It was shaping up as a relatively quiet session, with world equity markets slipping modestly on Thursday – despite blowout beats by Facebook and Microsoft which sent the latter’s stock 5% higher, sending its market cap above $1 trillion and making it the most valuable company in the world – amid worries on global growth and as investors digested European earnings, while the Swedish crown slumped to its lowest in 17 years and the euro suffered after German data.

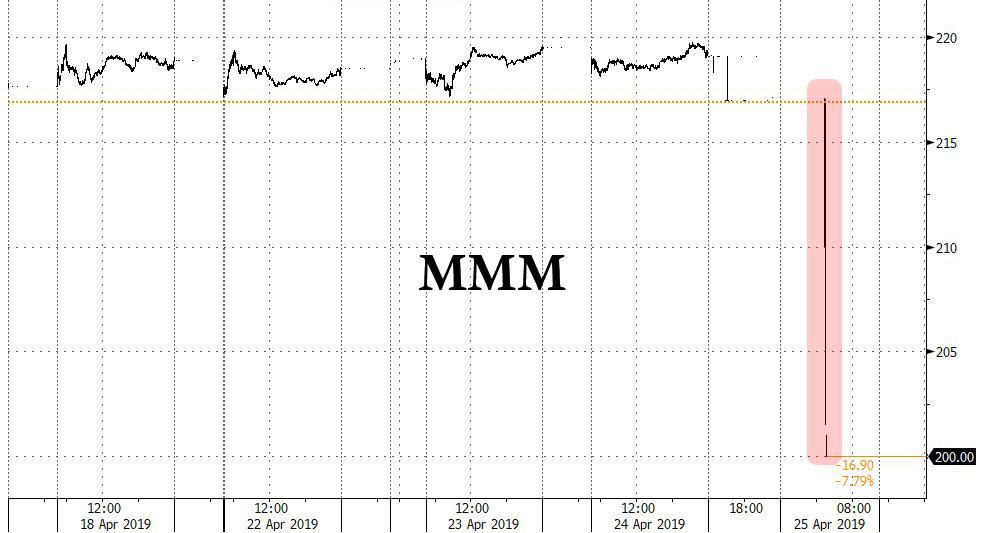

But it was Dow heavyweight 3M’s disastrous earnings report and guidance cut that sent Dow futures sharply lower as the industrial conglomerate became the first stock to validate investor fears about growth challenges for the rest of the year.

In a nutshell, this is what 3M reported as it lamented a “disappointing start” to 2019: Q1 adjusted EPS $2.23, missing the estimate of $2.48, and revenue of $7.86BN, Exp. $8.02BN. But most concerning of all was its guidance, which was slashed to an adjusted EPS of $9.25 to $9.75, down from its prior guidance of $10.45-$10.90, and far below the consensus estimate of $10.53, suggesting sharp weakness for the rest of the year. And the cherry on top: 3M announced it would fire about 2,000 jobs as the broad slowdown hits its operations.

Elsewhere, Europe’s STOXX 600 lost 0.3% in early trading, with concern over prospects for global growth underscored by weak economic data from South Korea which earlier in the session reported its weakest GDP print since the financial crisis.

Energy stocks and a 10% drop in Finnish telecoms equipment maker Nokia dragged down European shares, with a varied bag of earnings for the region’s banks.

Asian markets had fallen earlier in the day, losing 0.5% as South Korea’s economy unexpectedly contracted in the first quarter, a vivid reminder that the global economy continues to slowdown sharply. Chinese stocks also fell sharply late in the day, losing more than 2% following attempts by the central bank to temper expectations for further easing of monetary policy and another substantial liquidity withdrawal by the PBOC. Chinese officials also warned of protracted pressure on economic growth, casting a shadow over hopes for a sustained recovery in the world’s second biggest economy.

Those worries on growth also played out closer to home for European investors, with fears lingering over the state of the German economy after a survey on Wednesday showed German business morale falling.

