Authored by Ted Dabrowski and John Klingner via WirePoints.org,

Illinoisans have another reason to worry about their future – their state government is unprepared for the next recession. That means when the national economy finally slows, Illinoisans will get hit far harder than residents nationally.

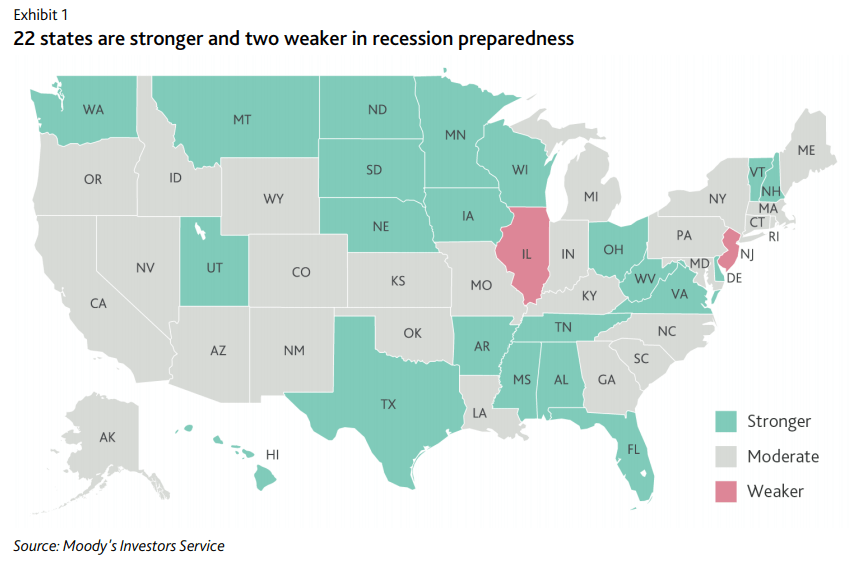

A new report by Moody’s Investors Service finds Illinois and New Jersey are the two weakest-prepared states in the country for whatever financial damage the next recession will cause.

The warning of sorts is yet another reminder that Illinois needs deep structural reforms, including an amendment to the pension protection clause, to restore financial stability and flexibility to the state. And it’s a further condemnation that Illinois’ business as usual – more taxes, more borrowing and pension can-kicking – have brought Illinois to the brink of a junk credit rating.

Moody’s measured four key factors in arriving at its conclusions: revenue volatility, reserves, financial flexibility and pension risk.

Here’s what they said:

“Our new criteria shows 22 states strongly prepared for the next recession, with 26 states moderately prepared, and two – Illinois (rated Baa3/stable outlook) and New Jersey (A3/stable) – weaker in recession preparedness.”

‘While current economic conditions are strong, states are aware that a downturn will come eventually and are building reserves to prepare,’ said Emily Raimes, Vice President and Senior Credit Officer at Moody’s. ‘While most states have healthy reserves and inherently strong fiscal flexibility, Illinois and New Jersey both have low levels of reserves relative to the potential revenue decline in our recession scenario. In addition, they both show weakness in their pension risk scores.’”

Readers of Wirepoints won’t be surprised with Moody’s conclusion. We’ve highlighted Illinois’ growing structural deficits, mass of unpaid bills and true retirement costs in the recent past:

- Moody’s vs. Illinois politicians: $100 billion difference in pension debts

- Illinois’ other debt disaster: $73 billion in unfunded state retiree health benefits

- Overpromising has crippled public pensions: A 50-state survey

- Why Warren Buffett is right to warn about Illinois: The state’s true retirement costs now total 50% of annual budget

- Why some Illinois R’s are making the wrong argument against a progressive income tax

Illinois scored badly on three of Moody’s four measures.

Moody’s says Illinois has some of the worst financial reserves of any state in the nation. Only four states have less available cash on hand to pay for emergencies than Illinois does.

