Authored by Sven Henrich via NorthmanTrader.com,

As outlined this weekend put call ratios are fairly low and benign going into this week’s Fed meeting. No worries.

Investor positioning? All in long it appears.

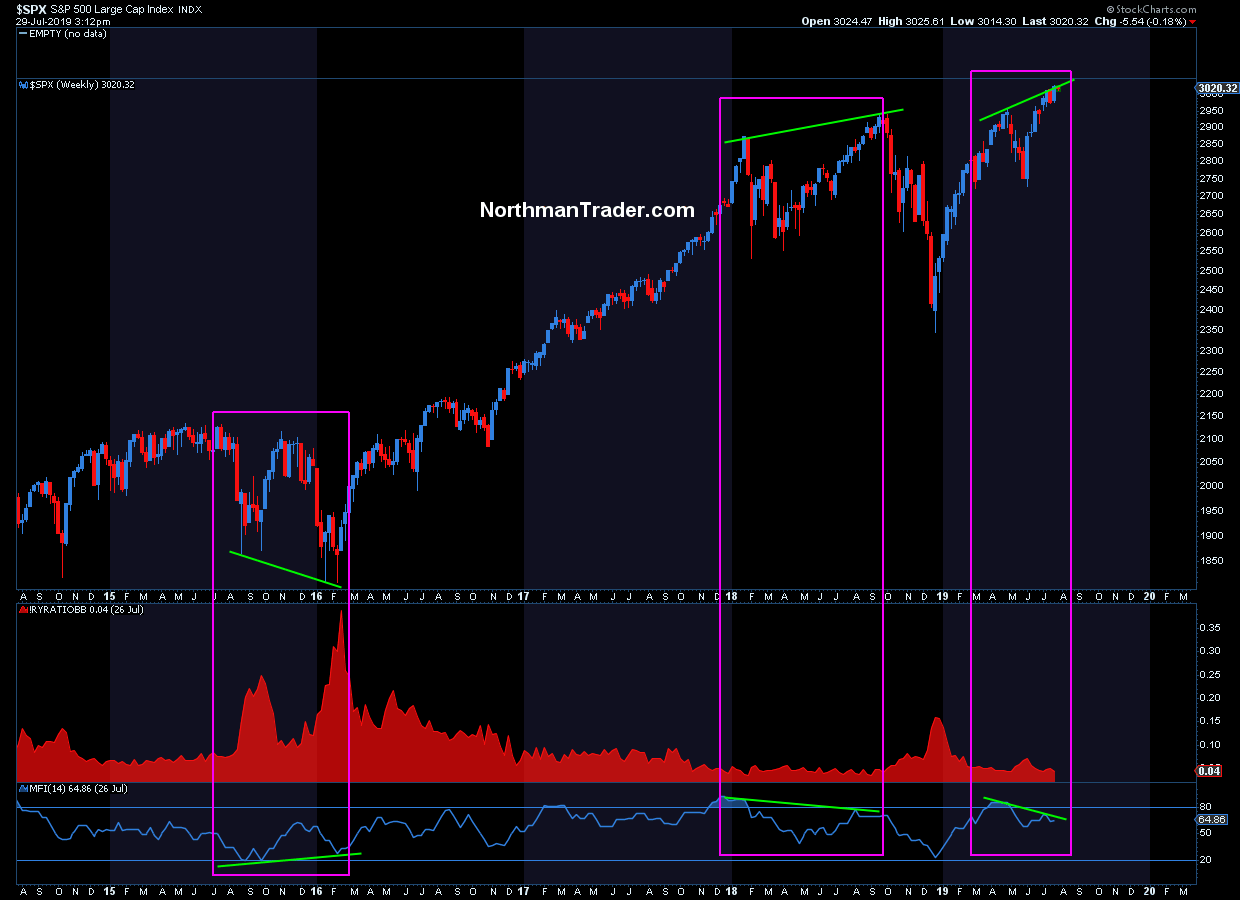

One indicator combination of interest, RYDEX account positioning as well as money flows. During times of market stress we can observe shifts to more bearish positioning and the RYDEX ratio moves higher, this last observed in larger size in 2015/2016. But the times of stress or fear are apparently over. Even last December’s 20% drubbing produced a much lesser spike during a big correction than ever before.

Indeed December’s 20% drop produced barely a blip. The reason? One can only speculate of course, but I suspect the massive switch to passive investing has a lot to do with it. Corrections don’t last anymore, that is been the investor lesson over the past 10 years. There is no reason to fear any longer.

Central banks always step in and after a few days the correction low is made. And investors have been right to take on that attitude. So far.

Indeed we saw the government step in with liquidity calls during Christmas and the Fed switching policy leading to the expected rate cut this week. The end result: A 0.04 ratio on RYDEX, indicating fully long account positioning.

But note that MFI (Money flow index) in the lower part of the chart. It shows a negative divergence. In early 2016 is showed a positive divergence on the new $SPX lows which firmed a major bottom. In October 2018 money flow showed a negative divergence on new highs, now another negative divergence. These divergences appear to be solid signals when the RYDEX ratio is at extremes. Last fall RYDEX also showed fully long positioning ahead of the 20% correction. What”s more extreme than 0.04? 0.03? 0? Everybody all in? Everybody all owning the same few stocks via index funds and ETFs. Nobody ever selling because markets are risk free?

That’s called intelligent investing these days:

Defined as intelligent investing:

Dollar cost average passively into index funds tracking a shrinking investable universe of stocks not knowing what you actually own or are exposed to, where everybody owns the same things but nobody ever sells cause the Fed will keep it all safe.— Sven Henrich (@NorthmanTrader) July 29, 2019

What happens if everybody long suddenly wants to sell for whatever reason? One has to wonder.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2MqxLKz Tyler Durden