As a result of this weakness in Asia and Europe, the MSCI world equity index also fell 0.3%.

Amid today’s renewed risk weakness, central banks continued to pivot dovishly, with the Bank of Japan on Thursday pledging to keep interest rates very low at least until early 2020, even as it retained main policy targets. However in stark reversal to the market’s prior response to central bank dovishness, Japan’s Nikkei barely responded, closing just 0.5% higher, while the Japanese yen also reacted little. The yen was last up about a third of a percent, at 111.85 yen per dollar.

Several hours later, the Swedish Krona plunged to its lowest since August 2002, after the central bank said weak inflationary pressures meant a forecast rate hike would come slighter later than planned, while the central bank announced it would resume QE until the end of 2020. The SEK sank 1.2 percent against the euro to 10.65 – on course for its biggest daily drop in more than six months.

Turkey’s lira also crashed against the dollar, tumbling after the central bank announced it was removing its tightening pledge, and confirming that Turkey would no longer defend the lira after the nation’s reserves dropped to dangerously low levels.

“You certainly have a common response (from central banks) to a global growth slowdown in terms of monetary policy,” said Peter Schaffrik, head of European rates strategy at RBC Capital Markets. “We haven’t generally seen outright reduction, but it is easing relative to what was previously communicated to, and implied in, the markets.”

The currency carnage was not over, however, and the euro suffered its worst day in over six weeks, falling 0.6 percent to a 22-month following the further signs of flagging growth in Germany. It was last at $1.1141. Also on the agenda for the single currency were Spanish elections on Sunday and economic concerns out of Italy.

China’s yuan also declined to a two-month-low against the dollar later Thursday, while the Bloomberg replica of the CFETS RMB Index, which tracks the yuan versus a basket of 24 trading partners’ currencies, was at the highest in ten months. While the People’s Bank of China actually weakened the yuan’s reference rate, that wasn’t enough to keep the yuan index from rising so much. “Periods of broad dollar strength, as we have seen overnight, will result in a higher CFETS Index as the yuan fixing is normally not as weak as the moves in the basket currencies,” said Khoon Goh, head of Asia research at Australia and New Zealand Banking Group. Overnight, Chinese state media reported that the PBoC will set up policy framework to implement relatively low RRR for small and medium banks, in which the extra funds will be used to support private and small companies. However, there were later comments from the PBoC that China’s prudent monetary policy is overall appropriate and neither tight nor loose and that the use of repos and MLFs does not signal loosening bias.

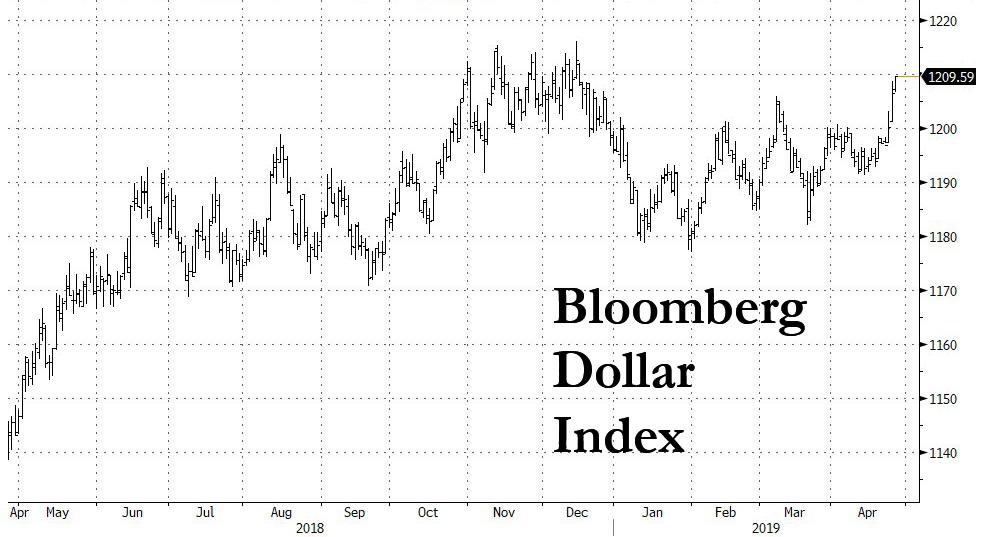

With currencies around the globe tumbling, it’s not surprising that the dollar extended its gains, rising sharply and touching on fresh 2019 highs.

