Authored by Sven Henrich via NorthmanTrader.com,

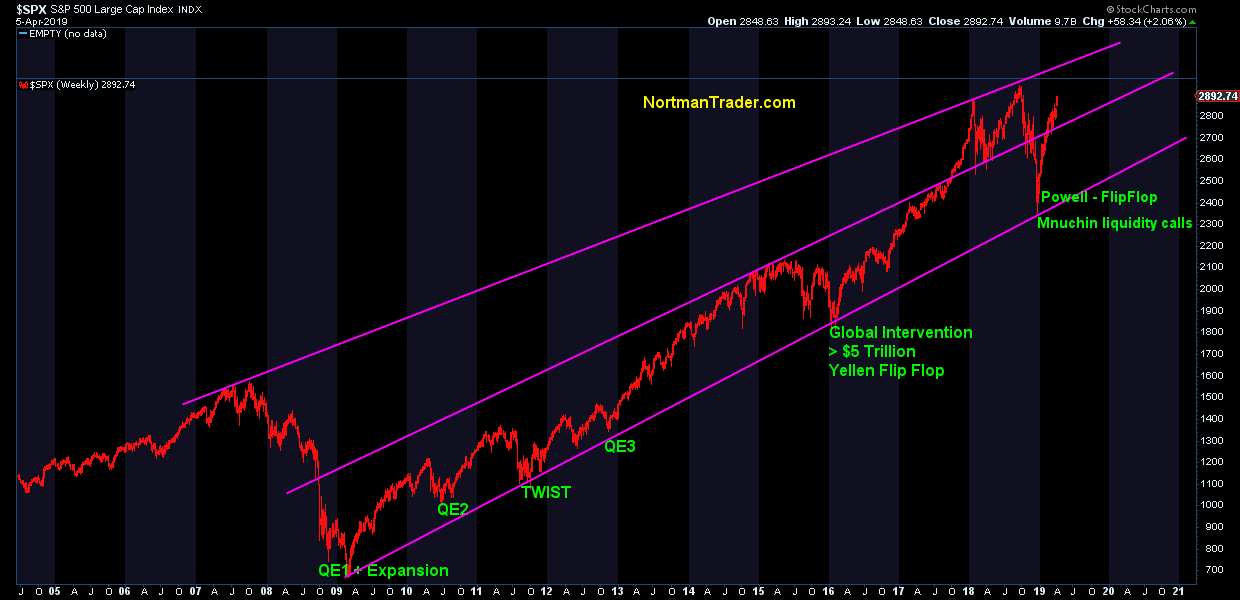

The lowest job claims in 49 years coupled with the loosest financial conditions in 25 years, yet the Fed panic stopped all rate hikes following a 20% market drop and for all intents and purposes has ended its rate hike cycle.

$SPX rallying 23% off the December lows and coming within 1.2% of all time highs on Friday and the president of the United Stated calling for rate cuts and a recommencement of QE.

$SPX Q1 earnings projected to come in negative yet markets ignoring all bad economic surprise data presuming the slowdown to be over.

Markets racing ever higher on negative fund flows, but supported by record buybacks, $270B in Q1 alone, over $1 trillion in just the past 5 quarters.

Daily jawbone efforts from the administration to signal an imminent China deal strategically placed to coincide with market open, market close or futures open ensuring gap ups with many never getting filled:

Atta boy:

“The market is way up today, Larry. So today, you’re great. When the market goes down — he’s not so great. But it’s been mostly up, I have to say.” Kudlow replies, “I’m only as good as my last trade, sir.”

Welcome to the theater of the absurd, the most jawboned market in history:

Now let’s cut rates and do QE:

I don’t fancy on commenting on the political, but as discussed in Two Faced the political is overtly aiming to influence markets and the calculus is as obvious as it is political: The prevent a recession for 2020, the historically biggest threat to any sitting president. Consequences be damned and the threat to make the Fed a quasi political election committee is real as evidenced by the nomination of political partisans Stephen Moore and Herman Cain to the Federal Reserve Board.

Don’t think this is hyperbole on my part, the mindset is on the public record:

“Janet Yellen for political reasons is keeping the interest rates so low that the next guy or person who takes over as president could have a real problem,” Trump said. “They are trying to put the next recession — it could be a beauty — into the next administration, and that’s not fair.”

The Fed of course is claiming independence and not being subject to political influences, but they are under a very overt threat to be subject to precisely that. Best of luck if the Fed gets political appointees on the policy voting roll.

