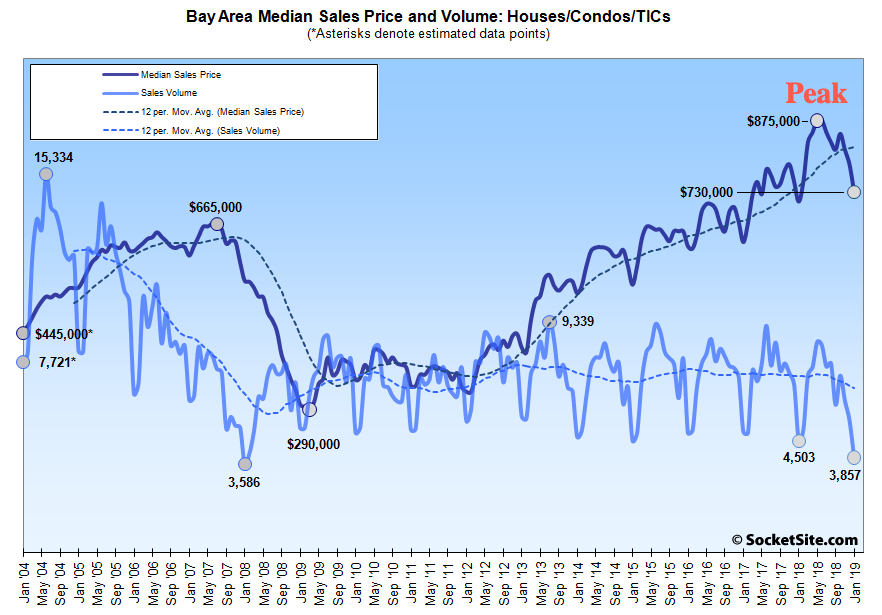

San Francisco Bay Area homes declined last month on a y/y basis for the first time in seven years, according to CoreLogic.

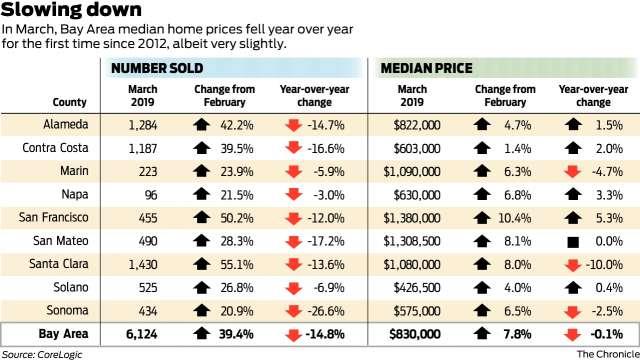

The median price paid for an existing home in the nine counties (Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Solano, and Sonoma) was $830,000, down 0.1% compared with March 2018.

The last time prices fell on a y/y basis was March 2012. After that, the Federal Reserve injected several more rounds of quantitative easing that sent home prices soaring for 83 consecutive months. In March 2018, the median home price gained 16.2% over March 2016.

In 2H18, the appreciation rate dramatically slowed due to quantitative tightening, mortgage rate increase, and the start of a synchronized global slowdown.

“It’s not that surprising that we hit the wall, at least in terms of a pause,” said Andrew LePage, a CoreLogic analyst, wrote in a release.

Glen Bell, a real estate broker with BetterHomes and Gardens Reliance Partners in the East Bay region, said home sales and prices tend to accelerate between February and March as buyers prepare to move before the summer months. He said there was a slight pick up in activity, “but not as strong as last year.”

“It reflects a trend that began in mid-2018 when home sales slowed and inventory grew, forcing sellers to be more competitive,” LePage said.”The year-over-year increase in the region’s median sale price was 16.2% in March last year. But after that, the gains in the median gradually decreased each month and fell to the 2 to 3% range early this year and then disappeared this March.”

Sales of homes in the nine counties were 15% lower in March when compared with last year. It was the lowest March in terms of sales in 11 years. Sales have been slowing on a y/y basis for the last 10 months – an ominous sign that not just the top is in, but a quick reversal in price is immient.

Santa Clara County noticed the most significant y/y median home price declines, falling 10% to $1.08 million in March. It was one of the hottest markets on the West Coast, if not the entire country last year – has fallen into a dangerous slump where prices are crashing.

“We’ve definitely seen some softness and some slowing,” said Michael Repka, chief executive and general counsel of DeLeon Realty in Palo Alto.

The total number of homes sold in the nine counties hit 6,124, up 39% from Feburary, but down 14.8% y/y, CoreLogic reported.

The slowdown in home sales and a decline in price last month “mainly reflect buyers purchasing decisions in Feburary,” LePage said in the press release. In early 1Q19, the market was recovering from a slowdown in the economy and a volatile stock market from Christmas.

Since Feburary, stock market volatility has dropped, mortgage rates are much lower, and since mid-March, IPOs have been debuting, which could bring more buyers to the market in the coming months.

Jason Nelson, an agent with Alain Pinel/Compass in Mill Valley, said that in Southern Marin, “there might be a slowdown in the market especially on the higher end.”

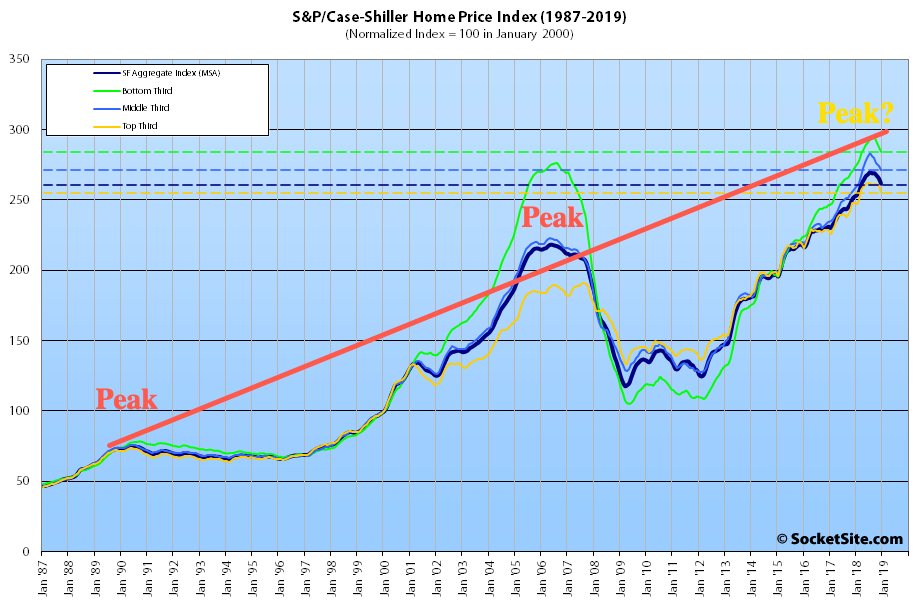

S&P Dow Jones Indices published S&P CoreLogic Case-Shiller Indices Tuesday, indicating that the decline in home prices wasn’t just centered in the San Francisco Bay Area, but rather seen across the entire US.

via ZeroHedge News http://bit.ly/2UVNKRO Tyler Durden