Earlier today we pointed out the paradox that the S&P hit a new all time high (i.e. it is back to levels last seen 6 months ago), as Treasuries continued to climb alongside European sovereign bonds and the dollar extended its rally – now to the highest level in 2019 – and defied the signal from record highs in US stocks as bond traders refused to “rotate greatly” into stocks, instead sees even more economic weakness (or just more QE) in the future.

At roughly the same time as we wrote that, BMO’s Ian Lyngen was making a similar observation, writing that “the breakdown of the ‘traditional’ relationship between equities moving higher and Treasuries edging lower has once again become topical” and adding that “this correlation holds ‘most’ of the time, but it always seems that when it fails is when it matters.” Of course, as we noted there is a simple explanation as Powell’s pivot has been the impetus which pushed stocks to new records; “that and a non-dismal earnings season, thus far” as Lyngen adds and notes that “given the importance of low equity volatility to easy financial conditions, we’re content to conclude that while the Powell put seems unlikely to be employed again soon, its relevance to the bid in risk assets is difficult to ignore.”

So while traders contemplate whether the S&P will continue rising from here, a better question may be what yields do next, and according to BMO, for the time being, “a drift back toward the year’s low-yield marks appears the path of least resistance as stochastics have fully crossed while in oversold territory.” Looking purely at technicals, the BMO strategist believes that there is plenty of room for the bullishness to extend from a momentum perspective “and the dearth of economic data leaves the technicals especially relevant in the very near-term. The 50-day moving-average in 10s at 2.58% offers compelling support ahead of GDP Friday.”

The fundamentals are also beneficial, and come from one place: Japan, as Bloomberg noted in an article this morning titled “Global Yield Slide Spurs Japan Insurers to Take More Risks; many firms plan to raise exposure to unhedged foreign bonds.” We have previously discussed the eagerness by Japanese lifers to buy US treasuries, especially if – as they now claim – they are willing to do so unhedged, and as BMO adds, “we’ve noted the seasonality of Japanese flows in Treasuries that favor buying during the summer months and suffice it to say, such flows are very much on our radar as beach season approaches our thoughts turn toward Keto and Kale.”

Yet even with all these considerations in mind, traders appear surprised by the aggressive bid for yield today, and as Lyngen points out in a follow up note, “we’ve been asked several times today what’s behind the move in the curve and outright yield levels” and answers that one thing we can conclude with certainty is that it not

- the data,

- Fed-speak,

- month-end (yet), or even

- an equity selloff.

So, to quote Lyngen, as Arthur Conan Doyle coined ‘once you eliminate the impossible, whatever remains, no matter how improbable, must be technical analysis.’ Or something like that…”

And speaking of technical analysis, below are a couple of charts that illustrate the relevance of the technical landscape at this moment. Stochastics were extended into oversold territory at the beginning of the week…

