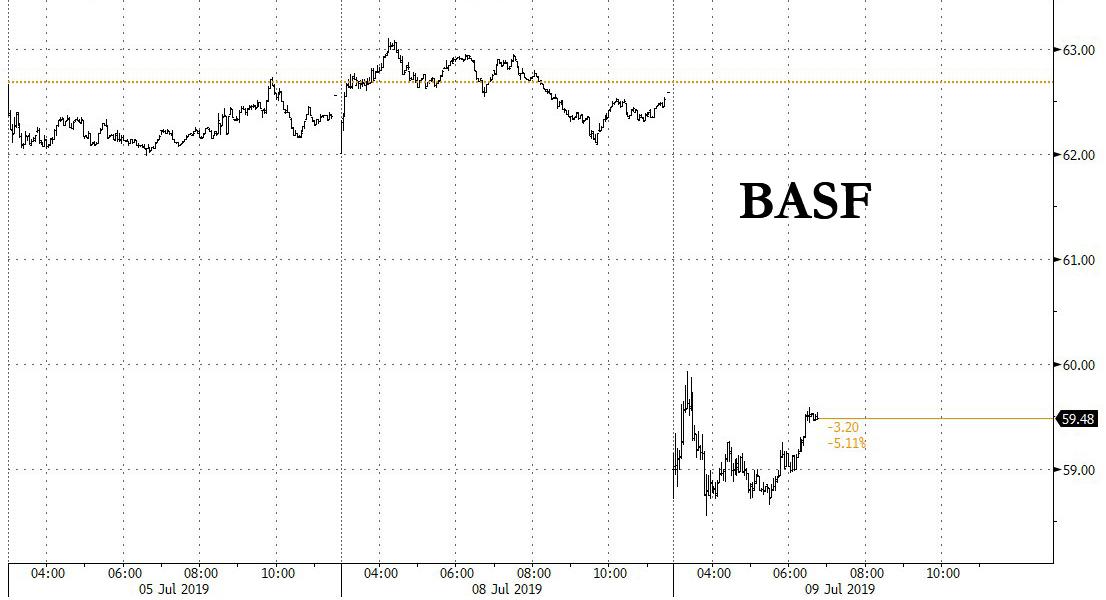

While European stocks avoided the global slump suffered by Asia and the US on Monday, on Tuesday they were not so lucky, and were at the forefront of the global selloff, with the Stoxx 600 dropping as much as 1%, dragged lower by banks – well, really just one particular German bank which crushed sentiment – and a shocking guidance cut by German chemical giant, BASF, which slashed its EBIT outlook by 60% below consensus.

With all major markets slumping, world stocks fell for a third straight day on Tuesday, as concerns that earnings season may be far worse than expected mingled with fears about the ongoing global trade war coupled with rising nerves that central banks may be less dovish than expected. The S&P emini future was down between 0.4% and 0.6%.

The session started on the back foot with MSCI’s index of Asia-Pacific shares outside Japan dropped 0.4%, declining for a third day led by material and industrial firms, but pared earlier losses, having traded at its lowest level since June 19. Markets in the region were mixed, as Chinese blue-chips ended down 0.3%, while Hong Kong’s Hang Seng fell 0.7%. Japan’s Nikkei was the only outlier as gains in a few heavyweights in the index helped it edge up 0.1%. Japan’s Topix gauge fell 0.2%, driven by Keyence, Sony and Shin-Etsu Chemical, as tensions between Japan and South Korea threatened to upset a global technology supply chain. The Kospi Index dropped 0.6%. The Shanghai Composite Index retreated 0.2%, with Bank of Communications and Kweichow Moutai among the biggest drags. Hong Kong leader Carrie Lam signaled withdrawal of a controversial legislation that would allow extraditions to China, bowing to weeks of mass protests; even so the Hang Seng Index declined 0.8% for a fifth day of losses. The S&P BSE Sensex Index fluctuated, as a quarterly earnings season started in India amid slower economic growth. The nation’s most valuable company, Tata Consultancy Services, fell as much as 3.9% ahead of results due today

Later in the session, European losses made up for some of Monday’s resilience with the Stoxx 600 Banks Index among Tuesday’s worst performers with a 1.2% drop, dragged down by Danske Bank’s profit forecast cut, UniCredit’s disposal of FinecoBank stake and continued concerns on Deutsche Bank’s overhaul: declines were led by Deutsche Bank -4.3%, Danske Bank -3.1%, and FinecoBank -2.7%.

