Want to know why millennials are miserable and broke?

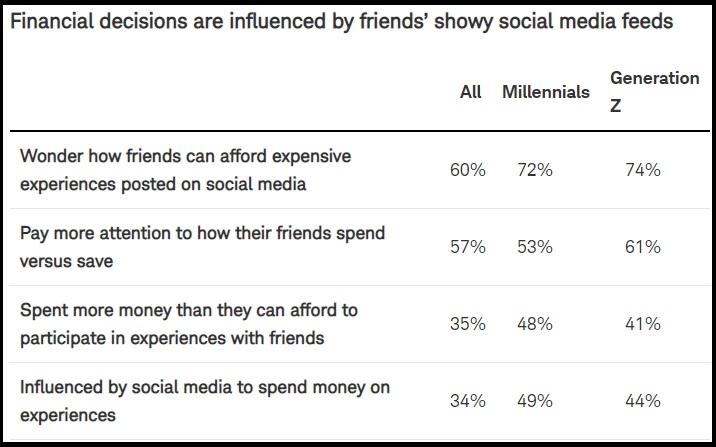

According to a new survey by Charles Schwab, almost half of millennials (49%) say their spending habits are driven by their friends bragging about their purchases on social media vs. around one-third of Americans in general.

And according to Marketwatch, other surveys agree:

Other surveys have uncovered similar trends: Roughly two in three millennials think that social media has a negative impact on their financial well-being, according to a 2018 survey of more than 2,000 millennials from financial firm Fidelity. Data released in 2018 by mobile bank firm Varo Money found that 53% of millennials admit to buying something they saw advertised on social media. And a 2018 survey from Allianz Life shows that more than half of millennials (57%, versus just 28% of Gen Xers and 7% of boomers) say they’ve spent money they hadn’t planned to because of something they saw on social media.

This is partly because millennials say they feel pressure to keep up with their friends’ spending — and of those, nearly half say that social media posts of friends’ vacations and lifestyles contribute to that pressure, according to 2017 data from TD Ameritrade. Social media also makes 61% of millennials (versus just 35% of Gen Xers and 12% of boomers) feel inadequate about their own life and what they have, with 88% comparing themselves to others on social media (compared to just 71% of Gen Xers and 54% of boomers who say the same), according to the Allianz data. And the Varo data found that three-quarters of millennials feel social media portrays an unrealistically positive view of people’s lives — and as a result 41% have made a purchase to feel better about their own lives. –Marketwatch

“Social media has become the millennials’ financial Achilles Heel,” according to the Allianz survey of more than 3,000 adults aged 20–70. “More than any other generation, social media and the allure to spend beyond their means could have long-term negative effects on [millennials’] finances if they’re not careful,” said Allianz’s Vice President of Consumer Insights, Paul Kelash.

Meanwhile, Millennials have virtually no money – with 60% of them having less than $500 in savings, and 45% of them who told banking company Varo Money that they don’t even have a savings account.

Among those who have a savings account, 30% said they couldn’t correctly define what Annual Percentage Yield (APY) means. Of those who could define APY, the majority (56%) said they are getting less than 1.00%.

According to a 2017 survey by GoBankingRates.com, almost half of younger millennials have $0 in savings.

But, they can figure out how to sink further in debt as they try to keep up with their friends on social media. According to Marketwatch, citing psychological publications – this can be detrimental to one’s mental health.

Not only can social media wreak havoc on our finances, it can also hurt our mental health. Younger adults who use social media a lot are at a higher risk of depression, and people who use many different social media sites are at higher risk for anxiety and depression. What’s more, the more time people spend on social media, the more likely it is they feel socially isolated — with people who spend more than two hours swiping through social media sites nearly doubling their risk of feeling socially isolated. –Marketwatch

Coming to a future bankruptcy court near you…

via ZeroHedge News http://bit.ly/2WCAUcM Tyler Durden