And so yes, market levels have become subject to political calculus. And it was well advertised in advance, after all Treasury Secretary Mnuchin has called the stock market the economic score card for the administration. No wonder Mnuchin initiated emergency liquidity calls with the big banks over Christmas when the advertised score card burst into flames.

For now markets appear to be cheering the obvious: Cheap money forever as the truth can no longer be denied: The Fed, as all central banks, have lost the battle of normalization before it even began. Central banks have no choice to be dovish or risk a major market meltdown, hence they always react at the time of trouble:

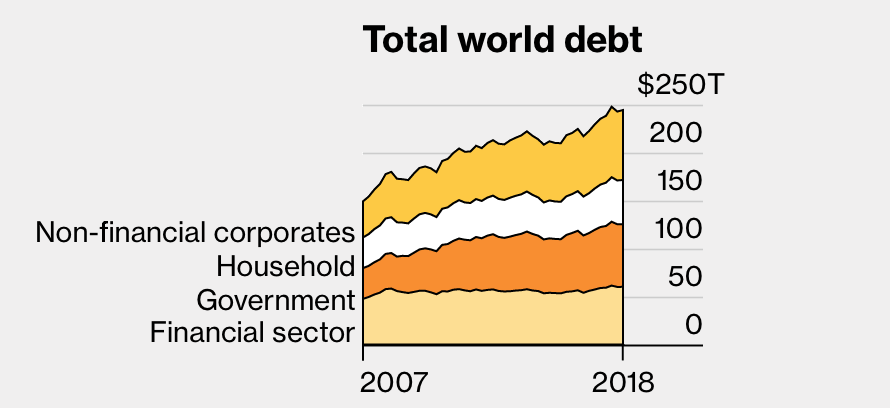

The global financial system remaining entirely dependent on ever more debt generation sustained by cheap money forever and ever amen. Trillion dollar deficits and trillion dollar buybacks, the ultimate pair trade.

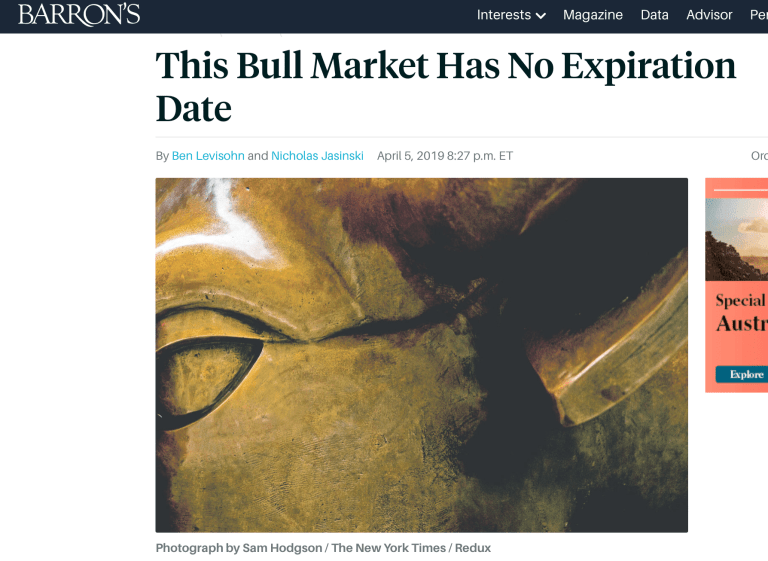

So let’s all just admit it and cut rates, go back to QE and blow the biggest stock market bubble in history. After all the bull market has no expiration date. No really:

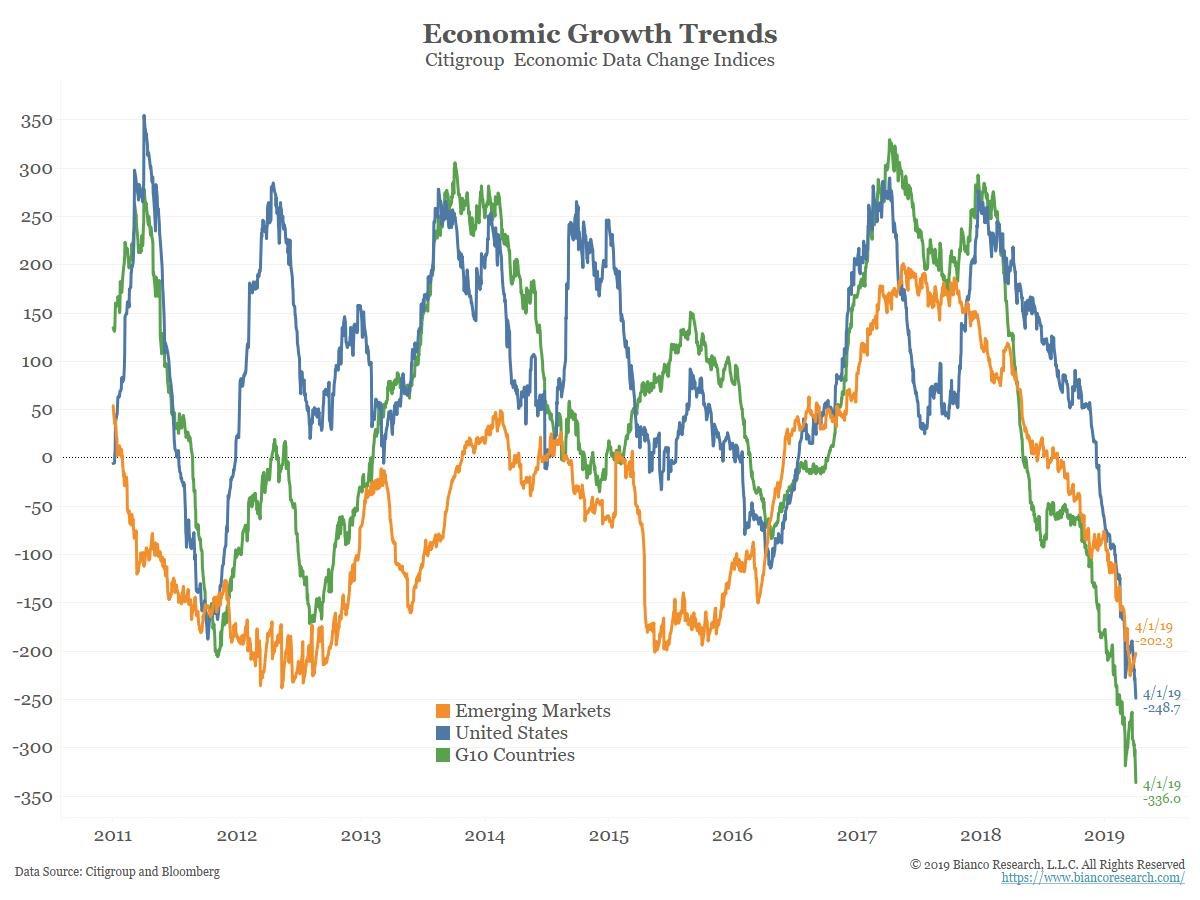

The business cycle no longer exists, because, you know, central banks:

“We are all used to using the word ‘cycle’; we’re all used to looking at historical charts and graphs and equations and relationships. The reality is that maybe the word ‘cycle’ is no longer even relevant, given that we have so much unconventional central-bank involvement. This is not a normal cycle just left to itself to run. It is continually fiddled with by these central-bank injections”.

Welcome to the theater of the absurd.

It’s all good:

Central bankers who have failed for 10 years to reach their self stated inflation objectives and utterly failed to even embark on a path to policy normalization will fix it all.

And so the world economic structure remain entirely dependent on ever more expansion:

Let’s not stop here, let’s continue on that path forever, consequence free:

The greatest trick the devil ever pulled is convince the world that debt doesn’t matter. https://t.co/GJqLQS9X47

— Sven Henrich (@NorthmanTrader) April 6, 2019

Welcome to the theater of the absurd.

In last week’s brief I mentioned: “Favoring bulls in April is, generally speaking, positive seasonality especially in the early part of the month”.

Markets, greatly spurred on by overnight China deal rumors kept running from one open gap to the next. 7 consecutive gap ups now, with 3 unfilled gaps since just March 29. This coming week buybacks will be largely in their blackout window and all eyes will be on earnings, starting with bank earnings later in the week. But fear not, there will also be at least 7 Fed speakers this week. After all the ever dovish message must be reinforced over and over again.

Just remember:

A market that keeps relying on magic overnight gaps as its primary price discovery mechanism is increasingly at risk of a meaningful technical reversal.

— Sven Henrich (@NorthmanTrader) April 5, 2019

For the discussion of technicals and select key charts please see the video below:

* * *

To get notified of future videos feel free to subscribe to our YouTube Channel. For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2U54tBn Tyler Durden