US index futures, European stocks and Asian markets all drifted lower following an ugly report from Intel which hit chip stocks, offsetting a surge in Amazon’s Q1 profits as investors awaited the release of Q1 US GDP data and earnings season continued apace. Even so, global shares were on track for a fifth weekly gain in a row despite subdued trade, while the dollar retreated from 23-month highs.

Global stocks were largely flat on the day after subdued trading in Asia. MSCI’s All-Country World Index was down less than 0.1% as an unexpected tumble in Japanese industrial production underscored worries over the global expansion.

Looking at the key overnight earnings, another FAANG member showed their teeth after the Wednesday blowout number from FB, when Amazon beat EPS expectations by over $3 and didn’t sacrifice this gain in their revenue print, which came in marginally above expectations. This came as web services revenue increased by over 40% with the company reporting their most profitable quarter ever. Clouds remain on the horizon after the bright earnings, however, as the company warned of a slower Q2. In the pre-market AMZN are trading with gains of 1%.

On the flipside, Intel short-circuited and reported shockingly bad earnings guidance despite top and bottom line printing inline with expectations. The hardware maker cut their FY guidance and forecast a weak Q2 as Chinese data centre sales remain soft, as the region is consuming fewer microchips than expected, and follows on from a similar warning sign eschewed from Texas Instruments. As a result of the terrible results INTC is trading with losses of 7% in the pre-market.

Most European bourses opened lower, with Germany’s DAX and France’s CAC 40 being the only gainers. The pan-European STOXX 600 index was down 0.1 percent. The Stoxx 600 was little changed at press time as raw material producer losses were offset by gains in healthcare and media companies. In corporate news in the region, Deutsche Bank cut its revenue target and AstraZeneca posted an increase in cancer-drug sales.

While US stocks continue to trade at all time highs, albeit with dismal volumes suggesting there is little enthusiasm to chase prices here, sentiment in China has turned decidedly for the worse, and Chinese stocks suffered their worst week since October, showing the influence that Beijing’s economic policies still hold over the bull market. As we previewed on Sunday, markets got a taste of how much equities are worth without the prospect of additional measures that had helped restore $2.3 trillion to share values since January. Shanghai stocks lost 5.6%, the most since October, after the Politburo signaled last Friday it will pare back support for the economy amid evidence of a recovery. China’s sovereign bonds, which are rapidly turning into Asia’s worst performers, also slumped.

Meanwhile, the yuan edged up after President Xi Jinping said his country won’t engage in currency depreciation. In overnight China news, President Trump suggested that Chinese President Xi will be visiting the White House soon. In other news, the US is considering concessions on drug protection in talks with China after the latter was said to offer 8 years of IP protections for biologics data vs. 12 years under current US law. SCMP subsequently reported that, Chinese President Xi could travel to the US to sign a trade deal as soon as June; if the two sides finalise a trade deal.

As Bloomberg notes, “it’s a pivotal moment for a world-beating rally in China that’s been underpinned by expectations of more stimulus and ample liquidity” noting that a barrage of earnings from the nation’s largest firms could swing sentiment either way, though the picture isn’t encouraging so far. Traders are also eyeing next week’s trade talks with the U.S., though the closure of China’s markets for a three-day holiday from Wednesday will likely dampen trading.

Meanwhile, back in the US, all eyes are on the U.S. GDP release which will be closely watched after a string of largely resilient data from an economy in its 10th year of expansion. A string of solid numbers has led analysts to revise up their forecasts for growth and the latest consensus estimate is for an annualized 2.3%, while the closely-watched GDP estimate of GDP from the Atlanta Federal Reserve is projecting an outcome of 2.7%, a huge turnaround from a few weeks ago when it was at 0.5%.

“A steady GDP reading will reinforce (stock) bulls’ appetite as worries over a recession will diminish but a potential miss may trigger some nervous profit-taking ahead of the weekend,” said Konstantinos Anthis, head of research at ADSS.