“The Fed isn’t keen to hike rates, but they are the strongest of the bunch so money will gravitate toward the U.S. dollar,” said David Madden, an analyst at CMC Markets in London.

Meanwhile, despite the dollar strength, oil continued to rise, Brent crude rose above $75 per barrel for the first time in 2019 in the wake of tightening sanctions on Iran, while gains in U.S. prices were crimped by a surge in U.S. supply.

Durable goods orders, initial jobless claims are due, while the afternoon sees scheduled earnings from Amazon and Intel.

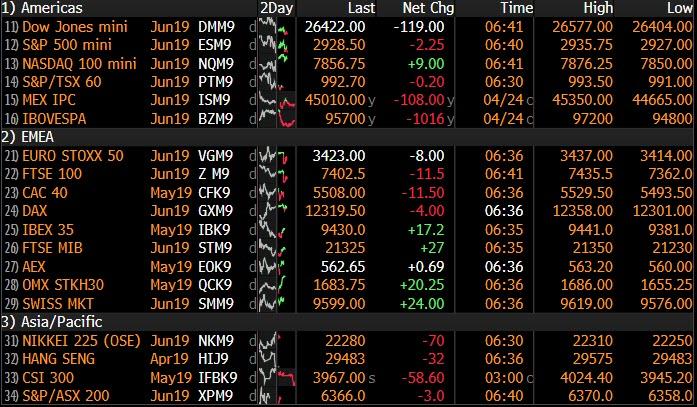

Market Snapshot

- S&P 500 futures down 0.03% to 2,929.75

- STOXX Europe 600 down 0.3% to 389.91

- MXAP down 0.4% to 161.83

- MXAPJ down 0.9% to 536.76

- Nikkei up 0.5% to 22,307.58

- Topix up 0.5% to 1,620.28

- Hang Seng Index down 0.9% to 29,549.80

- Shanghai Composite down 2.4% to 3,123.83

- Sensex down 0.2% to 38,970.94

- Australia S&P/ASX 200 up 1% to 6,382.14

- Kospi down 0.5% to 2,190.50

- German 10Y yield fell 0.3 bps to -0.015%

- Euro down 0.1% to $1.1142

- Brent Futures up 0.9% to $75.25/bbl

- Italian 10Y yield fell 4.0 bps to 2.262%

- Spanish 10Y yield rose 0.8 bps to 1.081%

- Brent Futures up 0.9% to $75.25/bbl

- Gold spot up 0.2% to $1,277.62

- U.S. Dollar Index up 0.01% to 98.18

Top Headlines from Bloomberg

- The biggest currency driver in the European session was Sweden’s Riksbank which fell in line with the dovish tilt seen in other major central banks such as the European Central Bank. The Riksbank backtracked on plans to tighten monetary policy, as a less certain economic outlook meant negative Swedish rates may persist into next year — a shift from earlier where a rate hike was expected this September.

- The BOJ said it would keep interest rates extremely low through at least around spring 2020. A change to forward guidance was predicted by only 3 of 48 economists surveyed by Bloomberg. BOJ now projects it won’t hit its 2 percent inflation target at least through March 2022, which will be nine years since Governor Haruhiko.

- Deutsche Bank AG and Commerzbank AG ended talks on a historic tie-up, throwing the future of both lenders into question after failed turnaround plans. The two lenders decided that attempting to integrate would be too difficult to execute and also cited the restructuring costs and additional capital requirements.