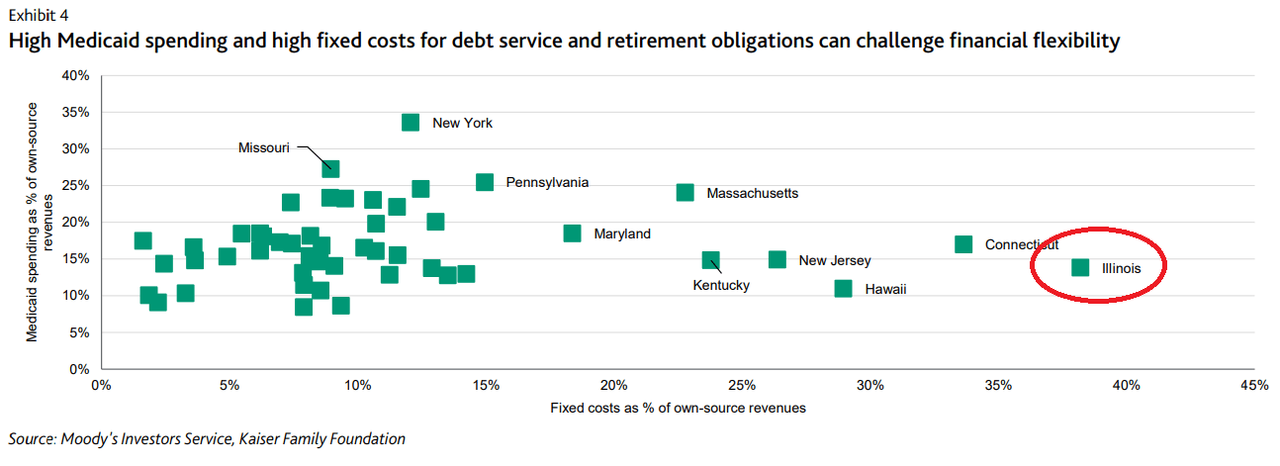

The agency also found that Illinois has very little financial flexibility to deal with a recession. Nearly 40 percent of Illinois’ annual budget is consumed by “fixed costs” like pensions, debt service and Medicaid. Illinois is the nation’s outlier. That means core spending on other priorities like education, social services and public safety would be cut under a harmful recession.

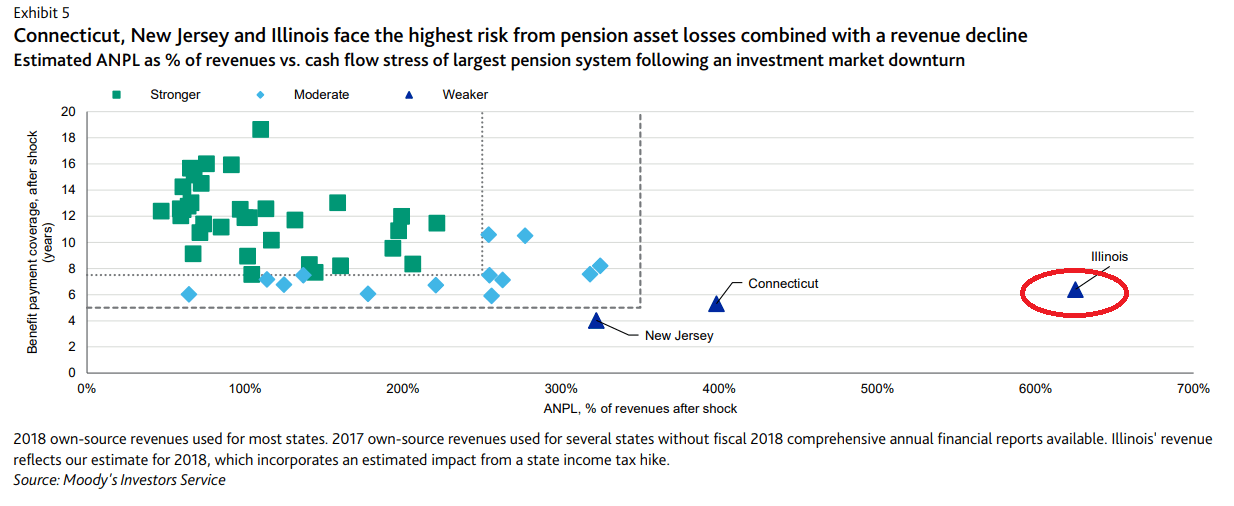

The agency also found Illinois is the extreme outlier when it comes to the damage a recession would wreak on its pension funds. Illinois stands alone as the worst off in the nation according to Moody’s pension “stress test.” No only would a recession force economically-struggling Illinoisans to pay billions more into pensions when they can least afford it, but it could also bring many funds to the brink of total insolvency, risking benefits for government workers.

The only measure Illinois scored average on was “revenue volatility.” Illinois’ flat income tax keeps revenues fairly stable in comparison to states “relying on the highest earners through high and progressive personal income tax rates.” Any move to a progressive tax scheme in Illinois will increase the state’s revenue volatility.

* * *

Illinois is in dire financial straits, as the above graphics show. The state is an outlier in most fiscal categories nationwide, and in many cases, Illinois is the extreme outlier.

The current “panacea” offered by Gov. J.B. Pritzker, a progressive tax scheme, does nothing to address the underlying structural causes of Illinois’ mess. Tax proponents may get the tax hike they want, but look it for it to accelerate Illinois’ downward spiral. Instead of fixing Illinois, it will only perpetuate the status quo and do further damage to the state’s competitiveness.

Moody’s warns a recession could have an “adverse impact” on Illinois’ credit. And seeing as Illinois is just one notch from junk, there’s only once place the state can go. That’s something nobody wants.

via ZeroHedge News http://bit.ly/2Qed2K9 Tyler Durden