Authored by John Rubino via DollarCollapse.com,

There was a time when “price stability” – that is, money that buys the same amount of stuff every year – was considered a good thing. But as debts began to pile up around the world, it became clear to policymakers that managing that debt required money that got a little less valuable over time, say 2%, to allow debtors to pay interest in cheaper currency and employers to placate workers with “cost of living” raises.

This delayed the reckoning on the old debt but at the cost of soaring new debt, as pretty much everyone figured out that it’s smart to borrow depreciating currency.

In the decade since the trough of the Great Recession, nearly every sector of every major economy took on historically unprecedented amounts of new debt. And now the old “optimal” inflation rate of 2% isn’t enough to make interest payable for a growing number of borrowers.

The solution? Higher inflation of course. The old 2% target was arbitrary to in any event. And as with so many other things in life, if a little was good, a little more must be better, right?

So the question becomes how to phrase the transition to faster currency depreciation in a way that shapes the behavior of buyers, sellers, borrowers and lenders in the best possible way.

China got the ball rolling back in December, with fuzzy words designed to reassure while avoiding specifics:

China’s top policy makers confirmed that more monetary and fiscal support will be rolled out in 2019, as the world’s second-largest economy grapples with a slowdown that’s yet to show signs of ending.

“Significant” cuts to taxes and fees will be enacted in 2019 and while monetary policy will remain “prudent,” officials will strike an “appropriate” balance between tightening and loosening, according to a statement published after the annual Economic Work Conference that concluded in Beijing Friday.

Very comforting: “Significant” is actually “prudent and appropriate.”

Thus reassured, Chinese banks and their customers went on a lending/borrowing spree for the record books. From Doug Noland’s Credit Bubble Bulletin:

China’s Aggregate Financing (approximately system Credit growth less government borrowings) jumped 2.860 trillion yuan, or $427 billion – during the 31 days of March ($13.8bn/day or $5.0 TN annualized). This was 55% above estimates and a full 80% ahead of March 2018. A big March placed Q1 growth of Aggregate Financing at $1.224 TN – surely the strongest three-month Credit expansion in history. First quarter growth in Aggregate Financing was 40% above that from Q1 2018.

While China was setting records, QE pioneer Bank of Japan conflated “powerful” and “patient”:

Bank of Japan Governor Haruhiko Kuroda on Tuesday vowed to “patiently continue” the central bank’s “powerful” monetary easing as it was taking longer than previously thought to accelerate inflation to its 2 percent target.

Japan offers a glimpse of the future as its population ages and its debts soar. The further it travels down this path, the more difficult the math becomes. Which means hitting the BoJ’s 2% target will just set the stage for even more “patient but powerful” easing.

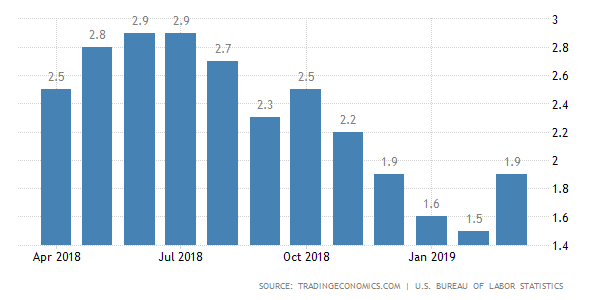

Now it’s the Fed’s turn. US core inflation handily exceeded 2% last year, but has since trended down a bit.

source: tradingeconomics.com

Still, the recent average is close to 2.5%, which you’d think would be fine if 2% is still sufficient to manage our debts. But it’s not, and the Fed is now sending its talking heads out to break this news:

The U.S. Federal Reserve should embrace inflation above its target half the time and consider cutting rates if prices do not rise as fast as expected, a top policymaker at the central bank said on Monday.

“While policy has been successful in achieving our maximum employment mandate, it has been less successful with regard to our inflation objective,” Federal Reserve Bank of Chicago President Charles Evans said in New York.

“To fix this problem, I think the Fed must be willing to embrace inflation modestly above 2 percent 50 percent of the time. Indeed, I would communicate comfort with core inflation rates of 2-1/2 percent, as long as there is no obvious upward momentum and the path back toward 2 percent can be well managed.”

Again, lots of focus-grouped soft, comforting words: “modestly … no obvious upward movement … well managed.”

But the truth is less comforting: Rising inflation, by in effect putting money on sale, encourages borrowers to borrow more, which sends aggregate debt higher at a rate that (see China) exceeds the rate of inflation, thus making the problem worse at an accelerating rate.

The only solution to too much debt is a borrower die-off. And those are by definition the opposite of “well managed.”

via ZeroHedge News http://bit.ly/2VWr4ly Tyler Durden