Authored by Bryce Coward via Knowledge Leaders Capital blog,

As we look into the second half of the year and into 2020, we are left with a fleeting feeling about the prospects for a cyclical uptick in growth and therefore earnings. The problem is not so much with the current pace of growth or incoming data (which by the way hasn’t been very good). It’s more about the tea leaves telling us that the slowdown we’ve experienced over the past few months could continue and even accelerate through year end and into next year. As we see it, the three main impediments to economic growth are:

-

Baked in fiscal tightening

-

Lagged effects of the monetary tightening cycle

-

Tariffs and the second order effects

Baked In Fiscal Tightening

It’s often overlooked that the US economy has a serious fiscal tightening in the pipeline,which is in stark contrast to 2018 and 2019. As a matter of fact, fiscal policy added 1.32% to overall growth in 2018 and .83% in 2019. In 2020 it will subtract .77% from overall growth. That is to say, if we assume trend nominal GDP growth is 3.5%, then all else equal the economy should have grown by 4.82% in 2018 and should grow by 4.33% in 2019, both above trend. For 2018 at least, actual nominal GDP growth came in at 5.18%, not far from what would have been expected from the fiscal expansion alone. In contrast, 2020 nominal growth will only be 2.73% if we assume fiscal policy is the only variable that would create a delta between trend growth and realized growth. That would be the lowest growth rate since 2016 when we had a recession scare and an actual profits recession. We had hoped that some sort of infrastructure package would act as an offset to the baked in fiscal tightening, but for now that deal appears to have been tabled.

Lagged Effects of Monetary Tightening

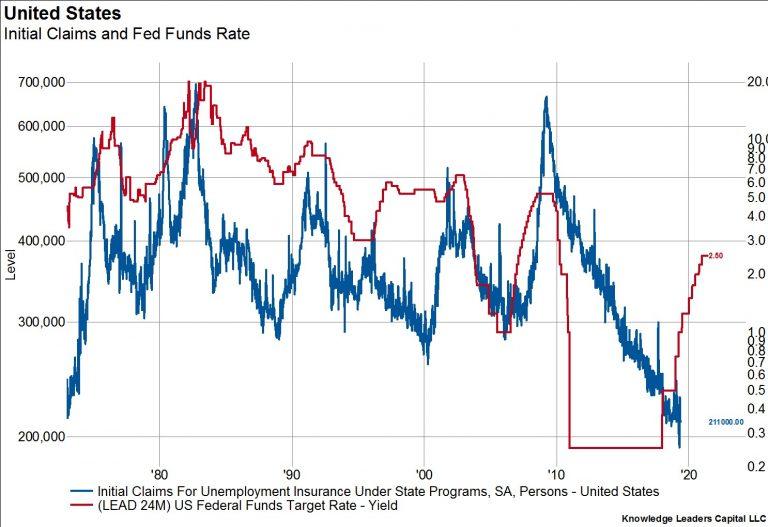

The tightening isn’t just on the fiscal side. The monetary tightening that we experienced for two years leading to the Fed’s last rate hike in December, 2018 will be with us for some time.

We know our readers understand that monetary policy impacts the real economy with long lags ranging from 18 months to 2 years. By that math, we’ve still got 13 to 19 months left until the after affects of the tightening cycle stop being a drag on economic growth. One of the areas that are traditionally affected by Fed tightenings is employment, which has so far been extremely resilient.

History suggests that could change in the second half of 2019.

Tariffs and Second Order Affects

The escalation of the US-Sino geopolitical conflict will have consequences to economic growth. Tariffs are a dead weight loss to economic output, thus the higher they go the higher the dead weight loss. Private estimates have the impact to 2019 growth ranging from -0.2% of GDP to -1% of GDP, depending on the quantity of Chinese products that will ultimately be subject to tariffs and at what rate. Of course, the impact to growth can be mitigated by phasing the tariffs in over time. Of possibly greater significance is the impact on private business confidence.

When business owners are confident they invest, and the opposite is also true. Last year, shortly after large-scale tariffs were levied on Chinese imports, small business investment peaked and has since been going down. The escalation we’ve seen in the US-Sino conflict could further dent confidence and thus capex, adding yet another headwind to growth.

In part two of this series we will discuss what this all means from an asset allocation perspective and why the rally in long bonds could just be getting started.

via ZeroHedge News http://bit.ly/2YV0vOA Tyler Durden