With global macroeconomic clouds looming and critical policy signals due from Jerome Powell on Wednesday, the headlines and mood focused on three individual stocks… and they were not happy. Shares in BASF slumped almost 6% in Europe after the German chemicals giant issued what one trader described as a “shocking” profit warning, blaming a global slowdown and trade war between the United States and China.

The pain continued for Deutsche Bank, which tumbled as much as 5% after sliding 5.4% the previous day in a 10% intraday slide after it axed 18,000 staff – while Apple’s overnight drop of more than 2% after a broker downgrade dragged the tech sector lower.

Some blamed Morgan Stanley, which as we first reported on Sunday, turned the most underweight on US stocks on record: “Both from a bottom-up and top-down perspective, equity market valuations appear far too ambitious,” Morgan Stanley analysts wrote in a note. It was particularly stark, they said, as the U.S. business cycle was in a downturn and both forward-looking indicators like global PMIs and global trade are now in contraction territory.

“Indeed, companies have begun cutting their 2019 profit forecasts, citing the trade conflict as a reason.” Just look at BASF.

Elsewhere, Apple’s suppliers, such as Murata Manufacturing and Taiyo Yuden, fell 2% and 4%, however, after Rosenblatt Securities cited a “fundamental deterioration” for the U.S. gadget giant over the next 6-12 months. In Greater China, suppliers from Hon Hai to AAC Tech also lost between 1.4% and 3.1% and in Europe Infineon, ASM and STMicroelectronics slipped about 2%.

Meanwhile, in FX, the looming question remained the potential reaction to the weaker outlook from the world’s top central banks. A just as important question is what happens if the economy posts a sharp rebound, forcing banks to turn hawkish once again.

On Wednesday, Powell will answer some of the questions when the Fed chairman testifies before Congress; ahead of that, Mmney market futures are still fully pricing in a 25 bps cut at the Fed’s July 30-31 meeting, but have almost priced out a larger 50 bps move that had been seen as a real possibility a couple of weeks ago.

The dollar changed hands at 108.78 yen, having risen in the previous session to its highest in more than a month. The dollar index versus a basket of six major currencies was also a touch higher at 97.432, while the euro dropped as low as 1.1204, its weakest level since mid June.

And already the doves were startying to cry: “It would be pretty disruptive at this stage for Powell to rule out a cut in July or dampen expectations of a cut in July,” said Michael Metcalfe, head of global macro strategy at State Street Global Markets. “The last few Fed speakers, albeit non-voting speakers, have suggested July is not a done deal… and even now, if you look at economists’ forecasts, there is not a consensus that there will be a move, and yet the market is 100% priced.”

In commodities, oil prices were slightly softer as concerns about whether slowing global growth would hit demand eclipsed tensions over Iran’s nuclear program. Brent crude futures fell 0.2% to $64.01 a barrel. U.S. West Texas Intermediate crude futures shed 0.4% to $57.46. Gold prices also ticked lower, as the dollar scaled its multi-week highs. Spot gold was down 0.2% at $1,393.03 per ounce and U.S. gold futures fell 0.3% to $1,395.70 an ounce.