- Bond traders are adding to Federal Reserve rate-cut bets in face of record stocks run. The futures market is moving back toward pricing in a full quarter-point cut this year, even as U.S. and Chinese economic data show signs of improvement.

- Rich Asians came to the rescue of UBS Group AG in the first quarter after Chief Executive Officer Sergio Ermotti’s dire outlook on market conditions sent investors into shock and investment banking revenue plummeted.

- South Korea, a bellwether for global trade and technology, cast doubt over hopes for a quick rebound in the world economy by reporting its biggest contraction of gross domestic product in a decade. Asia’s fourth-largest economy shrank by 0.3% in the first quarter from the previous three months, versus estimates for a 0.3% gain.

Asia equity markets traded cautious following an uninspiring lead from Wall St where the major indices consolidated albeit near record levels. In addition, holiday closures in Australia and New Zealand, the BoJ policy announcement, weak South Korean GDP and a slew of earnings provided much for participants to ponder over. Nikkei 225 (+0.5%) traded higher with newsflow and the biggest gaining stocks in Japan dominated by corporate results, while KOSPI (-0.5%) was subdued following abysmal growth data for Q1 in which GDP Q/Q unexpectedly contracted by 0.3% which was the worst reading since Q4 2008 and GDP Y/Y expanded at the slowest pace in almost a decade. Elsewhere, Hang Seng (-0.8%) and Shanghai Comp. (-2.5%) were downbeat as earnings season also started to pick up in the region and after the PBoC refrained again from liquidity operations which resulted to a net CNY 80bln drain. In addition, there were state media reports the PBoC will set up policy framework to implement relatively low RRR for small and medium banks, although this failed to spur a recovery given the absence of an actual RRR cut announcement and as PBoC officials reaffirmed a preference for prudent monetary policy. Finally, 10yr JGBs were choppy amid the cautious risk sentiment in the region and after the BoJ policy announcement which initially lifted 10yr JGBs at the open due to the dovish aspects from the statement and downgrades in the Outlook Report. However, prices then returned to pre-announcement levels as the lower projections were not much of a surprise given the recent data, while the BoJ slightly adjusted its modified forward guidance in which it stated that it will keep very low interest rate levels for an extended period of time at least through around Spring 2020.

Top Asian News

- BOJ Maintains Policy Rate, Adjusts Forward Guidance

- PBOC Has No Intention to Tighten or Loosen Policy, Liu Says

- South Korea Economy Unexpectedly Contracts as Investment Falters

- Axis, StanChart India CEOs Face Corp. Ministry Contempt Petition

- Global Steel Market Is Put on Notice as Top China Mill Warns

European Indices are trading with losses [Euro Stoxx 50 -0.5%] after having opened relatively flat, with markets initially taking the lead from the cautious performance in Asia. This morning’s downturn is on the back of significant underperformance in a number of Co’s after a morning driven by earnings with Nokia (-10.0%) leading the losses at the bottom of the Stoxx 600 after the Co. reported a EUR 50mln operating loss vs. Exp. profit of EUR 305mln. Separately, Sainsbury’s (-5.3%) are down after the CMA confirmed that they are to block merger discussions with Asda; as such the Co. are at the bottom of the FTSE 100 (-0.4%). The FTSE 100 is also weighed on by Barclays (-1.5%) post earnings where they reported a CIB total income which was lower than the prior, and Taylor Wimpey (-4.0%) after the Co. stated that increasing build costs are to push margins slightly lower. In recent reports Commerzbank (-2.0%) and Deutsche Bank (+3.0%) have confirmed that they have discontinued merger talks, as they believe that the merger would not result in sufficient benefits; which does follow earlier source reports that talks between the Co’s were on the verge of collapsing. Regarding this morning more positive earnings, ASM (+7.2%) lead the Stoxx 600 after beating on Q1 revenue and operating profit; while, Bayer (+3.5%) top the Stoxx 50 after confirming their FY guidance.