The GDP release will set the stage for the Fed interest rate decision next week, where investors will try to anticipate how the U.S. central bank will react to mostly resilient indicators of late. Yet the rebound has not been mirrored in inflation, which – according to the BLS – remains subdued across much of the developed world, prompting a host of central banks to turn dovish. Just this week central banks in Sweden and Canada have backed off plans to tighten, while the Bank of Japan tried to dispel doubts about its accommodative stance by pledging to keep rates at super-low levels for at least one more year. ECB Vice-President Luis de Guindos on Thursday opened the door to more money-printing if needed to boost inflation in the euro zone. Meanwhile, rate cuts look much likelier in Australia and New Zealand after recent disappointingly weak inflation reports.

In rates, Treasuries edged into the green alongside most European sovereign debt.

Elsewhere in currencies, the euro was off 1 percent for the week at $1.1136 as euro zone economic figures continued to disappoint, though it was 0.1 percent higher on the day. Against a basket of currencies, the dollar was 0.8 percent firmer for the week so far at 98.145 having touched its highest since May 2017.

In commodity markets, spot gold was 0.4 percent firmer at $1,281.81 per ounce. Oil prices dipped on Friday on expectations that producer club OPEC will soon raise output to make up for a decline in exports from Iran following a hardening of sanctions on Tehran by the United States.

. Expected data include 1Q GDP and University of Michigan Consumer Sentiment Index. American Airlines, AON, Chevron, Colgate-Palmolive, and Exxon are among companies reporting earnings

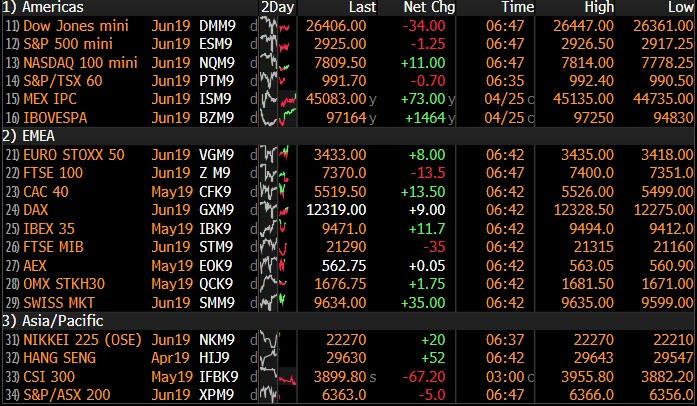

Market Snapshot

- S&P 500 futures down 0.2% to 2,922.00

- STOXX Europe 600 down 0.02% to 390.07

- MXAP down 0.08% to 162.00

- MXAPJ up 0.01% to 537.28

- Nikkei down 0.2% to 22,258.73

- Topix down 0.2% to 1,617.93

- Hang Seng Index up 0.2% to 29,605.01

- Shanghai Composite down 1.2% to 3,086.40

- Sensex up 0.6% to 38,977.58

- Australia S&P/ASX 200 up 0.05% to 6,385.65

- Kospi down 0.5% to 2,179.31

- German 10Y yield fell 1.3 bps to -0.022%

- Euro up 0.08% to $1.1141

- Italian 10Y yield rose 5.4 bps to 2.316%

- Spanish 10Y yield fell 0.9 bps to 1.082%

- Brent futures down 1.1% to $73.56/bbl

- Gold spot up 0.4% to $1,282.33

- U.S. Dollar Index down 0.1% to 98.11

Overnight Top News from Bloomberg

- Theresa May’s plan to stop Britain taking part in European elections in the middle of Brexit looks all but dead. The prime minister is unlikely to put her Brexit bill to Parliament next week, according to a government official

- Emmanuel Macron promised a new wave of tax cuts for France’s middle classes as he sought to placate Yellow Vest protesters and reinvigorate his flagging presidency.

