Better late than never.

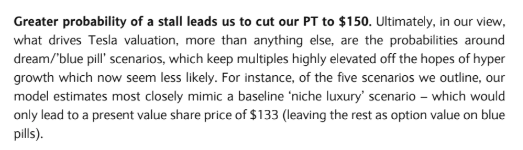

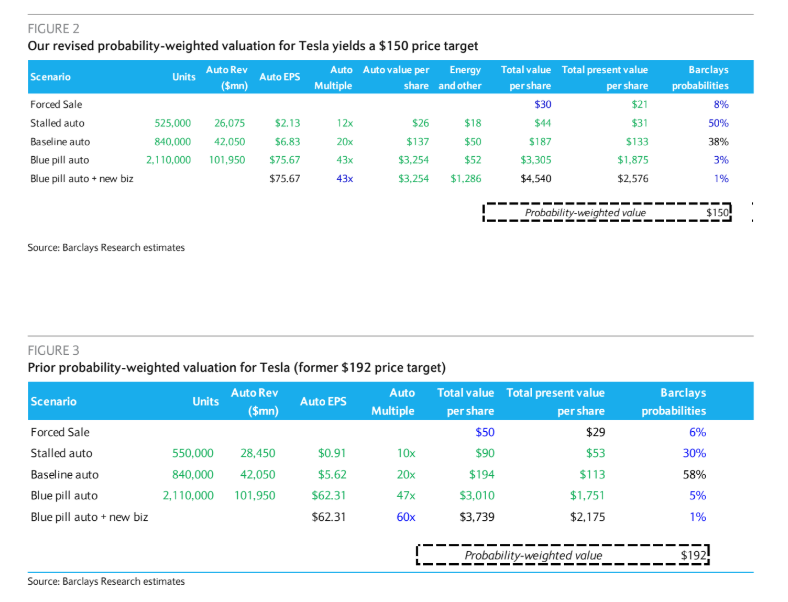

After last week’s onslaught of sell side downgrades of Tesla, Barclays joined the party, and on Thursday it slapped the second lowest street $150 price target on the company (Vertical Group’s Gordon Johnson has the lowest at $54) and highlighted a scenario that could see shares go as low as $133.

Analyst Brian Johnson said that the automaker could be relegated to the status of becoming just a “niche luxury carmaker”, an angle that many Tesla skeptics have insisted would have been a better path for Tesla from the get go.

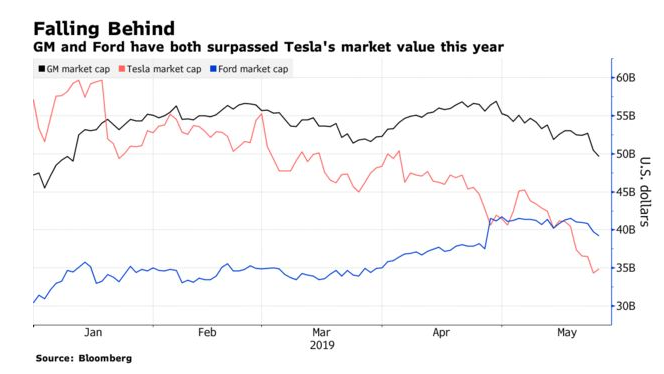

Barclays predicts that there isn’t much left of the blissfully ignorant illusionary view on Tesla, stating that the company’s “blue pill” call option value now appears far out of the money. Barclays also predicts that it could be time for the rest of the market to embrace the harsh realities and brutal truths of the dying Tesla narrative. Johnson’s note suggests that recent price action, “even in the face of a successful fund raise” indicated that market participants are starting to take the “red pill”.

As a result, Barclays lowered its target on the company to $150 from $192, saying that – despite Elon Musk’s recently leaked email claiming “great” demand – that demand for the Model 3 has stagnated in the U.S.

“The company lacks a path to significant profitability from its auto business and its solar storage installations have declined sequentially over the past two quarters,” Johnson said. Like Morgan Stanley last week, Barclays said that there was “no excitement” around the brand anymore, observing that the CEO’s pivot to robotaxis fell on deaf ears.

