A financial cage match is forming between Goldman and JPMorgan.

In the hawkish corner we have Goldman’s chief economist, Jan Hatzius who until very recently was expecting no rate cuts in the coming year, and in fact is anticipating the Fed will hike toward the end of 2020, arguably as a result of the upcoming inflationary spike as a result of trade war. In the dovish corner, we have JP Morgan which as of this morning has turned so bearish that the latest report from the bank’s chief economist, Michael Feroli, says that “Making Abysmal Growth Attainable” again would require not one but two rate cuts before the end of 2020!

As Feroli writes, “last night’s tariff announcement adds yet another trade-related headwind to the growth outlook. If the Administration follows through on the proposed actions, we believe the adverse growth implications would prompt Fed easing. Even if a deal is quickly reached with Mexico, which seems plausible, the damage to business confidence could be lasting, with consequences that might still require a Fed response.”

As a result, the biggest US bank is now looking for two 25bp reductions in the federal funds rate target, in September and December, and provides the following explanation:

By combined import and export shares Mexico is the US’s second-largest trading partner after Canada. Moreover, the supply chain integration has been deepened over the last quarter-century by an understanding that the steady rule of law would govern that trading relationship. This is now in doubt. It is unusually difficult to quantify the drag on growth from last night’s announcement, but we believe ground zero will be business capital spending—the expenditure type most sensitive to uncertainty. We now merely pencil in a quarter-point reduction in our Q3 GDP outlook to 1.5%. The greater worry—which could prompt a larger revision—is that capital spending weakness morphs into hiring caution, and from there into consumer spending.

To be sure, Feroli hedges without binding himself to a specific timing stating that his “revised Fed call averages scenarios” cautioning that “if tariffs on Mexico are raised all the way to 25%, the Fed may well need to cut by much more than 50bp.” Yet even with a quick deal, JPM still sees “some chance that the Fed would guard against downside risks.”

That said, Feroli expects that the Fed will want to see some weakening in the economic data before taking action. Moreover, the May data cycle—which begins next week—will be much too soon to look for the effect of either the Chinese or Mexican tariffs. For this reason, JPM tells its clients not to expect a material shift in the Fed’s stance at the June meeting. But if JPM is right in its newly found pessimism, it would expect to see the deterioration in the business sentiment data, and subsequently hard activity data, beginning in early July.

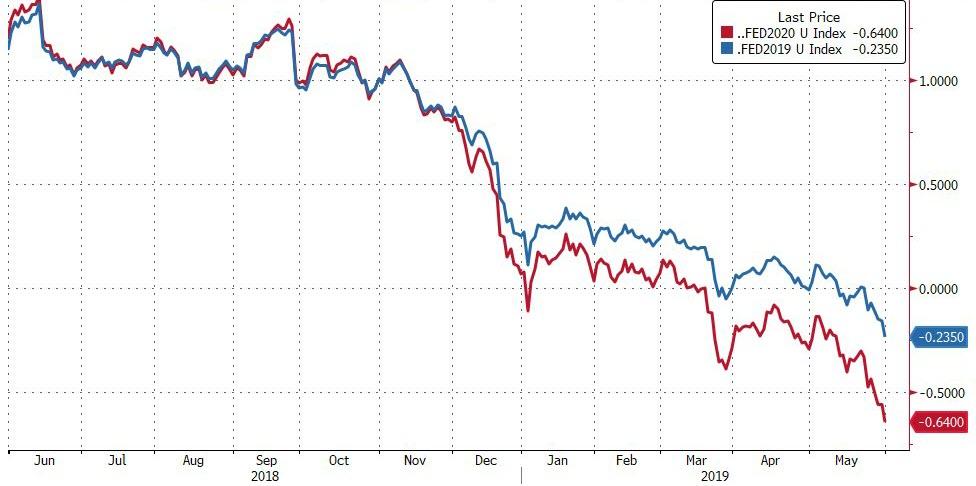

And while we wait to see if Goldman matches this revision, and finally throws in the towel on its hawkishness, the market has already spoken, and as of this morning it is pricing in 1 rate cut by the end of 2020 and almost three by the end of 2021.

via ZeroHedge News http://bit.ly/2W4vaHm Tyler Durden