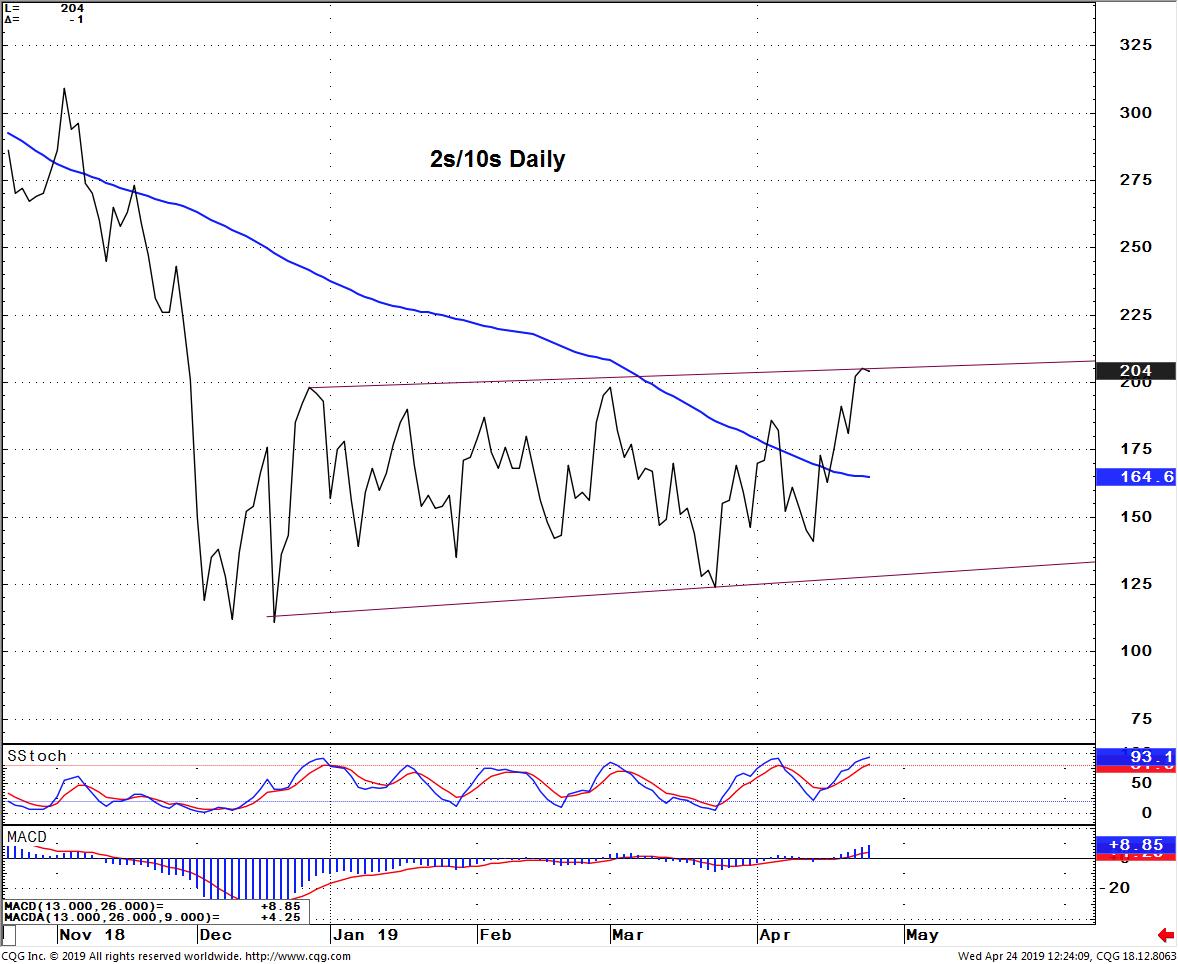

… so a sellers’ strike was always a risk according to BMO, which notes that despite the auctions, “that is exactly what ultimately emerged” adding that “we’re left to ponder what it means for the curve with 2s/10s poised for the long-awaited steepening breakout; still in the ‘go with’ camp beyond 23/24 bp (i.e. a sustained range-breach).”

Finally, going back to the fundamentals, BMO lists 4 more reasons to consider as well, including:

- Weak Aussie inflation – it’s a thing,

- 10-year bunds back below zero-point-zero,

- Dollar strength with lower rates risks importing deflation, and

- Bank of Canada dropped the bias for more hikes in a bit of a catch-up with Powell… but is nonetheless bullish and begs the question who will win the race to be the first to cut?

And incidentally, that “other” Canadian bank, TD Securities, published a note in which strategists Priya Misra and Gennadiy Goldberg predicted that QE4 will begin next year, when the Fed “may begin buying $300b of Treasuries in the secondary market per year“, arguing that buying will be driven by the central bank replacing MBS paydowns with Treasuries starting in October, and offsetting the growth of currency in circulation starting in April 2020. More on that in a follow up post.

via ZeroHedge News http://bit.ly/2UBgdfx Tyler Durden