Fitch Ratings suggests in a new report that declining interest rates won’t be enough to spark a rebound in housing market activity for 2H19, with affordability concerns and a lack of supply remaining as a significant constraint.

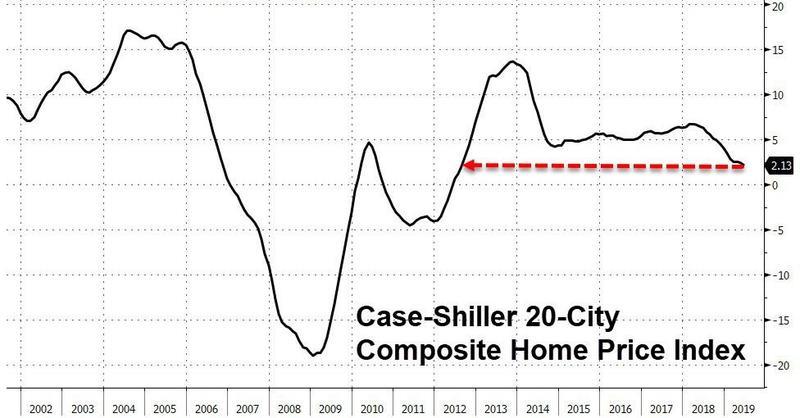

Almost 40 weeks of declining mortgage rates haven’t led to a jump in housing market activity in the US, but rather a decline in home price growth across the country, as per data published via S&P CoreLogic Case-Shiller’s 20-City Composite price index on Tuesday.

Here are Fitch’s top three ideas for why lower interest rates are probably not going to spark an increase in housing activity in 2H19: lack of new housing supply for first-time homebuyers and others who want a new build; mortgage lenders unable to handle the capacity due to cutbacks made in anticipation of 2019 being a sluggish year; and most borrowers refinanced in 2016 when rates were at the same levels as they were today.

Fitch estimates housing starts could rise by 1% this year, with new home sales expected to increase by 2% YoY.

Existing home sales are expected to “decline modestly” this year, mostly due to the lack of inventory for starter homes.

Fitch says builders have responded to the inventory shortfall by constructing new affordable homes to keep up with demand, while more expensive homes are seeing accelerated price cuts.

Some of the homebuilders Fitch monitors have already shifted to building more affordable homes, the ones who did saw net orders improve.

The report found that building affordable homes today is almost near impossible thanks to the increasing cost of the build, tariffs, and labor costs.

“Affordability issues driven by price appreciation continue to constrain the housing market, with rising input costs for homebuilders further exacerbated by tariff considerations,” Fitch noted.

Fitch also suggests refinancing activity could remain depressed. It said this constraint could have an impact on housing market activity. Lenders aren’t adequately staffed to deal with the surge in refinancing this year, the industry as a whole prepared for higher rates in 2019.

“Lower interest rates historically have ushered in higher levels of fee income from mortgage originations for banks, both in purchase and refinancing activity,” Fitch writes. “However, from a practical standpoint, banks may not be staffed for a surge in refi activity, as the industry was until recently expecting higher rates.”

And despite the 40-week decline in rates, the 30-year fixed mortgage rate is back to levels not seen since 2016.

“The 30-year mortgage hasn’t moved very much despite the relative volatility of the 10-year, and many households that would be considering refinancing may have done so over the past few years,” Fitch analysts wrote in the report.

What is most shocking is that the rapid decline in rates hasn’t triggered home buying demand:

“Lower mortgage rates have yet to lead to a notable rise in home buyer demand,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting. “Purchase applications fell more than 3%, but were still 5% higher than a year ago.”

Last year this time, Bank of America rang the proverbial bell on the US real estate market, saying existing home sales have peaked, reflecting declining affordability, greater price reductions and deteriorating housing sentiment.

BoFA Chief economist Michelle Meyer warned that “the housing market is no longer a tailwind for the economy but rather a headwind.”

“Call your realtor,” the BofA note proclaimed: “We are calling it: existing home sales have peaked.”

With that being said, the housing market has likely topped and possibly preparing for a contraction into 2020. It now should make sense why President Trump is begging for 100bps rate cuts, quantitative easing, and an emergency payroll tax cut. The market is rolling over.

via ZeroHedge News https://ift.tt/2NHGwk7 Tyler Durden