Following a sharp drop at the open, equities have not only regained all of today’s losses but are once again in record high territory, despite the overnight FX quake which saw the central banks of Japan, Sweden and Turkey all try to hammer their currencies, while the won and yuan both tumbled as the dollar surge, a manifestation of a worldwide dollar shortage according to some, accelerates, while interest rate volatility is once again on the way up.

What is behind this relentless bid in stocks? At the macro level, the answer is two-fold; first, and courtesy of the WSJ, earlier this week speculation spread that Fed the may “pre-emptively” cut rates by the end of the year in order to stimulate core Inflation and “more generically” keep events from abroad from pushing the US into Recession; the second reason is the “better than we feared” earnings from Tech/Growth giants (FB, MSFT, V, PYPL, CMG) which as Nomura’s Charlie McElligott writes have stabilized the recent Growth & Momentum “Slow-flation April Unwind” vs unloved Cyclicals/Value, which had been exploding following the multi-week “repricing of growth higher” phenomenon

On the other hand, and working against the rally, is what we reported on Sunday, namely that last Friday’s Chinese Politburo comments (and ensuing Reuters piece on “RRR cuts to sidelines”) as a hawkish shift away from “broad easing”, and taking some of the “easy money” off the table, especially in China where stocks have suffered their worst weekly drop of the year.

Yet while this mornings’ disastrous earnings fom MMM spooked traders due to the dismal cross-read on global growth in the second half, with UPS also missing wildly, the melt up has return in full force, so we take this opportunity to publish this visual reminder courtesy of Nomura’s Charlie McElligott “why we melted up”… and why we continue to melt up.

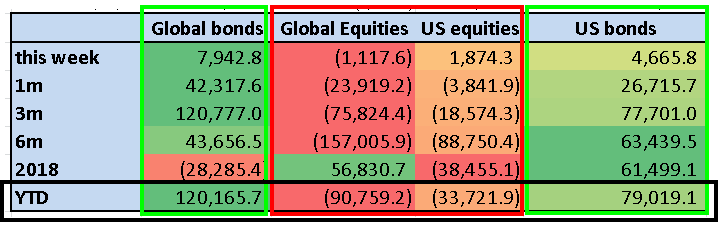

EPFR Global Equities and Bond Fund Flows Year-To-Date ($Billions)–$91B “out” of Global Equities, $120B “into” Global Bonds:

Source: EPFR

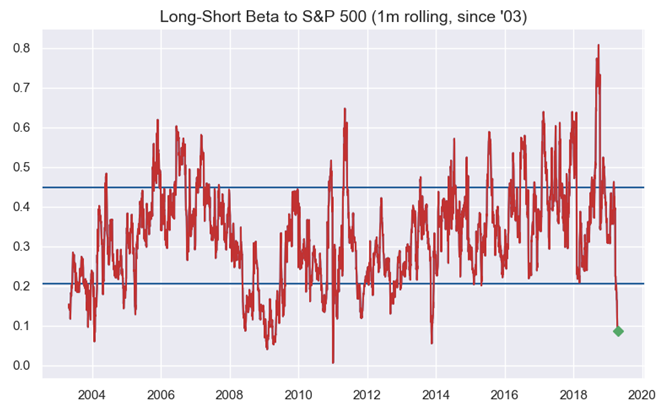

Equities L/S Hedge Fund Beta to S&P 500—just 1st %ile since 2003:

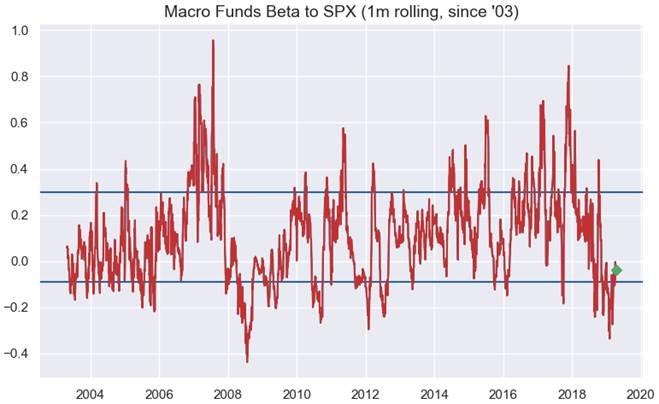

Macro Hedge Fund Beta to S&P 500—just 25th %ile since 2003:

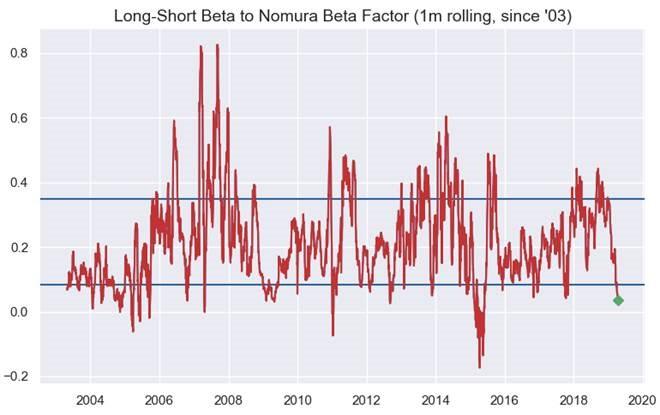

Equities L/S Hedge Fund Beta to Nomura Beta Factor—0th %ile since 2003:

Leveraged Fund S&P 500 Futures Net $Notional Positioning now -$27.4B Short:

Nomura QIS Risk Parity model estimates fresh 2y+ lows in U.S. Equities $Exposure (Across SPX, NDX, Russell): Clearly the 2 year look-back time horizon is capturing more of the ‘2018 “QE to QT” macro regime—which was representative of the narrative that “we have tightened ourselves into a slow-down / recession”

ALL OF WHICH DOES THIS…

Epic Delta %iles as underexposed funds “grab” at upside through upside:

SPX / SPY Consolidated $Delta at 97.4th %Ile since 2013:

QQQ $Delta at 100th %ile since since 2013:

And in the meantime, Systematic Trend / CTA has violently RE-LEVERAGED into US Equities (from “Max Short” in Dec ‘18 to current “Max Long”), with Notional Exposures at 7 month highs as the already +100% Price Signal continues to see the notional position size continue to grow due to the collapse in trailing realized volatility across the short- to mid- term models:

via ZeroHedge News http://bit.ly/2vlOTr8 Tyler Durden