Despite all the talk of a great US economy ready for rebirth now that The Fed has taken its foot off the neck of expansion, US macro-economic data has collapsed (absolutely and relative to expectations) in recent weeks to its lowest since July 2017 – taking on the ugly title of ‘worst economic data in the world’…

And things are getting worse. As Knowledge Leaders Capital blog’s Steven Vanelli notes, so far this week, we’ve received a few data points that reinforce the manufacturing slowdown taking place in the US.

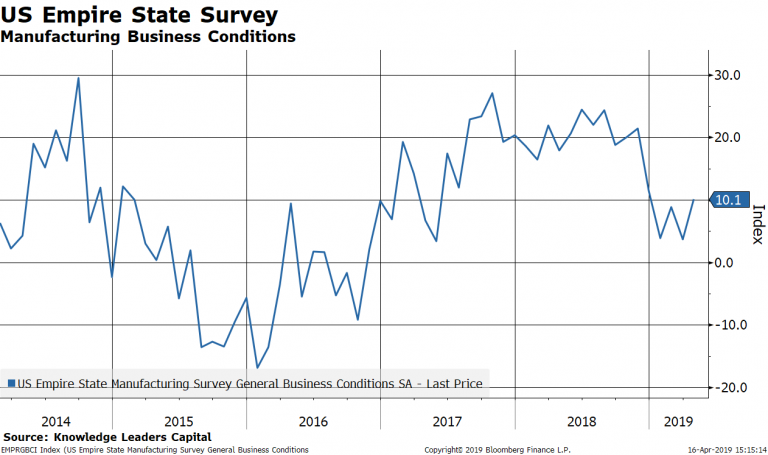

On Monday, we got the Empire State Survey, a survey of manufacturing in New York.

Importantly, this is one of the few “soft” data points we have for April, so its message is important. It turned up slightly from last month, showing some stabilization and beating estimates, but it is still well down from 2018 levels.

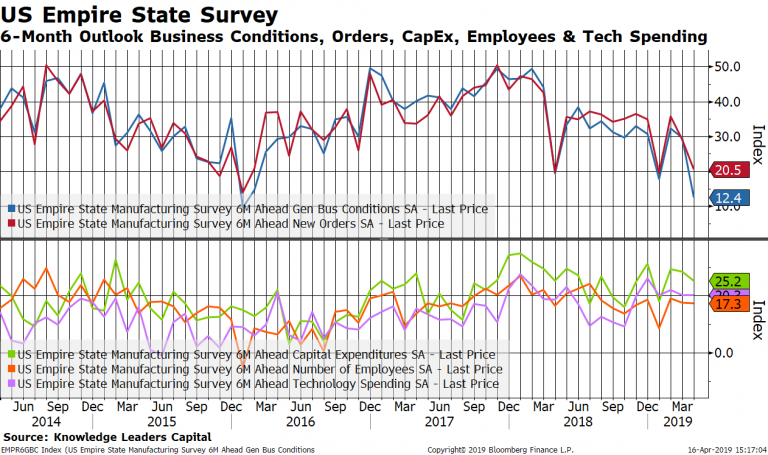

Underneath the surface, the data was a bit less encouraging. In the 6-month outlook, expectations for general business conditions and new orders plunged.

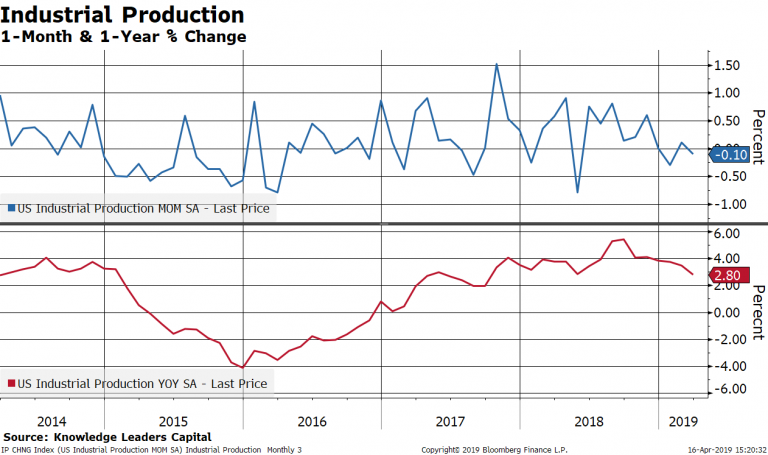

Industrial production undershot monthly estimates, falling .10% when it was expected to rise .2%. This brought the 1-year percent change down to 2.8% from a rate about twice that of last September.