Top European News

- RBS Says Ross McEwan Has Resigned From Role as CEO

- Wirecard Addressing Auditing Quality Issues, CEO Braun Says

- Swedish Krona Tumbles as Riksbank Pushes Back Rate-Increase Plan

- SEB Says Riksbank Decisions Much More Dovish Than Expected

In FX, a technical break below support in Eur/Sek and brief look at the 10.5000 proved fundamentally flawed or just premature as the cross catapulted more than 15 big figures on a much more dovish than expected Riksbank policy meeting outturn, while Usd/Sek hit its highest levels in some 16 years. In short, the Swedish Central Bank pushed back the likely timing for further rate normalisation to year end or early 2020 from H2 this year and lowered its repo path over the forecast horizon, adding that the current -0.25% level will be maintained for longer than previously anticipated (ie as flagged in February). The Riksbank also predicted softer inflation in light of recent weaker than expected price developments and announced that Sek45 bn SGBs will be bought from July 2019 through December 2020 regardless of a couple of reservations. Eur/Sek has eased back from a circa 10.6655 peak, but remains relatively close to chart resistance around 10.6730 and Usd/Sek is now eyeing 9.6000 as the Dollar continues to rally across the board.

- USD – The Greenback is still outperforming or gaining at the expense of its currency counterparts, as the DXY consolidates and builds on advances through 98.000. In truth, aside from the Swedish Crown’s post-Riksbank collapse the Buck breached key levels late yesterday as resilience in several rivals finally gave way and the index cleared resistance ahead of the round number to register a new ytd best at 98.189, with only a relatively minor extension to 98.233 so far today. However, the DXY remains in the ascendency and 98.496 is the next bullish chart target.

- CAD/GBP/EUR/AUD – All weaker vs the Usd, albeit just off worst levels, as the Loonie continues to reflect on Wednesday’s shift from the BoC to a wait-and-see stance vs tightening previously and fails to derive much support from a rebound in oil prices. Meanwhile, Cable has fallen under 1.2900 to test Fib and MA supports, with Eur/Usd probing below its latest 2019 trough to 1.1135 and eyeing downside chart levels ahead of 1.1100 (1.1190-10), Aud/Usd pivoting 0.7000 where hefty option barriers lie and the Franc back to straddling 1.0200.

- JPY/NZD – The Yen has recovered well from new ytd lows vs the Usd around 112.40 to trade back above 112.00 amidst more speculation about positioning for the upcoming lengthy Golden Week holiday and not really reacting to the BoJ’s attempt to clarify policy guidance given Governor Kuroda’s admission that it is highly possible that ultra accommodation may continue beyond Spring 2020 as the 2% inflation target could well remain elusive even after FY 2021. Elsewhere, the Kiwi is trying to cling to 0.6600 vs its US peer ahead of NZ trade data and with some indirect help via the Aud/Nzd cross that is hovering near the base of a 1.0627-42 range at the tail end of ANZAC day.

In commodities, Brent (+1.0%) and WTI (+0.4%) prices are in the green as oil prices have now largely shrugged off yesterday’s larger than expected EIA build; which came in at 5.479M vs. Exp. 1.25mln, as this was below Tuesday’s API build of 6.86M. This morning Brent prices did surpass, and remain above, the USD 75/bbl level for the first time in 2019. In recent newsflow Iran’s Foreign Ministry have stated that Tehran will not allow any country to replace their oil sales within the market; which does come in the context of the Iranian oil waivers ending on May 2nd. Separately, Iraq’s Oil Minister states that they have the capacity to increase oil production to 6mln BPD, for reference Iraq currently have a production level of 4.5mln BPD; however, there will be no change in production and if markets need more oil this will be decided at the relevant time. Gold (+0.1%) has been relatively uneventful overnight, as the yellow metal remains subdued by the continuing dollar strength. Elsewhere, Anglo American reported Q1 copper production of 161k tonnes vs. Prev. 155k tonnes, and an increase in iron ore output from their Minas-Rio mine, 4.9mln tonnes vs. Prev. 3mln tonnes; with the mine having reopened in December after an 8-month closure due to a pipeline leak.

