A Huawei reprieve (again) and stimulus hopes from China (rate reform) and Germany (nothing official) prompted the machines to squeeze stocks back to run stops above last week’s pluinge. What now?

Chinese stocks were panic-bid at the open…

Source: Bloomberg

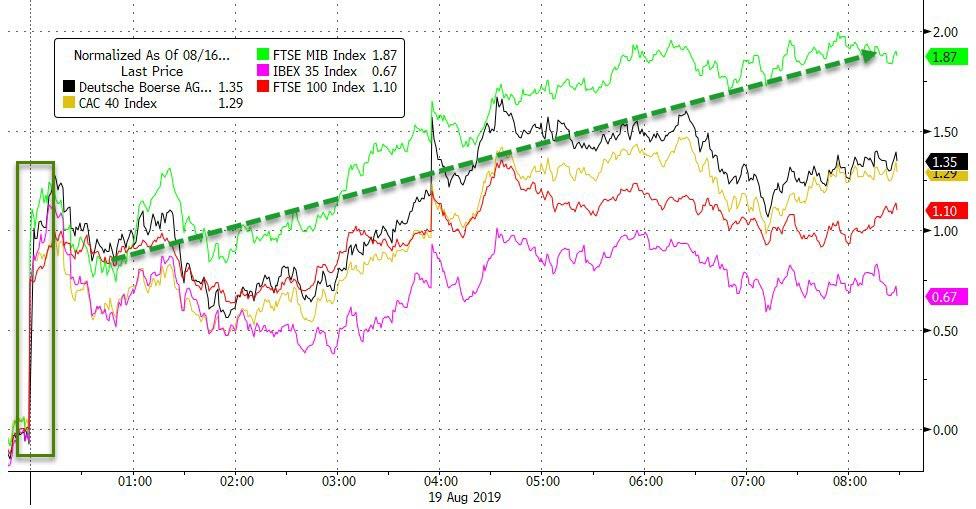

Hopes of German fiscal recklessness (again) lifted European stocks…

Source: Bloomberg

And German bond yields…

Source: Bloomberg

US equity markets extended Friday’s surge, erasing last week’s carnage but stalled once they had run the stops…Small Caps, S&P, and Nasdaq are back unch from the plunge last week, Trannies and Dow Industrials are still lower…

NOTE – weakness at close, unable to hold the gain.

A weekend of jawboning from Kudlow and Navarro and overnight headlines (but no actual, real news) suggesting Germany may go fiscally irresponsible (and China rate reform will save the world), sparked the biggest two-day short-squeeze in US stocks since the start of the year.

Source: Bloomberg

NOTE – The early June spike was all about Bullard, Powell, and an avalanche of fed speakers (as was the End-Dec and early Jan spikes)

Friday and today’s short-squeezer has perfectly erased the plunge from last week…

Source: Bloomberg

FANG Stocks were unable to recover all the losses…

Source: Bloomberg

Google celebrates its 15th anniversary of IPO…

Source: Bloomberg

AAPL ramped higher again (maybe Trump’s dinner with Tim Cook prompted more irrational buybacks)?

Source: Bloomberg

VIX slipped lower today, and the VIX term structure shifted out of inversion…

Source: Bloomberg

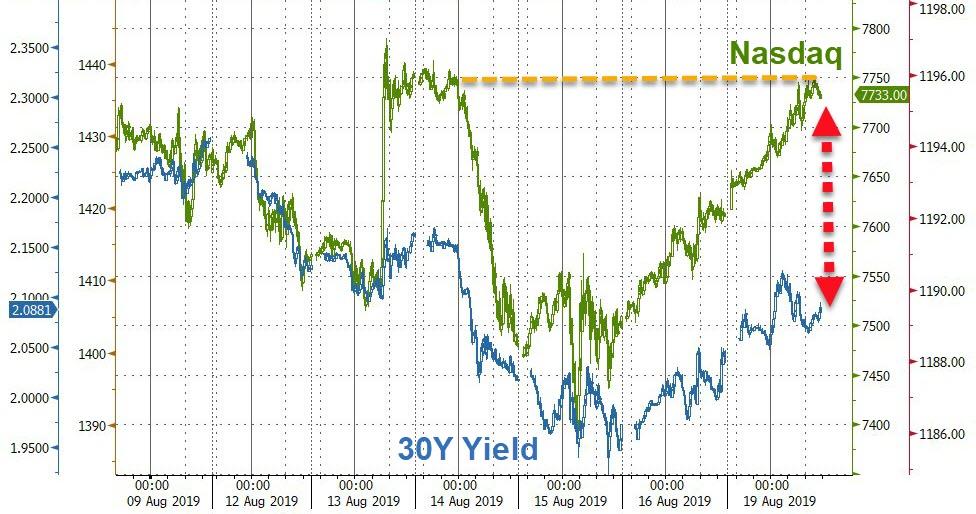

Stocks and bonds are not in agreement that everything is awesome…

Source: Bloomberg

Treasury yields rose on the day, spiking on the German headlines overnight with the short-end underperforming

Source: Bloomberg

2s10s started top flatten again…

Source: Bloomberg

Before we leave bondland, it’s worth noting that the odds of a 50bps cut in September have plunged as stocks bounced…

Source: Bloomberg

The dollar rallied for the 5th straight day, hitting YTD highs, thanks in some part to relatively hawkish comments from Fed’s Rosengren…

