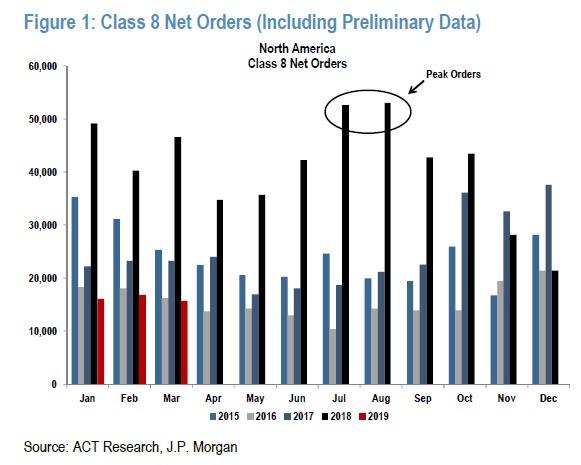

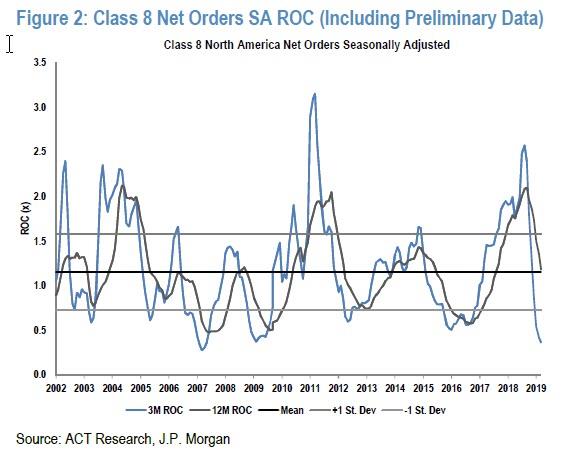

North American Class 8 net order data shows the industry booked 14,800 units in April, down 57% from a year-ago. The number also marks a sequential decrease of 6.2% from March. The decline is being blamed on companies filling orders from a bloated backlog of last year’s record purchases and buyers juggling remaining orders. The numbers from last month were the lowest for an April since 2016.

Year to date, the numbers continue to look ugly. There have been 63,000 trucks ordered, a 63% percent decline from the 169,186 orders placed during the same period in 2018. And it doesn’t look like the rest of the year is going to get any better.

Kenny Vieth, ACT president and senior analyst said:

“We continue to contend that current order weakness has more to do with very large Class 8 backlogs and orders already booked, than with the evolving supply-demand balance. Of course, contracting freight volumes, falling freight rates, and strong Class 8 capacity additions suggest that the supply-demand balance will become an issue later this year.”

Vieth continued, pivoting to the medium duty market:

“While the U.S. manufacturing/freight economy has been droopy since late 2018, the medium-duty market continues to benefit from underlying strength in the consumer economy. In April, NA Classes 5-7 net orders were 23,100 units, down just 6.8% year-over-year and up 12% from March.”

Don Ake, FTR vice president of commercial vehicles commented:

“They remember what happened last year when they needed trucks, but could not get enough of them. New orders are expected to remain soft until ordering for 2020 begins this fall.”

Bob Costello, chief economist of the American Trucking Associations went back to an old favorite – blaming the weather. He said: “In March, and really the first quarter in total, tonnage was negatively impacted by bad winter storms throughout much of the U.S.”

Class 8 trucks, which are made by Daimler (Freightliner, Western Star), Paccar (Peterbuilt, Kenworth), Navistar International, and Volvo Group (Mack Trucks, Volvo Trucks), are one of the more common heavy trucks on the road, used for transport, logistics and occasionally (some dump trucks) for industrial purposes. Typical 18 wheelers on the road are generally all Class 8 vehicles, and traditionally are seen as an accurate coincident indicator of trade and logistics trends in the economy.

This data comes on top of March orders falling an astounding 66%, making April’s sequential decrease stand out even more. Specifically, March Class 8 net orders were just 15,700 units (16,000 SA; 192,000 SAAR), down 66% YoY from 49,600 a year ago and down 6.7% sequentially.

The decline in March was also attributed to a 300,000+ vehicle backlog potentially prompting fleets to halt purchases in the near term. We don’t doubt that the economic slowdown is also playing a major part in the latest collapse.

via ZeroHedge News http://bit.ly/2UZC947 Tyler Durden