Authored by Alex Kimani via SafeHaven.com,

When Uber Technologies ended years of speculation by holding its hotly anticipated initial public offering on May 11, CEO Dara Khosrowshahi tried to appease nervous investors by claiming that the rather low asking price of $45-a-pop was a fair reflection of a lackluster IPO environment. Well, apparently, he underestimated just how treacherous and unreceptive the market has become to newbies deemed as being all flash and little substance.

Uber shares have tanked 12 percent in its short public life, dropping nearly $10 billion from its valuation in less than three weeks in what is shaping up to be yet another disastrous listing. Driving the massacre are hordes of short-sellers, with shares sold short surging 160 percent to 36 million from 13.6 million at the time of its IPO.

Uber is facing a fate even worse than that by its close peer Lyft, Inc.(NYSE:LYFT), with the value of short positions surpassing Lyft’s for the first time.

Wrong timing

Maybe the ride-hailing company was being a little naïve for expecting the red carpet treatment at a time when the market had clearly soured on unprofitable startups.

Just a few months earlier, shareholders had raked Lyft shares over the coals for its lack of profits. Yet, Uber is the real champion in that department, with the company having lost $4 billion last year alone and nearly $7 billion cumulatively in its 10-year lifespan. Lyft’s $900 million loss last year certainly pales in comparison with that.

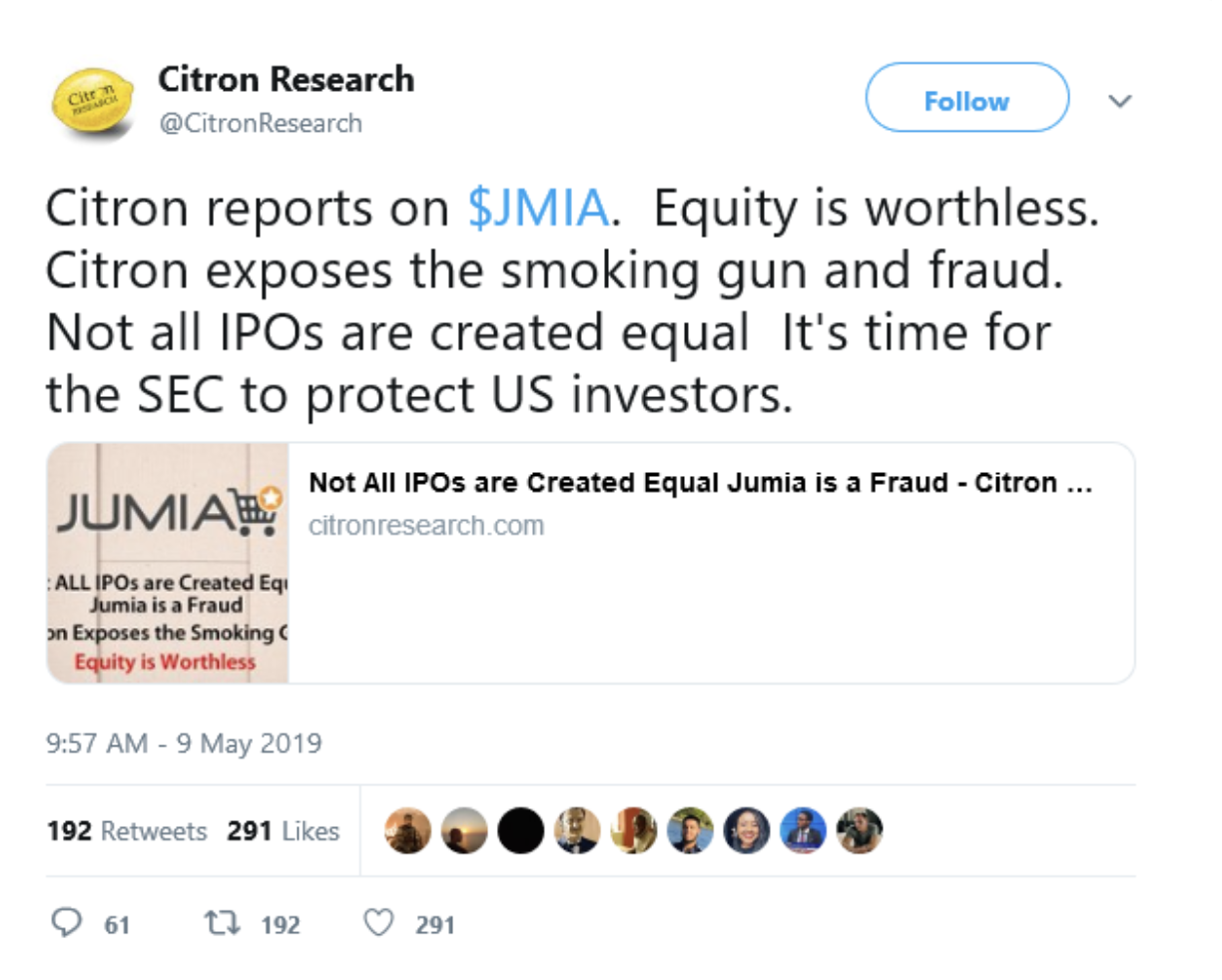

There’s a clear trend developing here with the market going out on a limb to punish startups with nothing to show at the bottom line. After a Cinderella run that saw its shares climb 75 percent post-IPO, Jumia Technologies(NYSE:JMIA), Africa’s first unicorn to list on NYSE, has tanked nearly 50 percent in May after famous Wall Street short-seller Citron Research, took to Twitter and laid in on the company accusing it of fudging its numbers to give the impression of a far more stable business. Citron alleges these are material discrepancies and labeled the shares “worthless”. Citron’s Andrew Left has evenreleased a video to back-up claims of the said fraud.

