The overnight session was largely a repeat of Monday, if somewhat less extreme.

Just like yesterday, the overnight mood was lifted early, after the PBOC fixed the yuan weaker for the 9th consecutive session, however at 7.0326, it was once again stronger than the 7.0421 consensus expected, helping push US futures higher. But this time the optimism from China’s tentative olive branch was short-lived, and it didn’t take lone before a bearish tide swept across markets, as first Asian stocks slumped, then European shares fell…

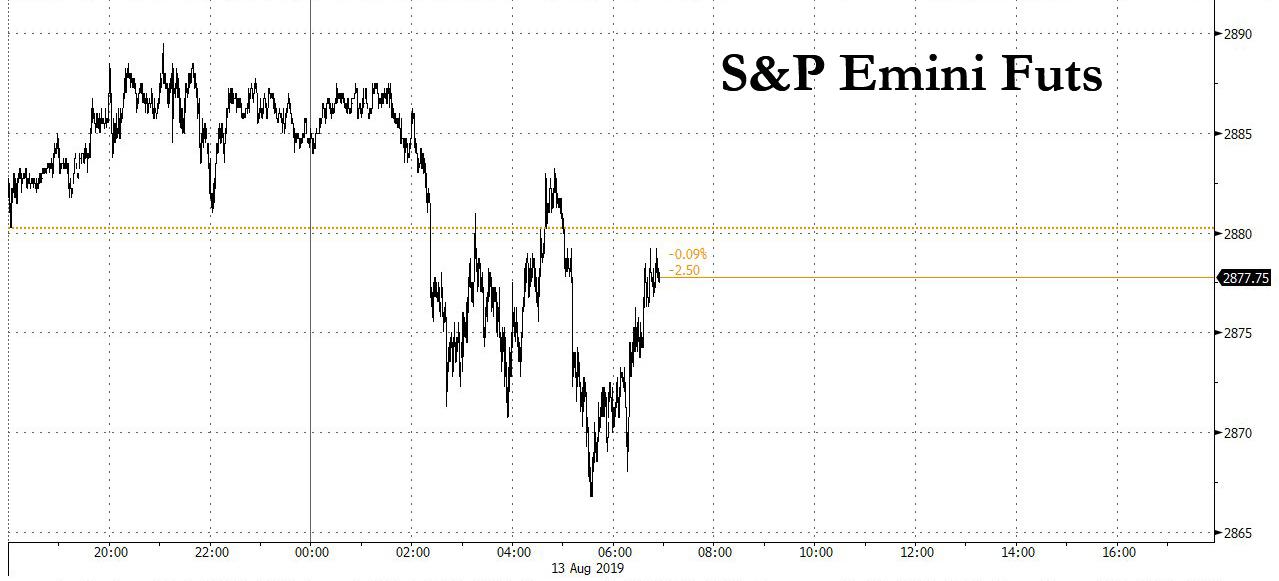

… and US equity futures erased all gains…

… as turmoil in Hong Kong – which canceled all departing flights for a 2nd day – and total chaos in Argentina spooked investors already on edge over the trade war.

The weeks-long protests in Hong Kong began in opposition to a bill allowing extraditions to mainland China but have quickly morphed into the biggest challenge to China’s authority over the city since it took Hong Kong back from Britain in 1997. A state of “panic and chaos” now exists, the city’s embattled leader Carrie Lam said on Tuesday, defying fresh calls to quit. As she spoke, the Hang Seng index hit a seven-month low. By the close, it had dropped 2.1%, dragging down markets across Asia and taking its losses past 6% since the protests began in June.

As a result, global markets dropped for a third straight day on Tuesday as investors huddled in bonds, gold, and the Japanese yen for safety. While Hong Kong’s airport, the world’s busiest cargo hub, reopened briefly after protests closed it the previous day, renewed protests resulted in reports that all departing flights had been canceled for a second day even as Chinese forces were massing across the border with China in Shenzhen.

