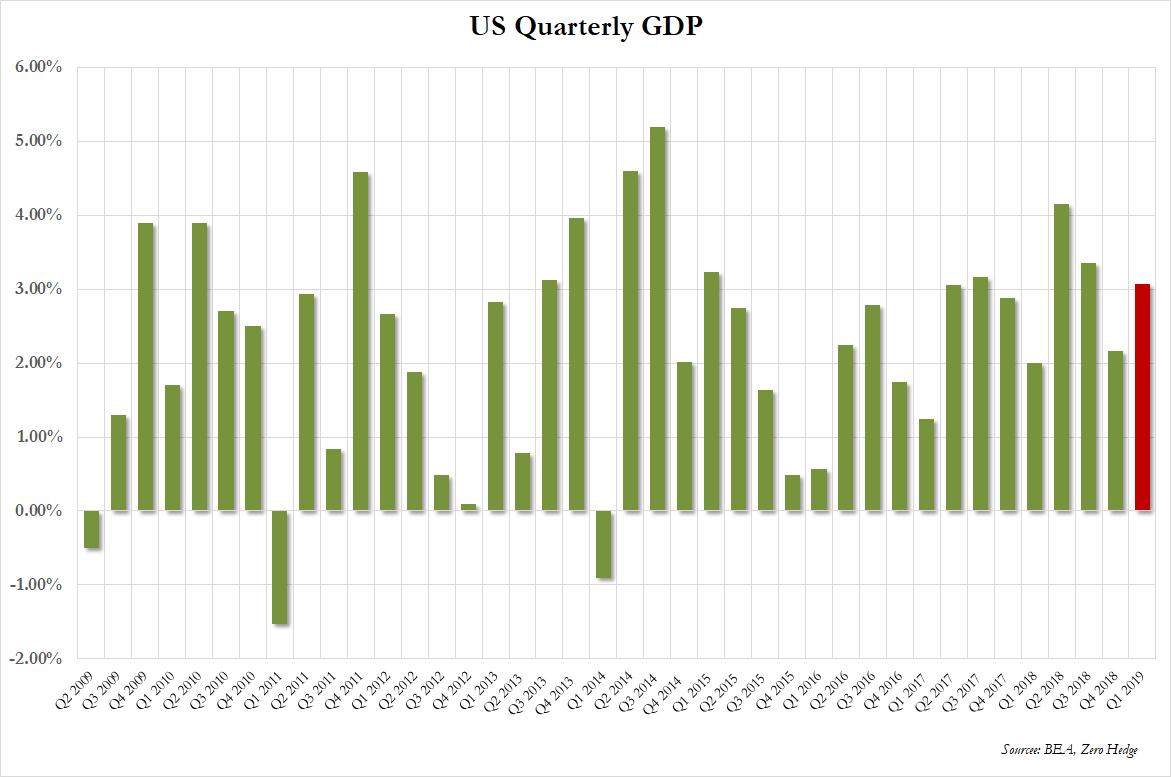

After Wall Street was stunned when the BEA reported a far stronger than expected first reading of Q1 GDP, which soared to 3.2%, smashing earlier expectations that it would print around 1%, moments ago the Dept of Commerce reported the first revision to the first quarter number, which was revised fractionally lower to 3.1%, which however was still just above the consensus estimate of 3.0%, and certainly better than the 2.2% recorded in Q4.

