Authored by Sven Henrich via NorthmanTrader.com,

Bull and bear are entering the Thunderdome in September and October and only one will emerge victoriously. Both have 5 known developments to contend with inside the dome: The Fed, the ECB, the China trade deal, earnings and Brexit, all of which can and will throw curveballs as neither bull nor bear can be certain how either of these developments unfold nor what the reactions to them may be.

It’s a time of extreme uncertainty and before you accuse me of saying markets can either go or up or down I will come straight out and say markets can go either up or down, it really depends on how these developments shake out. I’m not a fortune teller, I’m a realist and I analyze technical structures in context of a complex macro picture.

And so everyone is clear: Charts are always evolving and markets are a journey, some don’t seem to grasp that concept. Markets are always shifting and our job is to evaluate risk and reward as charts evolve, especially in a time of great uncertainty.

For purposes of this article I want to focus on the immediate developments in front of us in September, the Fed, the ECB, and the China trade deal and I’ll outline what I see to be the key technical decision nodes as they present themselves right now.

On Thursday I had an opportunity to discuss some of the technical and macro considerations on CNBC Fast Money and I wanted to offer some more detail behind the discussion in today’s article.

For reference here’s the discussion from Thursday:

This screaming sell signal could send stocks spiraling, says strategist Sven Henrich @NorthmanTrader. Here’s what has him worried. pic.twitter.com/8LJtmtAmcX

— CNBC’s Fast Money (@CNBCFastMoney) August 29, 2019

To me the central questions going into the next two months are these: 1. Will there be a China deal or not? 2. Will central banks remain in control, can their coming actions kick the can further down the road and help avert a global recession or not?

Let me handicap both of these questions a bit before I jump into the technicals:

China Trade deal: The likely largest impetus for a large rally in the Q4 would be a positive resolution of the China trade deal, but at this stage there is no guarantee of this. Markets want a resolution hence they rally each time there is a sign of easing of tensions and obviously this has been the standard playbook all year:

“What would you do if you were stuck in one place and every day was exactly the same, and nothing that you did mattered?”

— Phil Connors (Bill Murray), Groundhog Day pic.twitter.com/fY5Atw1l93

— Sven Henrich (@NorthmanTrader) August 30, 2019

That’s a lot of optimism and so far it has meant squat. There is no China deal, but we’ve entered a phase of high stakes gamesmanship between the US and China and the stakes are increasing as 9 major economies are already overtly flirting with recession. No China trade deal and the risk of a global recession increases exponentially by the month hence markets may be running out of patience soon and phone calls may not be enough.

The global slowdown in PMIs and growth is a real and present danger to the global economy and a deal is needed to rescue uncertainty.

So yes, get a deal, no matter the substance, just the relief and appearance of certainty will cause a major rally, don’t get one and the continued drag of slowing data and uncertainty risks a global recession being triggered. It is this binary.

Central bank intervention: No bull market without central bank intervention. We’re back to the same program we’ve seen over the past 10 years. Markets are in trouble and we look for the Fed to save markets. I can’t deny the possibility that the Fed and ECB again launch rate cut and ultimately QE bazookas and succeed in re-inflating asset prices higher.

I do however question the efficacy of it all, especially in context of the boarder valuation and technicals picture and I encourage everyone to visit this tweet thread for the further background. Start of thread, click to expand thread:

S&P 500 median price to sales ratio:

2000 2.0

2007 2.0

2019 2.6

Stock market value vs GDP ratio

2000 146%

2007 137%

2019 145%— Sven Henrich (@NorthmanTrader) August 28, 2019

Key concerns:

1. Limited Fed ammunition coming off of a much lower rate basis, after all the the Fed only has 8 rate cuts before being back at zero bound, the ECB still being on negative rates never having raised rates, and Europe on the brink on recession despite.

2. Conflict between Fed & markets. Markets want a 100bp cut, the Fed tries to keep calm with mid-cycle adjustment talk. In fact everybody is again screaming for aggressive rate cuts. Save us. Examples from just week: Pimco, Stifle, Danske Bank, and of course the wanna be rate cutter in chief:

If the Fed would cut, we would have one of the biggest Stock Market increases in a long time. Badly run and weak companies are smartly blaming these small Tariffs instead of themselves for bad management…and who can really blame them for doing that? Excuses!