- China won’t pursue yuan depreciation that harms others, President Xi Jinping says at Belt and Road forum in Beijing. Nation will keep yuan stable at reasonable and equilibrium level, he said

- The Trump administration may concede to a Chinese proposal that would give less protection for U.S. pharmaceutical products than they receive at home, according to people familiar with the matter, a move that could draw opposition from the American drug industry

- Japan’s factory output unexpectedly fell in March, raising the likelihood that gross domestic product shrank during the first quarter

- Oil is poised to notch an eighth weekly gain on the back of OPEC+ production cuts and as the U.S. moves to tighten sanctions against Iran

- Japan’s retail investors have propelled their net long yen positions against the dollar to near a record ahead of the nation’s extended Golden Week holidays

- North Korean leader Kim Jong Un used talks with Russian President Vladimir Putin to accuse the U.S. of “bad faith” in nuclear discussions, warning that the current detente on the Korean Peninsula was at risk

- Japan’s industrial production contracted by a surprisingly large amount in March as falling exports weigh on the world’s third- largest economy

- Chinese President Xi Jinping signaled his approval for Trump’s trade war demands in an address to some 40 world leaders where he pledged to address state subsidies, protect intellectual property rights, allow foreign investment in more sectors and avoid competitive devaluation of the yuan

- Wall Street is moving closer to modernizing the clubby $2 trillion market for new corporate bond issues while seeking to retain control of a lucrative business that’s being eyed by the tech sector

- The new Brexit Party started by anti-EU campaigner Nigel Farage is threatening the ruling Conservatives– and they aren’t even fighting back. Polls put the group on course to win the most votes in the EU elections next month

Asia-Pac risk sentiment was mostly downbeat as markets remained heavily focused on earnings releases and following the lacklustre performance of counterparts stateside. ASX 200 (Unch.) and Nikkei 225 (-0.2%) were both subdued with underperformance seen in Australia’s energy sector after a pullback in oil prices although losses in the broader market were only marginal and the index eventually recovered, while the Japanese benchmark was pressured amid a slew of earnings and following disappointing Industrial Production figures with participants also reducing exposure ahead of a 10-day closure for Golden Week. Elsewhere, Hang Seng (+0.2%) and Shanghai Comp. (-1.2%) opened lower as PBoC inaction resulted to a CNY 300bln liquidity drain for the week but with losses in Hong Kong later pared amid earnings including China Life Insurance which almost doubled its Q1 net from the prior year. Finally, 10yr JGBs are higher with prices underpinned by the mostly risk-averse tone and BoJ presence for JPY 480bln of JGBs in the belly.

Top Asian News

- Asian Chip Sector Shares Decline After Intel Cuts Outlook

- China Evergrande Is Said to Be Eyeing European Auto Acquisitions

- China’s Big Earnings Showdown Looms as Stocks Begin to Sink

- Sony Withdraws Some Profit Targets as Forecast Misses Estimates

- A Giant in China’s Equity Market Is Starting to Look Expensive

Major European indices are mixed but little changed overall [Euro Stoxx 50 +0.1%], with sectors portraying a similar scene; notably, the Oil & Gas sector is underperforming in-line with the recent downturn in oil prices and with sector heavyweights Total’s (-0.4%) broadly as expected earnings unable to counter the downward pressure. After an earning fuelled morning the FTSE 100 (-0.3%) is somewhat lagging its peers with the index weighed on predominantly by RBS (-4.4%) in-spite of the Co’s beat on Q1 profit before tax, as the Co. stated that the ongoing impact of Brexit uncertainty is likely to impact income growth in the near term. Glencore (-3.0%) and Just Eat (-3.2%) are also weighing on the FTSE 100 after the CFTC stated they are investigating if the Co’s units violated CFTC regulations and as UK Q1 orders increased by only 7.4% respectively. Other notable movers include Deutsche Bank (-3.0%) are lagging the Dax (+0.1%) after the Co. cut their FY19 sales outlook and they expect FY19 revenue to be flat. Elsewhere, Renault (+3.0%) posted Q1 revenue in-line with expectations and confirmed their guidance for FY19.

Top European News

- Continental Pushes Ahead With Powertrain Listing as Profit Drops

- Ferrexpo Slumps as Deloitte Resigns Amid Charity Probe

- Hydrogen as Replacement for Natural Gas Gets a Boost in U.K.

- Amundi Sees Investors Pull $7.7 Billion as DWS Stems Outflows

- Bayer’s CEO Faces Rebuke to Leadership as Shareholders Gather

In FX, the Kiwi and Swedish Krona are leading a comeback of sorts vs a still solid Greenback that is holding above the 98.000 handle in DXY terms and Fib support just shy of the big figure (97.961), with data providing respite for both G10 currencies in the form of NZ trade and Swedish retail sales. Nzd/Usd has subsequently extended its rebound through 0.6600 to just over 0.6650, with the added impetus of relatively upbeat rhetoric from RBNZ Orr overnight, while Eur/Sek has retreated further from post-Riksbank peaks and back below 10.6000 as the single currency lags amidst dovish remarks from ECB’s Rehn.

