Via Greg Hunter’s USAWatchdog.com,

Money manager Peter Schiff says all the money printing and debt explosion since the Great Recession comes with a huge downside.

Schiff says, “All sorts of bad policies basically took place thanks to the monetary excesses applied by the world central banks, but now we are at a point where all these inflation chickens are going to come home to roost.”

“It will not be in stock prices or real estate prices or bond prices, but in good old fashion consumer prices. Food, energy and all the things that we need to live are going to get a lot more expensive.”

Schiff says the Fed is overlooking some big problems coming. Schiff says, “They [The Fed] did not stress an environment where we have more inflation or where we have stagflation, where we not only have a rise in unemployment and a recession, but consumer prices and long term interest rates that go up at the same time. They (Fed) are not even thinking that’s possible…”

“…but that’s actually probable. The real problem is when real inflation rears its head, there is nothing the central bankers can do about it. If they try to fight the inflation by tightening up on monetary policy, it’s like slamming on the brakes.

They are going to have to jack interest rates very high, and everything is going to start imploding. The whole credit bubble is going to collapse. We are going to see stock markets tumble. Bonds are going to go into default. There will be bankruptcies, layoffs, bank failures and the governments will have to start defaulting on their obligations and payments on social programs, or even interest on principal.

You have a massive crisis coming if the Fed fights inflation, but you have an even worse crisis if they don’t. I am betting on this initially. As inflation gets worse and worse, the central bankers are going to say it is a good thing.”

Schiff predicts, “Inflation is going to run out of control…”

“…contrary to the idea that inflation is somehow “dead,” and that government deficits can be endlessly funded by printing pieces of paper that everyone will passively accumulate, my impression is that the coming few years are likely to produce “revulsion” toward an increasing stock of unbacked government liabilities. To some extent, you can see that emerging revulsion in the recent behavior of gold. It’s not something that’s fully taken hold yet, but it will be important to closely monitor the prices of inflation-sensitive assets, including commodities, inflation-protected securities, the U.S. dollar, and other alternative ways of holding purchasing power. “

[ZH: None other than John Hussman agrees with Schiff, noting in his latest market comments:

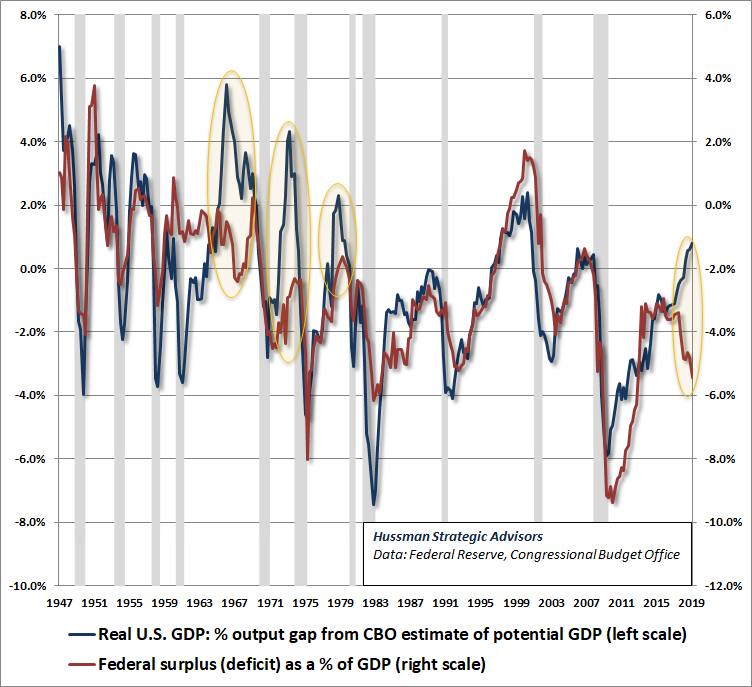

Notably, the points where we’ve observed rapid increases in U.S. inflation – the late 1960’s, the early 1970’s, and again in the late-1970’s, overlap those periods where the U.S. economy was running near full capacity yet government deficits were expanding.

With the U.S. budget deficit pushing deep in the red despite an economy operating at full employment, we’re approaching a similar situation at present.

“This is why people need to buy gold. Paper currencies are going to lose a tremendous amount of value. So, if you want to preserve your purchasing power of your savings, you better be saving real money and not all this funny money the central banks create. . . . Once the market perceives that there is no light at the end of the tunnel, that we are never going back to normal, that interest rates are going to stay negative in real terms forever, that the Fed has no ability to raise rates, that all the new money that has been created will never be destroyed, that the Fed balance sheet will grow in perpetuity so liquidity will never be removed, then the dollar will fall through the floor. Then we are going to get all that inflation.”

Schiff is predicting another bull market in gold and silver. Schiff says:

“If we are going to have another bull market in gold, which we will and it’s probably already starting, we are going to have a bull market in silver. I don’t think we have ever had a gold bull market that didn’t include silver. In every gold bull market, silver has outperformed gold (on a percentage basis). So, there is a lot of upside in silver.

Join Greg Hunter as he goes One-on-One with Peter Schiff, founder of Euro Pacific Capital and Schiff Gold.

To Donate to USAWatchdog.com Click Here

via ZeroHedge News https://ift.tt/2Nht1cx Tyler Durden