Despite an avalanche of monetary and fiscal easing, record-breaking credit injections, and the media’s insistence that a trade war will cause inflation carnage, China’s producer prices were unchanged year-over-year in June – the weakest since August 2016.

Producer Goods (-0.3%) and Raw Materials (-2.1%) were the biggest deflationary drivers of PPI’s weakness.

At the same time, China consumer prices rose 2.7% YoY (as expected), hovering near its highest since Feb 2018. Food

As Bloomberg notes, the deceleration brings back fears of a return of deflation which would erode companies’ profit and their ability to repay debt. In the longer term, lower factory prices in China could put pressure on global inflation outlook via exports.

Going forward, “a rising base effect will likely help bring down headline CPI, barring sudden surges in food prices; and PPI may be capped due to a rising base and overall lackluster demand,” Eva Yi, economist at China International Capital Corp. wrote in a note.

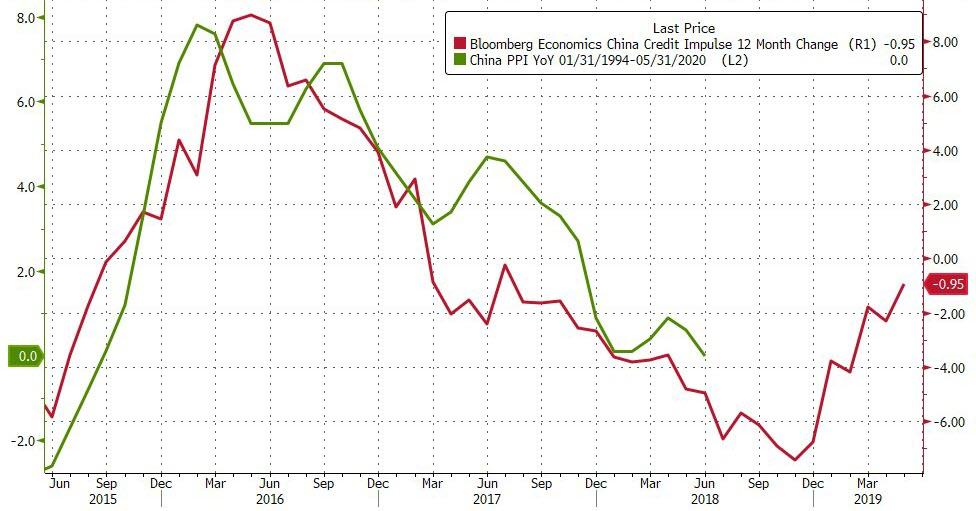

However, given the relationship with China’s lagged credit impulse, we suspect deflation will threaten China for at least the next six months, before taking off…

via ZeroHedge News https://ift.tt/2xC50lG Tyler Durden