- AUD – Another major beneficiary of short covering and position paring in advance of US growth and PCE price gauges, as the Aussie recovers more ground from sub-0.7000 levels vs its US peer towards 0.7040, albeit still trading heavily on a Aud/Nzd cross basis under 1.0600 following weak Q1 CPI data earlier in the week that ramped up RBA easing expectations.

- EUR – As noted above, the Euro has been hampered to a degree by Rehn comments adding a bit more credence to sourced reports suggesting that some GC members are inclined towards shifting guidance on rate normalisation out further than the current end of 2019 or later to a BoJ-style next year. Hence, Eur/Usd’s bounce from yesterday’s new ytd low (circa 1.1116) has been stymied ahead of 1.1150 and decent option expiries stretching to 1.1160 (1.5 bn), while residual bids above 1.1100 may also be supplemented by hedging or buying interest linked to a total of 1 bn running off at the strike.

- GBP/CHF/CAD/JPY – All narrowly mixed vs the Usd as Cable pivots 1.2900 awaiting more Brexit developments and eyeing next week’s super BoE Thursday, while the Franc continues to straddle 1.0200 and meander between 1.1375-50 against the single currency in wake of yet another reminder from the SNB that NIRP and FX intervention are still warranted. The Loonie is still managing to hold above post-BoC lows and above 1.3500 even though crude prices are recoiling further from best levels in the run up to Canadian budget balances for February. Elsewhere, Usd/Jpy remains rangebound below 112.00 and just over chart support sub-111.40 in the form of the 30 DMA and a 61.8% Fib (at 111.37 to be precise), with the upside also capped by 1.1 bn option expiries from 112.00-20, and the impending long Japanese holiday still drawing attention as a potential hazard given the so called flash crash in currency and other markets when Japan was absent earlier this year.

- EM – A double-whammy for the Rouble on the aforementioned pronounced downturn in oil and with speculation that the CBR could take a lead from other Central Banks along a dovish policy path. Usd/Rub currently trading closer to the top of 64.8310-5630 parameters.

In commodities, Brent (-1.3%) and WTI (-1.3%) prices are firmly in the red with prices dropping below the USD 75/bbl and USD 65/bbl levels; notably, Brent had only reached the USD 75/bbl level yesterday for the first time this year. Iran’s crude oil exports from their Southern Ports have reportedly increased so far in April to 3.56mln BPD; specifically, regarding the Iranian oil waivers, Turkey are attempting to convince the US to allow Turpas to continue the purchase of oil from Iran. For reference, under the import waivers Turkey was permitted to import around 60kBPD of oil from Iran, and in December a total of around 54k BPD of oil was imported by Turkey from Iran. Elsewhere, following reports that a number of refineries had suspended the import of Russian oil from the Druzhba pipeline (1.2mln BPD) due to contamination issues, Russia has stated that the issues will be resolved from April 29th. However, reports indicate that some of the refineries that have suspended imports believe the problem will continue for another one or two weeks. Gold (+0.4%) prices have gradually moved higher across the session, benefitting from the cautious risk tone and concern ahead of Japan’s Golden Week holiday where markets will be closed for 10-days. Elsewhere, due to the softer dollar ahead of today’s GDP data, metal prices have retraced some of the prior session’s losses; and there were reports this morning of an explosion at Port Talbot, which is the UK’s largest steelworks. Tata Steel, who own the site, stated that there were no serious injuries and an investigation is ongoing.

US Event Calendar

- 8:30am: GDP Annualized QoQ, est. 2.3%, prior 2.2%

- 8:30am: Personal Consumption, est. 1.0%, prior 2.5%

- 8:30am: Core PCE QoQ, est. 1.4%, prior 1.8%

- 10am: U. of Mich. Sentiment, est. 97, prior 96.9; Current Conditions, prior 114.2; Expectations, prior 85.8

DB’s Craig Nicol concludes the overnight wrap

If the baton started with US equity markets hitting fresh record highs this week and then passed to the bond market on Wednesday, then it was the turn of EM to run the anchor leg yesterday following a day of relatively wild price action across assets.

