What until this morning was a bad dream for Turkish Lira longs just became a full-blown nightmare.

While the Turkish Central bank kept its overnight lending rate, weekly repo rate and liquidity window rate all unchanged at 25.5%, 24% and 27%, respectively, some very critical language was removed from the latest Turkish Central Bank statement: the central bank’s prior pledge to deliver “additional tightening” if needed. And with that, the government’s defense of the lira – which according to Bloomberg cost the central bank between $10 and $15 billion in just the last few weeks of March – is now officially null and void.

The Turkish Monetary Policy Committee also tweaked its forward guidance saying its action “will be determined to keep inflation in line with the targeted path.” Just like with the BOJ and Riksbank earlier, investors interpreted the change in language as a dovish turn by the central bank.

“This is much worse than expected and supports the view that policy has gone off the rails,” said Win Thin, global head of currency strategy at Brown Brothers Harriman. “This signals that any orthodoxy at the central bank has effectively been crushed, since no sane central bank would be leaning dovish at a time like this for Turkey.”

Others were just as perplexed by the CBRT decision, with economist Timothy Ash saying asking if someone can explain “why the CBRT would remove the reference to further tightening, if required? What trends in inflation have there been to justify that change, I just don’t see it. The lira has been weaker and oil higher.”

Can someone explain why the CBRT would remove the reference to further tightening, if required? What trends in inflation have there been to justify that change, I just don’t see it. The lira has been weaker and oil higher.https://t.co/4ZVyjkEczv

— Timothy Ash (@tashecon) April 25, 2019

He added “The only logical explanation for this move is that the CBRT is again coming under political pressure to cut, and this was a sop to those forces. But it will only make their problems worse. I still cannot see any justification in the data 4 this move.”

As Bloomberg notes, central bank head Cetinkaya had pledged to wait for a “convincing” inflation slowdown before cutting rates, but has been stymied by the weaker lira.

Meanwhile, investors have soured on Turkey’s currency as the central bank struggled to explain moves in its reserves, fueling concern about the state of the nation’s finances. Even ahead of today’s announcement, the lira was down over 6% so far this month against the dollar in the worst performance globally. Meanwhile, price pressures abound as inflation still hovers at nearly four times the official target of 5 percent, despite the economy entering its first recession in a decade last year.

Following the central bank’s decision to steamroll lira long, the TRY tumbled as much as 1.5% to its weakest since mid-October and traded 1.3% lower at 5.9532 per dollar.

And now that the central bank has capitulated in its response to soaring inflation, the focus shifts to the central bank’s supply of reserves.

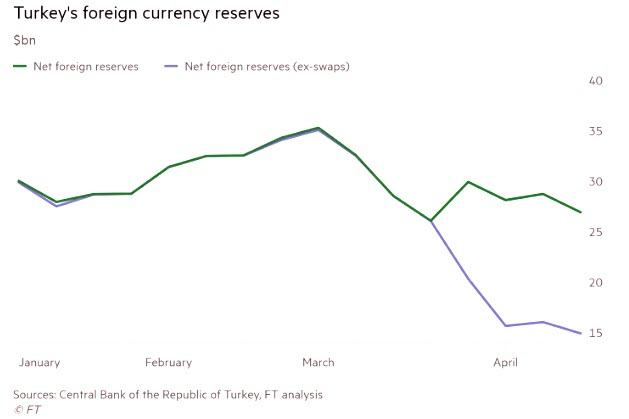

And this is where it gets interesting, because as the FT reported, Turkey’s hard currency reserves fell by another $1.8 billion last week, “highlighting the country’s deteriorating financial defences and piling pressure on the central bank to spell out the unusual accounting methods behind the funds.”

Specifically, net foreign currency reserves fell to $26.9 billion in the week to April 19, down from $28.7 billion in the previous week, fresh data from the Turkish central bank show. However, the net reserves excluding bank swaps have tumbled to only $14.9 billion, a number which may not last the country even one month if it engages in another episode of full-blown lira defense, which in turn suggests that an IMF bailout may now be inevitable.

Needless to say, such an intervention would mean that the lira is eventually headed for double digits against the dollar.

Meanwhile, a Turkey analyst at a major international financial institution, who asked not to be named over fears of retaliation by Erdogan, told the FT that the worsening reserve situation suggests the country’s “external vulnerability is at levels we haven’t seen before”. She described the situation as a “real test” of market participants’ appetite to continue investing in the country, which is reeling from a sharp economic downturn and inflation of near 20 per cent.

via ZeroHedge News http://bit.ly/2J1hTfQ Tyler Durden