Authored by Sven Henrich via NorthmanTrader.com,

On Mount Everest the Death Zone is the altitude above 8,000 meters above which climbers cannot survive for an extended period of time without oxygen (speak: artificial help). In the Death Zone “most climbers have to carry oxygen bottles to be able to reach the top. Visitors become weak and have inability to think clearly and make decisions, especially under stress“. It is my assertion that investors and traders are confronted with a similar situation as the S&P500 is approaching its own version of the Death Zone, the Sell Zone, in the vicinity of the 3,000 level.

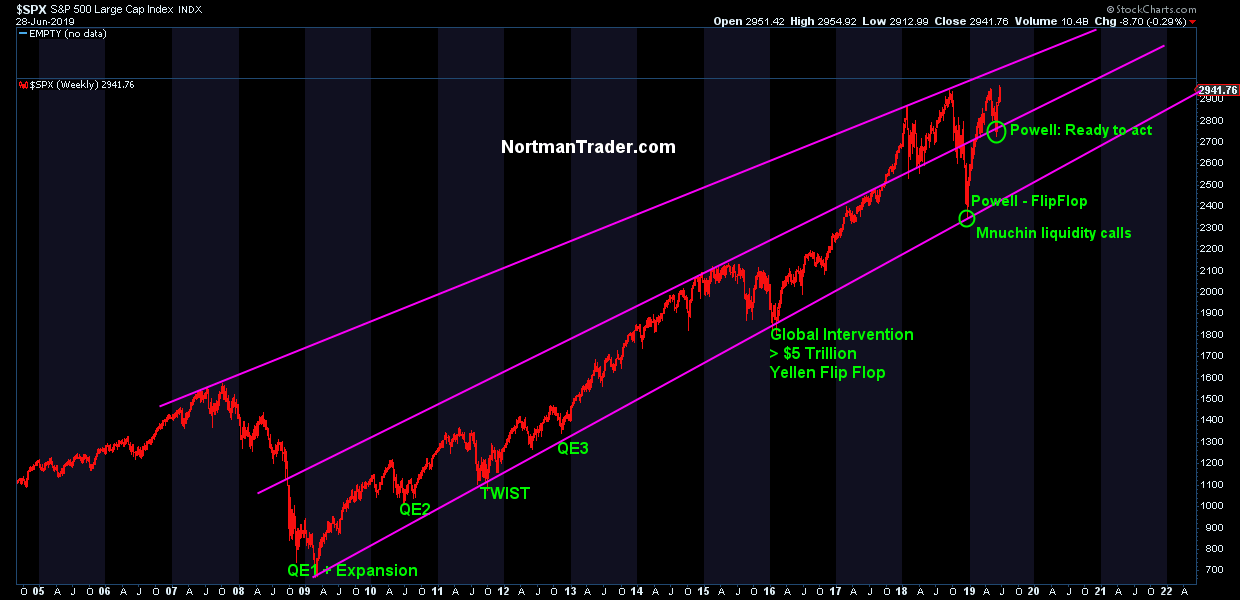

Why? Because stock buyers can’t sustain themselves above 3,000 without artificial help (central banks), the rallies keep getting weaker on an equal-weight basis, and investors are experiencing dizziness and find it difficult to think clearly in an environment where fundamentals and bond markets scream recession yet stock markets keep climbing to new highs.

In this week’s edition of the Weekly Market Brief, I’ll outline what I consider to be a major Sell Zone for markets and will also make clear where/when I think I’m wrong, meaning central banks once again retain control over the price equation irrespective of fundamentals.

Let’s speak plainly and realistically.