Looking at today’s calendar, expected data include NFIB Small Business Optimism Index. PepsiCo, Couche-Tard, Levi Strauss, and WD-40 are among companies reporting earnings

Market Snapshot

- S&P 500 futures down 0.4% to 2,965.25

- STOXX Europe 600 down 0.7% to 387.01

- MXAPJ down 0.5% to 519.66

- Nikkei up 0.1% to 21,565.15

- Topix down 0.2% to 1,574.89

- Hang Seng Index down 0.8% to 28,116.28

- Shanghai Composite down 0.2% to 2,928.23

- Sensex down 0.1% to 38,670.01

- Australia S&P/ASX 200 down 0.1% to 6,665.69

- Kospi down 0.6% to 2,052.03

- German 10Y yield rose 0.7 bps to -0.359%

- Euro down 0.1% to $1.1203

- Italian 10Y yield rose 3.8 bps to 1.429%

- Spanish 10Y yield rose 0.6 bps to 0.443%

- Brent futures up 0.4% to $64.37/bbl

- Gold spot down 0.5% to $1,388.04

- U.S. Dollar Index up 0.2% to 97.57

Top Overnight News from Bloomberg

- U.S. Commerce Department determined that China and Mexico are unfairly subsidizing exports of fabricated structural steel and said it would impose duties on imports

- Japan’s wages dropped for a fifth month, adding to concerns over the resilience of consumer spending as a sales tax increase approaches in October

- Japan will raise sales taxes as scheduled in October, barring a shock on the scale of the financial crisis that followed the collapse of Lehman Brothers, Finance Minister Taro Aso says

- Bipartisan Policy Center said there is a “significant risk” that the U.S. willbreach its debt limit in early September unless Congress acts. The group’s evaluation marked a revision from its previous forecast

- Oil fell as concern over the slowing global economy took precedence over geopolitical tensions

- The U.K. economy probably shrank for the first time since 2012 in 2Q, according to Bloomberg’s latest survey of economists. The prediction for a 0.1% contraction marks a downgrade from June, when economists only predicted stagnation. The survey came as retail industry reported another drop in sales and said “the picture is bleak”

- U.K. Conservatives working to prevent a chaotic Brexit have proposed legislation to stop the next prime minister suspending Parliament to force a no-deal break from the European Union

- Union chiefs on Monday said Labour’s policy must be to put any Brexit deal back to voters to approve — and that the party must oppose leaving the EU on any terms negotiated by the Conservative government

- More than half of U.K. businesses with non-British staff say they would be harmed by post-Brexit immigration plans, according to the British Chambers of Commerce and the global job site Indeed.

- The ECB will have plenty of newer notes to consider if it returns to the corporate-bond market as part of stimulus measures. Companies have issued about 108 billion euros ($121 billion) of ECB-eligible bonds this year. That has kept the overall ECB-eligible universe at just over 1 trillion euros, based on data compiled by Bloomberg

- Hong Kong Chief Executive Carrie Lam said controversial bill that would allow extraditions to China was “dead,” stopping short of saying she would withdraw the legislation after weeks of protests

- Airbus SE will ask airlines operating 25 of its older A380 planes to inspect their wings for possible cracks, a problem that’s arisen in the past on the double-decker aircraft

Asian equity markets were negative following the losses on Wall St where the majors suffered in a continued fallout from the tempered Fed rate cut expectations and cautiousness ahead of Fed Chair Powell’s testimony. ASX 200 (-0.1%) was once again led lower by gold miners and with financials pressured after APRA announced it will require Australia’s major banks to increase total capital by 3ppts of risk-weighted assets by beginning of 2024 which despite being more generous on the timeline than the initial proposal, is estimated to total an extra AUD 50bln of funds to be put aside by the banks. Nikkei 225 (+0.1%) initially bucked the trend as recent favourable currency moves kept the index afloat for most the session although eventually succumbed to the pressure in late trade. Hang Seng (-0.8%) and Shanghai Comp. (-0.2%) were lacklustre amid continued PBoC liquidity inaction and after less than constructive comments from China’s Vice Foreign Minister who warned of disastrous consequences if the US treats China as an enemy, while Geely Auto underperformed in Hong Kong after June sales volume slipped 29% Y/Y which prompted the automaker to cut its FY sales volume forecast by 10%. Finally, 10yr JGBs were flat with demand subdued as Japanese stocks remained afloat for most the session and amid mixed results at the 5yr JGB auction.

