Having a credit card in China is much more of a luxury than it is in the United States, and its exclusivity in China could actually be weighing on China’s economy, according to a new Bloomberg op-ed. More than 66% of Americans over the age of 15 have a credit card, but that number stands at just 21% in China. And it’s not because the Chinese don’t want to spend – a recent survey showed that 44% of Chinese internet users plan to consume more and only 33% intended to scale back.

The lack of credit isn’t because the Chinese are financially irresponsible, either. Most borrow within their means and the average loan usually amounts to a little more than a month’s salary. But the lack of access to credit in China “dramatically undercuts Chinese citizens’ financial security” according to Bloomberg, and cardholders are a privileged bunch.

The average credit card holder in China is a 34-year-old millennial who earns at least $16,400 per year, which is close to three times the average urban income in China. There is an 82% chance that they live in one of the country’s four biggest megacities, including Beijing, Shanghai, Shenzhen and Guangzhou.

Those Chinese without credit cards are forced to either live within their cash flow means, or resort to online borrowing, where loans come relatively easy to those who have established good Sesame Credit, a scoring system developed by Alibaba group. For those who have online loans already, or for those who want to borrow more, peer to peer lending or even payday loans are popular – just as they have grown in popularity in the United States.

But online rates are much higher than those charged by credit cards. This has led to predatory lending scandals across the country in recent years. For instance, US listed company Quidan (QD) sparked outrage in 2017 after it disclosed that more than half of its transactions had annualized rates exceeding 36%, the legal limit. In March, CCTV ran a lengthy interview with a woman whose debt went up 70 fold in three months because she took out a “714 missile loan”, the name for a 7 to 14 day loan. She would’ve never faced these consequences if she had a credit card, which doesn’t charge interest for a whole month, the op-ed argues.

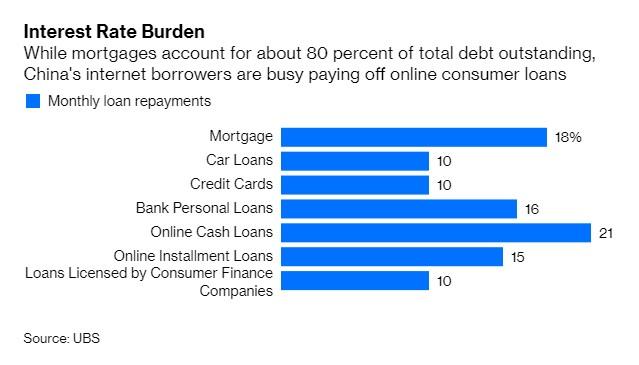

And higher interest rates are starting to weigh on borrowers. Mortgages accounted for 80% of total outstanding debt for those who responded to the survey but such payments are only a small part of monthly obligations for Chinese citizens when compared to other types of debt.

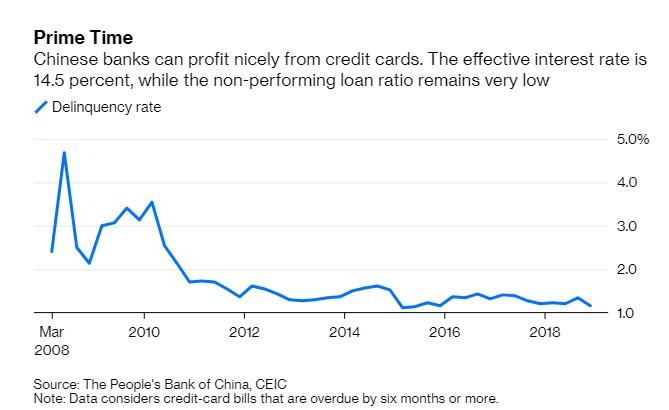

This has led people to ask what banks are doing to help people get credit cards. Lenders can earn about 14.5% effective yield from clients whose 1% delinquency rate makes them prime borrowers. Not only that, the People’s Bank of China now allows commercial banks to package credit card loans into asset-backed securities that they can sell. The typical yield for an ABS is 3% to 5% on the safest tranches.

Boosting the case for broader credit card penetration, borrower creditworthiness is surprisingly transparent in China: if a customer has a checking account with Bank of China, the lender has access to their income and also how much they spend every month. Meanwhile, online lenders and peer to peer lenders have to work off of limited information, like social credit scores.

And yet, because bureaucrats in Beijing believe millenials tend to use credit cards to buy highly risky penny stocks or take out home-improvement loans to speculate on the real estate market, they have been dragging their feet. Regardless, the rise of online lending and fintech companies makes it easy for Chinese citizens to find funding somewhere if they want it. So, why not credit cards? The conclusion: if China wants economic growth to be driven by domestic consumption it should allow its citizens more access to them. After all what’s the worst that could possibly happen if China becomes exactly like America…

via ZeroHedge News http://bit.ly/2UsReuJ Tyler Durden