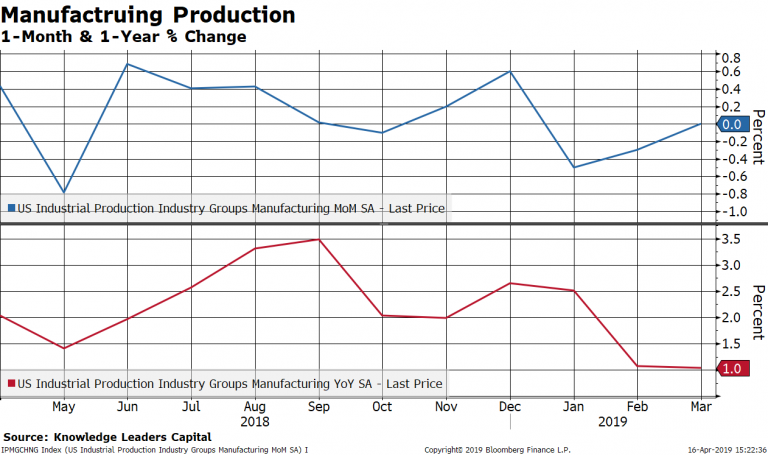

The manufacturing component of industrial production came in .10% under expectations also, slowing to a 1% 1-year rate of change.

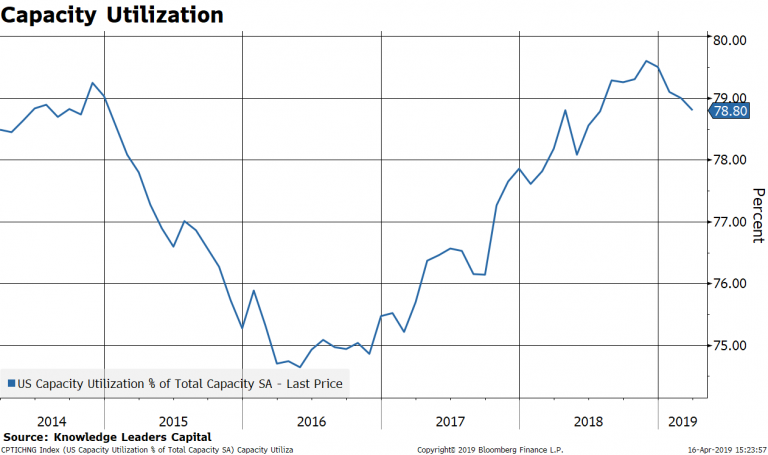

Lastly, capacity utilization was reported at 78.8%, coming in .3% lower than the 79.1% estimate.

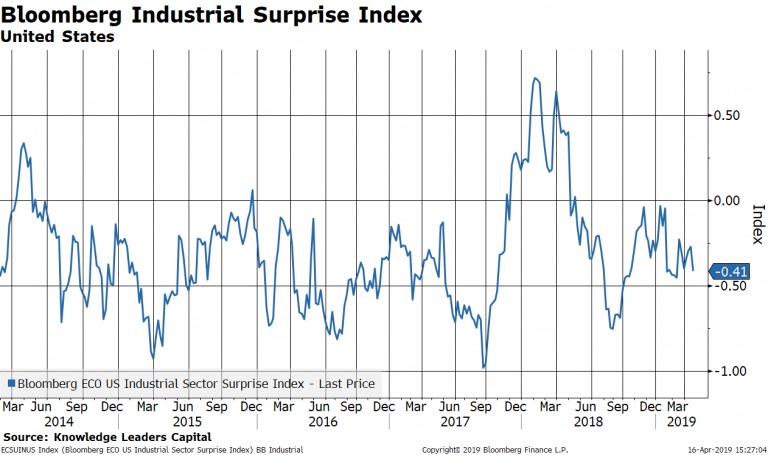

All of this explains why the Bloomberg Industrial Surprise Index – a sub-index of the Bloomberg Economic Surprise Index – has notched down recently.

…even as stocks near record highs.

via ZeroHedge News http://bit.ly/2vb9uP3 Tyler Durden