European stocks dropped as much as 0.6% in early trading after heavy drops in China, Hong Kong, Japan and other parts of Asia left MSCI’s main 47-country world index down nearly 4% for August so far. With bond yields slumping to unprecedented negative levels, the Stoxx 600 Bank Index falls 0.9%, the worst performer on Tuesday’s European sector leaderboard, and headed for a sixth consecutive week of declines. The decline was led by banks more exposed to low rates, such as Germany’s Commerzbank falling -2.1%, as well as Italian lenders as the political uncertainty in the country drags on. Banking stocks are down 11% this year, making them the worst- performing sector against Stoxx 600 Index’s 9.3% gain.

Earlier in the session, Asian stocks tumbled, with MSCI’s index of Asia-Pacific shares skidding 1.2% as Chinese stocks and the Nikkei in Tokyo both fell around 1%, led by technology and financial firms. Almost all markets in the region were down, with Hong Kong and Thailand leading declines. The Topix retreated 1.2%, erasing its 2019 gains, after the yen climbed to the strongest level since March 2018. The Shanghai Composite Index fell 0.6%, with large insurers and banks weighing on the Chinese benchmark. The Hang Seng Index dropped 2.1%, as the Hong Kong airport continued to suffer flight cancellations in the wake of a mass protest. India’s Sensex slipped 0.8%, dragged by HDFC Bank and Housing Development Finance. Shares in Reliance Industries Ltd. surged as much as 12% after billionaire Mukesh Ambani revealed a plan to slash debt

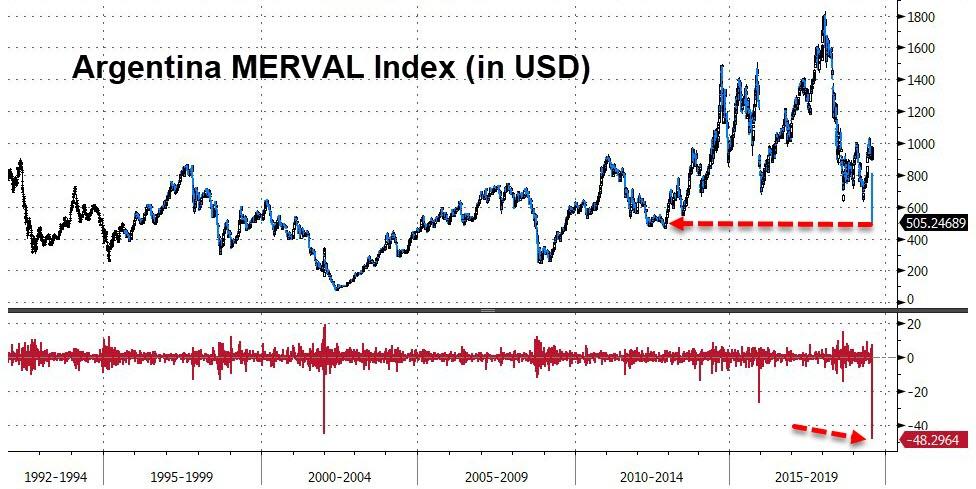

Investors also remained on edge over the damage caused by Monday’s crash in Argentina – the 2nd biggest one day market crash in history which saw about 50% of the local stock market value wiped out in one session – after its President Mauricio Macri became the latest pro-free market, pro-reform leader to be given a beating at the polls by a populist rival.

The response was brutal. The peso collapsed 15%, equities crumbled 48% in dollar terms and the bond market crashed, with a 100-year bond that investors had recently gobbled up tumbling 20% as fears of yet another government default spiked.

“Yes, Argentina is a small economy. However, the last thing global markets want to see is another market-friendly government fall to populism and/or geopolitics,” said Rabobank strategist Michael Every. He added the “wall of worry” also now includes: the trade war, Brexit, China, Hong Kong, Iran, Italy, Kashmir, North Korea, South China Sea, Turkey, and Venezuela. “Did I miss anything with tired eyes?”

With investors fleeing risk assets – which Morgan Stanley now sees in a bear market, one which will only get worse – investors parked in traditional safe havens such as the 10-year German government bond, whose yields hit a new record low, even as the German economy appears to have passed right through recession and is fast approaching depression levels, with the ZEW Economic Sentiment crashing from -24.5 to -44.1, shattering expectations of only a -28.5 print.