— Donald J. Trump (@realDonaldTrump) August 30, 2019

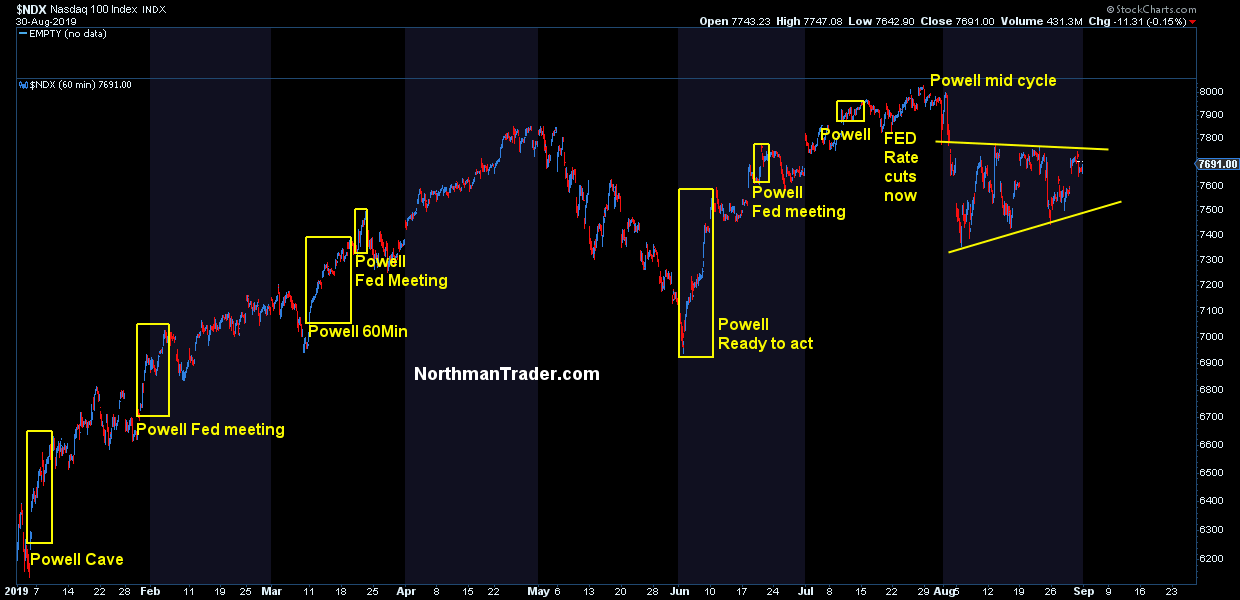

All firming up the main message: No bull market without central bank intervention. If the Fed doesn’t cut aggressively everything falls apart. And why wouldn’t it? After all, aside from trade optimism, the multiple expansion rally in face of slowing growth of 2019 was largely Fed driven:

It only ran into trouble when the Fed actually cut rates in late July. No, this market is banking all its hopes and dreams on central banks and a China trade deal. But seriously why are we expecting the Fed put to work again which brings us to concern number 3:

3. Financial conditions are already the loosest in 25 years, if you have slowing growth with the loosest conditions why would even looser conditions produce growth? See mortgage applications, declining despite mortgage rates dropping. So it comes down to efficacy and this is an open question.

And for historical context look at where the Fed is cutting rates now versus previous cycles:

Perhaps some journalist can actually grill Jay Powell on why in the world the Fed is cutting rates w/ the loosest financial conditions in decades.

In the past the Fed raised rates during loose conditions & cut rates once conditions tightened.

Not this lot. pic.twitter.com/8kAlYoo3xq— Sven Henrich (@NorthmanTrader) August 21, 2019

Now put these loose financial conditions in context of the overall macro structure:

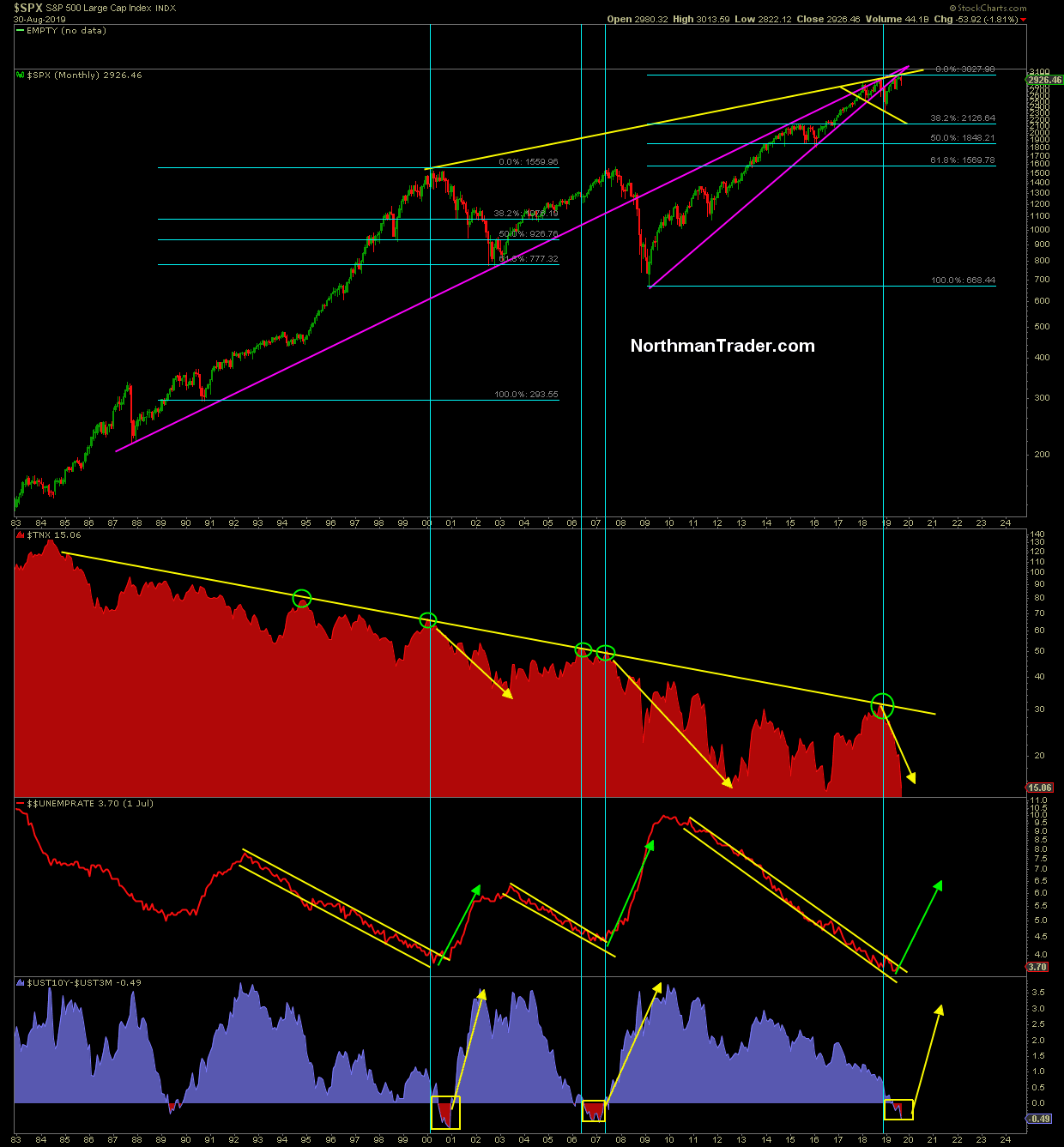

The bond market and the yield curve is signaling precisely what they’ve signaled in past pending downturns: The 10 year rejects its long term trend line hard and yields drop hard into inversion while equity markets are in engaged in a topping process as consumers are still confident due to a cyclical low unemployment rate. The typical end game: The yield curve steepens sharply following inversion as unemployment signals a shift higher. Hence unemployment is the last shoe to drop. Unemployment is at 3.7%. Please show my any history that says low unemployment of such a degree is sustainable for an extended period of time.