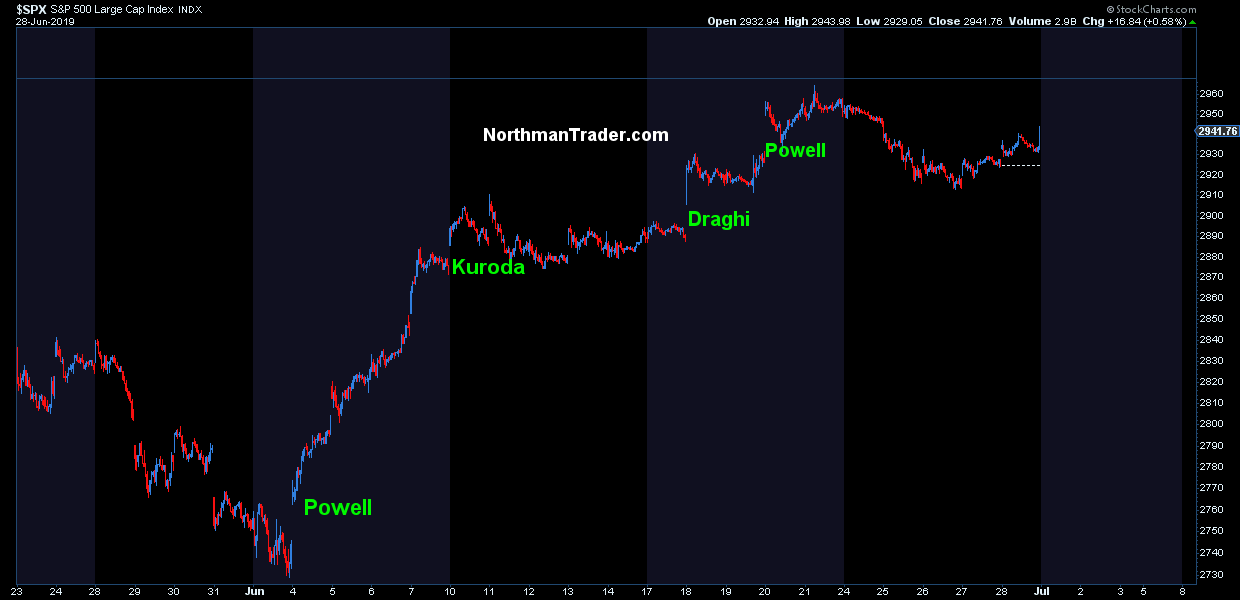

Market prices in June were again all about central banks:

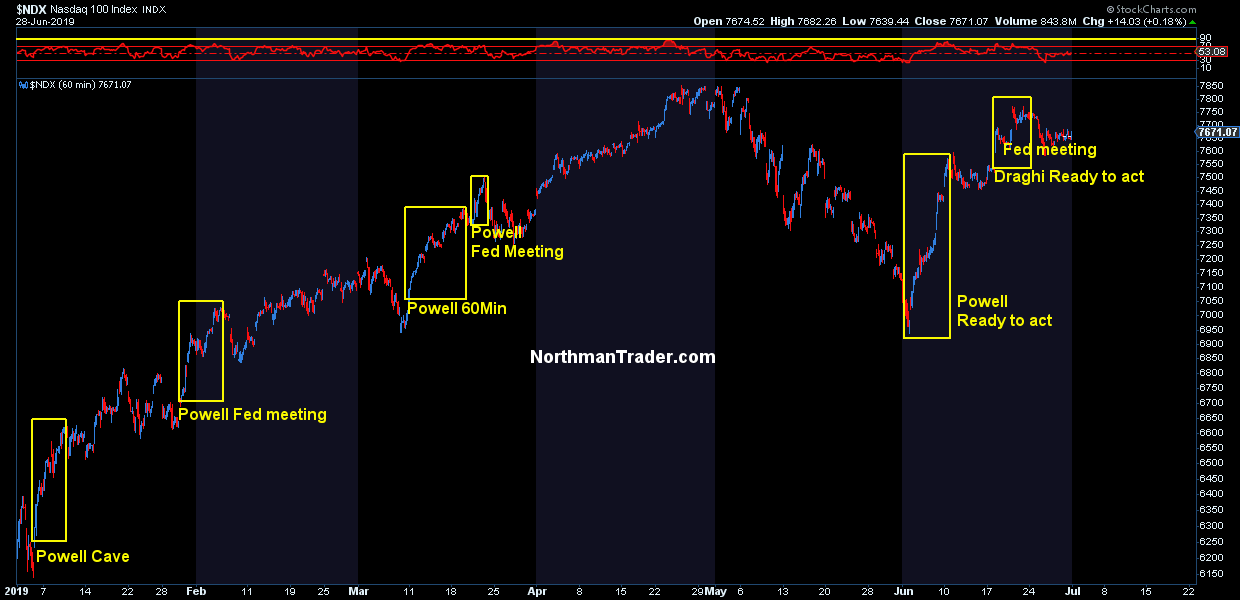

Indeed 2019 has been all about the Fed:

