Authored by Lance Roberts via RealInvestmentAdvice.com,

I recently discussed one of the biggest potential “flash points” for the financial markets today – corporate debt.

What I find most fascinating is how quickly many dismiss the issue of corporate debt with the simple assumption of “it’s not the subprime mortgage market.”

Correct, it’s not the subprime mortgage market. As I noted previously:

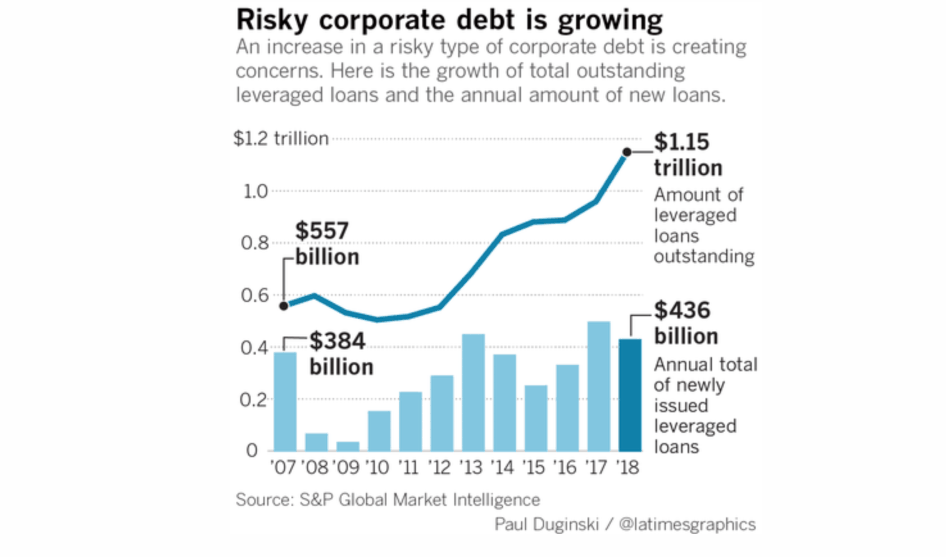

“Combined, there is about $1.15 trillion in outstanding U.S. leveraged loans (this is effectively “subprime” corporate debt) — a record that is double the level five years ago — and, as noted, these loans increasingly are being made with less protection for lenders and investors. Just to put this into some context, the amount of sub-prime mortgages peaked slightly above $600 billion or about 50% less than the current leveraged loan market.”

Every bubble has its own characteristics. The current bubble is no different, and I would suggest that it has the potential to have more severe consequences than seen previously. The reasoning is that the fallout from the sub-prime directly impacted both lenders and the homeowners. This time a “corporate debt bust” will impact a much broader spectrum of companies which will lead to a surge in bankruptcies, mass job losses, and the subsequent contraction in consumption.

Same effect. Different characteristics.

Remember, in 2007, Ben Bernanke gave two speeches in which he made a critical assessment of the “sub-prime” mortgage market.

“At this juncture, however, the impact on the broader economy and financial markets of the problems in the sub-prime market seems likely to be contained.” – Ben Bernanke, March 2008

“Given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the sub-prime sector on the broader housing market will likely be limited.” – Ben Bernanke, May 2007

Of course, the sub-prime issue was not “contained,” and all it required was the right catalyst to effectively “burn the house down.” That catalyst was Lehman Brothers which, when it declared bankruptcy, froze the credit markets because buyers for debt evaporated and liquidity was non-existent.

It was interesting to see Federal Reserve Chairman Jerome Powell, during an address to the Fernandina Beach banking conference, channel Ben Bernanke during his speech on corporate “sub-prime” debt (aka leverage loans.)

“Many commentators have observed with a sense of déjà vu the buildup of risky business debt over the past few years. The acronyms have changed a bit—”CLOs” (collateralized loan obligations) instead of “CDOs” (collateralized debt obligations), for example—but once again, we see a category of debt that is growing faster than the income of the borrowers even as lenders loosen underwriting standards.Likewise, much of the borrowing is financed opaquely, outside the banking system. Many are asking whether these developments pose a new threat to financial stability.

In public discussion of this issue, views seem to range from “This is a rerun of the subprime mortgage crisis” to “Nothing to worry about here.” At the moment, the truth is likely somewhere in the middle. To preview my conclusions, as of now, business debt does not present the kind of elevated risks to the stability of the financial system that would lead to broad harm to households and businesses should conditions deteriorate.” – Jerome Powell, May 2019

In other words, corporate debt is “contained.”