Indeed broad EM FX slid as much as -0.59% before buyers stepped in during the New York session, arresting the broad declines and leaving the index close to flat by the end of play yesterday. A modest -0.04% decline was however still good for the fourth consecutive daily drop, with the index now down in 8 out of the last 10 sessions. Over that period, it has fallen -1.76%.Of the 24 most active EM currencies, 20 weakened versus the USD. This did however mask bigger declines for the likes of the Argentinian Peso (-2.43%) – which hit a new record low – and the Turkish Lira (-0.92%) which closed at 5.928 and the weakest since last October.In fact it was a rough day for assets in both of the countries. The Argentinian and Turkish equity markets dropped -0.64% and -1.71%, respectively, and 5y CDS spreads widened +26bps and +22bps. 10y hard currency bond yields rose 19.1bps in Turkey, but, somewhat puzzlingly and inconsistently with the action in other asset classes, 10y hard currency yields rallied off their intraday peaks to actually close -20.4bps lower in Argentina, completing an intraday swing of 72.3bps. More broadly the MSCI EM index closed -0.16% after trading down as much as -0.94% and this week has dropped -1.91%. That compares to a gain of +0.73% for the S&P 500. US HY spreads are a modest +3.3bps wider this week so there’s been little sign of the EM move spreading to credit so far.

That four-day move for the S&P 500 included a small -0.04% decline yesterday. In fairness there were some reasonable divergences on Wall Street yesterday with the NASDAQ (+0.21%) getting a boost from those Facebook and Microsoft results, while the DOW (-0.51%) got hit almost entirely due to a -12.95% drop for 3M following a disappointing set of results.Meanwhile the USD – which has been part of the reason for the weakness across EM recently – did at least ease off yesterday, closing flat. Treasuries also had a quieter day with 10y yields creeping up +1.4bps.

It’s worth jumping straight to Asia now where this morning the EM pain has seemingly hit the Nikkei (-0.68%), Shanghai Comp (-0.78%) and Kospi (-0.52%),with only the Hang Seng (+0.11%) posting a gain. Weak March industrial production data in Japan (-0.9% mom vs. +0.0% expected) is also playing a role. Asian FX is hanging in a little better, while the CNY (+0.12%) is slightly stronger after following a stronger than expected fix. President Xi Jinping also reiterated China’s commitment to keeping the currency stable by saying that China won’t engage in currency depreciation that harms other countries. Generally it’s the PBoC that make comments like this so it’s perhaps significant to come directly from the President, especially as he is chairing a number of economic committees.

Overnight, Bloomberg has also reported that the White House might concede to a Chinese proposal that would give less protection for the US pharma products in China (proposed 8 years) than they receive at home (12 years and new NAFTA 10 years). Elsewhere, Japan’s Finance Minister Taro Aso met with the US Treasury Secretary Steven Mnuchin as part of the ongoing trade talks with the US and said that Japan can’t agree to any talk of linking currency and trade policy while a Japanese Finance Ministry official said that he believes that talks concerning currency will be secondary to the trade talks between Economy Minister Toshimitsu Motegi and Lighthizer. President Trump and Japanese Prime Minister Shinzo Abe are due to meet today and are expected to discuss trade amongst other issues.

Turning back to yesterday’s US earnings, the highlights were a strong report by Amazon and a weak one from Intel. Amazon – who’s shares traded up just over 1% in extended trading – showed first quarter profits far above expectations, at $7.09 per share versus Bloomberg consensus expectation for $4.67, while revenues also grew strongly including a +47% gain in sales by Amazon Web Services, their cloud computing business. Strength in the same business line had boosted Microsoft earlier this week, with the software giant floating above a $1 trillion market capitalization in intraday trading before retreating slightly below that level. Intel – who’s shares dropped over 7% in extended trading – reported a 2.3% beat on profits, but lowered their full-year guidance markedly. Management now expects 2019 revenues to be around $69 billion, below consensus expectations for $71 billion. NASDAQ futures are little changed overnight as a result.

