SUVs, at one point, looked to possibly be the silver lining of an auto industry that is clearly in the midst of recession.

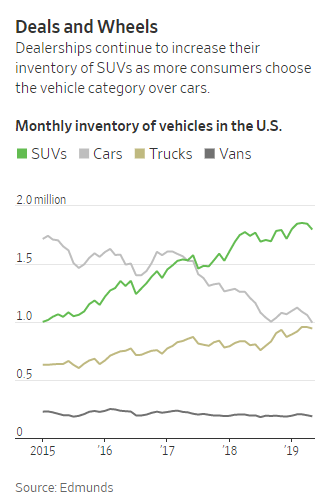

But now, production has likely gone too far and the SUV market has become “overcrowded with models sitting longer on dealership lots before being sold” – resulting in companies being forced to offer more incentives, according to the Wall Street Journal.

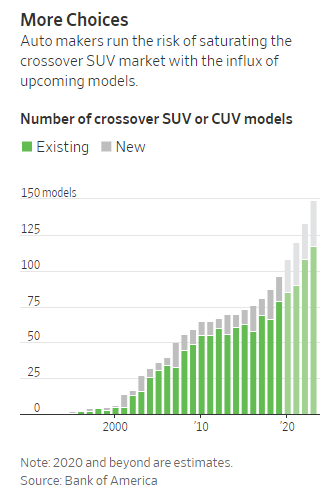

But this hasn’t stopped automakers from getting ready to roll out more SUVs over the next few years. This could actually be good for the consumer, as they will have a wider choice selection and will likely get better deals as a result. But, with the good comes the bad: it will also likely hit the bottom line of auto makers hard. In fact, some dealers are saying that automakers have fallen back to old habits of overbuilding to keep factories running and then turning to discounts when the demand doesn’t show up.

Earl Stewart, owner of Earl Stewart Toyota in North Palm Beach, Fla. said:

“We don’t need any more SUVs right now.”

The number of SUV and crossover models on sale has climbed from 70 in 2014 to 96 now. By 2023, the figure is expected to rise to 249.

John Murphy, an auto analyst with Bank of America said:

“This is a very significant trouble spot for the industry. The pendulum is swinging too far in the other direction. If trends continue, the profit premiums auto makers have long enjoyed on these models will fall over the next three years, eventually matching the lower margins now earned on sedans.”

As of today, SUVs make up more than 47% of the new vehicle market and sales of sedans and hatchbacks are down to only 30% of the market, from 50% during the same period in 2012. New SUV debuts include the “Hyundai Palisade—a large, eight-seat SUV—and a Lexus subcompact crossover called the UX.”

And industry executives don’t believe buyers will head back to sedans, either. Meanwhile, some analysts say the demand for SUVs is topping out amid the broader recession in the US auto market.

Jeremy Acevedo, an analyst for Edmunds.com said: “The piece of the pie is about set.”

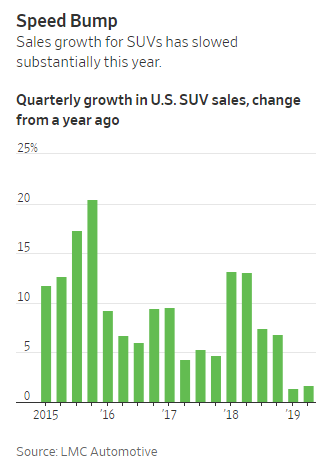

Sales of crossovers and SUVs were up 1.6% in the first half of 2019, but the pace of growth has slowed considerably from the 13.2% increase last year.

SUVs are simply taking longer for dealers to sell now, with the average vehicle on a lot for 71 days in May, up from 63 days last year and 51 days in 2015. This compares to 79 days for sedans, a figure that hasn’t changed much over the last three years. Incentive spending and discounts by car companies are up 6% through May over the same period.

Brandon Ambrosio, a 31-year-old systems engineer who was recently shopping for an SUV said: “There’s too many that seem so similar to each other.”

via ZeroHedge News https://ift.tt/2S3rXYl Tyler Durden