While all eyes focused on retail sales rebound in March, the flash US composite PMI plunged to 31-month lows in April, led by a collapse in the Services economy, catching down to the Manufacturing side.

-

Flash U.S. Composite Output Index at 52.8 (54.6 in March). 31-month low.

-

Flash U.S. Services Business Activity Index at 52.9 (55.3 in March). 25-month low.

-

Flash U.S. Manufacturing PMI at 52.4 (52.4 in March). Unchanged.

So it seems ‘hard data’ was right after all and ‘soft’ surveys wrong…

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at IHS Markit said:

“The US economy started the second quarter with its weakest expansion since mid-2016 as businesses reported a marked slowing in output, new orders and hiring.

“The survey indicates that the manufacturing downturn seen in the first quarter has persisted into April, but growth in the service sector has now also slumped to a two-year low as the malaise showed further signs of spreading beyond the factory sector.

“April also saw firms become more reluctant to hire as a result of weaker order book growth, pushing jobs growth to a two-year low. The survey’s headline employment index is indicative of non-farm payrolls growing by 130,000 in April, well below the 198,000 average indicated in the first quarter.

“A drop in price pressures meanwhile suggests that inflationary pressures continued to moderate, signalling that annual consumer price inflation could drop below 1% in coming months, as pricing power fades alongside weaker demand.

“While the overall rate of growth and job creation being signalled remain relatively solid, the slowdown likely has further to run. Companies’ expectations of future growth slid to one of the lowest levels seen since comparable data were first collected in 2012. Only mid-2016 has seen gloomier business prospects.”

And finally, Williamson notes that GDP is expected to slow dramatically…

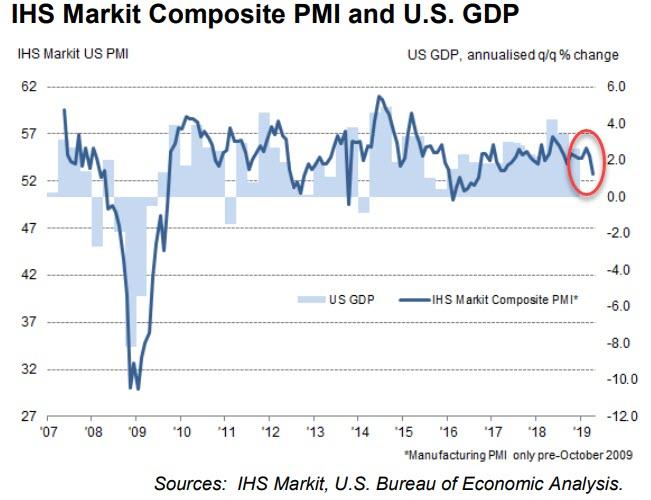

“The April surveys are consistent with GDP rising at an annualised rate of just under 2%, with the official measure of manufacturing production remaining in decline.

via ZeroHedge News http://bit.ly/2UGtMix Tyler Durden