Just hours ago, we reported that passenger vehicle sales in China showed their first tepid signs of recovery after a historic and record-breaking plunge in the country over the last two years. In that article, we pointed out that the “recovery” was only due to dealers looking to blowout inventory – at massive discounts up to 50% – to prepare for new emission standards that start on July 1.

We concluded by questioning whether or not the relief would be short lived. We stated:

To say the least, it should be interesting to see how sales numbers respond for the month of July.

Now, it looks as though we are already starting to get an idea – and it also looks as though the “recovery” may already be over.

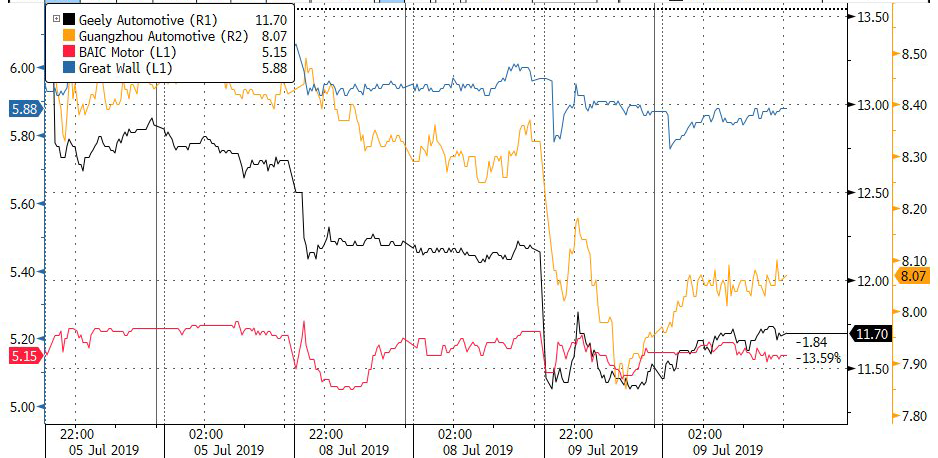

China-based auto stocks in Hong Kong dropped overnight after Geely issued a profit warning and other investors are worried about China based manufacturers preparing to issue similar warnings.

Geely said that its first half 2019 net profit likely fell by 40% and it cut its 2019 sales target. The stock was the worst performer on Hong Kong’s Hang Seng index last year.

In response, Guangzhou Automobile also fell as much as 5.8% and Dongfeng Motor dropped as much as 3%. Great Wall Motor was down as much as 4.2% at one point and BAIC Motor fell 2.7%.

Recall, Jefferies said in a note Monday morning that the country’s planned stimulus for the auto industry could help along cities and provinces whose economies are heavily reliant on the auto industry.

For instance, as a result of planned subsidies, residents in places like Hunan’s capital Changsha who buy a locally produced car could get as much as 20,000 yuan in subsidies, analyst Patrick Yuan said. SAIC-VW, GAC-Mitsubishi, GAC-FCA, and BYD all have plants in Changsha. The city’s sales represent about 1.2% of China’s total market.

via ZeroHedge News https://ift.tt/30qLzc4 Tyler Durden