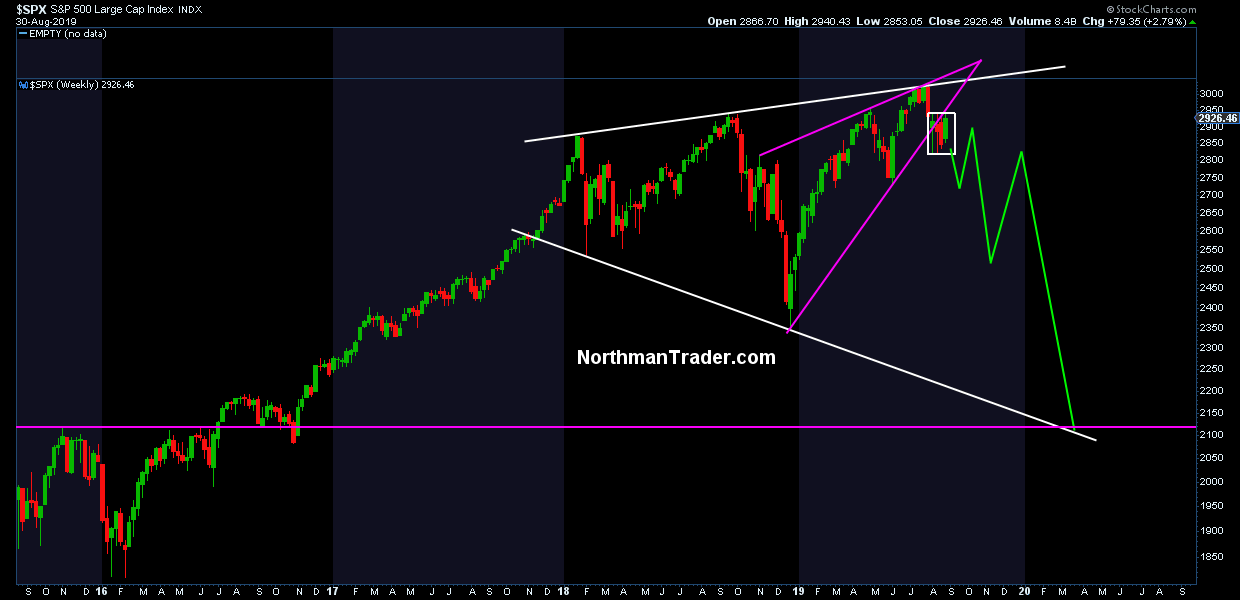

And note what happens to markets each time when the final shoe drops. Markets correct hard. Following the 2000 top markets corrected to the .618 fib, in 2007 they gave back the entire bull run and more. Hence I said in the interview that the .382 fib and lower megaphone target of 21o0 is actually not dramatic from a technical perspective. And if a global recession will result in a US recession then this technical target may even just be a stepping stone for a much larger journey to come, but we are far from this as of now, hence no point speculating about this now.

So from a market perspective it really comes down to how long low unemployment can be sustained and if markets can engage in another final hurrah rally and much of this is dependent on the above mentioned factors: China trade deal and central bank efficacy.