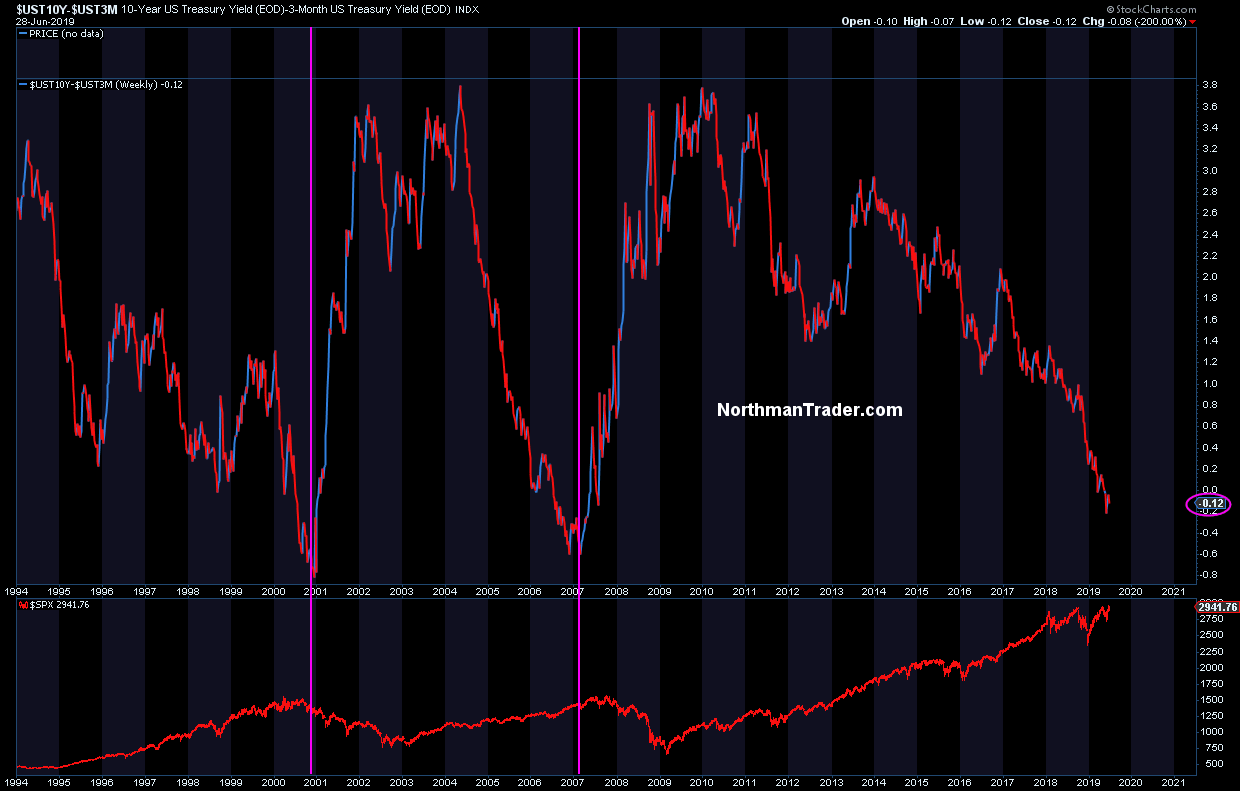

It’s NOT been about fundamentals as bond yields have collapsed and yield curves have inverted:

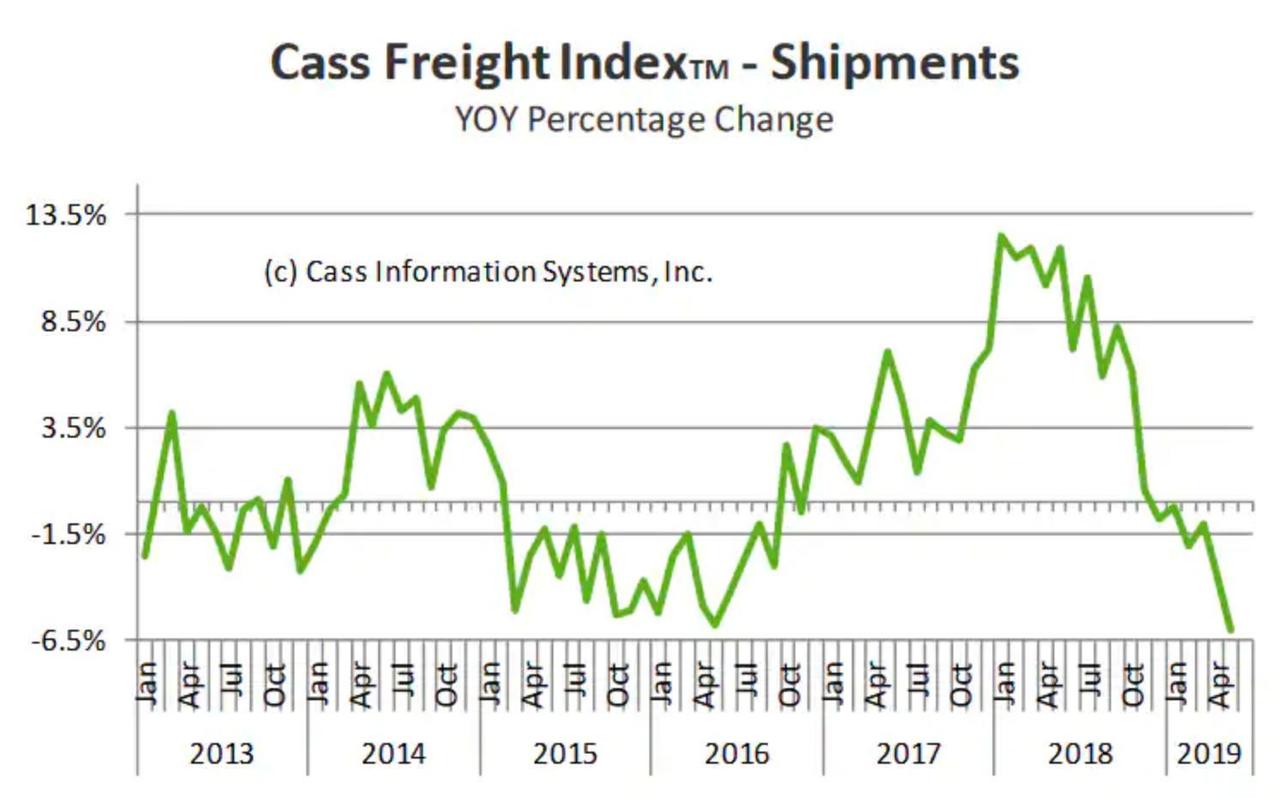

While freight shipments have collapsed:

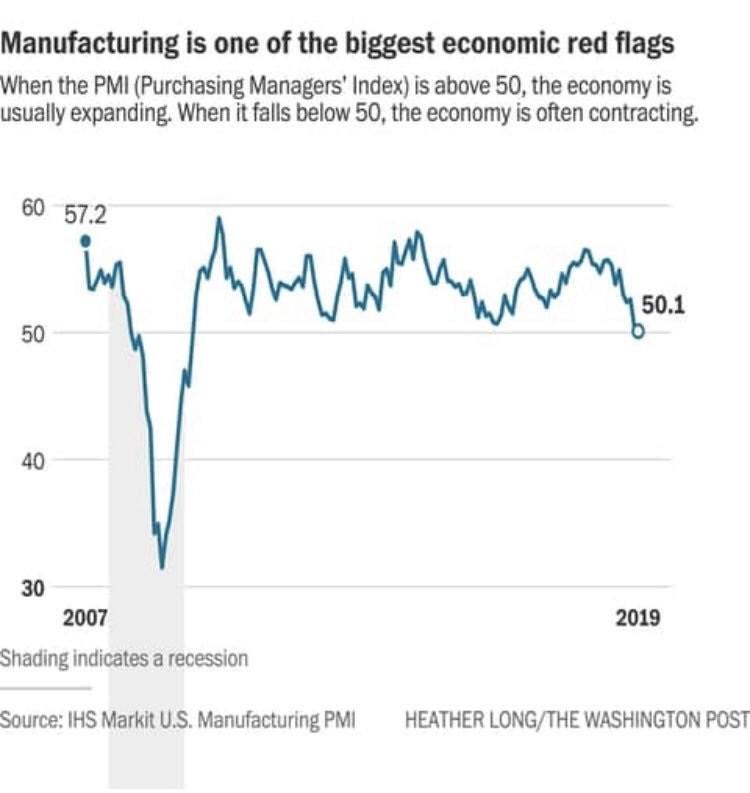

While manufacturing has been declining to levels not seen since the 2007 recession:

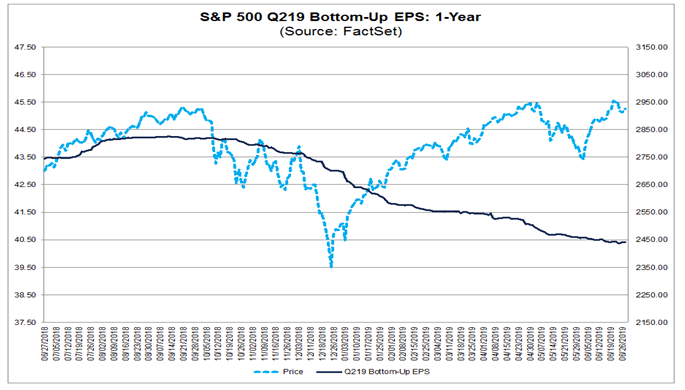

While earnings estimates have dropped nearly 7% over the past 12 months:

No, let’s be very clear here: Central banks have capitulated because bears have been right. January 2018 was a global blow-off top, the trillions upon trillions of monetary stimulus since 2008 were able to bring growth only so far because it all turned south on the slowing of such stimulus. After all the Fed tried to raise rates, the ECB ended QE and everything fell apart only to require again central bank dovishness.

But be clear, central banks have once again shown to be in control of prices. While officially never targeting equity prices they remain the single largest driver of the same:

And yet now it is dawning on everybody: Without cheap money, low to zero or negative rates the global debt construct cannot sustain itself. Zero rates forever.

