“Talk, Talk” is what sparked a furious 700-Dow-point pumpathon off overnight lows. The question is – did they?

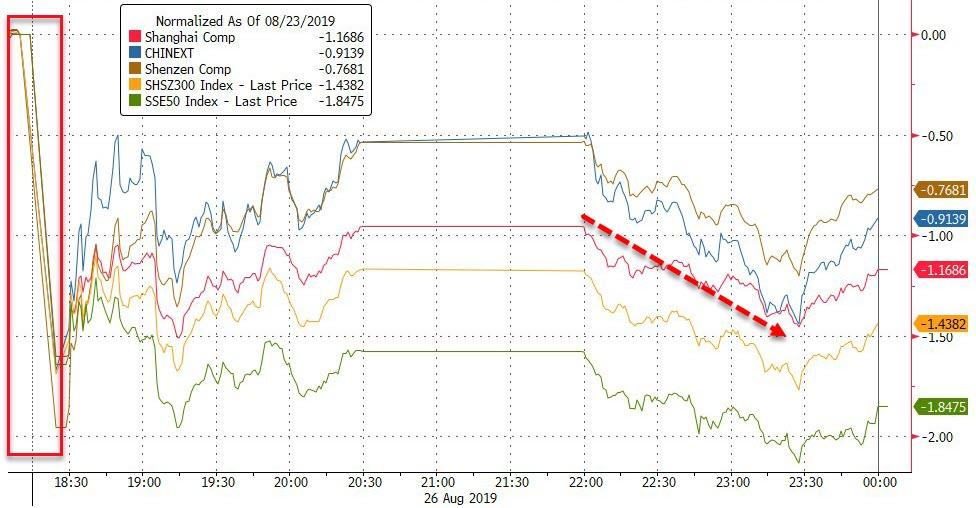

Chinese stocks closed before Trump jawboned markets higher, catching down to Friday’s US collapse…

Source: Bloomberg

European stocks opened lower but ramped like every other risk asset on Trump hype about a “call” with China (UK was closed)…

Source: Bloomberg

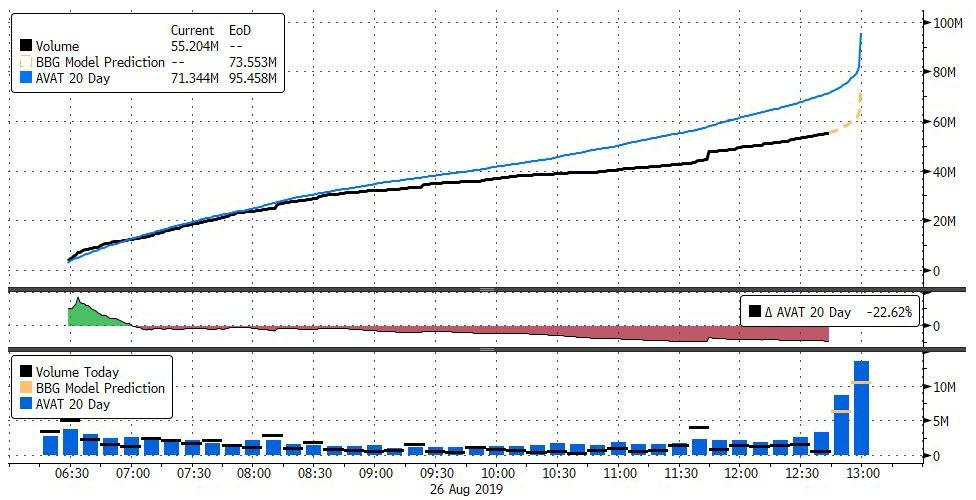

US equities managed gains thanks to Trump’s trade talk tales overnight but went nowhere intraday…

NOTE – look at the close!!!

But remain well down from Thursday’s close…

Volume was over 20% below average (not helped with UK’s holiday)

Source: Bloomberg

Futures show the real action as algos lifted markets overnight then snapped higher when Trump talked of “talks”… BUT The Dow could not break above its 61.8% retracement of the Friday plunge…