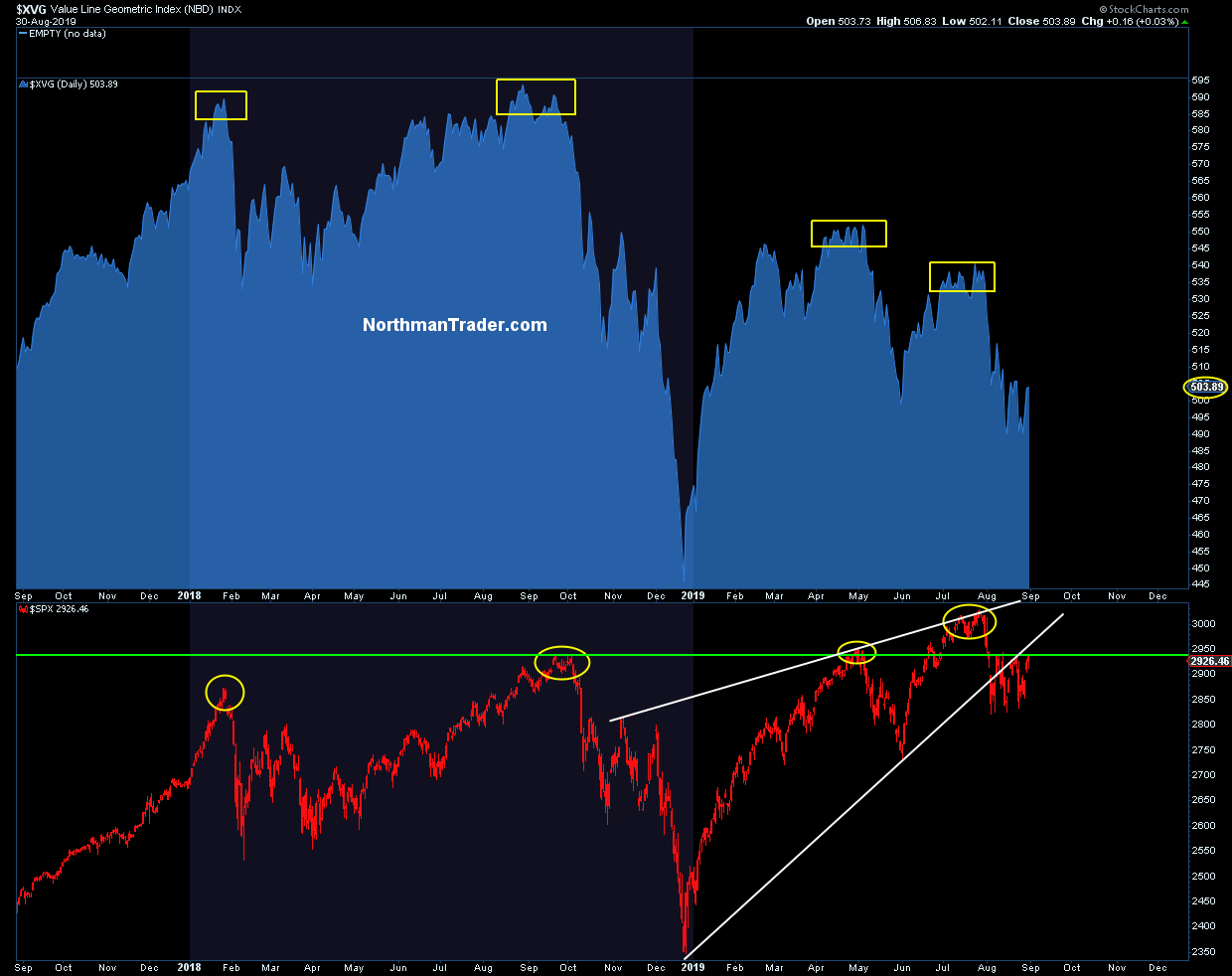

Now look at markets in 2019: Virtually all gains have come on multiple expansion, at the same time all new highs have come on very pronounced internal weakness.

In fact if you look at the $SPX versus the value line geometric index you see a total decoupling from what the indices are telling you: Ever lower highs on value line versus new highs on $SPX:

