The last time the S&P 500 was at a record high and this overbought was January 2018 – right before the world fell out of the bottom of VIX shorts…

And remember, VIX traders have never been shorter vol than they are now…

Notably, extending last week’s decoupling, VIX was higher as stocks rose today… The last time we saw this was January 2018’s melt-up as buyers bid up vol on the back of call options

Ignore this…

“Probably nothing”

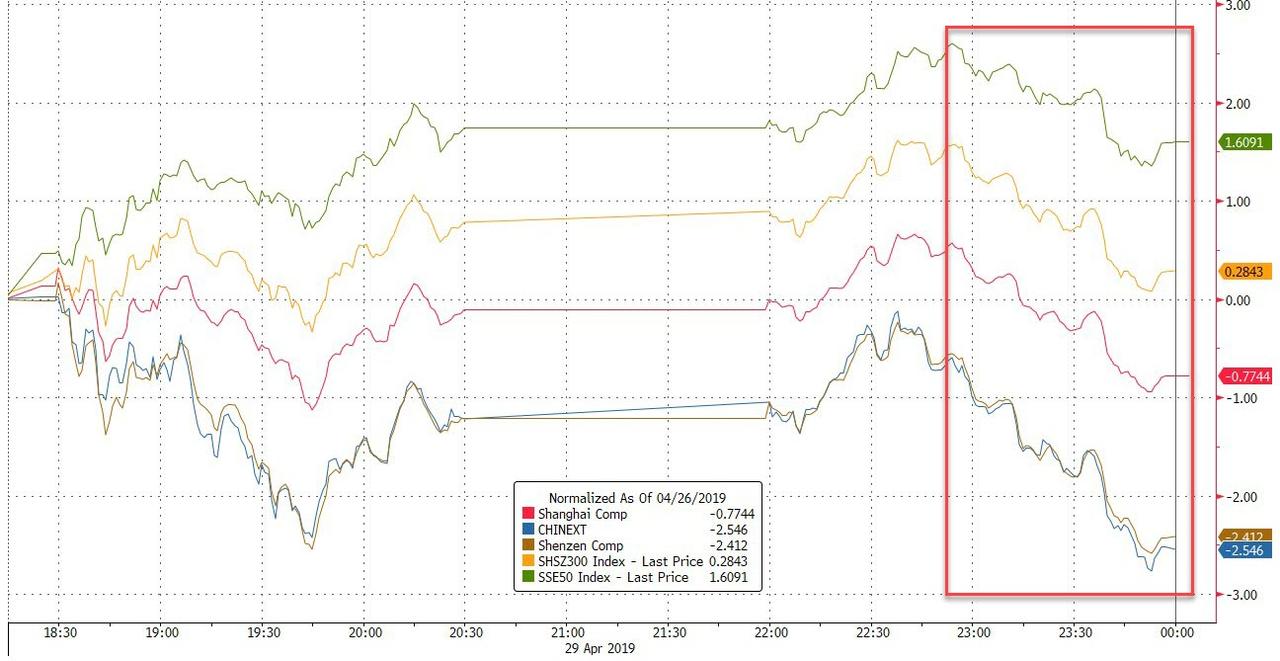

After the worst week in six months last week, Chinese stocks were very mixed overnight with ChiNext dumping and the big cap SSE50 rallying…

Notably, SHCOMP broke below the 3100 level and its 50DMA…

The day started ugly for Spain after their elections but a magic bid arrived across Europe and lifted everything back to breakeven by the close…

After Friday’s late-day melt-up, was there ever any doubt that the S&P 500 would break to record intraday highs…

Small Caps led on the day, Trannies lagged…with the Dow managed to just hold green

