On Sunday, when commenting on last week’s latest Chinese politburo meeting, we said “If your bullish thesis to buy stocks in recent months has been anchored by the expectation of aggressive monetary easing by China reinforcing the narrative that “bad news is good news” for the market, you may consider selling” because, as Goldman put it simply, the “politburo meeting signaled a less dovish policy stance.”

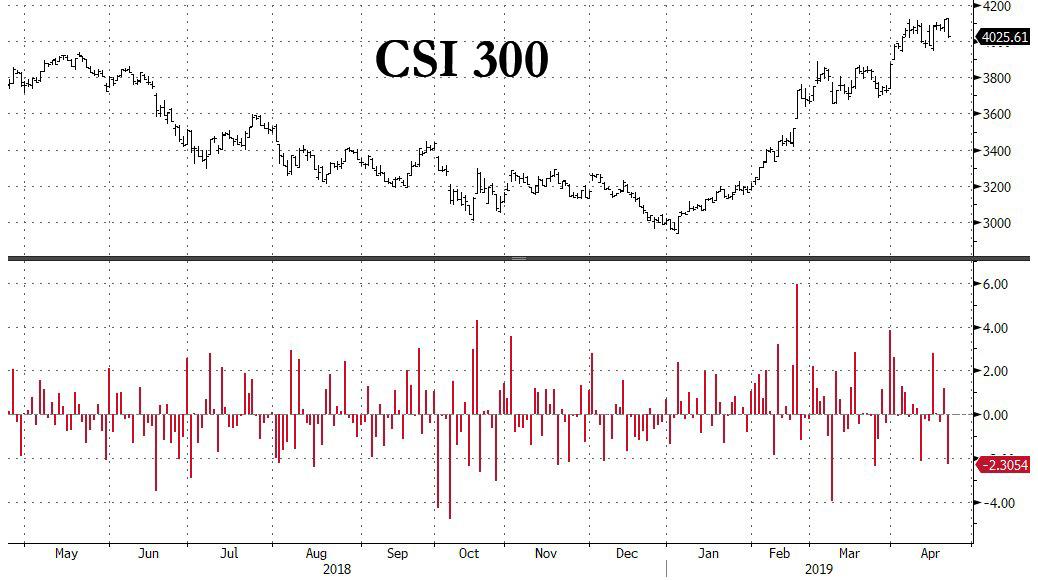

One day later, it appears that quite a few investors did indeed consider selling, because shortly after Beijing signaled it is far less amenable to adding stimulus, and in fact is once again contemplating pushing deleveraging (as we explained in detail) the world’s best performing stock market is suddenly looking a lot more vulnerable as China’s CSI 300 Index of equities traded in Shanghai and Shenzhen sank 2.3% on Monday, its biggest loss in a month and 3rd worst drop of 2019. Property developers led the plunge, along with companies reliant on consumer discretionary spending and so-called old economy shares such as banks and industrial companies.

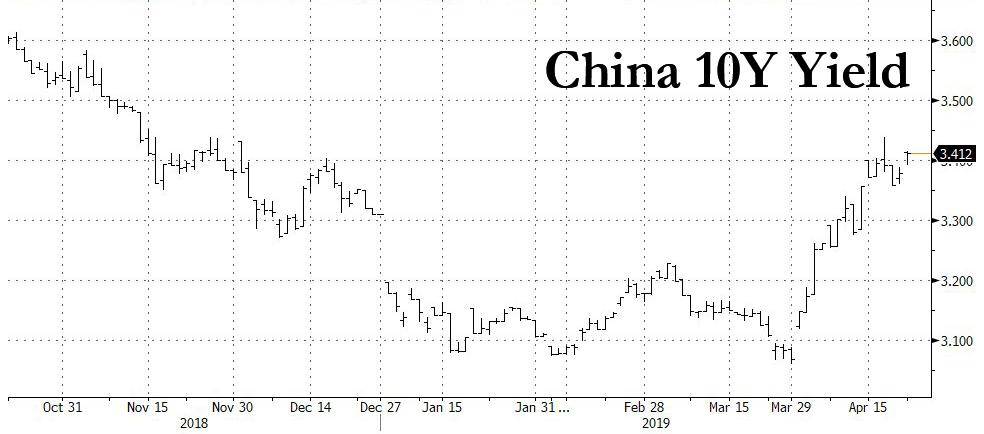

It wasn’t just Chinese stocks that got hammered: the yield on China’s 10-year sovereign bonds soared above 3.41%, closing at the highest level since November, and continuing a three-week surge, following comments that China needed to keep a proper balance between tightening and loosening.

