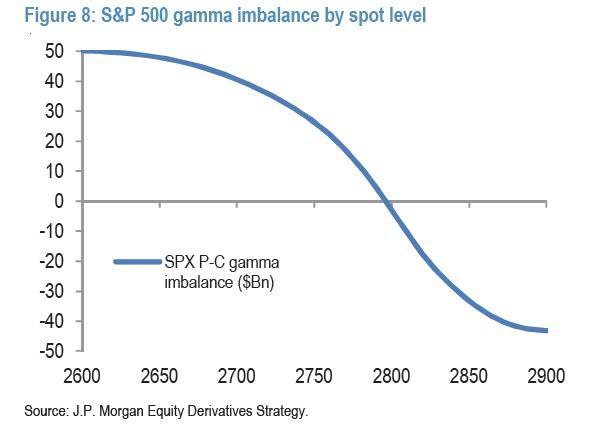

We first warned about “gamma gravity” in March as US equity markets seemed stuck in a constant, daily meltup ahead of the March option expiration “quad witch”, even as flows showed investors were consistently dumping shares.

Specifically, it was the “extreme” dealer gamma that was providing support for the S&P, because the higher the market rose, the more risk dealers had to buy to hedge positions.

And crucially, as we pointed out at the time, if gamma is no longer a factor in the market’s upside – as the weakness of the last few days might suggest – that means gamma gravity will be a factor in the downside.

And now, The Wall Street Journal has caught on, pointing out that investors have noticed a force some call a “gamma trap.”

The exposure comes from brokers and investment banks who sell investment strategies to their clients and then have to hedge their positions by trading in stocks and futures. It has become increasingly apparent that this trading by banks and brokers often goes against the markets, which suppresses daily movement of stocks and indexes.

When gamma is positive, options quickly get more valuable when the price of the related shares rise. The bank taking the opposite position to the investor then sells those shares. That damps volatility. When gamma is negative, it is the other way around, and banks buy shares when prices are rising and sell when they are falling.

“Dealers being long gamma is like a black-hole effect, a negative feedback loop that squishes volatility,” says Kokou Agbo-Bloua, global head of flow strategy and solution at Société Générale .

He calls the long stretches of low volatility a “gamma trap.”

Charlie McElligott, cross-asset strategist at Nomura in New York, publishes daily commentary on how he thinks dealers are positioned, based on Cboe and internal Nomura flow data, to identify where dealers’ hedging will start to exacerbate market moves.

“If you have a good estimate of dealers’ gamma exposure, you can anticipate their hedging flows and pile into that either way,” says Mr. McElligott.

The force is a byproduct of big investors embracing so-called low-vol investment strategies that promise income and smooth out gains and losses through the use of options markets.

Benn Eiffert of QVR Advisors, a specialist volatility trading fund, says his estimates for gamma positioning – which use data from the Cboe Global Market Inc.’s options platform – explain “this jumping back and forth between markets that are completely dead and markets that are suddenly and briefly very exciting,” he says.

But perhaps most worrisome is the echoes of 1987 we see and hear every day as “low vol” strategy investing (often selling put options with a life of one month or less with the effect of increasing gamma in the market) becomes more and more popular, just as “portfolio insurance” did 32 years ago…

Both creating a similar ‘gamma gravity trap’ making the market considerably more vulnerable to dramatic downside collapse (and upside meltups) than many believe. In fact, the gamma trap is making it harder to tell whether news or events are properly reflected in market prices, according to Helen Thomas, founder of U.K.-based research firm, Blonde Money.

“Dealer hedging behavior is creating pockets of sensitivity in the markets,” she says.

“If Trump tweets something about China when the S&P is at one level, it doesn’t matter. But if he does it when it’s, say, 20 points lower, it’s panic stations.”

“Panic stations” indeed… but 1987 could never happen again, right?

via ZeroHedge News https://ift.tt/2YL9vWW Tyler Durden