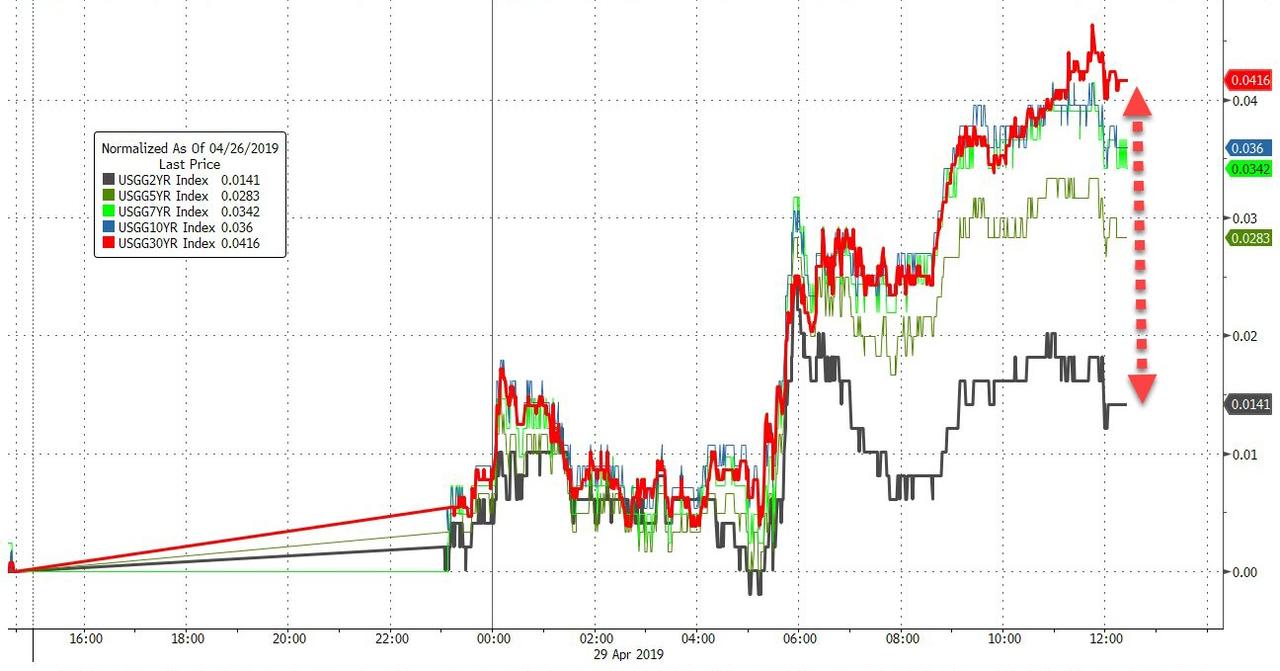

Treasury yields rose on the day with the long-end the biggest price laggard, steepening 3bps against the short-end (NOTE – Japan on golden week)…

30Y remains well below 3.00% though.