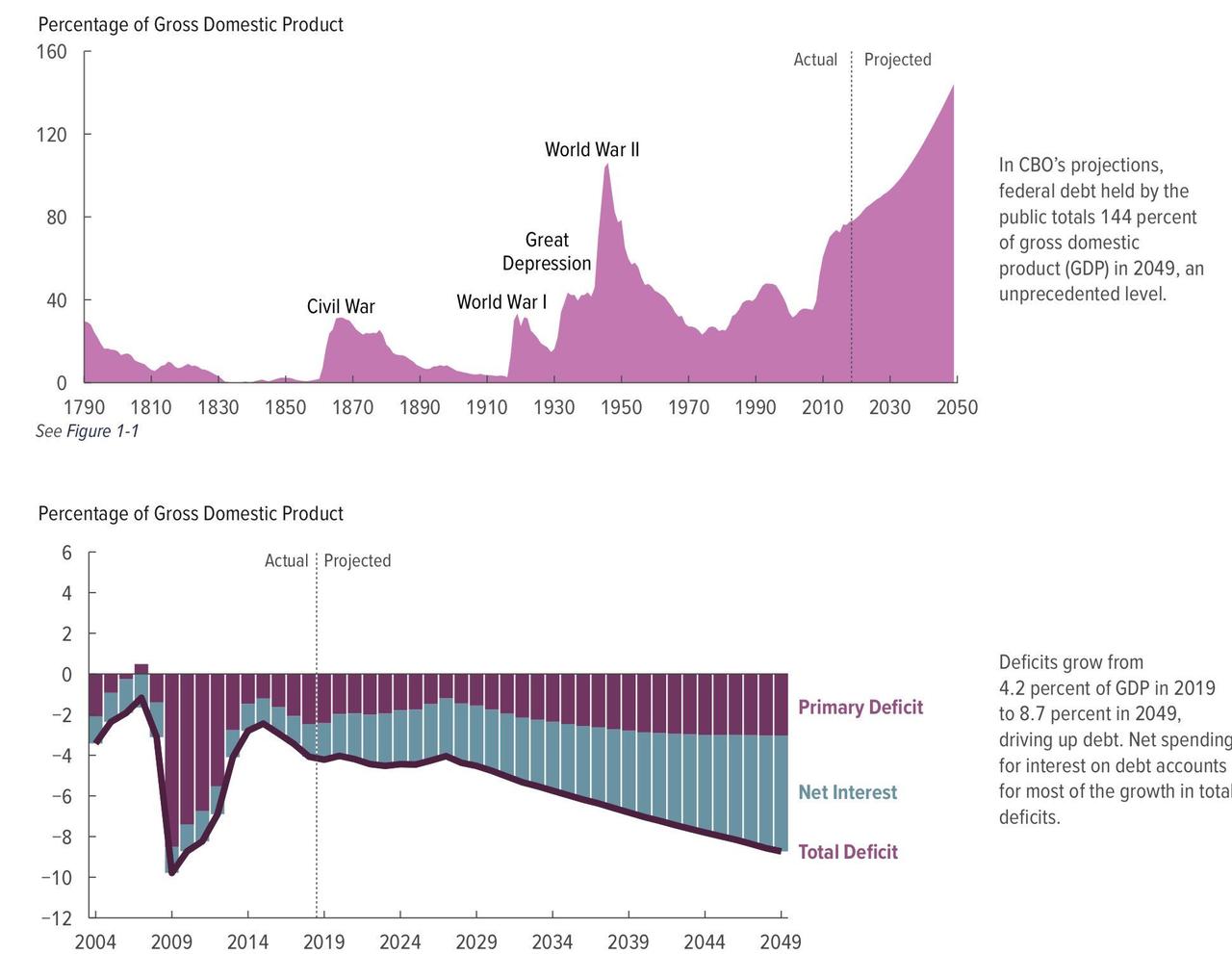

Why? Because Mount Everest is staring everyone in the face:

It’s an admission of a bankrupt system, a system that cannot do without artificial stimulus and cheap money.

Stock markets are driven by 2 factors only at the moment: Optimism & hope. Optimism that a trade deal with China will magically solve all growth concerns. Hope that central banks will cut rates and keep the boogeyman at bay.

On the trade deal front the problem is that there is no trade deal. The G20 announcement was simply to restart talks, but the resumption of talks came at a price:

Translated: He had to make 3 concessions to get trade talks started again. https://t.co/DSWLVE42a3

— Sven Henrich (@NorthmanTrader) June 29, 2019

Reality check: Trump’s on a 2020 clock, the Chinese are not. He has to win an election, the Chinese do not. In May they walked away, Trump raised tariffs and cut off Huawei only to now backtrack by not following through on new tariffs on consumer sensitive products, on now allowing Huawei to purchase US goods and easing on Chinese VISA issues. The implications are clear: Trump caved because he had to, he is the one that needs a deal and the Chinese know it and called his bluff and won in the process. As I’ve said before: Why would the Chinese agree to a deal they consider to be bad for them? They won’t. And so Trump has boxed himself into a corner and lost face, a potentially disastrous strategic move as now the prospects for an actual substantive move have diminished greatly.

The implication: Any deal that may come may be PR fluff as opposed to substance. Last time I checked PR fluff does not produce growth, a relief rally perhaps, but nothing sustainable. As it stands there is no deal, but there is optimism. Again. With no actual progress to measure.

And there is hope, hope that the Fed will cut rates and it is this hope that has come on the heels of complete capitulation of central banks that has stocks back to the brink of the sell zone.

So this coming month of July is shaping up to be an epic battle for control in the Sell Zone: Hope and optimism versus the reality of earning reports telling a different story.

What is the Sell Zone precisely? When do we know that central banks will have rendered the Sell Zone null and void? What is the technical target of the Sell Zone?

Please see the video discussion for the details:

* * *

To get notified of future videos feel free to subscribe to our YouTube Channel. For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2ZZTugg Tyler Durden