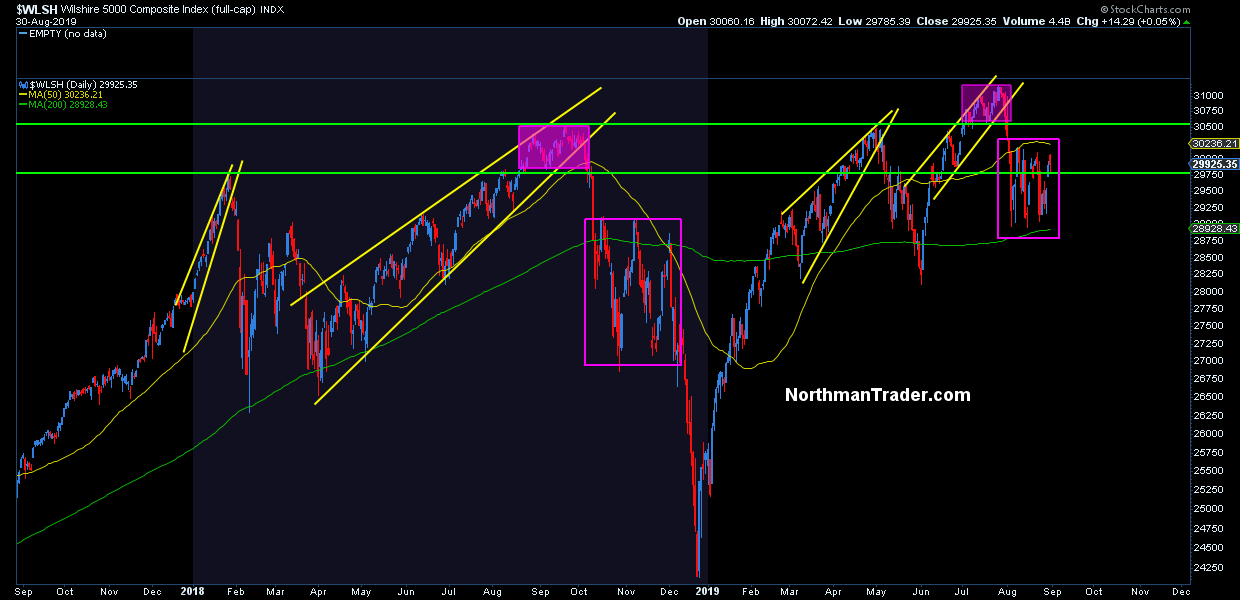

At the same time all new highs have been rejected each and every time, here’s the $WLSH driving this point home:

These are simple observable facts.

Most recently we’ve seen markets engage in a process of consolidation similar to the fall of 2018.

And this consolidation has come at a cost, the break of the 2019 up trend:

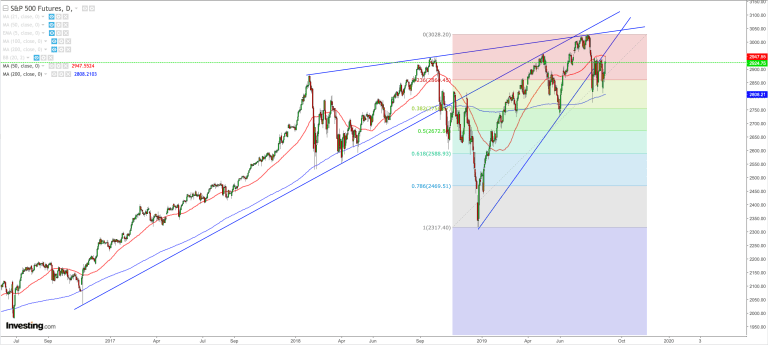

And note how $ES is currently engaged in a ping pong between the 50MA and the 200MA.