As Bloomberg follows up this morning, after Chinese equity soared almost 40% this year, “investors have grown increasingly sensitive to whether the authorities will maintain the massive scale of stimulus seen in the first quarter.” And, as we noted yesterday, Friday’s Politburo statement was interpreted “as meaning the economy is on a stable enough footing that extended support isn’t needed“, i.e., less dovish, and instead there was a focus on deleveraging and avoiding speculation in the housing market.

“The key takeaway from the meeting is that there is limited room for further marginal monetary easing,” said Tommy Xie, an economist at Oversea-Chinese Banking Corp. in Singapore. “Since the second half of 2018, China’s bonds rallied mainly on expectations of easing policies, but that has changed after signs that the Chinese economy is stabilizing.”

“People have come to a clear consensus that there won’t be any aggressive stimulus that floods the economy with excessive liquidity, indicating limited room for valuation recovery,” said Dai Ming, a Shanghai-based fund manager with Hengsheng Asset Management Co. “The market is entering a consolidation period that may last one to two months.”

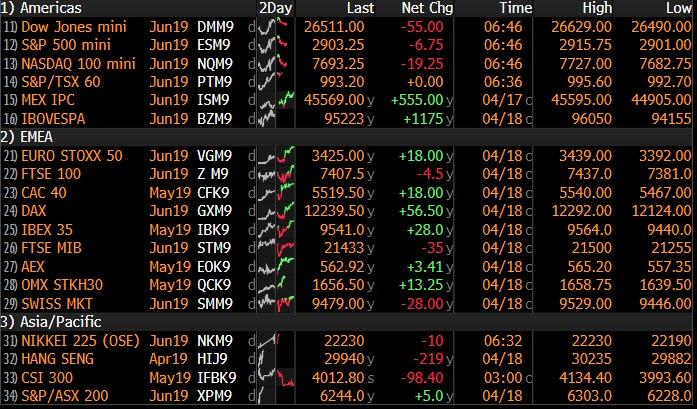

China’s weakness quickly spread across the globe, and S&P futures dropped on Monday amid very subdued trading…

… while stocks in Asia were mixed, as MSCI’s broadest index of Asia-Pacific shares outside Japan down 0.3 percent, and dropping from a nine-month peak scaled last week after Chinese economic data beat expectations and eased concerns about the health of the world economy. Japanese shares swung between gains and losses before finishing slightly higher as most of Europe – including markets in Britain, Germany and France – remaining closed for Easter Monday.

In Sri Lanka, bonds and the rupee slipped after Easter Sunday’s terrorist attacks.

The most notable move in an otherwise quite overnight session, was the surge in oil following a late Sunday WaPo Op-Ed, since confirmed by the WSJ, which said that the US scrapped waivers allowing the purchase of some Iranian crude, threatening to remove about 1 million barrels from circulation. Brent and WTI futures surged to nearly six-month highs on news reports that U.S. Secretary of State Mike Pompeo will announce “that as of May 2, the State Department will no longer grant sanctions waivers to any country that is currently importing Iranian crude or condensate.”

“The U.S. chief Iran hawks indeed have the President’s ear as (Secretary of State) Pompeo and (National Security Advisor) Bolton are singularly focused on bringing Iran’s economy to its knees,” said Stephen Innes, head of trading at SPI Asset Management. “Predictably oil prices are rising,” he said.