Across the Atlantic, US Treasury yields dropped to the lowest level in almost three years, gold was pinned close to six-year highs and the yen was within a whisker of a seven-month peak versus the dollar. Quoted by Reuters, ING analysts said the yen was benefiting “from the best of both worlds”, pointing to general risk aversion and a rush to price in more interest rate cuts by the Federal Reserve.

The dive for safety pushed gold up another 0.5% to $1.523 per ounce and its latest six-year high. Oil prices meanwhile held their ground as expectations that major producers will continue to reduce supplies balanced out worries about sluggish economic growth. Brent inched up to $58.74 while U.S. West Texas Intermediate futures were flat at $54.81 a barrel. It comes too with Saudi Arabia repushing plans to float its national oil company Saudi Aramco in what could be the world’s largest initial public offering (IPO).

“With Saudi Aramco reportedly eyeing an IPO once again, there is some support to the idea that Saudi Arabia has a heightened interest in strong crude prices and will cut its own output accordingly,” Vienna-based consultancy JBC Energy said.

Today’s economic data include July CPI figures, small business optimism

Market Snapshot

- S&P 500 futures down 0.1% to 2,877.25

- STOXX Europe 600 down 0.4% to 369.12

- MXAP down 1.2% to 150.37

- MXAPJ down 1.3% to 482.67

- Nikkei down 1.1% to 20,455.44

- Topix down 1.2% to 1,486.57

- Hang Seng Index down 2.1% to 25,281.30

- Shanghai Composite down 0.6% to 2,797.26

- Sensex down 0.9% to 37,243.13

- Australia S&P/ASX 200 down 0.3% to 6,568.54

- Kospi down 0.9% to 1,925.83

- German 10Y yield fell 2.0 bps to -0.612%

- Euro down 0.2% to $1.1189

- Brent Futures down 0.05% to $58.54/bbl

- Italian 10Y yield fell 10.1 bps to 1.348%

- Spanish 10Y yield fell 0.7 bps to 0.223%

- Gold spot up 0.9% to $1,524.86

- U.S. Dollar Index up 0.2% to 97.57

Top Overnight News from Bloomberg

- In the wake of President Mauricio Macri’s stunning rout in primary elections over the weekend, investors dumped its stocks, bonds and currency en masse in a selloff that left much of Wall Street wondering whether the crisis-prone country was headed for yet another default

- Deputy Premier Matteo Salvini will likely have to wait a week to move ahead with his power grab in Italy. Senate leaders on Monday failed to agree on a date for the confidence vote that could bring down the curtains on the country’s populist coalition, pushing back a decision until Tuesday. The full upper chamber will set a date at a session beginning at 6 p.m. in Rome

- The U.K. government doesn’t expect the European Union to shift its Brexit position for at least a month while it waits to see how British politicians opposed to leaving the bloc play their hand in Parliament, according to a person familiar with the matter

- The rate on 30-year Treasury bonds approached an all-time low and a closely monitored section of the U.S. yield curve hurtled closer to inversion as investors sought shelter amid a fraught geopolitical backdrop. China 10- year sovereign yield falls to 3% first time since 2016

- Australia’s back-to-back interest-rate cuts are flowing through the financial system and into the economy, while the falling currency should provide a similar stimulus to sustained declines of previous years, Christopher Kent, RBA assistant governor for financial markets said

- Oil holds steady after Saudi Aramco’s first-half earnings contained no surprises for the market, while sentiment remained cautious amid ongoing trade tensions between the U.S. and China and deepening unrest in Hong Kong

Asian equity markets followed suit from the losses on Wall St with global risk sentiment sapped by the continued overhang from the US-China trade war and after the disruption in Hong Kong where there are growing fears of Chinese intervention. ASX 200 (-0.3%) was subdued but with losses stemmed by strength in tech and mining related sectors, while Nikkei 225 (-1.1%) was among the underperformers as participants returned from the extended weekend and reacted to recent flows to the currency. Chinese markets also traded lower after Chinese Lending/Financing data disappointed and with heavy losses in Hong Kong after its airport was shut by a mass sit-in and although flights have since resumed, hundreds remained cancelled as they try to deal with the back log from the disruption. Furthermore, increased concerns China may intervene as the People’s Armed Police were reportedly gathering and heading towards the bordering city of Shenzhen, has added to the pressure for the Hang Seng (-2.1%) which declined to its weakest since early January, while losses in the Shanghai Comp. (-0.6%) were somewhat cushioned after the PBoC set a firmer than expected reference rate and continued its liquidity injections. Singapore’s STI (-0.9%) suffered from a double-whammy in which Q2 GDP missed estimates and the MAS dashed easing hopes by not considering an off-cycle policy meeting. Finally, 10yr JGBs were marginally higher and the 30yr yield dropped to 0.2% for the first time in 3 years amid the risk averse tone and following the bull flattening in the US, although upside was capped amid lack of BoJ presence in the market and given that prices were already at record levels.

