Have you ever thought about thinning out your classic car collection? Now could be the time before the antique car market rolls over.

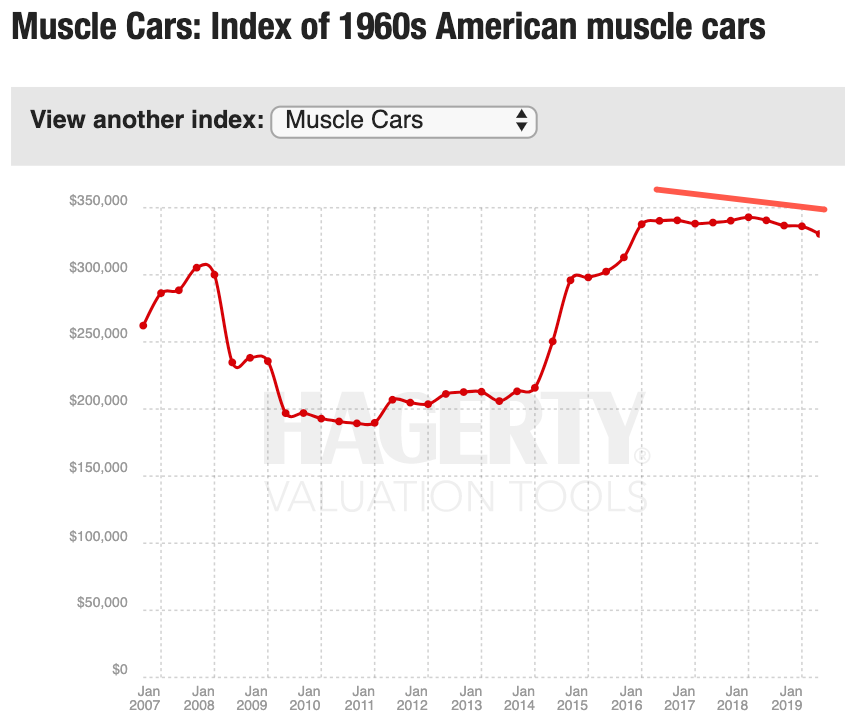

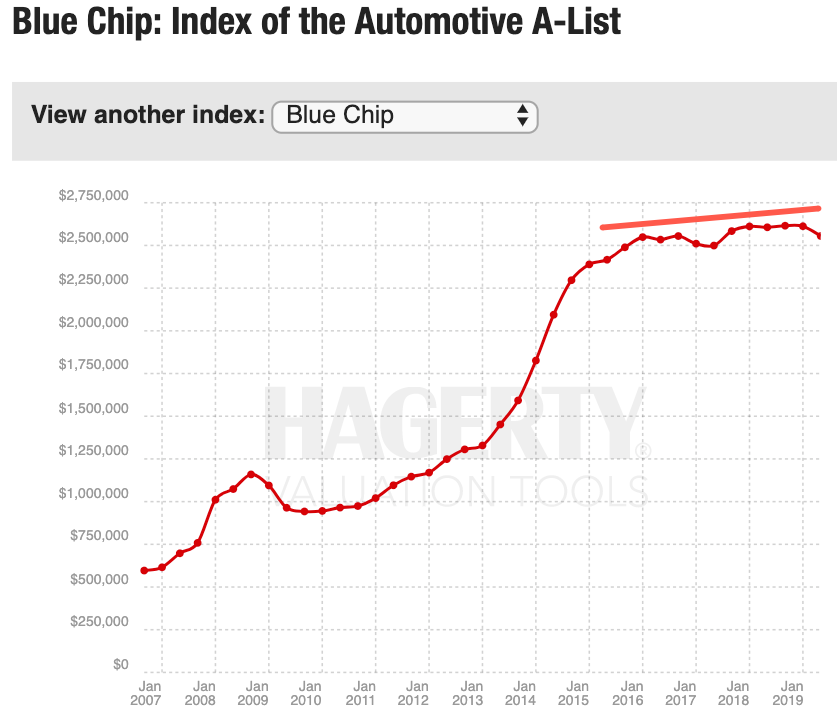

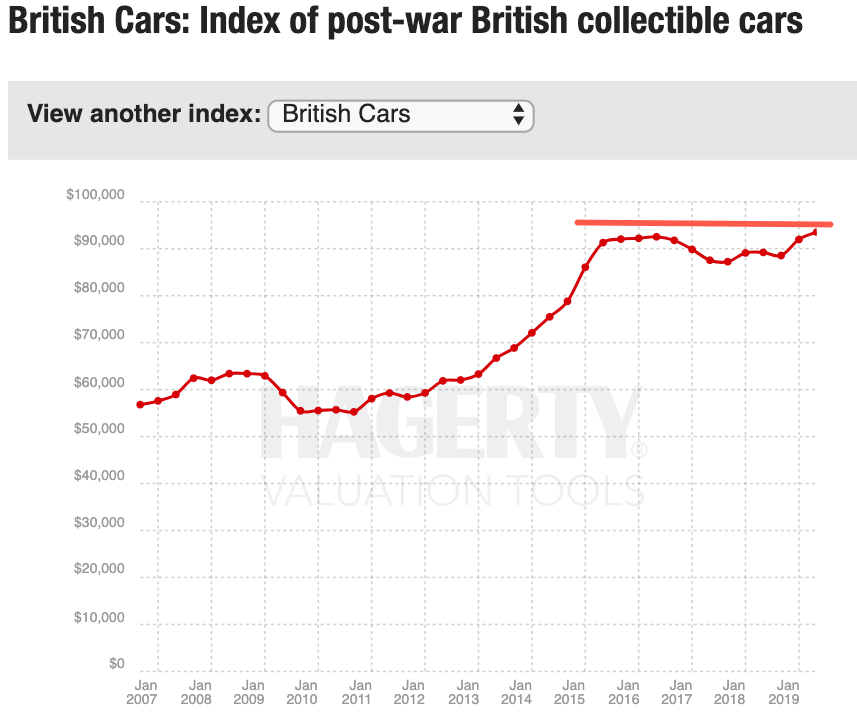

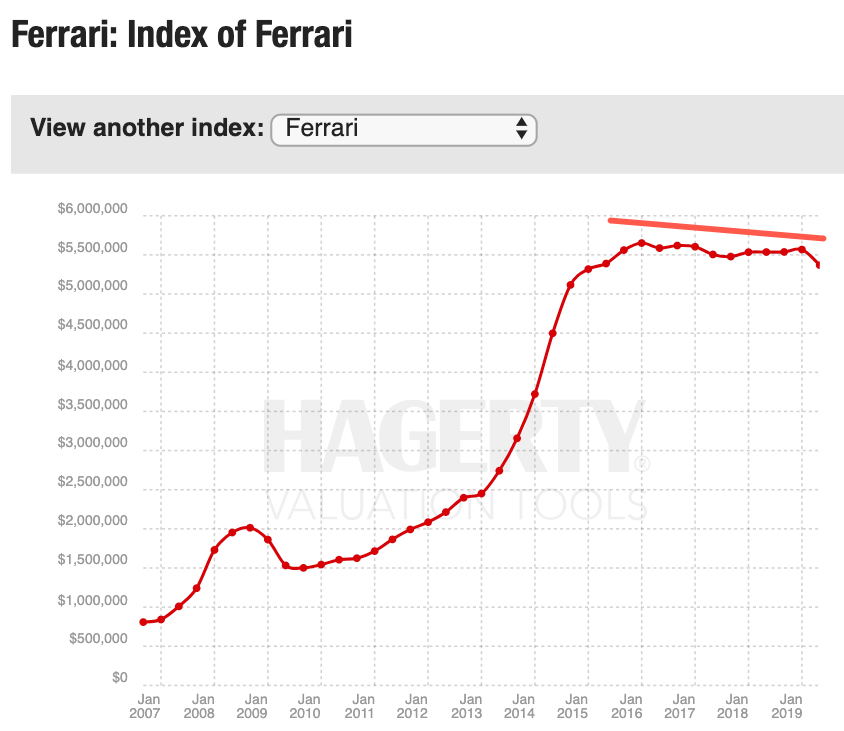

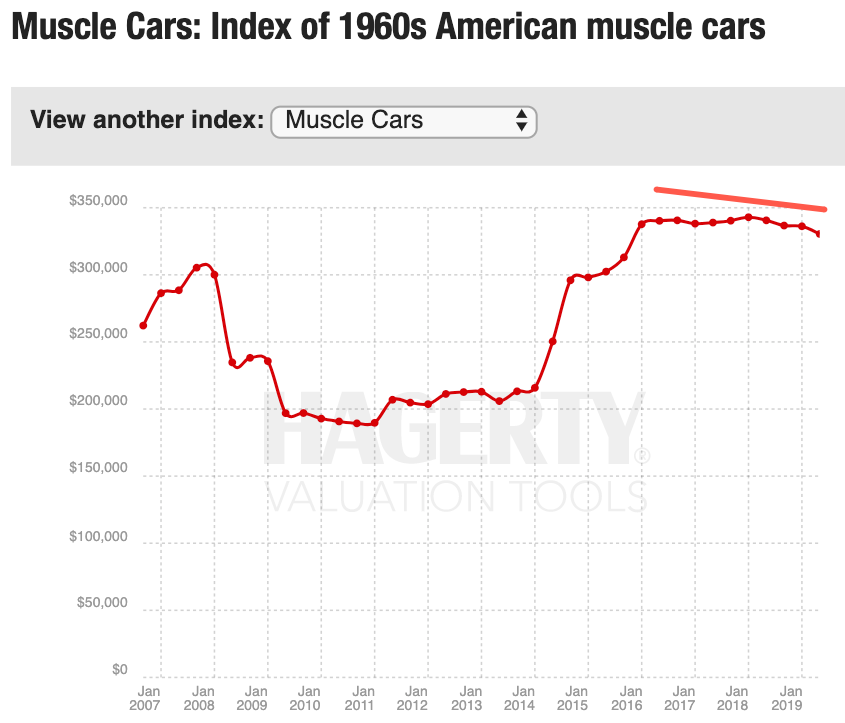

Hagerty Price Guide, the premier collector car value guide, shows that in the last four years, 1960s American cars, blue-chip cars, British cars, Ferraris, German collectibles, and Muscle cars have seen their prices stagnate at record highs.

Prices have been flat, depressed, and unlikely to go higher ahead of the next recession. A possible correction in the classic car market could unfold into the early 2020s.

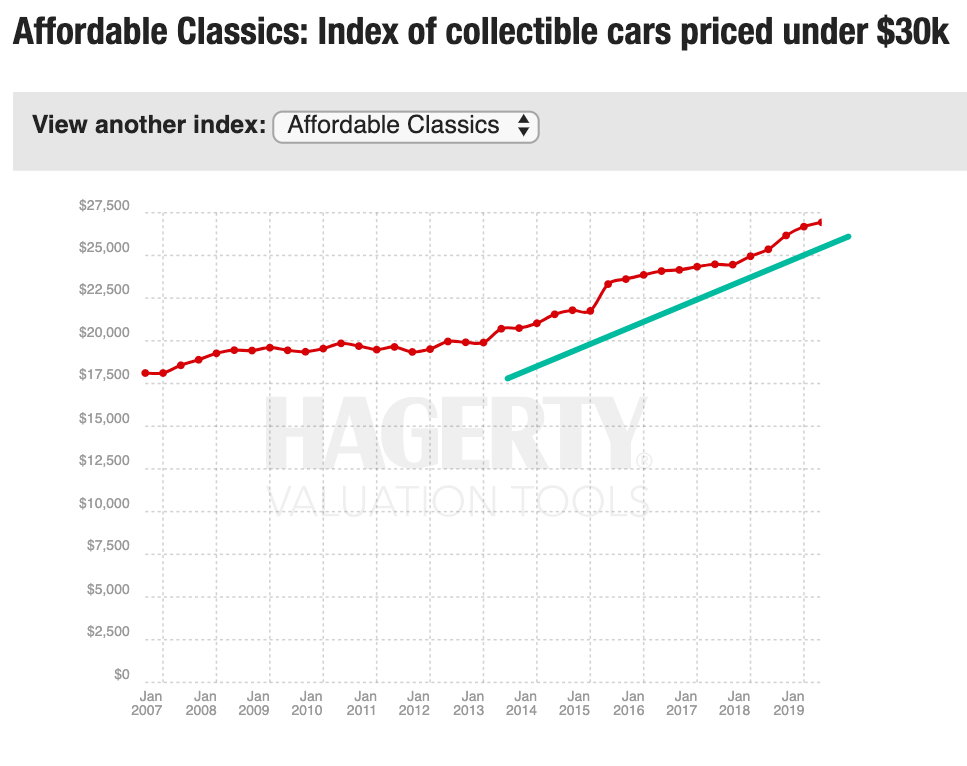

