Ever now and then we get a vivid reminder that America’s biggest threat are not a handful of Facebook ads bought by the KGB, nor Iran’s already brittle regime, nor Venezuela’s hyperinflating basket case of an economy, but over $100 trillion in unfunded future liabilities. Today was one such day, because that’s when the board of trustees for Social Security and Medicare reported that Medicare’s hospital insurance fund – also known as Medicare Part A – will be depleted in 2026, while Social Security program costs would exceed total income in 2020, for the first time since 1982.

Additionally, and in line with previous forecasts, the report also projected that Social Security funds could be fully depleted by 2035, leading to a devastating hit on expected payouts to retirees and other beneficiaries (read none), unless a comprehensive overhaul of the entire program is implemented in the coming years.

As a reminder, the Medicare trust fund comprises two separate funds: The hospital insurance trust fund is financed mainly through payroll taxes on earnings and income taxes on Social Security benefits. The Supplemental Medical Insurance trust fund is financed by general tax revenue and the premiums enrollees pay.

With uncertainty around possible cost-cutting solutions already weighing on healthcare stocks this year, US healthcare costs are expected to be a hot topic during the 2020 presidential campaign; most provocative of all is Bernie Sanders’ proposal of “Medicare-for-All” – a plan that would eliminate private insurance and shift all Americans to a public healthcare plan.

It now appears, that Bernie’s socialist healthcare vision is at best a pipe dream that will last about 6 more years, in line with Republicans’ complains that the Vermont socialist’s proposal is impractical and too expensive.

“At a time when some are calling for a complete government takeover of the American health car system, the Medicare Trustees have delivered a dose of reality in reminding us that the program’s main trust fund for hospital services can only pay full benefits for seven more years,” Seema Verma, administrator for the Centers for Medicare & Medicaid Services (CMS), said.

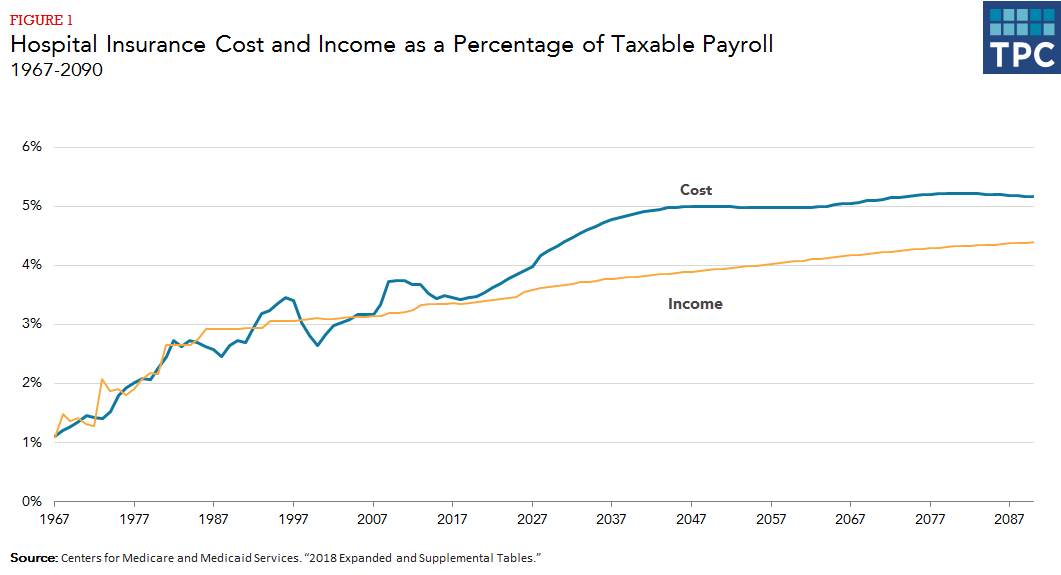

Here’s the reason: as the number of Medicare beneficiaries increases from about 58.4 million in 2017 to nearly 80 million by 2030, the number of workers per beneficiary will decline from 3.1 to 2.4. The cost of health care has increased rapidly as well putting further pressure on program costs. HI trust expenditures exceeded taxes for several years up to 2016, and though these outflows and inflows will roughly stabilize for a few years, the fund is projected to be exhausted by 2027. These pressures now and in the future will force lawmakers to find ways to finance promised benefits or cut services or provider payment rates.

Separately, the report said costs associated with the Medicare Supplementary Medical Insurance (SMI) trust fund, which covers drug costs in Part B and D in the program for seniors, are likely to grow steadily from 2.1% of gross domestic product in 2018 to about 3.7% of GDP in 2038, given the aging U.S. population and rising costs.

There was a sliver of good news, and one may have to thank Trump for it: cost projections for Part D drug spending, which covers pharmacy prescription medicines, are actually lower than in last year’s report because of slower price growth and a trend of increasing manufacturer rebates, CMS said.

Some more good news: unlike Medicare Part A, the trustees projected that the SMI fund for Part B and Part D will remain adequately financed into the indefinite future because current law provides financing from general revenues and beneficiary premiums each year to meet the next year’s expected costs.

Finally, in an unexpected twist, the trustees predicted that the Social Security program’s will extend for one more year than projected last year. Which means that instead of being exhausted in 2034, Social Security funding will hit zero in 2035, or as the LA Times put it, “the trust funds’ exhaustion last year was 16 years away; this year it’s still 16 years away.”

That said, the costs of running Social Security will exceed the revenue next year; in 2018 income of $1.003 trillion only barely exceeded the costs of $1 trillion. The program received $885 million from the payroll tax, $83 million in interest and $35 million from taxing benefits, while it spent $988.6 million on benefit payments, $6.7 million on administrative expenses and $4.9 million on railroad retirement expenses.

Costs haven’t exceeded revenues since 1982, but are projected to do so in 2020. After that, costs will then remain higher throughout the 75-year projection period, according to the forecast.The rising costs are a sign of America’s increasing aging population.

Finally, for those eager to save Social Security it could be donw… it will just cost an additional 2.7% from every paycheck. Specifically, the cost of making Social Security fully solvent would require an immediate increase in the payroll tax of nearly 2.7% points, bringing the tax to 15.1% (shared by employers and employees), up from the current 12.4%. Whether or not any Americans will be thrilled with having nearly 3% of each and every paycheck be paid down to fund healthcare for others is a different matter entirely.

via ZeroHedge News http://bit.ly/2VjxBJU Tyler Durden