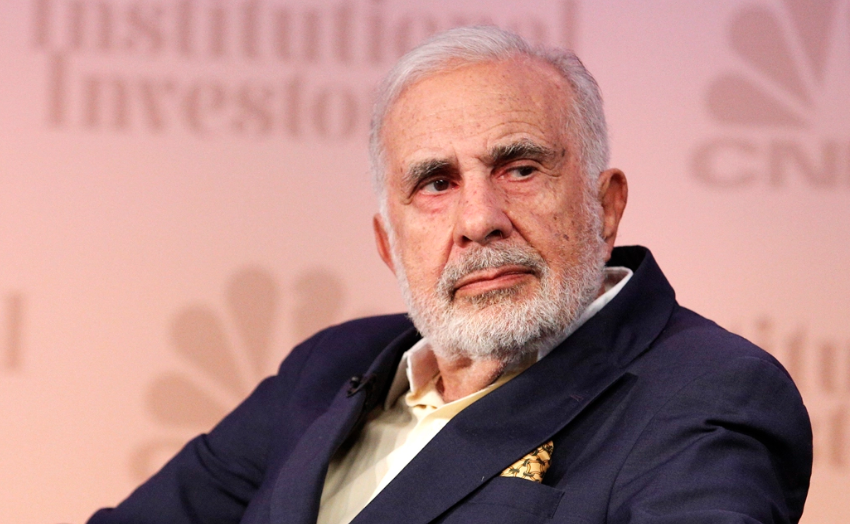

Wall Street legend and former special adviser to President Donald Trump, billionaire Carl Icahn, is out starkly warning against the idea of modern monetary theory, according to Bloomberg. Icahn believes that inflation could revive and “spin out of control” if the tenets of modern monetary theory are embraced.

This makes Icahn the latest in a long line of economic voices to speak out against the progressive “economic doctrine” – if you can even call it that – that has dominated the financial news headlines over the last year.

The idea that a country can’t go broke simply because it prints its own currency has backing from such economic intellectual heavyweights as freshman congresswoman and socialist Alexandria Ocasio-Cortez. The idea that the country can run larger budget deficits as long as prices stay low has made MMT one of the proposed solutions for expensive proposed legislation, like AOC’s Green New Deal.

Icahn, who has been around slightly longer than AOC, disagrees:

“You can print money up to a point, but after that point, it could become very dangerous. We don’t want to hit a wall that you can’t recover from. Once you get into an inflationary spiral, it’s very difficult to get out of it — and therein lies the danger.”

Icahn’s said three years ago that the obsession with the budget deficit was “ridiculous” and that America’s status as the global reserve currency would help alleviate some concerns over the deficit.

But his unwillingness to accept MMT shows that even the “reserve currency the world” has boundaries and limitations. Icahn’s comments come after Warren Buffett said this year he’s also not a fan of modern monetary theory because it could lead to spiraling inflation. Dozens of policymakers and leaders have also spoken out about MMT. Recent critiques have even come from Federal Reserve Chairman Jerome Powell and International Monetary Fund chief Christine Lagarde. We can’t help but think that when these inflation loving central bankers are the ones critiquing your money printing aspirations, maybe it is a little too much.

However, there are some economists supporting the idea. Olivier Blanchard, the former IMF chief economist, suggested that the money could be used for environmental purposes while bond investor Bill Gross, who just slunk out the back door after a couple years of awful performance retired, said the US could “easily double its deficit”.

The budget gap under Trump has continued to widen and is forecasted to reach $1.1 trillion by 2022, according to the CBO. That’s equivalent to 4.7% of GDP compared to an average of 2.9% over the past half century.

While the obvious result of MMT would be inflation accelerating, if not spiraling out of control, it is these very same basic economic principles that the academics in charge of monetary theory in this country seem unequipped to understand. Our hope is that they listen to some of the actual adults in the room, like Icahn, who are doing their best to guide them in the right direction.

via ZeroHedge News http://bit.ly/2VKvnnm Tyler Durden