Trade wars don’t appear to be as “good, and easy to win” as President Trump tweeted a year ago.

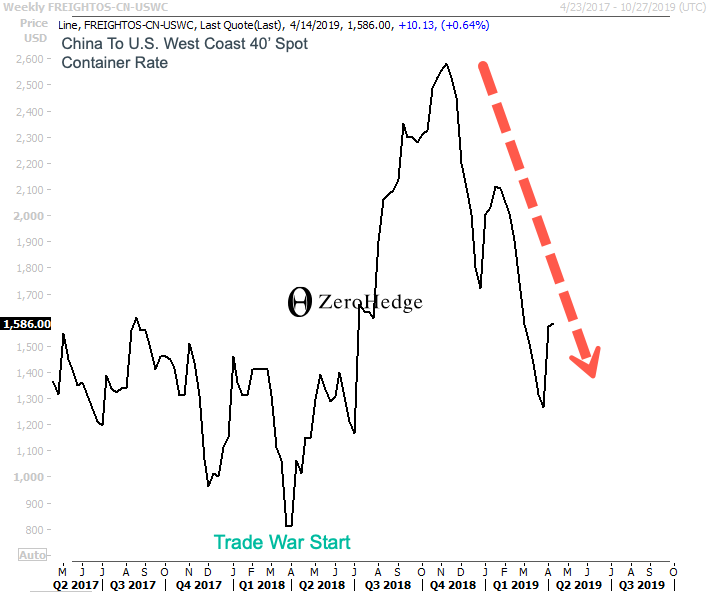

The disputes over tariffs forced American importers to pull forward growth in the second half of 2018, which supercharged the overall economy until October. But when the artificial growth was over, shipping rates across the world fell, as new evidence today from Drewry Maritime Research show the “tariff hangover” has cast a gloomy outlook over 2019 for U.S. west coast ports, reported The Loadstar.

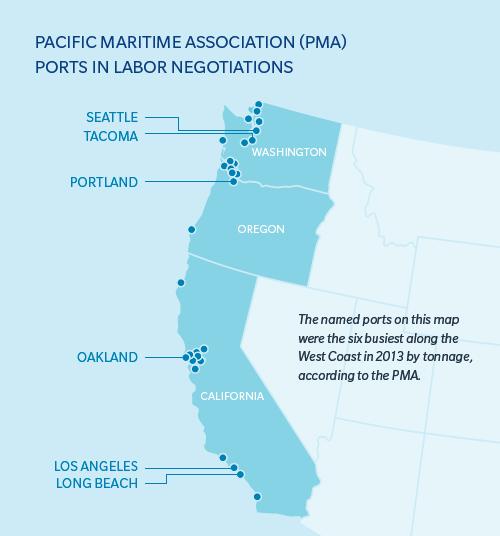

In the first three months of 2019, west coast ports transpacific imports plunged 19% on the previous quarter and by 3% y/y.

“The west coast market was always likely to suffer the most from a tariff hangover, as shippers had prioritized that gateway as the quickest means to beat the deadline [for import duty hikes on Chinese imports],” said Drewry.

“Now that the sugar rush, caused by the threatened tariffs on Chinese goods, has passed, the market is readjusting to much slower volumes and prices,” it added.

According to Drewry, Asia-US west coast trade lanes in January experienced near-100% load factors on head-haul vessels, but in February utilization plummeted to 80% – the lowest in two years.

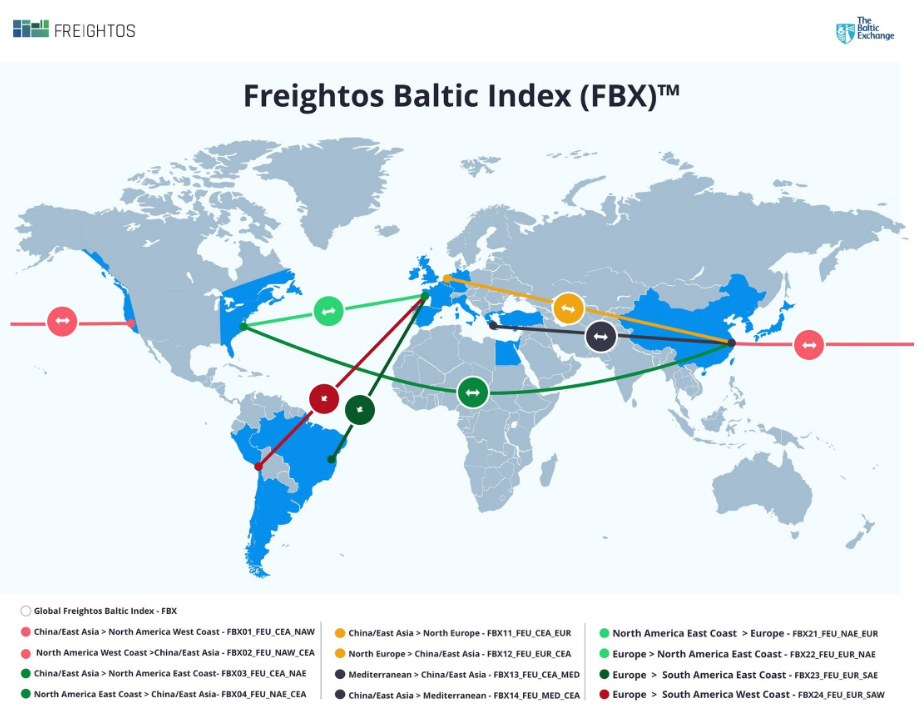

Weekly spot rates for 40′ containers for China to the U.S. West Coast plummeted 51% from its October 2018 high of 2852 to 1,267 by the end of March. In the last 14 days, the spot rate has rebounded to 1,586.

Drewry noted that the timing of the spot rate decline “could not have occurred at a more inopportune moment,” given that shippers are in the process of trying to secure rate increases on annual contract renewals that begin on May 1.

“Earlier in the year, it seemed the carriers might be able to secure some modest increase in revenue from their BCO [beneficial cargo owner] contracts, but those hopes now seem dashed,” suggested Drewry.

“The only discussion point that remains is to what extent the shipping lines can secure some agreement to a floating BAF [bunker adjustment factor] arrangement within those contracts, so that when, towards the end of 2019, the carriers start having to pay a premium for low-sulfur fuel oil, they can rely on some mechanism to kick in to automatically recover some of those additional costs,” it added.

Lars Jensen, the chief executive and partner at SeaIntelligence Consulting, told The Loadstar that shippers face severe headwinds in 2019, commenting: “There is clear cause for concern – precisely because the weakness is so widespread.”

The “tariff hangover” comes at a time when the International Monetary Fund (IMF) last week cut its global economic growth forecasts for 2019.

“This is a delicate moment for the global economy,” IMF chief economist Gita Gopinath said in a recent news conference.

More or less, the synchronized global slowdown has put developed and emerging economies into its most vulnerable spot since the financial crisis.

via ZeroHedge News http://bit.ly/2Xo0Lov Tyler Durden