Top Asian News

- Wumart, Meicai Said to Be in Final Race for Metro’s China Unit

- Geely Profit Warning Seen as Bad Omen for Other China Carmakers

- AB InBev Asia IPO Poll Signals Pricing Below Midpoint: Bernstein

- Temasek Portfolio Value Rises as Unlisted Assets Outperform

Major European indices are in the red this morning, [Euro Stoxx 50 -0.7%] losses are largely led by the Dax (-1.3%) as BASF (-6.0%) and Deutsche Bank (-4.5%) weigh on the index due to a profit warning and in continuation from yesterday’s restructuring downside respectively. BASF are firmly in the red after the issuance of a profit warning where notably the Co. now expect Q2 EBIT before special items to print at EUR 1.0bln, which is 47% down on the prior readin; additionally, Co. have lowered their FY outlook and are planning approximately 6k job cuts by the end of 2021. BASF’s downside has led to the Stoxx Chemical sector (-2.1%) underperforming its peers as the Co. hold a 13.4% weighting in the index. Additionally, the likes of Lanxess (-4.0%), Evonik (-3.0%) and Covestro (-6.0%) are suffering in sympathy. Separately, Danske Bank (-4.0%) also issued a profit warning, where the Co. revised their FY19 outlook down and believe that the generally weak momentum is set to continue. At the other end of the Stoxx 600 are Ocado (+5.6%) as the Co. reported H1 revenue of GBP 874mln which is 10.5% above the prior, aiding the FTSE 100 (-0.2%) in outperforming its peers, albeit still in negative territory, with the bourse also receiving some respite from a softer Sterling this morning.

Top European News

- Monte Paschi Said to Seek Buyers for $336m of Property

- Ocado Eases Investors’ Fears After Blaze at Robotic Warehouse

- Orange CEO Richard Cleared in Trial Over $451m Payout

- Irish Said to Accept Need for Border Checks in No-Deal Brexit

In FX, the biggest, but not the only G10 loser by any means as the Usd extends its post-NFP gains across the board and the DXY breaches 97.500 to trade at fresh multi-week highs of 97.588. However, the Aussie has been hit independently by a deterioration in NAB business and ANZ consumer confidence that together overshadowed an uptick in the former’s gauge of conditions. Aud/Usd has fallen through 0.6950 and Aud/Jpy is down through the 200 HMA (75.64), while the Aud/NZD cross is breaking below 1.0500 again or testing bids/support at the psychological level even though the Kiwi is also retreating further vs its US counterpart and only just holding above 0.6600.

- GBP – No deal Brexit risk and the prospect if not distinct probability of more bleak UK data on Wednesday have piled further pressure on the Pound as Cable slides to a fresh 6 month low and through the 1.2481 base posted last Friday. 1.2450 may offer Sterling some reprieve, though in truth there is little in terms of technical levels until 2019 troughs seen in early January around 1.2435-39 ahead of big option barrier defences lying at 1.2400.

- CAD – The Loonie has declined through 1.3100 ahead of Canadian housing data and tomorrow’s BoC policy meeting, with little support derived from firm crude prices or the fact that Canada has been excluded from US tariffs on fabricated structural steel imposed on China and Mexico.

- EUR/JPY – Also weaker vs the Dollar as the single currency dips through 1.1200 and nearer short term support around 1.1180-70, while the Yen retreats closer to 109.00 and tests a major Fib just ahead of the big figure at 108.92 (38.2% retracement of the move from 112.40 to 106.78).

- EM – Broad weakness vs the Buck, but the Lira is outperforming or holding up better than regional peers in wake of its more pronounced declines on Monday due to CBRT personnel changes and investor angst over the loss of independence/credibility. Usd/Try sitting tight within a 5.7450-7230 range in contrast to Usd/Zar up above 14.2300 and Usd/Rub over 63.8800.