US Event Calendar

- 8:30am: Initial Jobless Claims, est. 200,000, prior 192,000; Continuing Claims, est. 1.68m, prior 1.65m

- 8:30am: Durable Goods Orders, est. 0.8%, prior -1.6%; Durables Ex Transportation, est. 0.2%, prior -0.1%

- 8:30am: Cap Goods Orders Nondef Ex Air, est. 0.2%, prior -0.1%; Cap Goods Ship Nondef Ex Air, est. 0.1%, prior -0.1%

- 9:45am: Bloomberg Consumer Comfort, prior 60.3

- 11am: Kansas City Fed Manf. Activity, est. 8, prior 10

DB’s Craig Nicol concludes the overnight wrap

With the US equity rally catching its breath yesterday, it was the bond market which instead took centre stage with yields sharply lower across the board. Indeed, having spent 8 consecutive sessions above 0%, Bunds succumbed to gravity once again and dropped back into negative territory following a -5.3bps decline taking 10y yields to -0.015%. There were moves of similar magnitude across the rest of Europe while Treasuries also rallied -4.7bps for the biggest move in over a month as curves broadly flattened.

There was a bit of head scratching as to what was driving the moves however in the end it appeared to be a bit of a compounding effect of various data releases and newsflow. Initially the well below market Aussie CPI release got the ball rolling this time yesterday, before Europe took the baton with Germany’s soft IFO survey doing the early damage – more on that further down. There was some commentary also about a decent Bund auction which kept yields anchored towards zero while the ECB’s latest Bulletin hammered home the implications of rising protectionism for the Euro Area, even if there wasn’t a huge amount of new information. Later in the afternoon we also got a dovish BoC meeting – which saw 10y Canadian yields fall -7.4bps to their lowest level since the start of the year after the bank’s statement removed its hiking bias – adding more fuel to the rates rally fire. Meanwhile, there was also some more chatter about the WSJ story from the weekend which was suggested as still hanging over the bond market, as it seemed to more seriously entertain the idea of a rate cut than previously. Our US economists dug into the underlying interview transcripts though, and they think the article is sensationalizing the actual, more measured argument from Fed officials. Finally, US oil inventory data showed another surprising build in stockpiles, which sent WTI prices -0.62% lower and weighed a bit on inflation expectations.

Holiday volumes are probably also exaggerating moves this week, however with central banks falling into the dovish line one-by-one and data outside of the US still faltering, it’s no great surprise to see yields really fail to break higher at the moment. The dollar has also perked up in response to those trends, advancing +0.55% to its strongest level in almost two years. It might have been boosted by breaking through some key technical levels, but the greenback has regardless gained against most currencies this week. Also interesting is the decoupling of bonds from equities at the moment. Whilst US equity markets gently eased on the breaks yesterday it still didn’t stop the S&P 500 and NASDAQ going above their record highs again intraday, before closing -0.22% and -0.23%, respectively. The energy sector underperformed and fell -1.85%, following the move in oil. Earnings played their part again but ultimately appeared to cancel each other out.

Indeed all eyes had been on Caterpillar (-3.03%), given its reputation as a macro bellwether. The company reported higher earnings than expected and worked down its backlog of orders, and left its guidance mostly unchanged.On the positive side, the CFO said that “strong” US demand will continue to grow this year, but investors focused on softer language about China. Management said that they expect to lose market share in China, because of aggressive competition and pricing pressure. Elsewhere, Boeing (+0.39%) advanced after management downplayed the impact of the 737 Max grounding, though the ultimate impact remains uncertain.