Back to yesterday and specifically some of the idiosyncratic stories in Turkey and Argentina. The Turkish Lira really got moving post the Central Bank of Turkey meeting where, although policy was left unchanged, the Bank dropped a commitment to tighten policy further if needed, saying that the action “will be determined to keep inflation in line with the targeted path”. By the way, inflation in Turkey is running just below 20%. Meanwhile in Argentina the story appears to be one of a negative feedback look between political uncertainty, out of control inflation, and the weakening Peso.The closing level on Argentina’s 5y CDS yesterday now implies a 59% probability of default. Bonds maturing in 2 years were at one stage yielding over 20% yesterday. Back in February the same bonds were trading at ‘just’ 8%.

A reminder that it was declining EM growth expectations last year which eventually filtered through to weakness in broader DM markets, so it’s worth seeing if we get a continuation of this price action in the near term.

In the meantime it’s likely that today’s first look at Q1 GDP for the US will do nothing but highlight the DM/EM growth divergence. Our economists expect a +2.6% qoq/saar reading (full preview here ) which is above the market consensus of +2.3%. For what it’s worth the range of expectations for that consensus reading is from as low as +1.0% to as high at +2.9%, with the Atlanta Fed’s tracker at +2.7%. A reminder that Q4 came in at +2.2%. The last piece of data which could have helped fine-tune today’s growth expectations – the preliminary March durable and capital goods orders data – came in above market. Core capex orders printed at +1.3% mom versus expectations for +0.2% while durable orders ex transport rose +0.4% mom (vs. +0.2% expected). Both series were also revised higher in prior months as well.

The other data that was released yesterday included the latest weekly claims reading which revealed a surprisingly 37k uptick to 230k (vs. 200k expected).However, one-offs appeared to be in play again with strikes at New England supermarkets flagged as a reason behind the spike. Lastly the Kansas City Fed manufacturing survey for April fell to 5 from 10, remaining in positive territory for the 29thconsecutive month, the longest streak since February 2008.

In Europe there were no data releases with earnings still the main driver.Swedish industrial firm Atlas Copco (+5.01%) reported strong first quarter figures including surprisingly high new orders. Bank earnings were hit or miss, as UBS (+1.23%) gained but Barclays (-3.59%) lagged. The former attracted new inflows and announced the resumption of its buyback program, while the latter reported softer-than-expected figures for both its revenues and capital ratio. Spanish utilities firm Iberdrola (+4.30%) also outperformed after profits grew 12%, which explained just about all of the IBEX’s gain yesterday, as the index advanced +0.47% while the DAX and CAC slid -0.25% and -0.33%, respectively. Italy’s benchmark index traded flat, but BTP yields rose +5.5bps, possibly reflecting some anxieties ahead of today’s S&P ratings review.

Elsewhere in Europe, the Swedish Riksbank was the latest central bank to strike a surprisingly dovish tone, sending the krona to its weakest level versus the dollar since 2002.The central bank noted softer inflation and the weaker outlook for employment, and opened the door to the possibility that they do not hike rates at all this year, whereas the market had priced in one hike. Somewhat in parallel, ECB Vice President de Guindos said that he “cannot be super optimistic” about the European economy, which helped the euro to a -0.21% loss versus the dollar.

Over in the US, former Vice President Joe Biden officially launched his presidential campaign yesterday. He is viewed as more moderate than most of the rest of the Democratic field and has consistently polled at the top of the pack. It remains to be seen if he can maintain his initial strong position as the grind of the campaign accelerates.

Looking at the full day ahead, this morning the only data of note is more CBI survey data out of the UK. The focus then turns to that Q1 GDP print in the US while the final April University of Michigan consumer sentiment survey revisions follows. Away from that GDP print in the US the other potentially market sensitive event is a meeting between Japanese PM Abe and President Trump at the White House. Russian President Putin is also travelling to China to meet with President Xi Jinping while the earnings highlights include Exxon Mobil, Chevron, Total and Sanofi. Finally, S&P are due to complete their review of Italy’s BBB/Negative credit rating today.

via ZeroHedge News http://bit.ly/2W6OsNb Tyler Durden