In commodities, WTI and Brent futures have been choppy this morning, with initial weakness seen in-line with this morning profit warning driven poor stock performance. However, the complex is now in positive territory and towards the top end of the day’s range following industry sources state that Russia’s July 1st-8th oil output fell by 3%; which provided a bullish catalyst for oil on an day of relatively light newsflow for the complex thus far. Looking ahead, we have the weekly API release are expectations are for a headline draw of around 2.5mln; in addition, the EIA release their Short Term Energy Outlook which this month contains their Expanded Forecast Discussion at 17:00 BST, with the API and OPEC reports to follow later on in the week. Gold (-0.7%) is subdued as the yellow metal failed to hold onto the USD 1400/oz mark overnight, and is now towards the session low of USD 1388/oz as the dollar continues to strengthen and extend on its post-NFP gains. Separately, Copper prices are moving towards their lowest level in around 3 weeks on the risk-averse tone and ahead of the week’s key risk events of Powell’s dual testimony.

US Event Calendar

- 6am: NFIB Small Business Optimism, 103.3, est. 103.1, prior 105

- 8:45am: Fed’s Powell gives opening remarks on stress tests

- 10am: JOLTS Job Openings, est. 7,473, prior 7,449

- 10:10am: Fed’s Bullard to Make Welcoming Comments in St. Louis

- 2pm: Fed’s Quarles speaks on stress tests in Boston

- 2:20pm: Fed’s Bostic Speaks at Washington University in St. Louis

DB’s Jim Reid concludes the overnight wrap

As I’m sure you all will have seen, Deutsche Bank has announced a major transformation of its business to refocus on its core strengths. In light of this, we just wanted to make sure that everyone was aware that DB Research will remain at the forefront of the firm. As well as FIC, Macro, QIS, Data Science, and Thematic research, DB is still committed to providing extensive and top-quality Company Research coverage in Europe and the US. DB will combine Equity Research and Research Sales into a newly formed Company Research and Advisory Group to strengthen ongoing connectivity with institutional clients. So if you are a consumer of any of our research and have any questions, please let us know and we can try to answer them.

Aside from that and trying to avoid the world’s media when going to lunch, it hasn’t been a big 24 hours for headlines with markets in the twilight zone between last Friday’s employment report and tomorrow’s testimony from Powell. That will be followed by the minutes of the Fed’s June policy meeting later tomorrow and the second day of Powell’s testimony on Thursday. Our US economics team has a nice preview of what to watch for at these various events available here . We’ll be looking out for his comments on several important topics which have evolved since the last FOMC meeting, namely the trade war de-escalation, the strong jobs report, and still-low inflation expectations.

Back to the quiet markets, where last night’s -0.48% decline for the S&P 500 came with volumes around 25% below average and with the move driven by a bit of weakness in the tech sector. Indeed the NASDAQ ended -0.78% while the semi-conductor index shed -0.77%. This was after markets in Europe were a bit more tempered with the STOXX 600 down a very modest-0.05%.

Overnight one of the key headlines has been the U.S. Commerce Department announcing that it would apply duties ranging from 30.3% to 177.43% on Chinese imports of fabricated structural steel and an up to 74.01% duty on those from Mexico as the department found that both the countries are unfairly subsidising the product. The ruling is preliminary in nature and a final determination on the finding is scheduled on or about November 19. Imports of fabricated structural steel from China and Mexico in 2018 were valued at an estimated $897.5mn and $622.4mn respectively. In the greater scheme of things this is relatively small but the optics are bigger given the tense stage of trade negotiations between the US and China. The Mexican peso is down -0.20% this morning while, the Chinese onshore yuan is trading unchanged at 6.8822. Meanwhile, the US State Department has approved a possible US arms sale to Taiwan for an estimated cost of about $2.2bn. The move is not likely to go down well with China at a delicate stage of trade negotiations.

This morning in Asia markets are largely heading lower following Wall Street’s lead with the Hang Seng (-0.80%), Shanghai Comp (-0.57%) and Kospi (-0.17%) all down. The Nikkei (-0.04%) is trading flattish after erasing earlier gains. Elsewhere, futures on the S&P 500 are down -0.40%.

In other news, Hong Kong Chief Executive Carrie Lam said that the controversial legislation that would allow extraditions to China was “dead,” however, she fell short of saying she would withdraw the bill after weeks of protests. Elsewhere, here in the UK, The Times has reported that Philip Hammond has told UK PM May that he would fund her legacy plans as a trade-off for her allowing Tory MPs free votes on efforts to stop a no-deal Brexit.