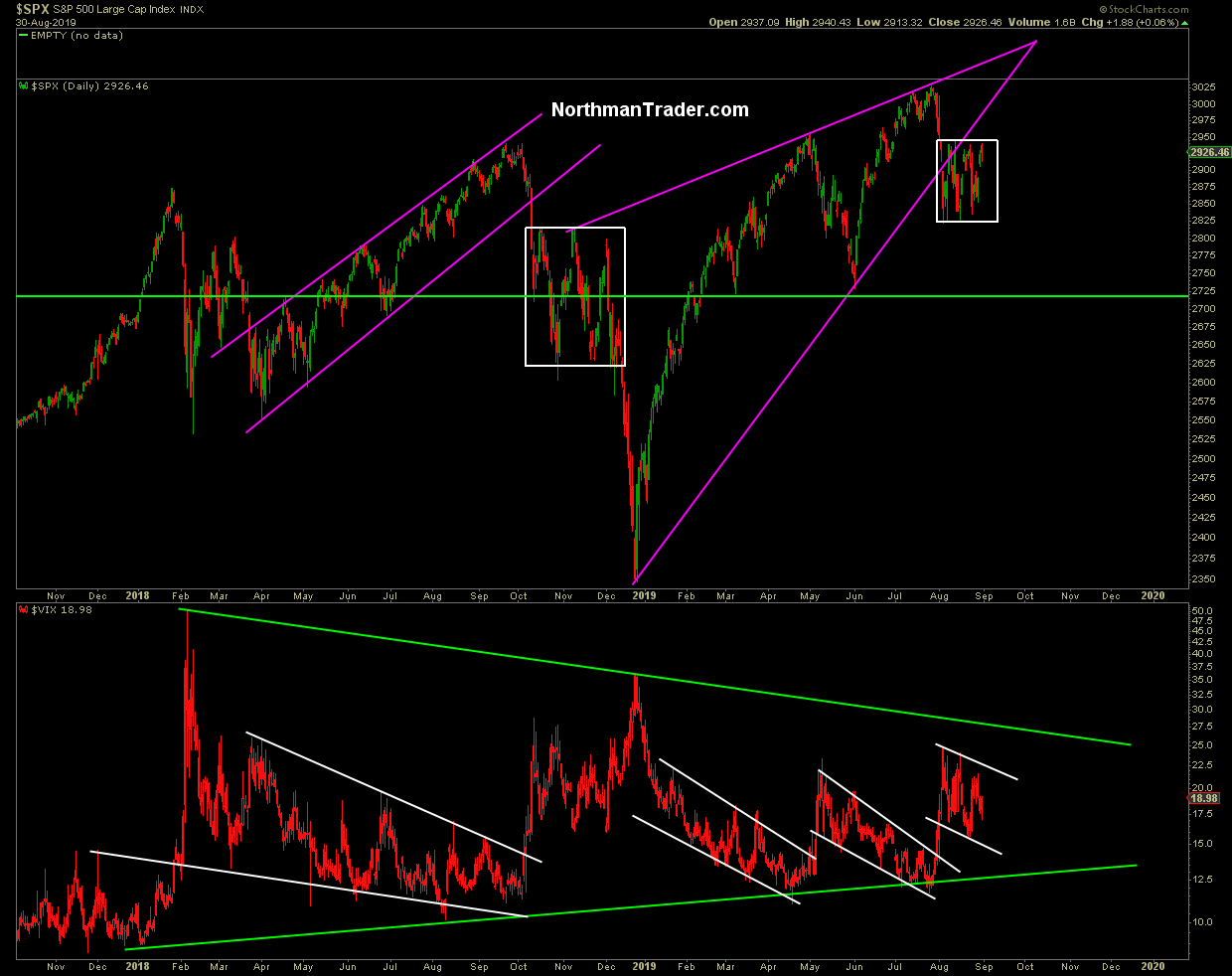

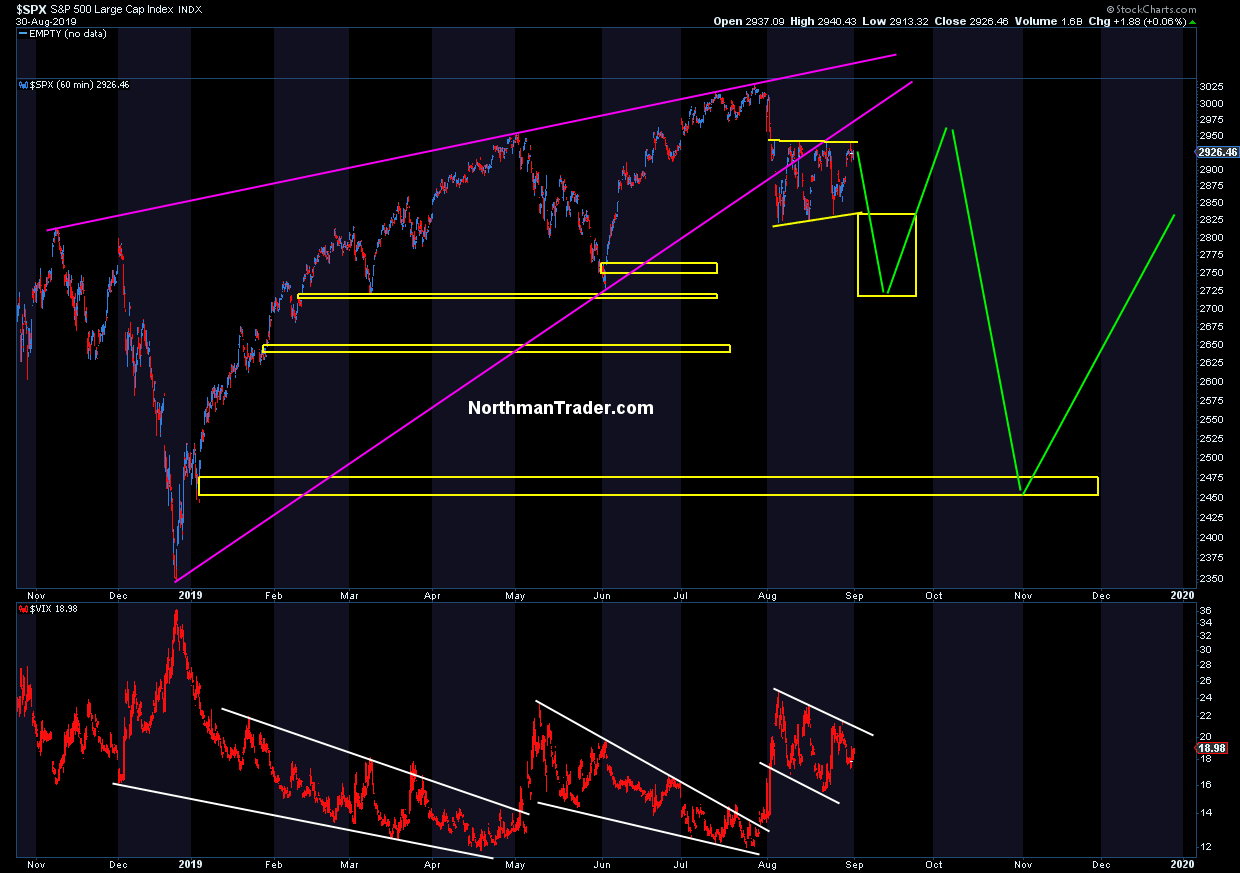

Not only a break of the 2019 uptrend, but also a break of a larger rising wedge. That’s what I referred to in the CNBC Fast Money interview. In the interview I also mentioned a potential bullish pattern on the $VIX and you can see it in the chart below, a bull flag if you will:

Indeed if I use a futures chart I could make the case $ES has corollary bear flag in process of building:

I full recognize that these short term patterns could get easily challenged tested or even invalidated by a single “tariffs delayed” tweet for example. But as of now these potential patterns are not invalidated.

So now how to handicap this upcoming Thunderdome fight technically. The Fed may surprise and cut by 50bp or they may disappoint. The ECB may introduce a QE bazooka as is rumored or they may disappoint. A China deal may happen or it may not and a meeting, if it happens, may produce results or it may not. Lots of variables.

Note: I’ll present some technical scenarios below that are entirely speculative, but technically entirely defendable pending the outcome of these key developments. Don’t hold me to specific time frames, these are conceptual so you have a sense of how one can define risk/reward and pivots here in the current context. As I said earlier, charts and structures evolve and we must keep a close eye on any coming changes.

Let’s start with the bull case, the most commonly presented by Wall Street, the one says a China deal may happen and central banks remain in control with the next round of interventions, the scenario that says a global recession can be averted. I’m using the broadening wedge chart I discussed in the interview to highlight the case:

This scenario says that any corrective activity in September/October will get bought and will produce a larger Q4 rally to new highs, break above the upper trend line, retest it as support and then rally to continue the bull market.

