After several quarters of declining usage, Twitter surprised Wall Street with a solid quarter – mostly in non-GAAP terms – reporting revenue and EPS that beat expectations as well as user numbers that surprised to the upside.

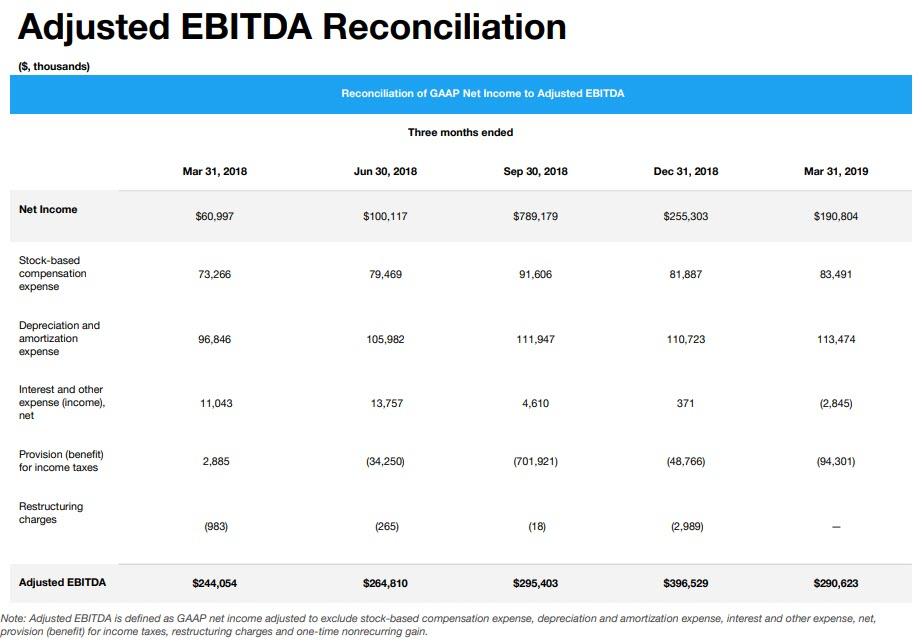

Q1 revenue came in at $787 million, above the $775 million estimate, resulting in non-GAAP EPS of 37 cents (9 cents GAAP), also above the 15 cent consensus estimate. Q1 adjusted EBITDA came in at $290.6 million, $46MM higher than a year ago, and beating not only the consensus average of $245.7 million but the highest Wall Street forecast of $286 million.

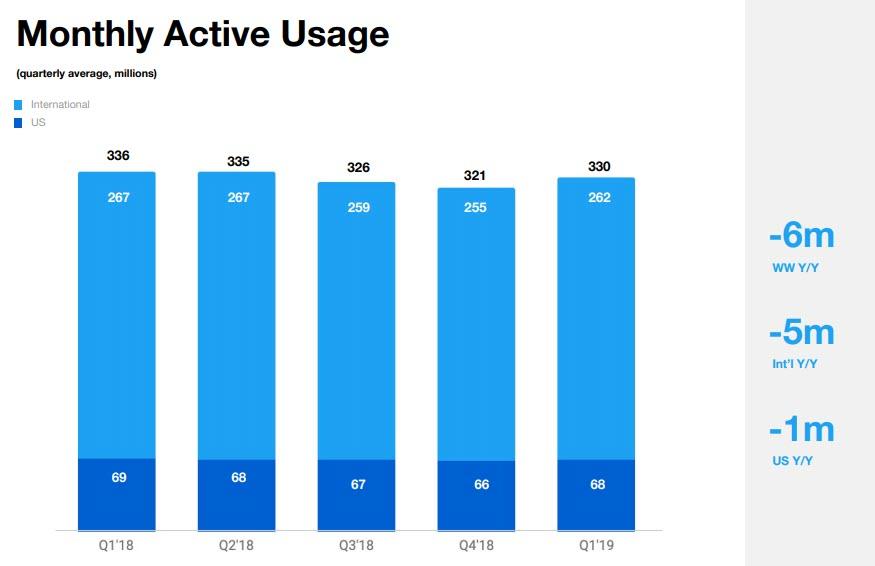

User numbers are surprised to the upside: while Monthly Active Users declined by 6 million to 330 million (as both International and US users dipped from a year prior), the number was a sequential improvement…