Getting back to markets, after the big moves in bond markets on Friday afternoon after the strong payrolls, Treasuries opened stronger but faded throughout the session to end the session a few basis points weaker. Ten-year yields eventually closed +1.6bps but are -1.3bps this morning to complete the round trip. Two-year yields underperformed, with yields up +2.9bps to their highest level in a month, sending the 2s10s curve -0.9bps flatter at 15.9bps. That actually means that the curve is now back to being the flattest since the end of May which is a little concerning. However, for now we’re just back to the bottom of the January-to-May range before we steepened up over the last c.6 weeks. As for Fed pricing, there’s still 24.5bps of cuts priced in for the FOMC meeting at the end of this month down from low 30bps before payrolls. A 50bps cut is now clearly being priced out.

The highlight in bond markets in Europe yesterday was Greece where 10y yields rallied as much as -13.4bps to 2.013% post the election result from the weekend, before moderating during the afternoon to end the session -5.1bps lower at 2.096%. That briefly brought 10y Greek yields to below 10y Treasuries for the first time since 2007, though they ended the session +4.7bps above the US benchmark. As for the rest of Europe, Bunds closed a touch lower at -0.366% while BTPs were +4.0bps higher in yield at 1.785% with most of the move coming at the end of the day following the announcement that Italy is looking to tap a 50y bond. This is a good time to highlight a note from Michal Jezek in my team which looked at negative yields in the EUR corporate bond market amongst other things. A couple of stats from the note stand out. One is that, based on where the Austria 100y bond is priced, Michal thinks Germany would likely be able to issue a 100y bond with a nominal yield around 0.7%. For my eyes, that’s getting close to a zero percent perpetual! Another is that one-third of EUR IG and a third of 1-2y EUR BBs now yield less than zero. See the full note for a lot more here .

In EM, the main talking point was Turkish assets where the Lira slid -1.87%, local 10y yields rose +74.5bps and Turkish equities fell -0.94% (although it did pare heavier losses) following the news we discussed yesterday morning that President Erdogan has dismissed central bank governor Cetinkaya over the weekend. To be fair the fallout in EM was contained only really to Turkey, with a basket of EM FX just -0.16% weaker and the MSCI EM equity index finishing -0.61%.

In other news, the ECB’s Coeure yesterday ruled himself out of the running for the top role at the IMF having been mooted as a potential successor to Lagarde. As for ECB policy, and the outlook in Europe itself, Coeure highlighted the slowdown in global activity and “significant” global risks which he therefore suggested “need an accommodative monetary policy more than ever” and that the ECB is “ready to react if new negative downside risks materialize”.

Finally, as for the data yesterday which didn’t really move the dial at all, German industrial production in May rose a little bit less than expected (+0.3% mom vs. +0.4% expected) while the May trade data revealed that exports rose +1.1% mom (vs. +0.9% expected) and imports surprisingly declined -0.5% mom (vs. +0.3% expected). Elsewhere, the sentix investor confidence reading for the Euro Area in July fell to -5.8 from -3.3 in June. That compares to expectations for a rise to +0.1, taking this month’s reading to its lowest since November 2014. In the US, the May consumer credit reading revealed a $17.1bn expansion in lending, roughly matching the recent trend, which has been healthily above the average of around $11bn. Separately, the NY Fed released its latest monthly survey of consumer inflation expectations. At the three-year horizon, they ticked up to 2.66% for June from a two-year low of 2.59%.

To the day ahead now which is a very quiet one for data with nothing of note in Europe and only the June NFIB small business optimism reading and May JOLTS report due in the US. It’s a busier day for Fedspeak with Powell due to make opening remarks at a conference on stress testing at which Quarles is also due to speak later. Meanwhile Bullard and Bostic are also due to speak separately while over at the ECB we’re due to hear from Visco, Villeroy and Lane at various stages.

via ZeroHedge News https://ift.tt/32i50Fp Tyler Durden