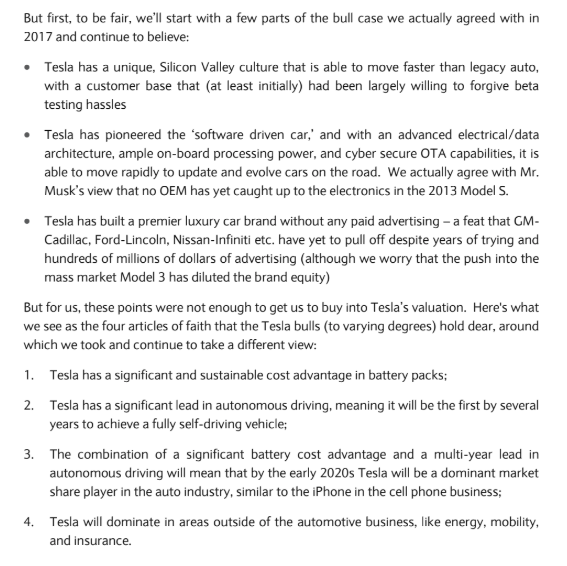

Johnson did try to recant some of the bull case that has been successful, but he then turned around to note why all of these points did not justify the company’s current valuation. He says that Barclay’s looks at four “articles of faith”, that Tesla bulls take to be gospel, with an eye of skepticism.

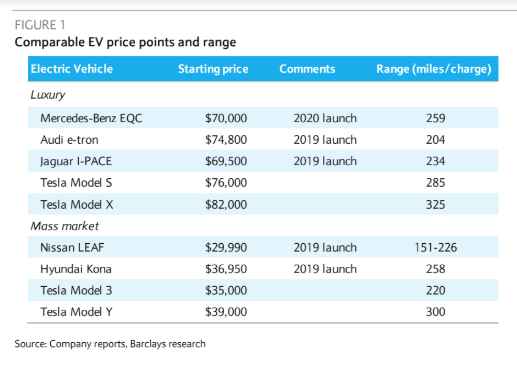

He also pointed out comparable EVs that will be coming to market and challenging Tesla, along with their price points and range.

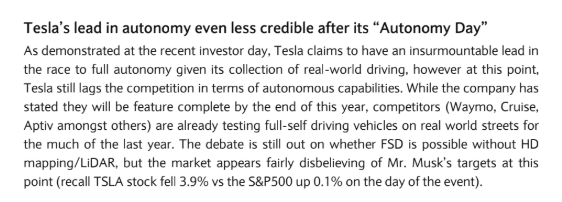

Johnson blasted the company’s Autonomy Day, stating that it made the company’s “lead” in Autonomous “even less credible”.

The onslaught continued, interspersed with the occasional silver lining of optimism, like this: “We expect more investors to gravitate back to Tesla’s near-term fundamentals of demand, profitability and cash generation.” Well, maybe optimism for the shorts. He also said his “niche carmaker” model would price the company’s shares around $133.

Recall, last week started with Wedbush proclaiming that Tesla faced a “Kilimanjaro-like uphill climb” to hit its profitability goals for the second half of the year. Analyst Dan Ives also slashed his price target from $275 to $230 and called the company‘s current state of affairs a “code red situation”.

Morgan Stanley analyst Adam Jonas then picked up the bearish baton with a midweek call with investors in which he said “supply exceeds demand, they’re burning cash, nobody cares about the Model Y, they raised capital near lows” and there’s been “no strategic buy-in”.

He then said: “Tesla’s is not seen as a growth story, it’s seen as a distressed credit and restructuring story.”

This came after Jonas’ note last Tuesday, which saw the investment bank lower its “bear case” target to on the company to just $10 per share.

Later in the week, longtime Tesla bull Gene Munster capitulated and issued a stern warning that he believed Tesla will miss its 2019 delivery target range. Munster cited shrinking sales in China and the ongoing trade war as the reason for his increasingly bearish commentary. Munster cut his estimate for Tesla’s full year global car sales by about 10%, to 310,000 vehicles, versus the 360,000 vehicle target that the company put out back in March.

Citigroup and Robert W. Baird & Co. analysts also slashed their target prices last week.

via ZeroHedge News http://bit.ly/2Xhbstp Tyler Durden