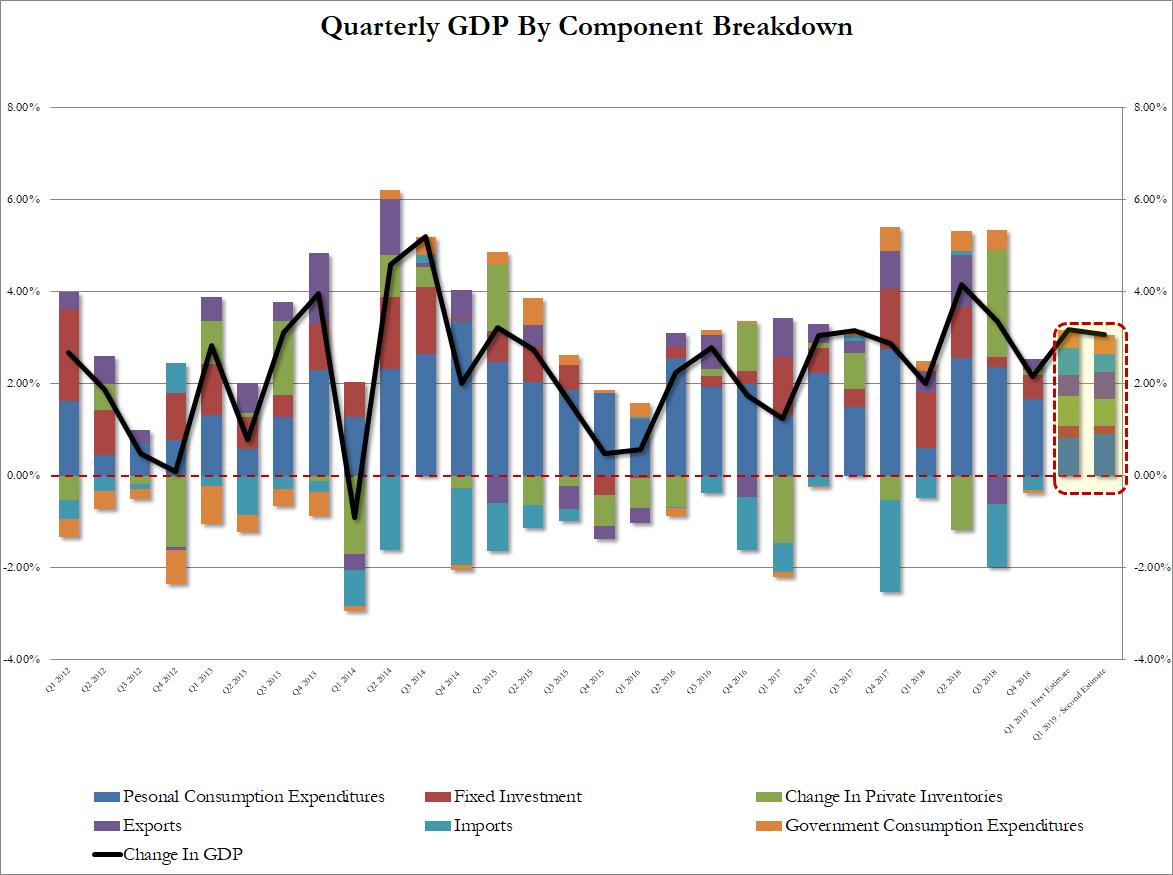

The revision was due to a modest downward revision in Fixed Investment (from 0.27% to 0.18% of GDP) and Private Inventories (from 0.65% to 0.60%) as well as net exports from just above 1% to just below, offset by a small revision higher in Personal Consumption, which increased from 0.82% to 0.90%. On an annualized basis, consumer spending, which accounts for the majority of the economy, grew 1.3%, topping projections for an unrevised 1.2% though still the slowest in a year. Finally, the government contribution to GDP was virtually unchanged at 0.42%.

Excluding trade and inventories, that gave a boost to GDP, final sales to domestic purchasers increased at a 1.5% pace – the slowest since 2015, though revised from 1.4%. This indicators, seen as a measure of underlying demand, suggests growth in the quarter was weaker than the headline number indicates.

The report may ease some investor concern that the economy is losing momentum and potentially help Trump as he starts his reelection campaign, even as sellside strategists are now expecting a 1% or lower Q2 GDP print. Indeed, as Bloomberg notes, “recent reports suggesting a dimmer outlook this quarter, along with the intensifying tariff conflict, are casting a shadow over an expansion poised to become the nation’s longest on record in July.” Notably, the 3M-10Y curve dipped to session lows of -11bps after the report.

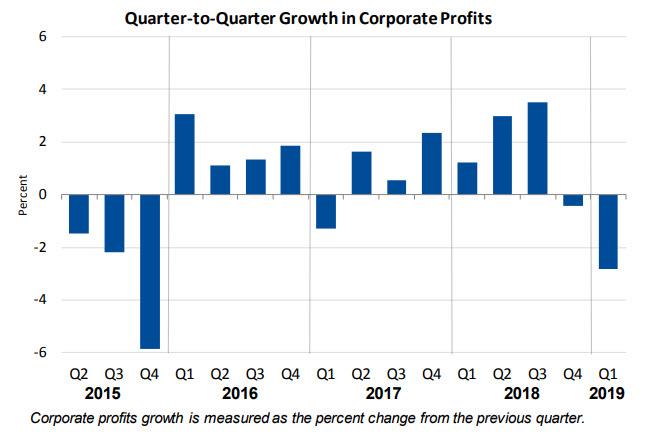

Today’s report also gave the first read on business earnings for the period, suggesting corporate America is facing headwinds from the trade war and the effects of Trump’s tax cut is waning. Pretax corporate profits fell 2.8% from the prior quarter, the biggest drop since 2015, and were up 3.1% from a year earlier, the least since 2017.

via ZeroHedge News http://bit.ly/2I7eni5 Tyler Durden