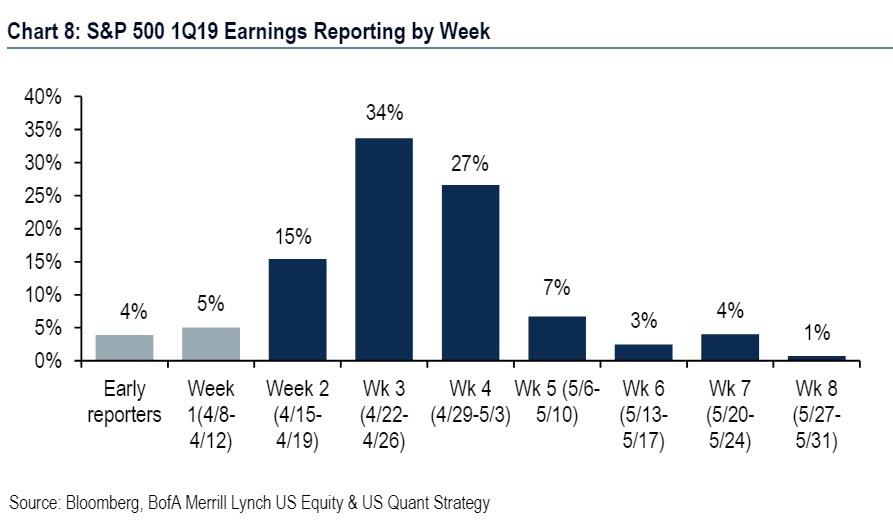

While markets today may be subdued due to continued Easter celebreations, corporate reporting season enters its busiest week, with 34% of the S&P on deck to report in the coming days, giving investors clues as to whether the dovish policy pivot from the world’s central banks can shore up global growth enough to overlook a potential contraction in earnings.

As Bloomberg notes, for now the stock market appears to be saying yes, with the MSCI world index on track for a fourth month of gains.

Investors will also be focused on the U.S. economy, with the first look at Q1 GDP due this Friday.

In currency markets, the dollar index posted modest gains despite higher yields; the Canadian dollar outperformed peers thanks to oil’s surge on reports that the U.S. won’t renew waivers that let countries buy Iranian crude without penalty. The Australian dollar slipped as risk assets were sold. Trading was subdued with markets including Hong Kong, Australia and New Zealand closed. Emerging Asian market currencies fell as trading resumed after the Easter holiday; rising crude prices damped the outlook for oil-importing nations; stocks and bonds were steady. The pound held steady with U.K. markets closed for Easter and lawmakers set to return Tuesday.

Expected data include existing home sales and the Chicago Fed National Activity Index. Halliburton, Kimberly-Clark and Whirlpool are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 0.3% to 2,902.75

- MXAP down 0.1% to 162.88 on Monday

- MXAPJ down 0.2% to 542.42 on Monday

- Nikkei up 0.08% to 22,217.90 on Monday

- Topix up 0.1% to 1,618.62 on Monday

- Hang Seng Index down 0.5% to 29,963.26 on Thursday

- Shanghai Composite down 1.7% to 3,215.04 on Monday

- Sensex down 0.8% to 38,816.92 on Monday

- Australia S&P/ASX 200 up 0.05% to 6,259.82 on Thursday

- Kospi up 0.02% to 2,216.65 on Monday

- Brent Futures up 2.6% to $73.85/bbl

- Gold spot up 0.3% to $1,279.47

- U.S. Dollar Index down 0.02% to 97.36

Top Overnight News

- Tourists are scrambling to leave Sri Lanka and hotels are bracing for cancellations after a deadly terrorist attack that killed 290 people targeted foreigners and churchgoers

- The Trump administration won’t renew waivers that let countries buy Iranian oil without facing U.S. sanctions, according to four people familiar with the matter

- Ukraine’s most-watched comedian won a landslide victory in Sunday’s presidential runoff as voters vented their frustration at the ex-Soviet republic’s lack of progress since a revolution five years ago

- The 2020 Democratic presidential race moves into a crucial new phase this week as the release of Mueller report and the expected entry of former Vice President Joe Biden into the fray reshape the debate and reset what’s been a fluid field of contenders

US Event Calendar

- 8:30am: Chicago Fed Nat Activity Index, est. 2.6, prior -0.3

- 10am: Existing Home Sales, est. 5.3m, prior 5.51m; Existing Home Sales MoM, est. -3.81%, prior 11.8%

via ZeroHedge News http://bit.ly/2Dpj05K Tyler Durden