After the US close we also got the latest results from a couple of the tech juggernauts in Facebook and Microsoft, with both companies posting quite strong results. Microsoft traded as much as +4% higher after hours and Facebook +10% higher. Both companies saw revenues grow much stronger than consensus expectations, and Microsoft had particular strength in its cloud-computing sector. Facebook’s growth has slowed in developed markets, but the company has improved in emerging markets to compensate. US equity futures are posting small gains overnight led by the NASDAQ (+0.30%).

Overnight we’ve also had the BoJ meeting. As expected, policy was left unchanged with the most notable statement changes including a mention to keep rates low through at least spring 2020. Previously the BoJ had suggested rates would stay low for an “extended period”. There were also modest downward revisions to growth and inflation while the BoJ is considering a facility to offer term-limited loans of its ETFs to investors. Kuroda is due to speak after we go to print.

Despite the Yen (+0.17%) advancing, the Nikkei (+0.30%) is also slightly higher post that news and leading gains in Asia with the Hang Seng (-0.07%), Shanghai Comp (-0.70%) and Kospi (-0.26%) all in the red. The latter has struggled after Q1 GDP printed at a well below market -0.3% qoq (vs. +0.3% expected) in South Korea – the weakest since 2008.

Back to yesterday, where as noted above the initial trigger for the rates rally appeared to be the soft German IFO survey. The headline reading came in at 99.2 which was both lower than the 99.9 consensus and also down half a point for March.The expectations component slid 0.4pts to 95.2, however that was almost a full point below consensus while the current assessment component dropped 0.6pts to 103.3. Like the PMIs, the manufacturing sector bore the brunt of the decline, dropping to the lowest since 2013.So little turnaround in sight for the sector. It’s worth noting that less followed confidence indicators in France were also softer for the manufacturing sector yesterday.

Interestingly, despite the Bund and broader rates move the DAX actually outperformed most other European equity markets, closing up +0.63% albeit entirely thanks to big moves for SAP and Wirecard.In contrast the STOXX 600 closed -0.09%, CAC -0.28% and FTSE MIB -0.79%. European Banks also got hit to the tune of -1.71% which was the biggest decline in a month. The rates move clearly overshadowing any positive read through from the Credit Suisse results.

Meanwhile, in EM the MSCI EM equity index fell -0.48%. It’s interesting to note that while US equities breached record highs two days ago, and European equities are not far off, EM has very much lagged the broader DM move with the index still -14.81% off its 2018 highs achieved last January.In FX a basket of EM currencies finished -0.69% with the Turkish Lira (-0.77%) again grabbing the spotlight, weakening for the fifth consecutive day, and to a new six month high. We’ve actually got the Central Bank of Turkey decision today where the market will no doubt be looking for some soothing words to stop the slide.

In other news, the latest on Brexit is that the 1922 Committee refused to approve any changes to the leadership rules, and thus taking the press of the PM.Staying with the UK, Chancellor Hammond confirmed yesterday that he hoped to make the appointment of Carney’s successor as BoE Governor by October. He also suggested that the new Governor wouldn’t necessarily have to serve a full eight-year term. Sterling closed -0.28% yesterday.

In terms of the day ahead,this morning in Europe we’re due to get CBI survey data for April in the UK. Also worth keeping an eye on given recent volatility is the Central Bank of Turkey decision at midday. This afternoon in the US we’ve got preliminary durable and capital goods orders data due which should be the last set of data to help sharpen Q1 GDP forecasts tomorrow. Also due up is the latest claims reading and Kansas City Fed manufacturing survey. Away from the data the ECB’s Guindos is due to speak this afternoon in New York. Japan’s PM Abe is also due meet Tusk and Juncker in Brussels while Japan’s Finance Minister Aro is due to meet with Mnuchin over provisions against currency manipulation. Finally the earnings highlights today are Amazon, Intel, ComCast, 3M, Ford, Bayer, and UBS.

via ZeroHedge News http://bit.ly/2LgKnp1 Tyler Durden