge News https://ift.tt/2YEdQM5 Tyler Durden