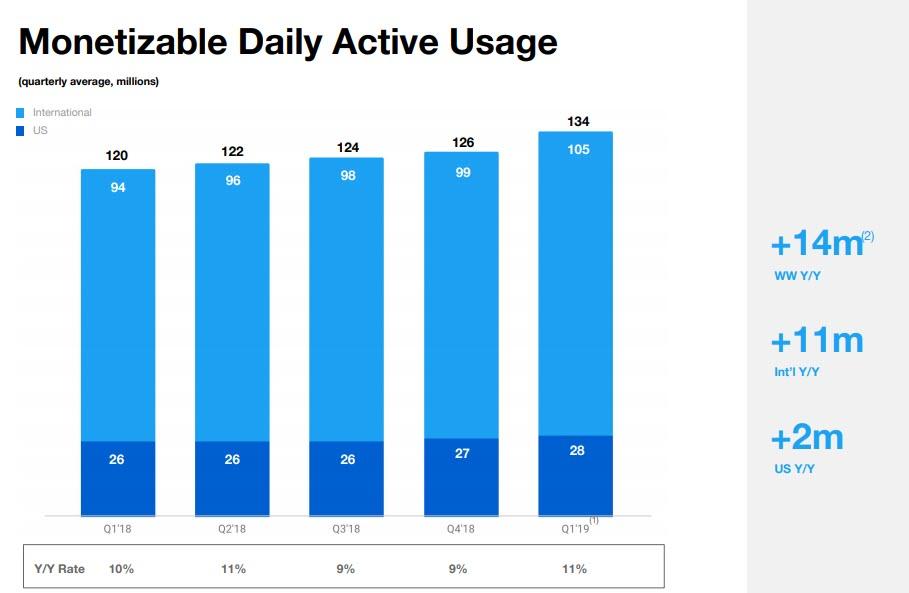

… but the one number that Twitter says is more important, the “monetizable” DAUs print (think of it as non-GAAP users), posted a solid 14MM increase year over year. It was not clear just what adjustments go into “normalizing” this trendline, but it is safe to say that it is “a lot.”

Commenting on the user data, Twitter said that “we have deployed new machine-learning models to detect potential policy violations and we are sending those flagged Tweets to agents for review, proactively. This has resulted in Twitter taking down significantly more abusive content, much faster than before. Of the Tweets we take down for abusive content every week, approximately 38% of them are now proactively detected.”

Twitter also said that it is “taking a more proactive approach to reducing abuse on Twitter and its effects in 2019, with the goal of reducing the burden on victims of abuse and, where possible, taking action before abuse is reported…. As a result, improvements in Q1 emphasized proactive detection of rule violations and physical, or off-platform, safety — including making it easier to report Tweets that share personal information, helping us remove 2.5 times more of this content.“

Much more important to investors was the report on total ad engagements, which TWTR said increased 23%, “resulting from higher ad impressions and improved clickthrough rates (CTR) across most ad formats.”

Looking ahead, the company delivered a mixed message, saying it now expects Q2 revenue forecast midpoint below analysts’ estimates as its monthly user-engagement metric topped consensus view: specifically, twitter sees 2Q revenue $770 million to $830 million vs the analyst estimate $819.2 million (range $784 million to $854 million). The company also sees 2Q operating income $35 million to $70 million. This would represent a drop from last year’s Q2 operating revenue of $80 million.

Twitter also expects stock-based compensation expense to be in the range of $350 million to $400 million, and capex to be between $550 million and $600 million.

While markets may have been a little concerned about the company’s weaker than expected guidance, the reversal in the declining MAU trendline was enough to send TWTR stock surging about 9% higher premarket. That, however, may have displeased president Trump who immediately after the company reported earnings took to bashing Twitter, complaining that the company doesn’t “treat me well as a Republican. Very discriminatory, hard for people to sign on. Constantly taking people off list. Big complaints from many people. Different names [ZH: such as Barack Obama]-over 100 Million…..But should be much higher than that if Twitter wasn’t playing their political games. No wonder Congress wants to get involved – and they should. Must be more, and fairer, companies to get out the WORD!”

…..But should be much higher than that if Twitter wasn’t playing their political games. No wonder Congress wants to get involved – and they should. Must be more, and fairer, companies to get out the WORD!

— Donald J. Trump (@realDonaldTrump) April 23, 2019

So far traders are ignoring Trump’s latest morning rant… which incidentally took place on – where else – Twitter.

via ZeroHedge News http://bit.ly/2W13G6x Tyler Durden