Many have wondered if the Fed is ignorant to the problems their policy prescriptions cause, or if they’ve just resigned to walking society down the path to destruction knowingly. It increasingly looks like the latter. Indeed, the Fed may very well understand that its “lower for longer” policy is leading the economy and global markets straight into disaster. However, as the same time, the central bank – feeling trapped after 10 years of unprecedented stimulus which if undone would result in a historic crash – is backed into a corner and has no choice but to accept this growing risk, as the world’s punch drunk central bankers continue to try at all costs to keep the bloated economic “expansion” going.

Indeed, the Fed itself acknowledges this risk, because according to the minutes of the FOMC policymaking meeting from March 19 and March 20. “A few participants observed that the appropriate path for policy, insofar as it implied lower interest rates for longer periods of time, could lead to greater financial stability risks” the minutes read.

Chairman Powell himself understands very well the risks that he is taking: he has previously pointed out publicly that the last two “expansions” ended in the dot com bubble burst and then the housing bubble burst, according to Bloomberg.

But it is the Fed’s willingness to continue down this path, despite seeing the dangers, that is disturbing. It’s a classic example of putting a Band-Aid on the problem now at the cost of the future. Holding rates down while pursuing maximum employment and 2% inflation is a policy that has proven to lead to disaster.

Tobias Adrian, a senior International Monetary Fund official said: “Easy financial conditions today are good news for downside risks in the short-term but they’re bad news in the medium term.”

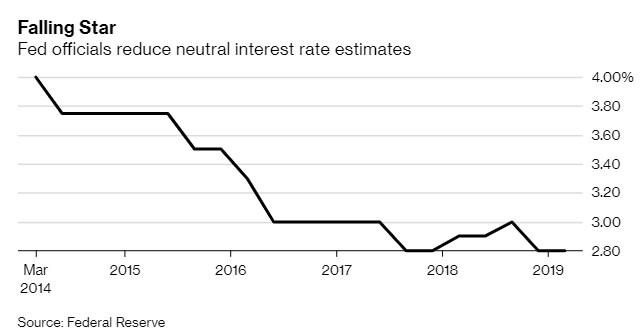

The Fed’s dilemma – obvious to everyone but them – is that the neutral rate of interest (i.e. “r star”) is simply too low – something we discussed back in 2015 – so low that, in fact, that instead of keeping the economy at an equilibrium, it simply encourages more risky behavior by investors.

The neutral rate has continued to fall as a result of rising debt, an aging population and slower productivity growth. Bloomberg has been using a term called “FAST-star” instead of “R-star” to denote a rate level that ensures financial stability. A setting above it stifles risk-taking while the setting below it encourages excess. The Fed’s neutral rate – “R-star” – falls well below this suggested rate.

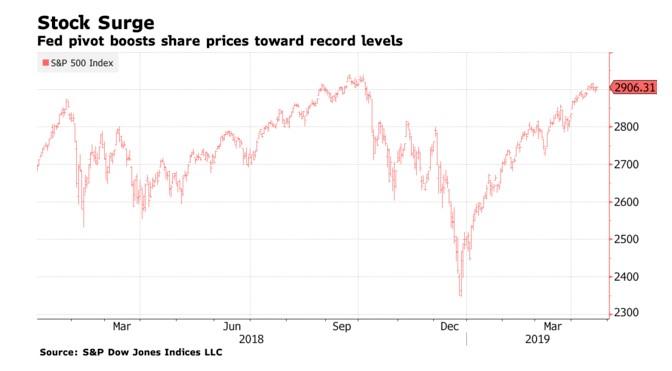

The dovish shift by the Fed at the end of the year last year helped prompt a massive stock market rally, even after raising rates from 2.25% to 2.5%. So far the S&P 500 index is up 16% in 2019. However, the one beating the drum the most in favor of dovish policy – President Donald Trump – continues to complain that rate increases have held back the economy.

Yet some policymakers at last month’s FOMC meeting believe that risks can be offset by, drumroll, “counter-cyclical macro prudential policy tools, combined with regulatory and supervisory measures.” This is the same tool and measures that failed to spot the last two financial crises until both were well underway. Additionally, there is another problem to this thinking: even in a best case scenario, the Fed has a limited set of tools. This was even acknowledged by Fed Vice Chairman for Supervision Randal Quarles during a March 29 speech.

Meanwhile, Powell has said that he doesn’t see a high risk of financial instability at this point, a comment that may soon be proven to be as accurate as Ben Bernanke’s assertion that “subprime was contained” prior to the housing crisis. Powell instead argues that the Fed tries to keep the system safe by requiring large banks to hold excess capital and undergo stress tests.

And at some points, Fed presidents have sounded open to the idea of using higher interest rates to cull the markets a little bit. For instance, New York Fed President John Williams said in October “that the central bank’s rate increases would help reduce risk-taking in financial markets, though he added that was not their principal purpose.”

But that type of talk has faded since then.

Jonathan Wright, a professor at Johns Hopkins University and a former Fed economist said: “There doesn’t seem to be the same idea of having tighter monetary policy so as to lessen the risk of asset bubbles developing.”

In April former Treasury Secretary Lawrence Summers concluded: “There are reasons for fearing the economic consequences of very low rates. These include a greater propensity to asset bubbles and incentives to substantially increase leverage.”

Ultimately, the Fed indeed has no choice: either it inflates away the debt – which is where MMT will come in very handy in a few years as helicopter money is unleashed under the guise of “QE for the people” – or it’s game over for the status quo anyway. If it means creating the biggest asset bubble in the process, so be it.

via ZeroHedge News http://bit.ly/2UCga2P Tyler Durden