Top Asian News

- Duterte Seen by Public as ‘Selling Out’ to China, Deputy Says

- Hedge Fund Warns of ‘Distressed Cycle’ as Trade War Deepens

- More Rain Seen in Flood-Ravaged Indian States; At Least 124 Dead

- Car Sales in India Drop Most in Two Decades as Slowdown Deepens

European stocks are lower across the board [Eurostoxx 50 -0.70%] following on from a downbeat Asia-Pac handover as global risk sentiment continues to be pressured by the US-China trade overhang and amid growing fears surrounding the violent Hong Kong protests and fears of intervention. Germany’s DAX (-0.9%) underperforms and hit levels last seen at the end of March after falling below a key tech level at 11600 (which was the reversal level during the May rout) with the aid of dismal German ZEW survey data and ahead of German GDP figures tomorrow. Sectors are mostly lower, with some resilience in defensive sectors as investors flock to “safe stocks”, whilst the energy sector outperforms amid the oil sector’s earlier gains, albeit this initial upside has since been retraced. In terms of individual movers, Henkel (-7.0%) rest at the foot of the Stoxx 600 amid a profit warning whilst it also noted that it does not envisage a H2 auto market recovery. Meanwhile, Rolls-Royce (-3.2%) shares continued to fall with today’s downside induced by a Moody’s downgrade to Baa1 from A3.

Top European News

- Scout24 Mulls Auto Unit Options After Elliott’s Breakup Call

- Swiss Franc Touches Strongest Level Since June 2017

- Iran Expects Tanker Held by U.K. to Be Released Soon, Fars Says

In FX, the Dollar remains divergent against G10 currency counterparts, but firm vs EMs as sentiment continues to favour safe-havens amidst ongoing unrest in Hong Kong and other parts of the globe, plus the US-China/EU etc trade conflicts. Hence, the DXY is still anchored around 97.500 and the index taking cues from moves in major basket constituents, like the Euro and Yen ahead of US CPI data.

- EUR/GBP – The single currency and Sterling are both holding relatively steady vs the Greenback and thus each other, with Eur/Usd back above 1.1200 despite more dire Eurozone survey news in the shape of the latest ZEW findings for Germany and the bloc as a whole. The Euro is benefiting from its status as a refuge when risk aversion is high, if not rife, but 1.1220 Fib resistance may yet cap the upside having been respected on multiple tests recently. Conversely, the Pound has not really been able to sustain gains/momentum on the back of firmer than forecast UK pay metrics as Cable labours ahead of 1.2100 on persistent no deal Brexit jitters.

- AUD/NZD/CAD – Some respite for the Aussie via an uptick in NAB business sentiment overnight and comments from RBA Assistant Governor Kent playing down the prospect of NIRP, as Aud/Usd pares losses from a test of key support towards 0.6770, but the Kiwi appears more vulnerable after relative outperformance or rather resilience yesterday with Nzd/Usd hovering around 0.6450 and Aud/Nzd just under 1.0500. In contrast, the Loonie is lagging either side of 1.3250 after last Friday’s disappointing Canadian jobs update and soft crude prices.

- JPY/CHF – The Yen looks ripe for another attempt to breach 105.00 vs the Usd where more hefty option expiries reside and psychological bids/support are propping the headline pair in front of the 104.87 flash crash low, but the Franc has crossed 0.9700 against the Buck and approaching 1.0850 vs the Euro awaiting more Italian political developments alongside any response from the SNB to signs that the Chf is getting too strong.

