Authored by Michael Every via Rabobank,

The ripple effects of the sharp rise in oil prices continued on Tuesday.

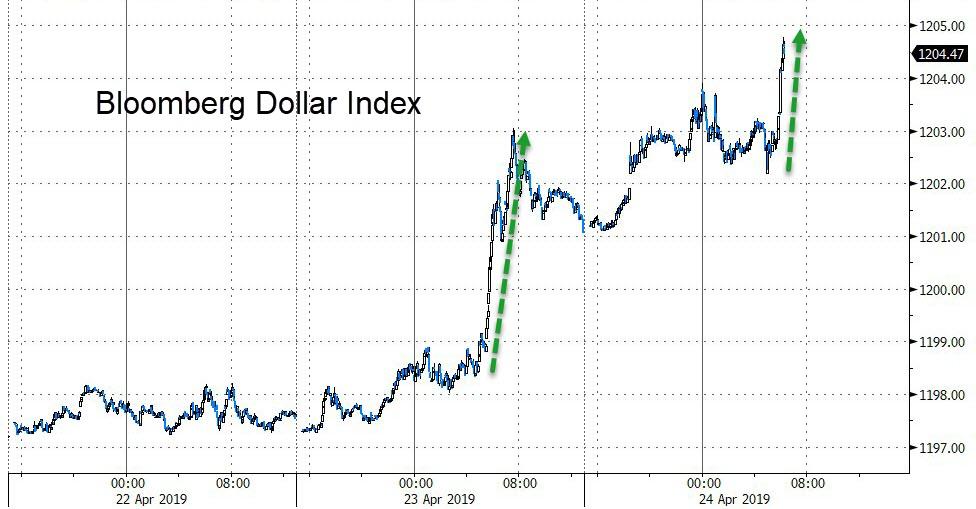

Brent crude spiked to a six month high after the White House announced that the US will no longer offer exceptions to buy Iranian oil when current waivers expire on May 2. The US dollar appreciated broadly against its G10 peers and US stocks proved relatively resilient to higher oil prices. The S&P 500 Index rose 0.9% to 2,933.7 on the back of another set of encouraging earnings with almost 80% of US companies reporting results that exceeded expectations.

The euro depreciated versus the dollar to the lowest level since early April. Apart from market concerns that higher oil prices could undermine already weak growth in the Eurozone, the fall in the euro could be also attributed to a threat from President Trump to retaliate against “unfair” EU tariffs. Trump explicitly mentioned Harley Davidson as a victim of European import tariffs after the company reported an almost 27% fall in its profits in Q1 partially blaming it on higher EU taxes. Conveniently, Trump refrained from mentioning that another important reason behind Harley Davidson’s disappointing Q1 profits was higher price of aluminium and steel as a result of Trump’s duties on metals. For the European markets the main message is that Trump intends to focus on the EU next once the US reaches a trade deal with China.

An escalation of trade tensions between the US and the EU would likely weigh on EUR/USD. At this stage the support area formed by the year-to-date low at 1.1177 and the April 2 low at 1.1184 is crucial to watch. A break below would be a fresh bearish signal for the single currency.

Sterling extended its recent losses yesterday after newswires reported that the 18 Tory MPs who make up the backbench 1922 committee were scheduled to meet to discuss changing the rules to allow another leadership vote in an attempt to force PM May to step down in the summer. Separately, grassroots Tories will reportedly hold a non-binding vote of confidence in May’s leadership as the Telegraph reported that Boris Johnson was now 17 points clear in a poll of the party’s favoured candidate as next leader. As ministers reportedly pressure the PM to walk away from cross-party talks with Labour, political uncertainty in the UK may increase in the coming weeks as PM May faces an increasing challenge from within her own party over her way of dealing with Brexit. From the perspective of technical analysis, the confluence of bearish signals have shifted the short-term bias to the downside in GBP/USD. This favours further retracement towards the February low at 1.2773 in the short-term.

In the EM FX space, losses were led by the South African rand. Not only is the rand often used as a proxy for its EM peers, but a rise in oil prices does not bode well for the already struggling South African economy. A weaker currency accompanied by rising costs of imported energy will have inflationary consequences. This in turn will limit scope for the SARB to lower interest rates to stimulate growth.

Turkey is even more vulnerable than South Africa as it is one of the countries which imports Iranian oil. The US warned that countries which continue to buy Iranian crude will face American sanctions. If Turkey is forced to buy more of expensive oil from other producers, it would fuel inflationary pressure and would also prevent C/A deficit from narrowing further due to higher import costs. The country could find itself in a very difficult position at the time when inflation remains stubbornly high close to 20% and its relationship with the US is already tense due to the dispute over the purchase of Russian S-400 defence system.

The Turkish lira is also very sensitive to developments in domestic politics. The currency briefly rallied on Tuesday afternoon when the newswires reported that the High Electorate Board rejected the main argument presented by President Erdogan’s AKP party that people dismissed from state jobs – over the allegations of participating in the failed 2016 coup – should not be allowed to vote. However, this was followed a few minutes later by a very important and potentially seriously consequential detail: the High Electorate Board agreed to investigate another AKP claim that more than 41,000 ineligible voters and election officials participated in the vote. The AKP has been urging to repeat the local elections in Istanbul after its candidate was defeated by the representative of the CHP opposition party on March 31.

A decision to cancel the outcome of the March 31 vote followed by another elections in Istanbul would be a major source of political uncertainty for investors who are already on the edge as reflected in the lira underperforming its EM peers so far this year.

Should political uncertainty escalate in addition to growing tensions between the US and Turkey over Iranian oil and the Russian S-400 defence system, this could prove sufficient for USD/TRY to convincingly brake above the March 22 high at 5.8448. Such a bullish breakout would expose the 6.00 level as the next potential target. The October top at 6.2282 would be the next important level to watch.

A sharp drop in Australia’s CPI inflation rate overnight has spurred talk of an election rate cut and placed fresh pressure on the AUD. The key annual core measure on inflation, favoured by the RBA, registered just 0.3% q/q for the March quarter and brought the year-on-year rate to 1.6%, well below the central bank’s forecast of 1.8%. Both the average and trimmed measures of inflation dropped to 1.4%. This was the same level as 2016 when the RBA cut rates twice. The data have underpinned market calls for two RBA rate cuts this year and increased the risk that the RBA could plump for the first move next month during the election campaign. AUD/USD has dropped almost 2% over the past 5 days.

via ZeroHedge News http://bit.ly/2IAzDPS Tyler Durden