The Dow bounced off its 200DMA…again

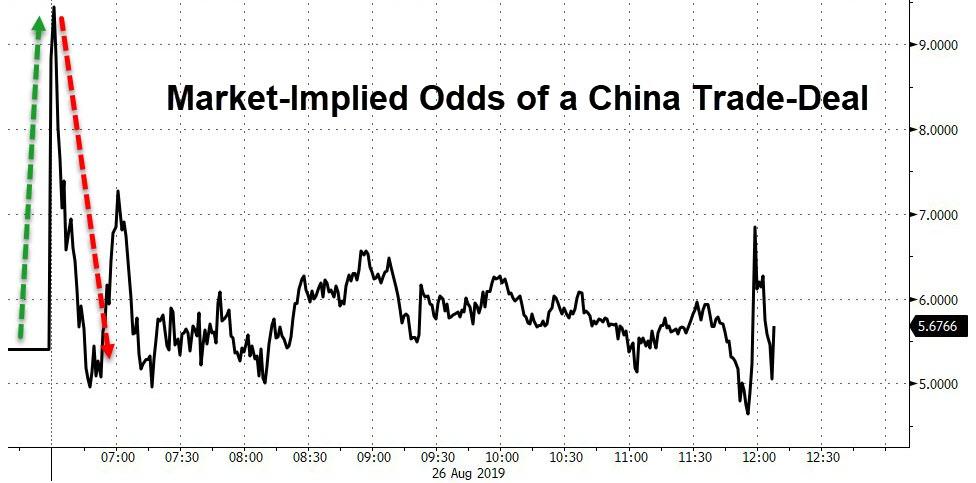

Notably, the odds of a trade deal spiked at the open but rapidly fell back as the day wore on…

Source: Bloomberg

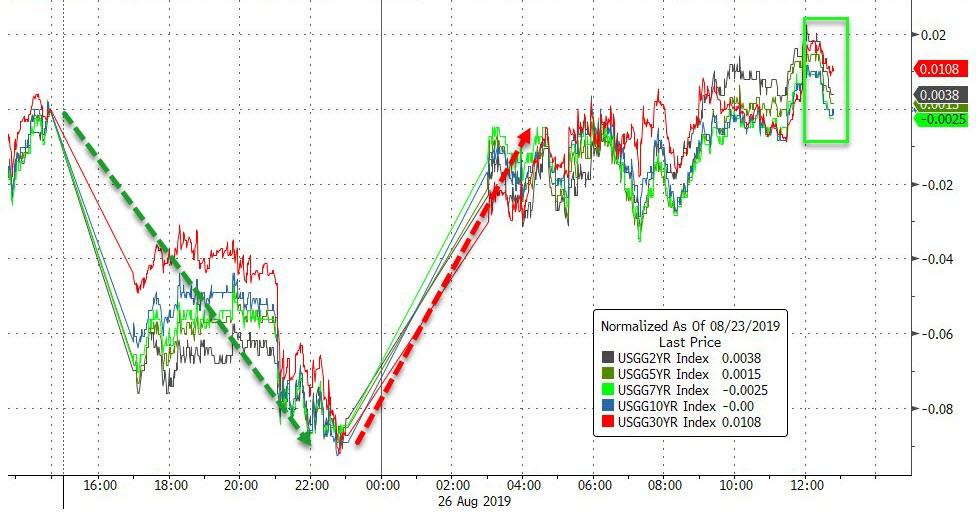

Treasury bonds ended marginally higher on the day as the initial yield collapse was ramped higher across Europe’s open (UK closed)…

Source: Bloomberg

Crazy shifts in yields (UK was closed) left 10Y and 30Y (back below 2.00%) marginally unchanged after plunging in Asia…

Source: Bloomberg

But the yield curve collapsed (2s10s closed at its most inverted since May 2007)… 3rd day of closing inversion in a row…

Source: Bloomberg

But it’s the 3m10Y spread that matters most and that has also collapsed to new cycle lows…

Source: Bloomberg

Treasury vol exploded higher…

Source: Bloomberg

The Dollar surged back today, erasing Fib 61.8% of the Friday plunge…

Source: Bloomberg

Turkish Lira flash-crashed an unreal 15% at the open (not seen in chart) but bounced back to still end significantly weaker on the day…

Source: Bloomberg

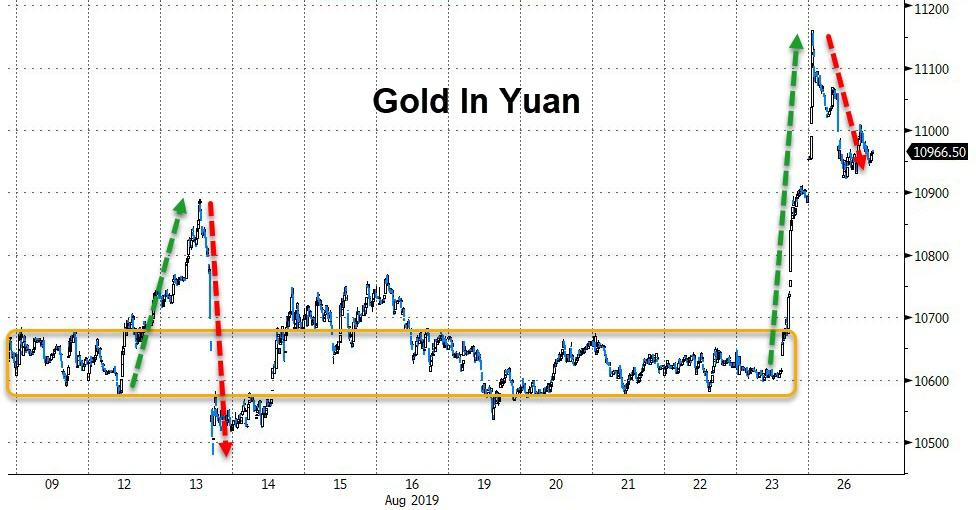

A stunning plunge in the yuan at the open saw some bounce (very modestly stronger fix) but that faded as the day went on…