The reality is that the corporate debt issue is likely not contained. Here are some stats from our previous report on this issue:

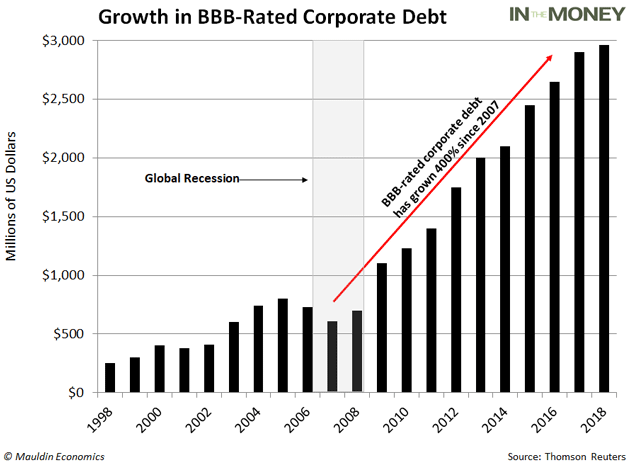

“Currently, the same explosion in low-quality debt is happening in another corner of the US debt market as well. In just the last 10 years, the triple-B bond market has exploded from $686 billion to $2.5 trillion—an all-time high.

To put that in perspective, 50% of the investment-grade bond market now sits on the lowest rung of the quality ladder. And there’s a reason BBB-rated debt is so plentiful. Ultra-low interest rates have seduced companies to pile into the bond market and corporate debt has surged to heights not seen since the global financial crisis.”

Let’s put that into context with the sub-prime crisis for a moment.

As Michael Lebowitz wrote for our RIA PRO subscribers. (Try FREE for 30-days)

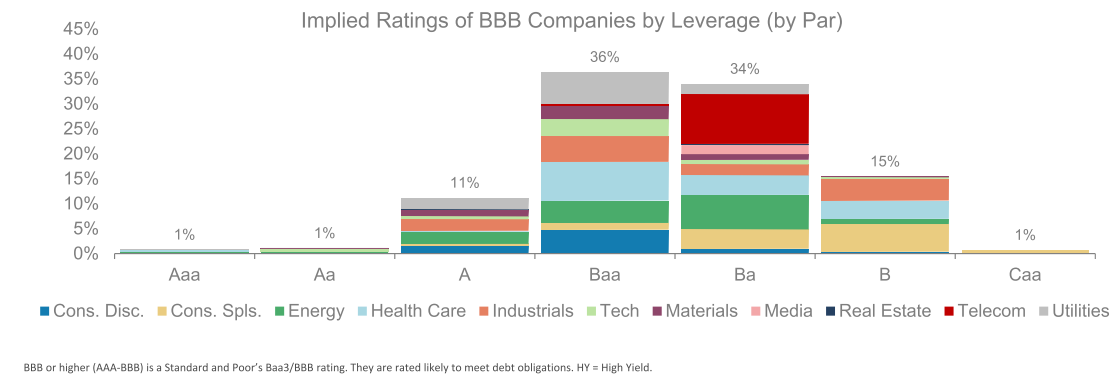

“The graph shows the implied ratings of all BBB companies based solely on the amount of leverage employed on their respective balance sheets. Bear in mind, the rating agencies use several metrics and not just leverage. The graph shows that 50% of BBB companies, based solely on leverage, are at levels typically associated with lower rated companies.”

“If 50% of BBB-rated bonds were to get downgraded, it would entail a shift of $1.30 trillion bonds to junk status. To put that into perspective, the entire junk market today is less than $1.25 trillion, and the sub-prime mortgage market that caused so many problems in 2008 peaked at $1.30 trillion. Keep in mind, the sub-prime mortgage crisis and the ensuing financial crisis was sparked by investor concerns about defaults and resulting losses.

As mentioned, if only a quarter or even less of this amount were downgraded we would still harbor grave concerns for corporate bond prices, as the supply could not easily be absorbed by traditional buyers of junk.”

Think about that for a moment. If all of a sudden there is a massive slide in ratings quality, many institutions, pension, and mutual funds, which are required to hold “investment grade” bonds will become forced sellers. If there are no “buyers,” you have a liquidity problem.

Let me just remind you that such an event will not happen in a vacuum. It will occur coincident with a recessionary backdrop where assets are being wholesale liquidated. Which is the problem with Powell’s comments which are all predicated on just one thing – no recession.

