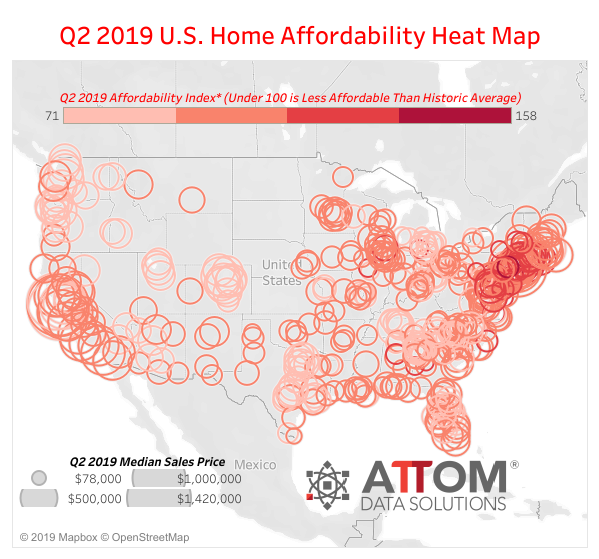

ATTOM Data Solutions published its 2Q19 US Home Affordability Report, which reveals median home prices last quarter weren’t affordable for the average American in 74% (353 of 480 counties) of the counties analyzed.

The most unaffordable counties, the reported noted, were in Los Angeles County, California; Cook County (Chicago), Illinois; Maricopa County (Phoenix), Arizona; San Diego County, California; and Orange County, California.

“Despite falling mortgage rates and rising wages, the cost of owning the typical home remains out of reach or a significant financial stretch for the nation’s average wage earners,” said Todd Teta, chief product office with ATTOM.

House price appreciation outpaced weekly wage growth in 40%, or 192 of the 480 counties, including Maricopa County (Phoenix), Arizona; Riverside County, California; San Bernardino County (Riverside), California; Tarrant County (Dallas-Fort Worth), Texas; and Wayne County (Detroit), Michigan.

For Americans who feel financially overwhelmed with unaffordable housing, the report does show 26%, or 127 counties examined, had affordable housing in Harris County (Houston), Texas; Wayne County (Detroit), Michigan; Philadelphia County, Pennsylvania; Cuyahoga County (Cleveland), Ohio; and Franklin County (Columbus), Ohio.

ATTOM calculated the affordability of each county by examining the amount of income needed to make monthly house payments (assume a 3% down payment and a 28% maximum “front-end” debt-to-income ratio) — including mortgage, property taxes, and insurance.

We noted in a recent report that most American renters now believe that purchasing a home is “financially out of reach.”

The most significant obstacle preventing renters from buying was “difficulty in saving for down payments and closing costs.”

So rising prices and the inability to save are the problems that have made housing unaffordable in many places across the country.

via ZeroHedge News https://ift.tt/2ZX7c3k Tyler Durden