Last quarter, when Amazon reported otherwise respectable earnings, the market hammered the stock after the company guided to the lowest revenue growth since 2001. And, as the company reported moments ago, while its guidance may have been slightly downbeat, it wasn’t too far off because Amazon reported Q1 net sales of $59.7BN, just above the $59.68BN expected, while generating an impressive $7.09 in Q1 EPS, well above the $4.67 expected.

Here are the summary highlights:

- EPS of $7.09, beating estimates of $4.67

- Revenue of $59.7BN, in line with estimates of $59.68BN

- Operating income of $4.42 billion, also beating consensus estimates of $3.10 billion

- Amazon Web Services rose 41% to $7.70BN, Exp. $7.67BN; this compares to growth of 45% last quarter and 46% the quarter before.

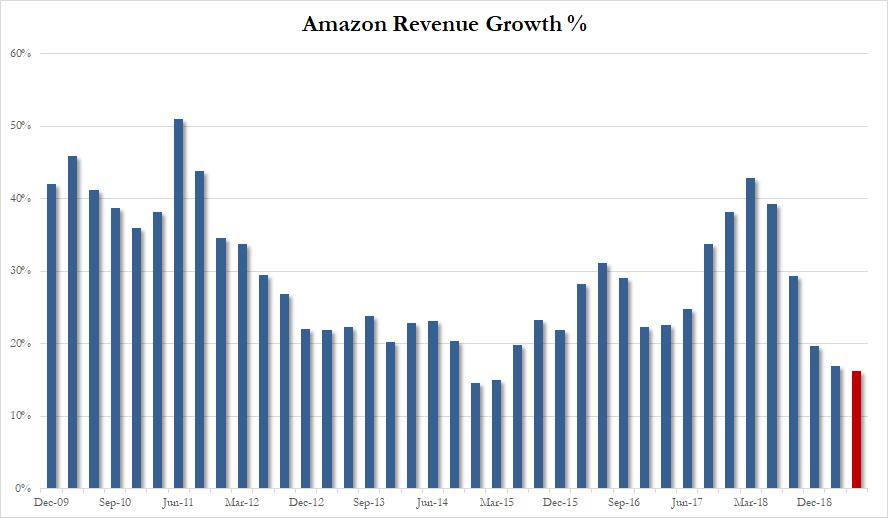

The good news here is that whereas Q1 revenue did come in slightly better than expected, it still showed a significant slowdown, rising 17% in Q1, the slowest growth pace in 4 years. Looking ahead, the slowdown is expected to accelerate, as the company now expects Q2 net sales of $59.5BN to $63.5BN, with the midpoint of $61.5BN coming in below the Wall Street consensus estimate of $62.4BN. If revenue comes in right on the midpoint, it would represent another top-line slowdown of 16.3% in Q2.

More disappointing was Amazon’s operating income outlook, which is expected to come in between $2.6 billion and $3.6 billion, compared with $3.0 billion in second quarter 2018, but well below the Wall Street consensus estimate of $4.2 billion.

As noted above, the all important Amazon Web Services was once again responsible for more than half of Amazon’s entire profit, with the division generating $7.7BN in revenue and $2.22BN in operating income, a 28.9% margin, down from the 29.3% in Q4, and responsible for 50.2% of Amazon’s total operating income of $4.42BN. Slightly more concerning was the slowdown in AWS revenue, which rose 41%, down from 45% last quarter.

Meanwhile, Amazon’s other revenue, which includes Amazon’s advertising business, grew only 36%, a sharp drop from the 97% growth in Q4 and the 132% growth it had a year ago.

The stock initially spiked on the big EPS beat, but has since retraced all gains as investors focused on the slowdown in AWS and the disappointing operating income guidance.

Developing

via ZeroHedge News http://bit.ly/2UHC5pi Tyler Durden