However, affordable classic cars, around the $20,000 price range, bucked the trend with prices moving higher.

The overall vintage car market is beginning to show signs of fatigue. Results from the Monterey Car Week earlier this month, an important bellwether for the state of the classic car market, had one of its worst auctions in 8 years.

Hagerty reported $245 million in sales during the two-day auction from Aug. 15 to 17. It represented a 34% drop from 2018’s results, which makes it the worst auction since 2011.

The average selling price plummeted by 36.7% to $319,610; the median sale price plunged 22.7% to $24,200; the sell-through rate (percentage of vehicles that sell) fell to 58% from 62%.

“Whether it’s threat of recession, broad economic volatility or too many cars crammed into too few hours, there’s no denying this year’s Monterey Auction Week results were depressed when you compare the results to recent years,” Hagerty’s Jonathan Klinger said.

This isn’t the first time Monterey’s sales have crashed. Sales plunged 72% from 2000 to 2002 and fell 14% between 2008 and 2009, according to Hagerty.

Klinger said recessions and credit bubble burstings fueled those drops.

“This year seems to be more anticipatory and reflective of broader market jitters,” Klinger said.

The downturn isn’t limited to just Monterey – it’s a broad-based cyclical downshift in the entire classic car market, except for cars priced under $20k. So now looks like the best time to thin out the collection before the next recession strikes.

via ZeroHedge News https://ift.tt/2zyFL4I Tyler Durden