Jumia had accumulated losses of close to a billion dollars by the end of 2018.

(Click to enlarge)

The shorts are clearly having a field day here.

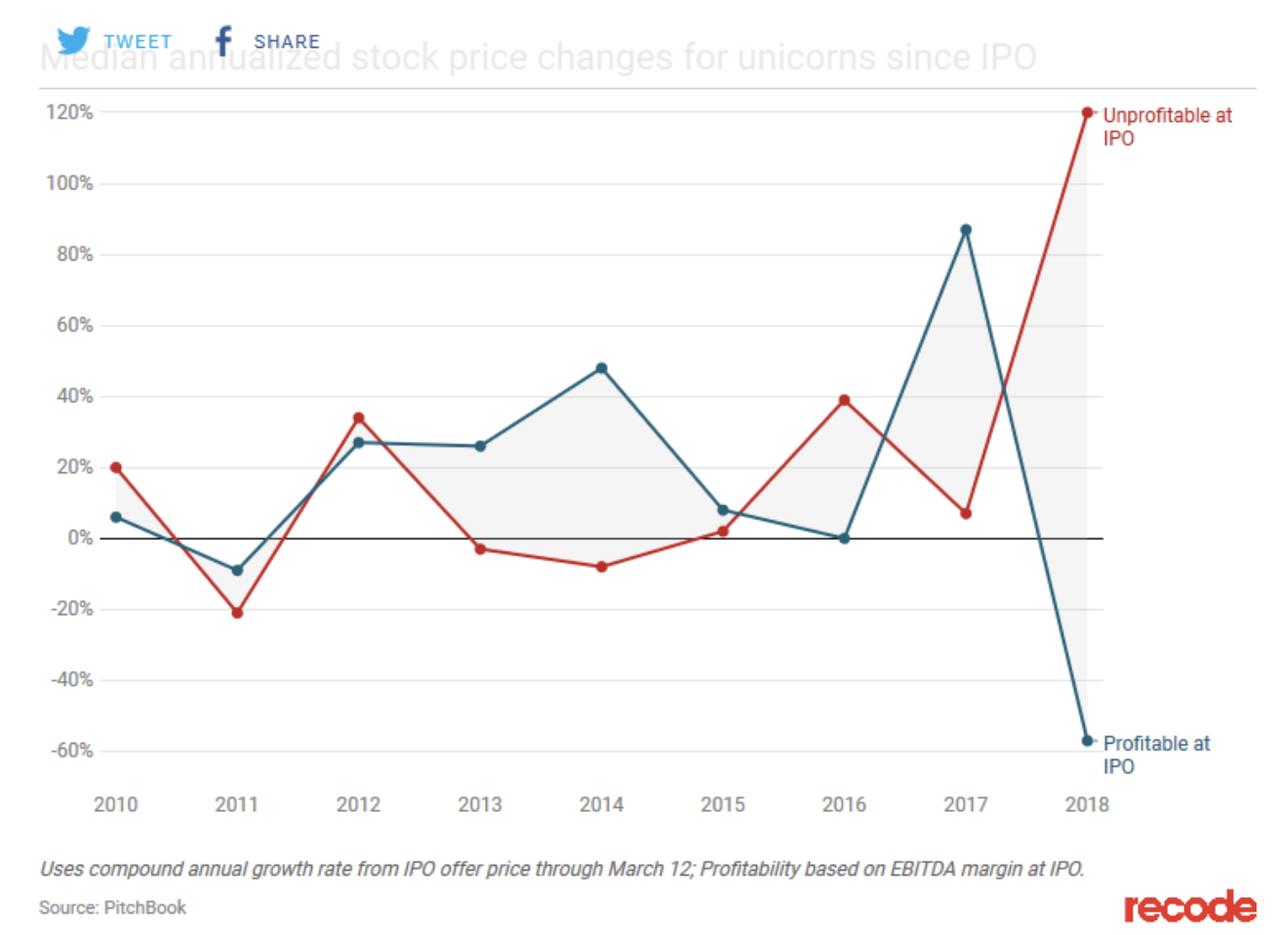

Yet, Uber, Lyft and Jumia should have known better. Stock markets can be incredibly capricious, with investor sentiment in a state of constant flux. Just last year, shares of unprofitable companies that IPO’d performed much better than those by their profitable peers.

However, experts were already warning earlier in the year that the mood had started to sour and the market was less likely to tolerate companies printing red ink.

(Click to enlarge)

Source: Vox

Mark Cuban, the billionaire investor and an early-stage Lyft investor to the tune of $1 million, told CNBC he thinks that both companies would have fared much better had they listed at the peak of their growth. Notably, Uber’s top line growth has slowed considerably, with 25 percent growth during the final quarter of 2018 being only a fraction what it used to be a few years ago.

Mark has even lambasted Silicon Valley’s venture capitalists, questioning their ability to accurately price pre-IPO companies.

Earnings on deck

Yet, Uber’s fate could get a lot worse when the company presents its first ever earnings scorecard to hostile shareholders after the close tonight.

According to Wedbush analyst Dan Ives:

“While investors have been expecting take rate compression as competition pushes irrationality and rider incentives in the near-term, we expect a focus on a path to improvement and accelerating revenue growth over the remainder of 2019 and into 2020, particularly as Lyft noted on its 1Q call that it believes the domestic rideshare market is becoming increasingly rational.’’

Uber has provided guidance for Q1 revenue of $3.0B-$3.1B and a net loss of $1.0B $1.1B. It’s going to be interesting to see whether investors will be willing to take Ives’ cue and play the long game. Just, don’t bet on it.

via ZeroHedge News http://bit.ly/2MjZDSl Tyler Durden