Source: Bloomberg

Asian FX plummeted to its lowest since 2009…

Source: Bloomberg

Cryptos spiked overnight but faded all day to end lower from Friday…

Source: Bloomberg

But Bitcoin held above $10k…

Source: Bloomberg

Commodities were crazy today with copper and gold mirroring each other, silver shrugging it all off as crude crumbled…

Source: Bloomberg

WTI tumbled to a $52 handle briefly overnight, before algos ripped it up to erase Friday’s loss, before it dumped all the way back down (reportedly in possible US-Iran tension easing)…

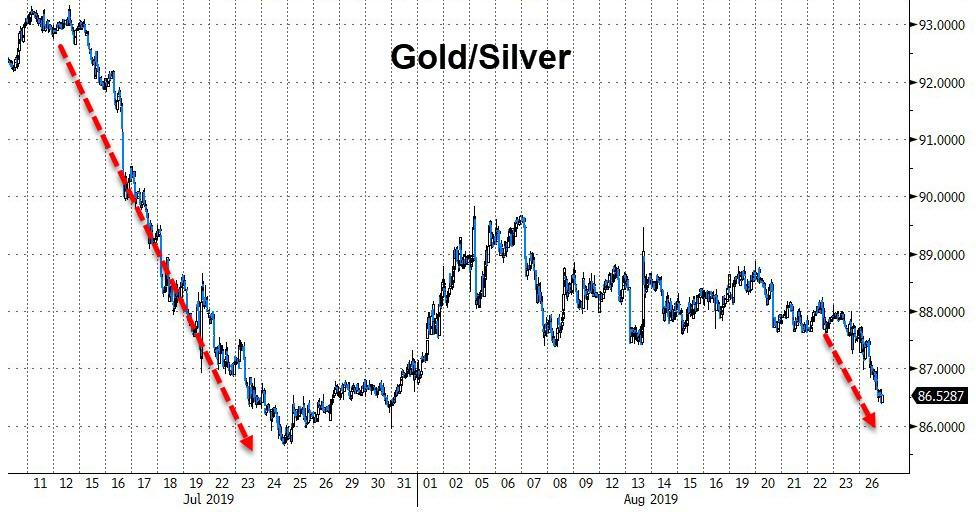

Gold managed to hold on to very modest gains after being dumped at the EU open (as Trump spoke) – after spiking above $1560 in Futs and $1550 spot…

Silver, on the other hand, was up well over 1%, refusing to listen to Trump…

Pushing Silver to dramatically outperform gold on the day…

Source: Bloomberg

As Yuan continues to weaken against the barbarous relic…

Source: Bloomberg

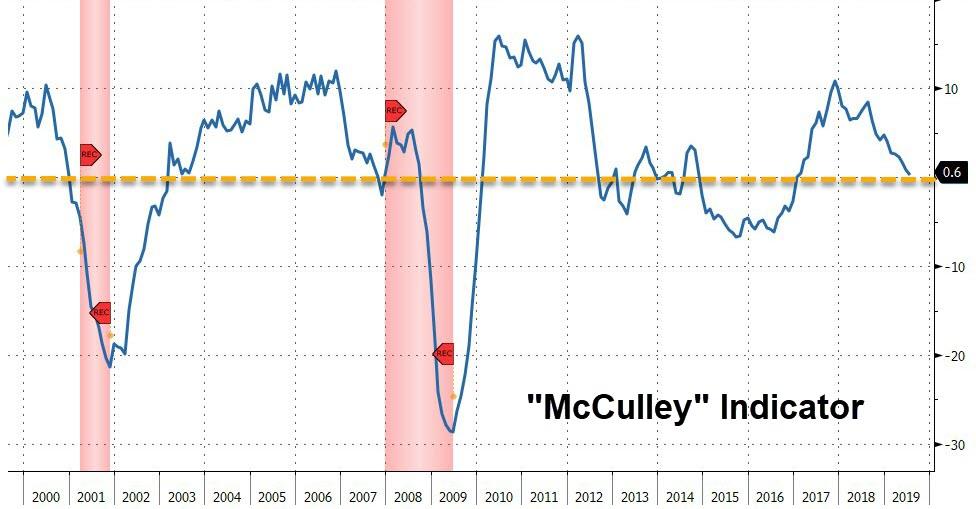

Finally, as Bloomberg’s Vincent Cignarella notes, the “McCulley Indicator” is rolling over. In markets speak, that means that the Capital Goods New Orders Non-defense Ex Aircraft & Parts series has been falling since November 2017 and is currently at 0.3%. (The measure is named for former PIMCO managing director Paul McCulley, who viewed it as a recession indicator.)

Source: Bloomberg

Over the last 20 years, when the data print has crossed below zero on a three-month Y/Y basis, a recession has followed.

via ZeroHedge News https://ift.tt/2LcPV06 Tyler Durden