WTI traded lower today (finding support around $63) as anxiety over the ongoing US-China trade deal weighed on global growth (demand) sentiment (after yesterday’s gains on OPEC/Saudi supply comments).

“Given the fact that the macro environment isn’t looking spectacular, oil is doing relatively well,” said Bart Melek, head of commodity strategy at Toronto’s TD Securities. “It’s very much marching to its own drumbeat here, with the supply side being supportive in the face of less risk appetite.”

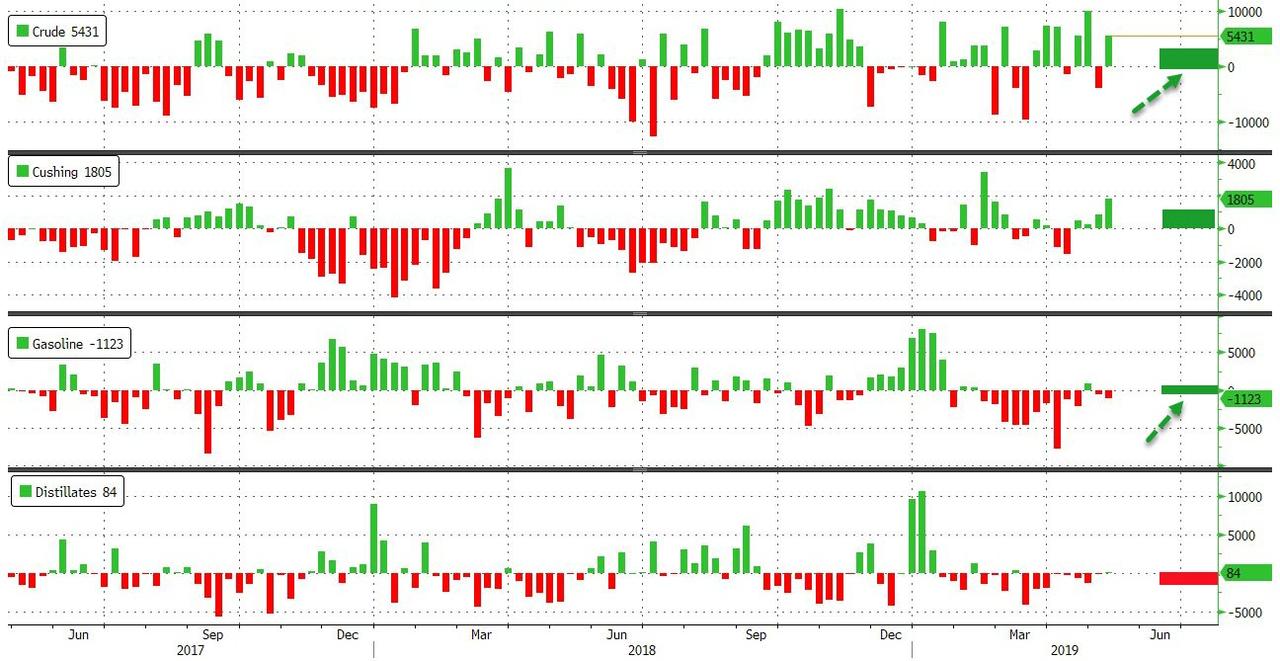

Product draws have been shrinking and crude builds increasing recently, dragging investors’ eyes back to the ‘gluttiness’ of energy markets…

API

-

Crude +2.4mm (-1.3mm exp)

-

Cushing +871k

-

Gasoline +350k (-662k exp)

-

Distillates -237k (-158k exp)

API reported a surprise inventory build in crude and gasoline…

WTI traded back down to Sunday night futures opening levels today, hovering around $63 ahead of the API print and kneejerking lower after the data hit…

via ZeroHedge News http://bit.ly/2HuQUZ2 Tyler Durden