Authored by Jesse Colombo via RealInvestmentAdvice.com,

In the financial world, those who subscribe to the contrarian school of thought (including myself) keep an eye out for certain cues or indications that a trend has become overcrowded and is nearing its end. Some examples of these contrarian indicators are investor sentiment indexes, fear gauges such as the CBOE Volatility Index or VIX, the construction of record-breaking skyscrapers, and also the topics that are chosen for finance and business magazine covers. The last example is called the Magazine Cover Indicator and the logic behind it is that, by the time a trend has gained enough momentum or attention to justify its own cover story, it is about to become passé. In an infamous example, Businessweek published the cover story “The Death Of Equities” on August 13, 1979, right before the secular bull market began.

Bloomberg Businessweek’s latest cover story is called “Is Inflation Dead?,” which should make contrarians question whether the actual risk is higher inflation (or hidden inflation, as I will explain).

Here are the first few paragraphs from this piece –

If economics were literature, the story of what happened to inflation would be a gripping whodunit. Did inflation perish of natural causes—a weak economy, for instance? Was it killed by central banks, with high interest rates the murder weapon? Or is it not dead at all but just lurking, soon to return with a vengeance?

Like any good murder mystery, this one has a twist. What if the apparent defeat of inflation blew back on the central bankers themselves by making them appear expendable? Far from being lauded for a job well done, they’re under populist attack. “If the Fed had done its job properly, which it has not, the Stock Market would have been up 5000 to 10,000 additional points, and GDP would have been well over 4% instead of 3% … with almost no inflation,” President Donald Trump tweeted on April 14. On April 5, channeling Freddie Mercury of Queen, he said “you would see a rocket ship” if the central bank eased up.

The irony of Trump’s criticism of the Federal Reserve is that by historical standards, the bank is remarkably dovish—that is, inclined to keep rates low. After decades of working to tamp down inflation, even at the cost of inducing recessions, and finally succeeding, central bankers in developed economies have spent most of the past 10 years reversing course and trying to reignite it, with very little success. At a press conference on March 20, Fed Chairman Jerome Powell said low inflation is “one of the major challenges of our time.”

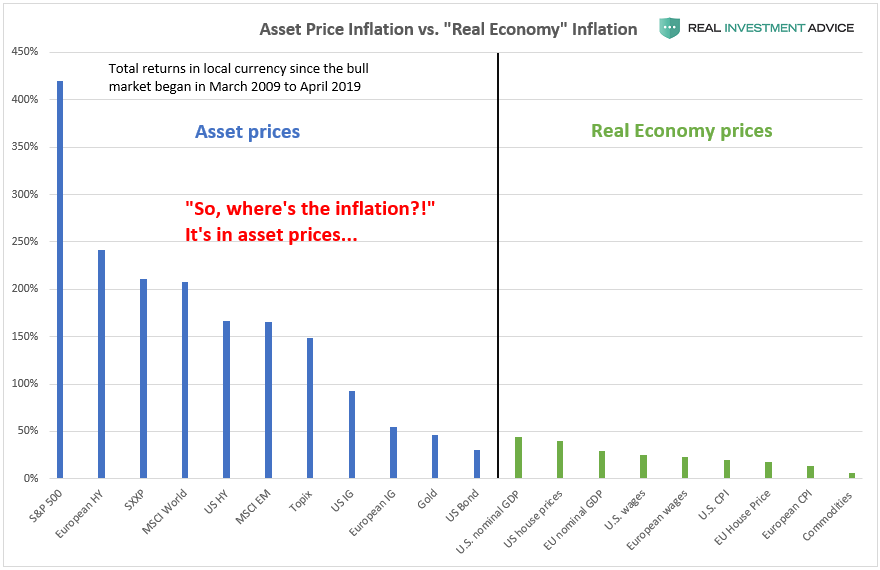

This “Is Inflation Dead?” cover story was published just a couple days after I published a detailed piece called “Where Is Inflation Hiding? In Asset Prices.” In that piece, I explained that the economics world was being fooled into believing a very dangerous fallacy over the last several years, which is the idea that there is very little inflation in the U.S. economy. I went on to explain how inflation is concentrated in asset prices (including stocks and bonds) rather than in consumer prices in this particular unusual economic cycle. Belief in the “low inflation” myth stems from the overly rigid reliance on conventional inflation indicators while completely ignoring the inflation in asset prices, which has resulted in extremely large and dangerous bubbles that will ultimately burst with disastrous consequences. As the chart below shows, assets such as global stocks and bonds have risen at a much higher rate than global real economy prices since the current bull market began in March 2009.

The people who are currently scratching their heads about low inflation while ignoring the massive asset bubbles that are growing right under their noses are the same ones who didn’t see the housing bubble’s warning signs in the mid-2000s. They were the ones justifying the growth of the housing bubble by saying “housing prices are rising because our population is growing,” “Americans are becoming wealthier and want larger, more luxurious homes,” and so on. During a bubble, the “crowd” will always tell themselves lies so that they don’t have to acknowledge the scary implications of the bubble and its coming burst. Once the bubble pops, they claim it was a freak occurrence that “nobody could have seen coming!” We’re making the same mistakes that we made during the housing bubble, but it’s just occurring in different industries, assets, and countries.

via ZeroHedge News http://bit.ly/2W0LpX7 Tyler Durden