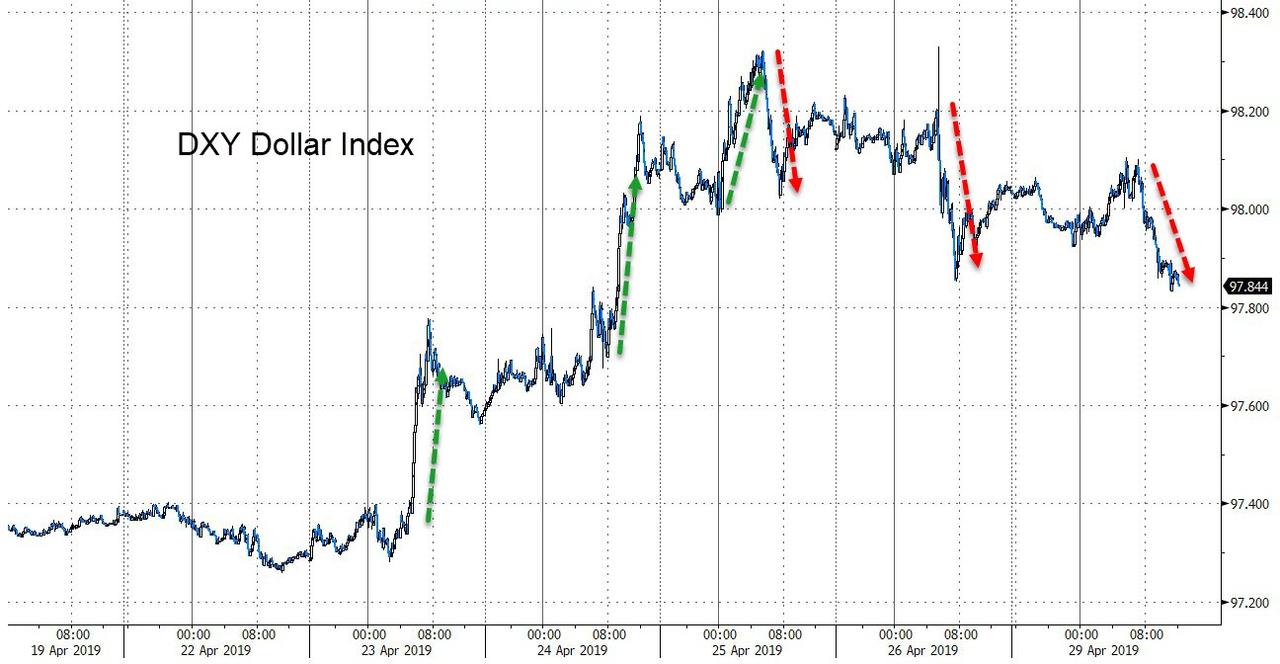

The slide in the dollar continues (albeit modestly)…

Cryptos were mixed with Bitcoin and Ether higher, Bitcoin Cash and Litecoin lower…

Copper and Crude managed gains as gold (and worse silver) slipped lower (despite a flat dollar)…

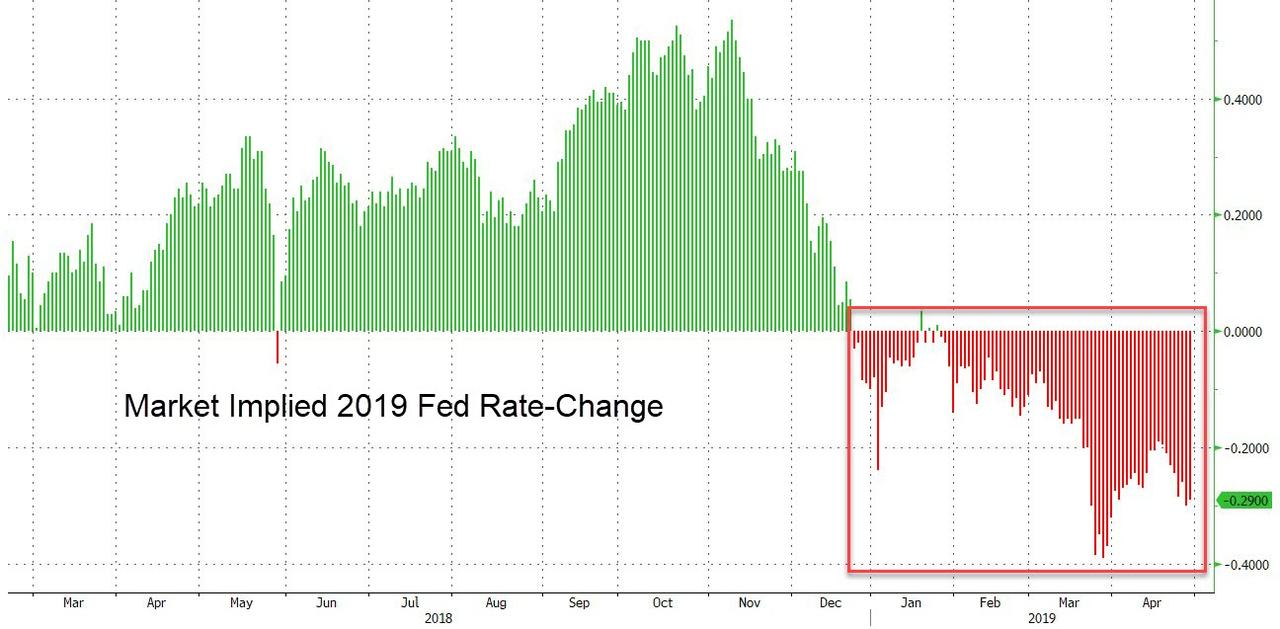

Finally, we ask a simple question – if everything is so awesome (which it ‘clearly’ is, just ask stocks), why are markets pricing in 29bps of rate cuts in the rest of 2019?

via ZeroHedge News http://bit.ly/2GQtz3z Tyler Durden