One must clearly acknowledge: In the circumstances described above it can happen. That’s in essence what bulls are counting on, for central banks to save the world again. No bull market without central bank intervention. It’s that simple. Cynically I can observe that many that didn’t forecast the collapse in yields are now confidentially projecting that the collapse doesn’t mean anything and that previous data in different circumstances suggest that markets still have a lot of time before a recession. Maybe, maybe not. I would generally just suggest some humility in making grand predictions. Since nobody predicted the collapse in yields, perhaps it would be wise to just pause for a while and acknowledge that markets may be moving in unexpected ways, which seems to be the case here.

The bear case looks very differently. No China deal and a global recession unfolds despite central bank intervention, i.e. the Fed has to cut rates to zero again or even go negative as the global macro cycle turns in earnest:

Incidentally if that tag of the lower trend line occurs it would most likely be a massive buy for a big rally to come, but we’re far from that.

How could this bear case unfold? As I said in the interview none of this would be a straight journey and there would be of course many rallies in between. I mentioned the buyable dip scenario if the $VIX were to play its current bullish pattern and produce a move to, say, the 2700 zone, one can imagine the following scenario:

A break of the recent consolidation pattern to the downside for a measured move of equal distance, then a big rally (similar to the bull case above) and then the fate of that rally would determine everything. If it fails, one could see a larger topping structure that targets the open gap from January near 2460 and then another big rally into year end.

Look, I know it seems silly to paint these scenarios as nobody can predict the future and in reality markets may well evolve differently, but technically these are entirely reasonable potential outlooks and worth keeping in mind as we see the coming developments unfold.

My perspective here: Keep an open mind, carefully evaluate headlines as they come in. Are they meaningful data or are they simply gamesmanship (i.e. “phone calls”) and how are markets reacting to them in context of these larger structures that are clearly and cleanly visible?

From my perch neither bulls nor bears can rest easy here. The battle in the Thunderdome will challenge everybody.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2zFHXHI Tyler Durden