Source: Bloomberg

Yuan slid notably on the day…

Source: Bloomberg

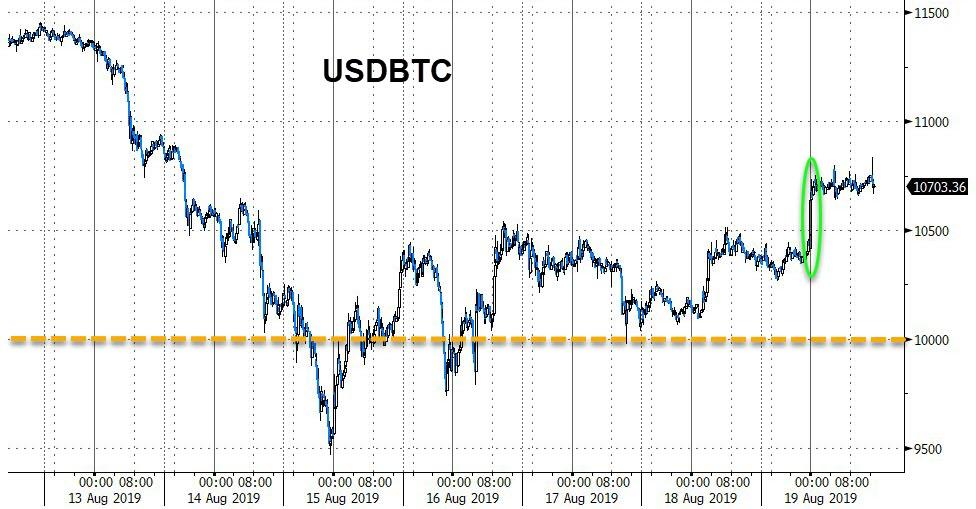

Cryptos are higher since Friday’s close…

Source: Bloomberg

Bitcoin is back above $10k…

Source: Bloomberg

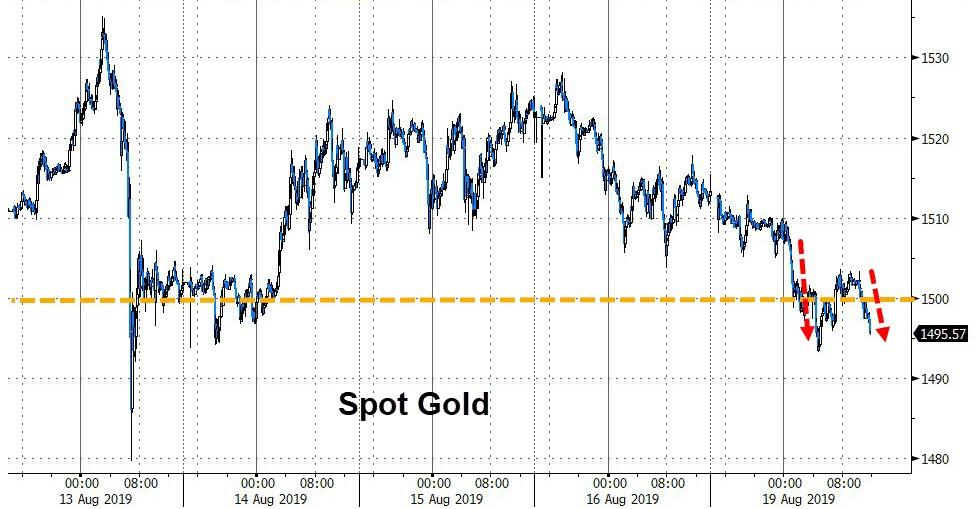

Oil soared on the day (growth stimulus hopes), as PMs slipped (no need for safe havens as everything is awesome…

Source: Bloomberg

Spot Gold fell back below $1500 intraday…

Source: Bloomberg

WTI ramped back in the same way as stocks – erasing last week’s plunge…

Source: Bloomberg

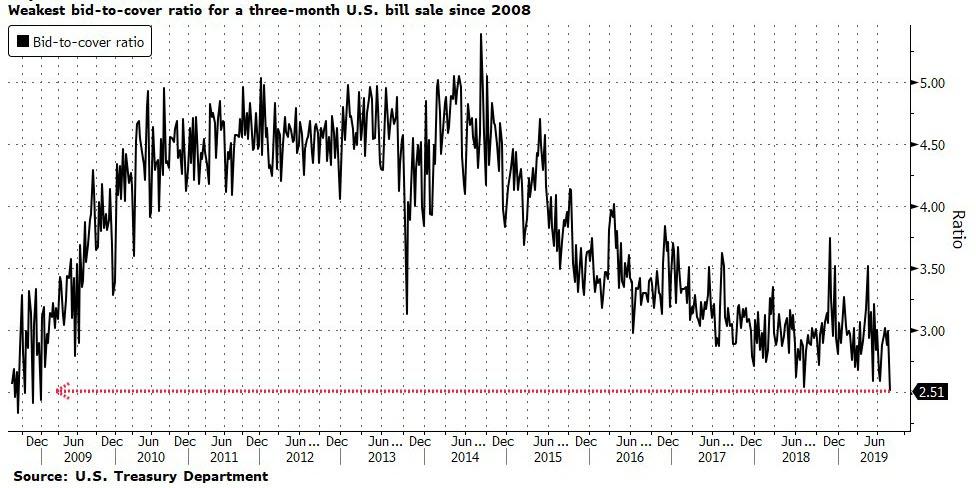

Finally, somewhat quietly, the U.S. government’s $45 billion auction of three-month bills on Monday attracted the weakest demand since December 2008, with just 2.51 bids submitted for every security on offer.

Source: Bloomberg

And fun-durr-mentals are driving stocks…not!

Source: Bloomberg

via ZeroHedge News https://ift.tt/2z8cq0L Tyler Durden