- EM – More broad losses across the region, and the Lira seemingly suffering from a lack of local participation as Turkey observe EID on top of increasingly bearish technical as Usd/Try has broken above the 200 DMA to expose the next significant upside chart level circa 5.6300.

In commodities, marginal losses in the oil complex with WTI and Brent futures choppy, with the former back below 55/bbl (after having visited the level earlier in the session) whilst the latter fell to around 58.50/bbl. News flow for the complex has again been light and the benchmarks seem to be moving off of sentiment/technical factors, with RBC yesterday highlighting that there is limited scope for short covering rallies due to positioning, i.e. speculators seem to have been unwinding long position rather than opening shorts. Nevertheless, participants will be on the lookout for geopolitical/trade developments, whilst Hong Kong also remains on the radar and whether China will intervene amid the rise in violent protests, which is likely to hit sentiment again, especially if US reacts with sanctions/tariffs. Looking at today’s docket, traders will await the weekly API crude data, expected to print a draw of 2.3mln barrels. ING notes that the narrowing of the WTI/Brent Arb (currently 3.6/bbl) could point to another weak of low exports as shown by the prior week’s EIA data. Elsewhere, gold remains on an upward trajectory amid safe-haven demand, with the yellow metal at a fresh 6yr high of 1526.7/oz. Meanwhile, copper is relatively flat on the day. Elsewhere, Dalian iron ore traded in a tight range whilst steel futures rose as much as 3.0% as the pollution curb on steel mills dampens iron ore demand but also disrupts steel supply. GS sees a rebound in iron ore prices as “2019 is on track to post the seaborne market’s first deficit in seven years”, and they see a deficit through 2020. Finally, Indonesia’s Minister noted that revisions to mineral ore export rules are currently being drafted. Indonesia initially planned to ban exporting nickel ore by 2022, in an attempt to build up its manufacturing base by using its raw resources but previously noted that bringing the deadline forward from 2022 will disrupt USD 4bln ore exports.

US Event Calendar

- 6am: NFIB Small Business Optimism, est. 104, prior 103.3

- 8:30am: US CPI MoM, est. 0.3%, prior 0.1%; CPI Ex Food and Energy MoM, est. 0.2%, prior 0.3%

- 8:30am: US CPI YoY, est. 1.7%, prior 1.6%; CPI Ex Food and Energy YoY, est. 2.1%, prior 2.1%

- 8:30am: Real Avg Hourly Earning YoY, prior 1.5%; Real Avg Weekly Earnings YoY, prior 1.16%

DB’s Craig Nicol concludes the overnight wrap

It may be a new week but markets have still been dealing with the all too familiar feeling of risk-off over the last 24 hours.In fairness, there wasn’t actually a great deal of newsflow for markets to get behind yesterday, but poor data from China, signs of further trade war escalation, and additional geopolitical risks – namely Hong Kong and Argentina – all combined to weigh on risk assets and drive another big move lower in rates. The S&P 500 and NASDAQ retreated -1.22% and -1.20% respectively, while the STOXX 600 fell -0.31%. HY credit spreads were also +9.2bps and +0.7bps wider in the US and Europe, respectively.

The real action was in US rates though, where 10-year treasury yields rallied -9.9bps to 1.646% and to within 30bps of their all-time lows from 2016. The move in the 30-year was even more extreme, dropping -12.7bps to 2.133% and to within 3bps of its all-time low. Front-end rates fell as well, with 2-year treasuries down -6.3bps and fed funds futures back to pricing in 67bps of cuts through year end. That understandably weighed on financials, which led losses in both Europe and the US, where indexes of bank shares fell -2.17% and -2.12%, respectively. As for the yield curve, the 2y10y metric flattened another -3.6bps to a fresh cycle low of 5.8bps. Our economists noted that the signal from the 2y10y is now much closer to signals from other yield curves measures which have already inverted: it implies a roughly 40% chance of recession over the next 12 months.

