Jes Staley’s battle to save one of Europe’s last bulge-bracket investment banks from a marauding activist who is hoping to force his way onto the bank’s board during Barclay’s May 2 GAM has necessitated an abrupt about-face: After a year where Barclays poured resources into the investment bank to beef up its international presence, the bank is now following in the footsteps of several of its even more troubled European peers and slashing bonuses for its bankers.

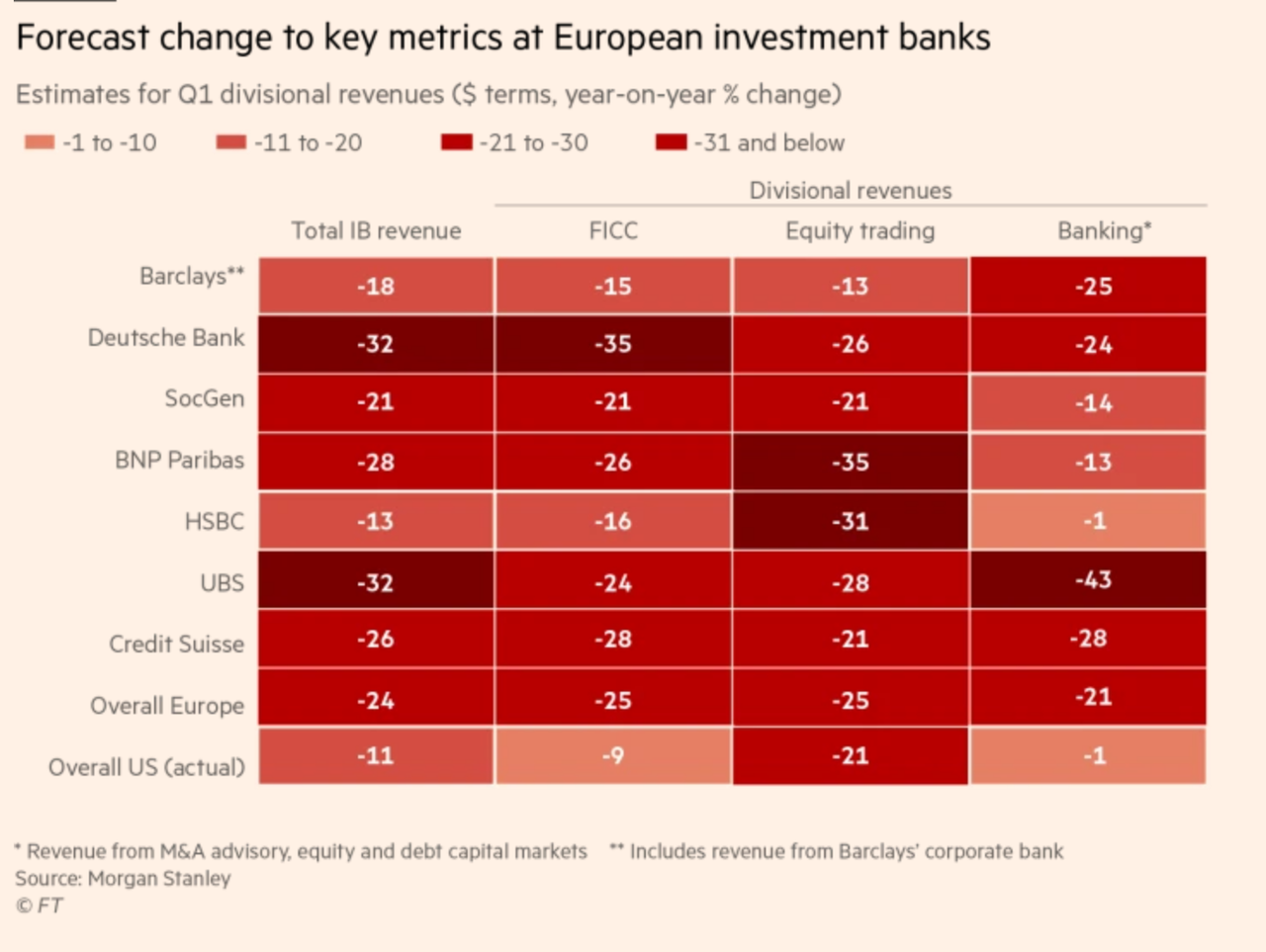

According to the FT, Britain’s last remaining global investment bank is planning to cut bonuses for its investment bankers as part of a cost-cutting drive after a first quarter that UBS CEO Sergio Ermotti described as “one of the worst” first quarters for investment banks in recent memory. After US banks reported a rocky start to the year, largely thanks to steep declines in trading revenue, banking analysts have downgraded their expectations for their struggling European peers. Analysts at Morgan Stanley, Citigroup and JPM are all forecasting double-digit declines in Q1 revenues, thanks to a drop in equities-trading revenue, per the FT.

The bonus cuts come at a precarious time for Barclays. As the Guardian reported, activist investor Edward Bramson, who owns 5.5% of Barclays via his Sherborne Investors vehicle, saw his campaign to gain a seat on Barclays’ board bolstered over the weekend when Pirc, an institutional advisory firm, declined to give a recommendation one way or the other for 2019, and hinted that it might advise shareholders to vote in favor of Bramson’s proposal next year. Though that might not sound like much, it’s a sign that some of the big institutional advisory firms are beginning to come around to Bramson’s way of thinking. His plans for revitalizing Barclays include steep cuts to the investment bank, something that Staley, Barclay’s CEO, has vowed to resist.

With Bramson breathing down his neck, Staley has been forced to shift his focus back to cost-cutting for the investment bank. Two sources told FT that the measures will extend beyond cuts to bonuses, and include lower pay for recruits and a pause on promotions.

Two people briefed on the plans said the bank was also planning to adopt a tougher line on promotions, with fewer bankers progressing from director to managing director. Last year, 85 bankers were promoted in Barclays International compared to 74 in 2017. “It will be reflected in a really tough MD promotion round this year,” said one. “It will be only a rare and special person who makes it over the line.”

They added that Barclays would also be more disciplined on pay when signing up new recruits.

The cuts come just weeks after the bank’s former head of investment banking, Tim Throsby, was ousted after pushing back against Staley’s “sacrosanct” profitability targets. Throsby had resisted a policy adopted in 2016 to tie bonuses more closely to profitability, and had succeeded and securing bonuses for his bankers even in business lines where revenues had lagged.

Going forward, bankers hoping to bring home big bonuses must abide by Staley’s return on tangible equity targets of more than 9% this year and more than 10% in 2020, goals that have been described as “sacrosanct”. And depending on what the bank reveals on Thursday when it reports Q1 earnings, this might not be the last round of cuts to Barclay’s investment bank.

via ZeroHedge News http://bit.ly/2Dt8rP0 Tyler Durden