“To preview my conclusions, as of now, business debt does not present the kind of elevated risks to the stability of the financial system that would lead to broad harm to households and businesses should conditions deteriorate. At the same time, the level of debt certainly could stress borrowers if the economy weakens.”

Jerome Powell is basing his risk assessment on the assumption of a “Goldilocks Economy” that will presumably persist indefinitely. In other words, “the only risk is a recession.”

Of course, Ben Bernanke’s mistaken assumption about “sub-prime” was also the belief in a “Goldilocks”scenario.

“We have spent a bit of time evaluating the financial implications of the sub-prime issues, tried to assess the magnitude of losses, and tried to determine how concentrated they are. There is a sense that, although there is always a possibility for some kind of disruption, the financial system will absorb the losses from the sub-prime mortgage problems without serious problems.” – Ben Bernanke, May 2007

Of course, the risk of recession has risen markedly in recent months and the resurgence of the trade war may be just enough to push the economy over the edge. But importantly, as Michael noted above, the real risk is when the recession does come. That risk was also highlighted by TheStreet.com

“Joseph Otting, who heads the U.S. Office of the Comptroller of the Currency, said in written testimony to the Senate Banking Committee that underwriting standards have declined on these junky loans, meaning investors will likely get less of their money back in the event of a default. That could spell big losses in an economic downturn, since many of the borrowers likely would suffer a sales decline.

Banks bear ‘indirect risk’ from the junk-lending frenzy because they lend to companies and investors who buy the loans once they’re made, according to Otting.

‘Although less transparent to the federal banking agencies, we will continue to monitor nonbank leveraged lending activity and its potential impacts to the extent possible,’ Otting said. The banks also lend to companies ‘that may have critical suppliers or vendors that are highly leveraged.’ Regulators and banking executives often use the delicate term ‘leveraged’ to describe a company that is highly indebted.”

The risk is also particularly exposed in the ETF market where investors have been crowding over the last several years.

We have previously pointed out the risk of the “passive investing” craze. To wit:

“’There is no such thing as passive investing. While it is believed that ETF investors have become ‘passive,’ the reality is they have simply become ‘active’ investors in a different form. As the markets decline, there will be a slow realization ‘this decline’ is something more than a ‘buy the dip’ opportunity. As losses mount, the anxiety of those ‘losses’ mounts until individuals seek to ‘avert further loss’ by selling.”

However, that “liquidity” risk is magnified when it comes to junk bonds because those instruments can be particularly illiquid and thinly traded. This was recently noted by Evergreen Capital

“While it’s well known that flows into stock ETFs have gone postal during this bull market, less top-of-mind is that the same thing has happened with bond ETFs. Per the charts below, most of the inflows have been into equity ETFs but corporate bond ETFs have increased by 1000% over the past decade.

Moody’s has also observed that ETF investors ‘may be in for a shock during the next sustained market rout’. They opine that this is especially the case with ETFs that hold lightly-traded securities such as corporate bonds and loans. This could lead to a potentially jarring collision between perceptions and reality. ETF investors think they can get out of even junk bond and sub-investment grade bank loan ETFs on a moment’s notice. To a point that’s true. If they hit the sell button at their on-line broker, they’ll be out instantly. But if they do so during another period of mass liquidation, they’ll get a horrible execution price. In my opinion, this is almost certain to happen in the not too distant future, particularly given that corporate bond volumes have contracted so dramatically in recent years. For example, since 2014 junk bond trading volumes have vaporized by 80%. Thus, the bond market is dangerously illiquid these days.

Unfortunately, while Jerome Powell may be currently channeling Ben Bernanke to keep markets stabilized momentarily, the real risk is some unforeseen exogenous event, such as Deutsche Bank going bankrupt, that triggers a global credit contagion.

The problem for the Fed is that they aren’t starting with a $900 billion balance sheet but rather one over $4 Trillion. Fed funds aren’t at 5% but rather 2.4%, and GDP is running at half the levels of periods preceding previous recessions. In other words, when the next recession comes, which will trigger not on a credit contagion but a mean reverting correction in asset prices, the Fed will have very little to work with.

Of course, this all reminds me of movie “Speed” with Howard Payne talking to Jerome Powell:

“Pop quiz, hotshot. There’s a ‘corporate junk bond’ bomb on a bus. Once the economy slides toward 0%, the bomb is armed. If Deutsche Bank goes bust, it blows up. What do you do? What do you do?”

For our clients, we have already gotten off the bus. We have eliminated our credit risk, shortened our duration and moved substantially higher on the credit quality scale.

What are you doing?

via ZeroHedge News http://bit.ly/2XjcbKM Tyler Durden