The China credit data from yesterday was the main source of pessimism, with new loans rising by 1.06 trillion yuan. That was well below consensus estimates for a 1.28 trillion print. The year-on-year growth rate for M2 fell to 8.1% (versus expected 8.4%), near its all-time low of 8.0%, and M1 grew only 3.1% (versus expected 4.4%). Credit growth is viewed as a key leading variable for the broader Chinese economy, so the slowdown heightened concerns over global growth. As for the trade war, there was some attention paid to a comment from Global Times Editor Hu Xijin that China’s People’s Daily istoday expecting to publish an article “vowing China can defeat any challenge and pressure the US”.

Those factors combined are weighing on Asian markets overnight with the Nikkei (-1.25%), Shanghai Comp (-0.74%) and Kospi (-0.70%) all lower. The Hang Seng (-1.86%) is leading the declines again though as protests continue and markets react to the city’s airport being brought to a standstill yesterday. In fact, the Hang Seng has now fallen into negative territory for the year – one of the few equity markets to have done so. As for FX, the US dollar is trading strong this morning (+0.22%) while the Chinese yuan is trading at 7.0634 (-0.10%). Elsewhere, futures on the S&P 500 are up +0.15% while spot gold prices are trading at $1516/oz (+0.34%) and 10yr JGB yields are down -1bp to -0.237%. Treasuries are also trading flat following the big rally yesterday.

Back to those political developments, where the biggest price action was reserved for Argentina where the peso sold-off -16.96% and to a record low of 53.0 versus the dollar following the weekend election result which saw the populist opposition candidate surprisingly beat President Macri in a landslide in the primary election. In fact, Argentinian assets were hit across the board. The benchmark stock index sank -37.93% – the biggest drop since 1990, while the country’s 100y bond dropped -18.6pts to 56.3. Slightly contrasting fortunes to where Austria’s 100y bond currently trades. Indeed, shorting the former while buying the latter would’ve doubled your money this year. Though of course we still have another 98 years before either bond matures for things to change. The contagion from Argentina into other EM assets was fairly limited in absolute terms however EM equities and FX did still fall -1.24% and -0.38%. In FX the biggest decliners outside of Argentina were currencies in Brazil (-1.03%), Uruguay (-1.41%) and Colombia (-0.91%).

Moving on. While it may have been quiet for data yesterday the good news is that it will pick up today with the July CPI report in the US this afternoon likely the highlight. A reminder that the consensus expects a +0.2% mom reading for the core although you shouldn’t expect anything less given that the last 45 monthly core CPI consensus prints have been for +0.2% mom. You have to go back to September 2015 to find the last time it wasn’t. Anyway, our US economists are below market at +0.13% mom essentially due to them expecting a partial unwind of June’s outperformance. However given that the market is already very dovishly priced for the Fed, it will likely take a lot for the market to become more aggressive on pricing in cuts.

Just wrapping up the other market moves yesterday, Italian assets recovered a bit as stories swirled that the Five Star Movement and Democratic Party are discussing a possible coalition to prevent the need for a new election (per Bloomberg). The Senate will reportedly pick a date for the no confidence motion in the government as soon as today, having delayed the decision yesterday, which could end up being the key date when we’ll know whether or not to expect elections. Ten-year BTP yields fell -10.6bps, but are still +32.6bps higher from their mid-week lows last Wednesday at 1.696%.

In terms of other news yesterday, there was some attention paid to the release of the Swiss National Bank’s sight deposit data, which is used as a proxy for their FX interventions. Sight deposits rose to 585.5bn francs, their biggest increase since early 2017 and suggesting some action by the SNB, but still far less than during periods of heavy intervention. Elsewhere, the US Treasury released its monthly budget statement, showing that the budget deficit was $119.7bn in July. That takes the deficit to $866.8 over the first 10 months of this fiscal year, bigger than the deficit over entire 2018 calendar year ($779.0bn).

Looking at the day ahead now, the aforementioned July CPI report in the US this afternoon is the likely data focus, however prior to that we’ll also get a decent slew of releases in Europe. We kick off with the final July CPI revisions in Germany not long after this hits your email, before the UK June and July labour market data is due to be released. The August ZEW survey in Germany follows while late morning we’re also due to get the July NFIB small business optimism reading in the US. Away from that the NY Fed is also due to release its Q2 household debt and credit report.

via ZeroHedge News https://ift.tt/33uRNtI Tyler Durden